The percentage method involves setting a stop-loss level as a percentage of the purchase price. This method allows traders to adapt their risk management strategy based on the volatility of the stock. A common practice is to set the stop-loss level between 1% to 3% below the purchase price.One of the main reasons professional traders don't use hard stop losses is because they use mental stops instead. The advantage of this is that you don't have to 'give away' where your stop loss is by placing it in the market.How much to set in stop-loss order It is common to have such a question one is trading, how much to set in stop-loss order Most of the traders use the percentage rule to set the value of the stop-loss order. Usually, the one who wants to avoid a high risk of losses set the stop-loss order to 10% of the buy price.

Is 5% a good trailing stop loss : Choosing 3%, or even 5%, may be too tight. Even minor pullbacks tend to move more than this, which means the trade is likely to be stopped out by the trailing stop before the price has a chance to move higher. Choosing a 20% trailing stop is excessive.

What is the 7% stop loss rule

IBD states that "this rule was set specifically at 7%-8% because our research shows that successful stocks rarely fall in price more than 7% or 8% below a proper buy point. If you buy stocks at the pivot point, you may want to cut your losses even sooner. Eight percent is considered a maximum stop loss."

Is 10% a good stop loss : A percentage-based stop loss is usually set 10 to 15 per cent below your purchase price, depending on the volatility of the stock, as this allows for short-term fluctuations in the price as the stock settles into a trend.

Finally, it's important to realize that stop-loss orders do not guarantee you'll make money in the stock market; you still have to make intelligent investment decisions. If you don't, you'll lose just as much money as you would without a stop-loss (only at a much slower rate.) Your stop loss gets often hit mainly because you haven't given enough room for the stock to go against you. We are always afraid of big loss, so most traders keep the stop loss minimal so that if it hits, then lose less if not they gain big. This is the basic principle most successful trader follows.

Is 20% stop loss good

When applied to a 54 year period a simple stop-loss strategy provided higher returns while at the same time lowering losses substantially. A trailing stop loss is better than a traditional (loss from purchase price) stop-loss strategy. The best trailing stop-loss percentage to use is either 15% or 20%For day traders and swing traders, the 1% risk rule means you use as much capital as required to initiate a trade, but your stop loss placement protects you from losing more than 1% of your account if the trade goes against you.IBD states that "this rule was set specifically at 7%-8% because our research shows that successful stocks rarely fall in price more than 7% or 8% below a proper buy point. If you buy stocks at the pivot point, you may want to cut your losses even sooner. Eight percent is considered a maximum stop loss." Many new traders come to hate the hard stop loss trade as very often, after they are stopped out of a trade, the price soon comes back to a point where the trade could have exited with a profit. They wonder why they took a loss when if they had just hung on they could have made a profit.

Why stop losses are a bad idea : The main disadvantage is that a short-term fluctuation in a stock's price could activate the stop price. The key is picking a stop-loss percentage that allows a stock to fluctuate day-to-day, while also preventing as much downside risk as possible.

Why don’t traders use stop loss : Many new traders come to hate the hard stop loss trade as very often, after they are stopped out of a trade, the price soon comes back to a point where the trade could have exited with a profit. They wonder why they took a loss when if they had just hung on they could have made a profit.

Antwort What is the best stop-loss strategy? Weitere Antworten – What is the best percentage for stop loss

The percentage method involves setting a stop-loss level as a percentage of the purchase price. This method allows traders to adapt their risk management strategy based on the volatility of the stock. A common practice is to set the stop-loss level between 1% to 3% below the purchase price.One of the main reasons professional traders don't use hard stop losses is because they use mental stops instead. The advantage of this is that you don't have to 'give away' where your stop loss is by placing it in the market.How much to set in stop-loss order It is common to have such a question one is trading, how much to set in stop-loss order Most of the traders use the percentage rule to set the value of the stop-loss order. Usually, the one who wants to avoid a high risk of losses set the stop-loss order to 10% of the buy price.

Is 5% a good trailing stop loss : Choosing 3%, or even 5%, may be too tight. Even minor pullbacks tend to move more than this, which means the trade is likely to be stopped out by the trailing stop before the price has a chance to move higher. Choosing a 20% trailing stop is excessive.

What is the 7% stop loss rule

IBD states that "this rule was set specifically at 7%-8% because our research shows that successful stocks rarely fall in price more than 7% or 8% below a proper buy point. If you buy stocks at the pivot point, you may want to cut your losses even sooner. Eight percent is considered a maximum stop loss."

Is 10% a good stop loss : A percentage-based stop loss is usually set 10 to 15 per cent below your purchase price, depending on the volatility of the stock, as this allows for short-term fluctuations in the price as the stock settles into a trend.

Finally, it's important to realize that stop-loss orders do not guarantee you'll make money in the stock market; you still have to make intelligent investment decisions. If you don't, you'll lose just as much money as you would without a stop-loss (only at a much slower rate.)

Your stop loss gets often hit mainly because you haven't given enough room for the stock to go against you. We are always afraid of big loss, so most traders keep the stop loss minimal so that if it hits, then lose less if not they gain big. This is the basic principle most successful trader follows.

Is 20% stop loss good

When applied to a 54 year period a simple stop-loss strategy provided higher returns while at the same time lowering losses substantially. A trailing stop loss is better than a traditional (loss from purchase price) stop-loss strategy. The best trailing stop-loss percentage to use is either 15% or 20%For day traders and swing traders, the 1% risk rule means you use as much capital as required to initiate a trade, but your stop loss placement protects you from losing more than 1% of your account if the trade goes against you.IBD states that "this rule was set specifically at 7%-8% because our research shows that successful stocks rarely fall in price more than 7% or 8% below a proper buy point. If you buy stocks at the pivot point, you may want to cut your losses even sooner. Eight percent is considered a maximum stop loss."

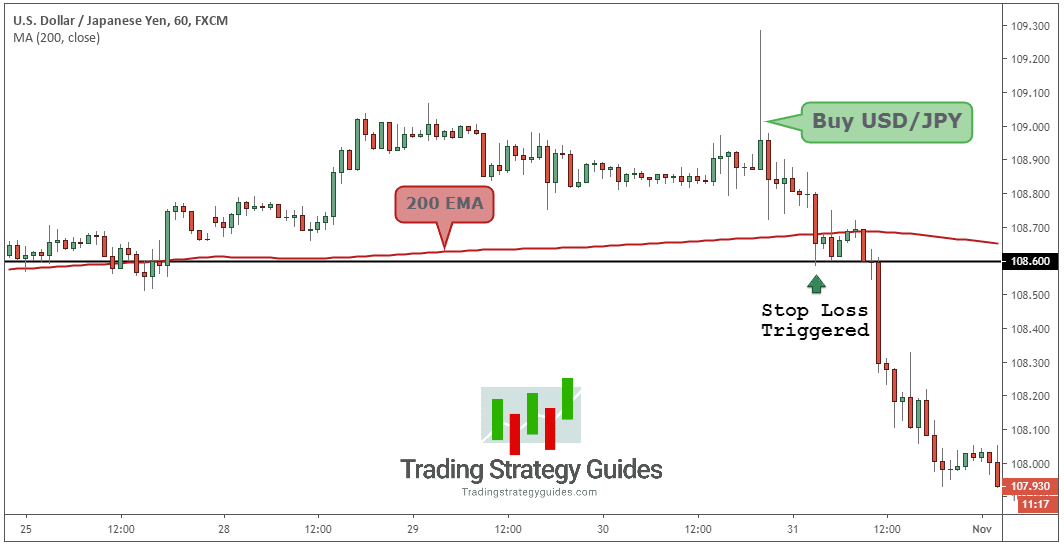

Many new traders come to hate the hard stop loss trade as very often, after they are stopped out of a trade, the price soon comes back to a point where the trade could have exited with a profit. They wonder why they took a loss when if they had just hung on they could have made a profit.

Why stop losses are a bad idea : The main disadvantage is that a short-term fluctuation in a stock's price could activate the stop price. The key is picking a stop-loss percentage that allows a stock to fluctuate day-to-day, while also preventing as much downside risk as possible.

Why don’t traders use stop loss : Many new traders come to hate the hard stop loss trade as very often, after they are stopped out of a trade, the price soon comes back to a point where the trade could have exited with a profit. They wonder why they took a loss when if they had just hung on they could have made a profit.