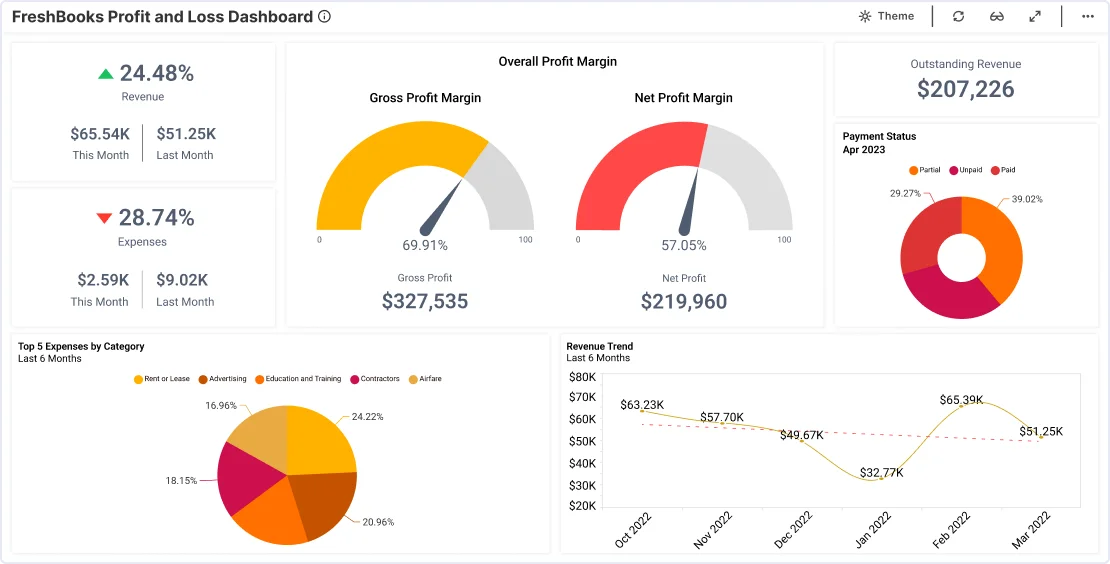

To visualize your data, you can use a Sankey Diagram as a revenue and profit graph. With a Sankey Diagram, you can draw financial conclusions for your organization. You can easily detect profits and losses a business is making. This is the best graph to show profit and loss trends in your data analysis.If you need to show how different amounts compare to one another, you can use a scatterplot, a bubble plot, a clustered column chart, or a radar chart (also known as a spider chart). These are good for comparing revenues or expenses for different departments, locations, and so on.Line graph

It is ideal for showing trends and changes over time. Best for: Visualizing time-series financial data as an expense graph such as revenue, profit/loss, cash flow, or other metrics over a period of time.

What type of graph is best for stocks : Line Charts

It is a series of dots representing the closing price of the stock over a period of time and when connected they form a line that creates a visual representation of the stock's price trend. This helps us visualize the overall trend of the stock's price movement.

What graph is best for income

7 Best Flutter Charts for Visualizing Income and Expenditure

#1 Column Chart.

#2 Waterfall Chart.

#3 Negative Stacked Bar Chart.

#4 Bubble Chart.

#5 Stacked Area Chart.

#7 Combination and mixed chart.

How do you show profit and loss : The single-step method is the simplest way to create a P&L statement. With this approach, you list all revenue items at the top of the statement and subtract all expenses to arrive at the net income or loss. It requires only a single calculation.

A Sankey is one of the best graph to show profit and loss insights. And this is because it provides micro-insights into the flow of revenue and expenses. For instance, North American sales territory is one of the significant contributors to the profit after tax. Revenue is the total amount of income generated by the sale of goods or services related to the company's primary operations. Profit, which is typically called net profit or the bottom line, is the amount of income that remains after accounting for all expenses, debts, additional income streams, and operating costs.

What is the best graph to show sales data

The best graph to show monthly sales depends on the specific information you want to convey. If you want to analyze the overall trend and changes in sales over time, a line graph would be suitable. A bar graph is more appropriate for comparing monthly sales figures for different categories.Ask yourself how many variables you want to show, how many data points you want to display, and how you want to scale your axis. Line, bar, and column charts represent change over time. Pyramids and pie charts display parts of a whole. While scatter plots and treemaps are helpful if you have a lot of data to visualize.Here's a general step-by-step guide to creating a profit and loss statement:

Choose a reporting period.

Gather financial statements and information.

Add up revenue.

List your COGS.

Record your expenses.

Figure your EBITDA.

Calculate interest, taxes, depreciation, and amortization.

Determine net income.

How to do a P&L statement

Gather all your financial information and documentation.

Select your reporting period.

Find your company's revenue.

Subtract the cost of goods sold (COGS) to find gross profits.

List your operating expenses.

Subtract total operating costs from gross profit.

List your non-operating income.

How do you structure a profit and loss statement : How To Create a Profit and Loss Statement

Choose a reporting period.

Gather financial statements and information.

Add up revenue.

List your COGS.

Record your expenses.

Figure your EBITDA.

Calculate interest, taxes, depreciation, and amortization.

Determine net income.

How to plot a profit and loss account : How to create a profit and loss statement

Choose how often you intend to create a P&L statement. Deciding on how often you create this report is the first step.

Write the revenue. Write out the money your business made from sales.

Cost of the goods sold.

Get the gross profit.

Operational costs and EBITDA.

Net income.

Should profit be higher than revenue

Can Profit Be Higher Than Revenue Revenue sits at the top of a company's income statement, making it the top line. Profit, on the other hand, is referred to as the bottom line. Profit is lower than revenue because expenses and liabilities are deducted. 10%

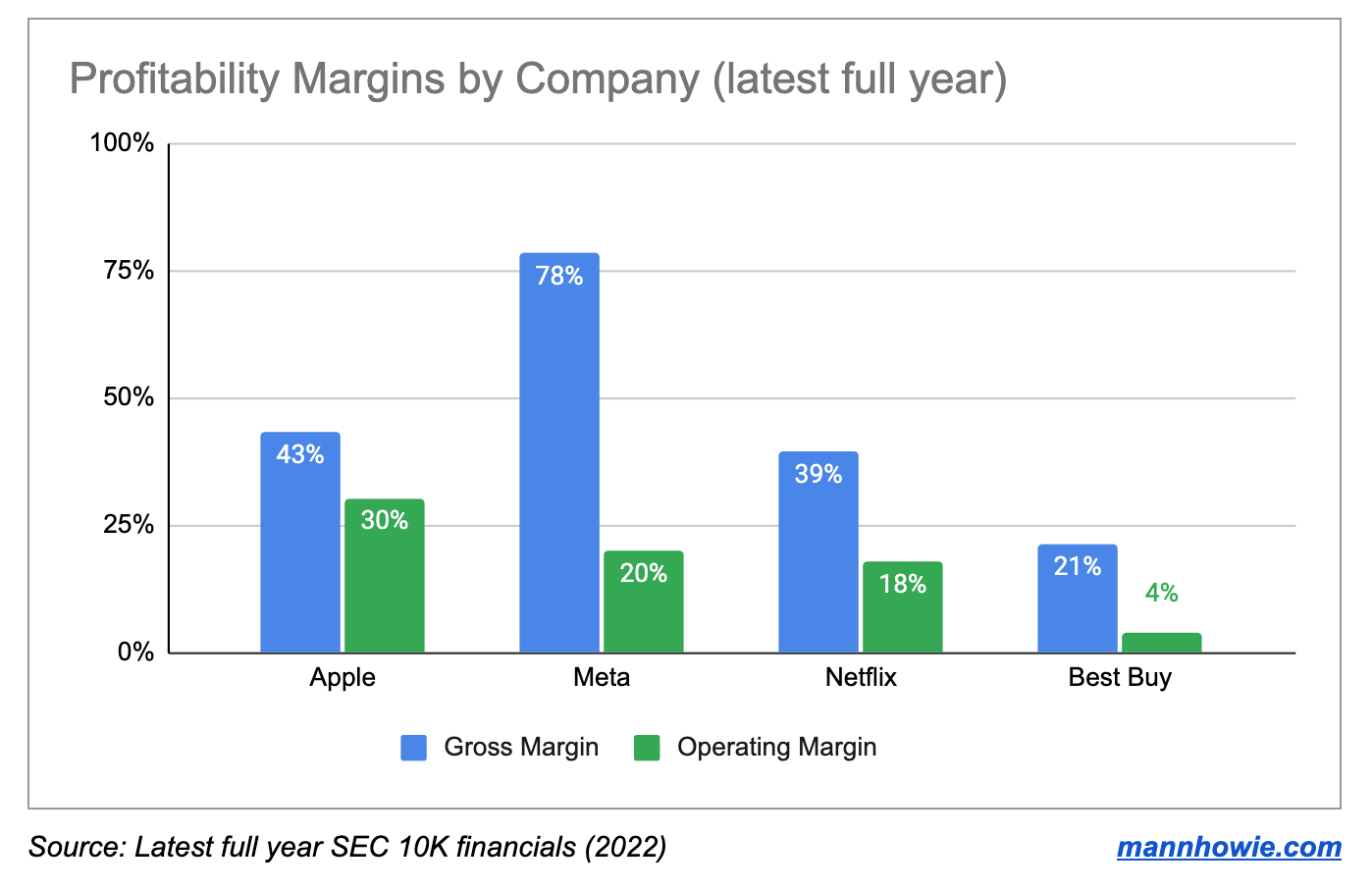

An NYU report on U.S. margins revealed the average net profit margin is 7.71% across different industries. But that doesn't mean your ideal profit margin will align with this number. As a rule of thumb, 5% is a low margin, 10% is a healthy margin, and 20% is a high margin.For ROI metrics, consider using bar charts, line graphs, or sparklines to depict financial trends over time.

What type of graph is best : Bar charts are good for comparisons, while line charts work better for trends. Scatter plot charts are good for relationships and distributions, but pie charts should be used only for simple compositions — never for comparisons or distributions.

Antwort What is the best graph for profit and loss? Weitere Antworten – What is the best graph to show profit and loss

To visualize your data, you can use a Sankey Diagram as a revenue and profit graph. With a Sankey Diagram, you can draw financial conclusions for your organization. You can easily detect profits and losses a business is making. This is the best graph to show profit and loss trends in your data analysis.If you need to show how different amounts compare to one another, you can use a scatterplot, a bubble plot, a clustered column chart, or a radar chart (also known as a spider chart). These are good for comparing revenues or expenses for different departments, locations, and so on.Line graph

It is ideal for showing trends and changes over time. Best for: Visualizing time-series financial data as an expense graph such as revenue, profit/loss, cash flow, or other metrics over a period of time.

What type of graph is best for stocks : Line Charts

It is a series of dots representing the closing price of the stock over a period of time and when connected they form a line that creates a visual representation of the stock's price trend. This helps us visualize the overall trend of the stock's price movement.

What graph is best for income

7 Best Flutter Charts for Visualizing Income and Expenditure

How do you show profit and loss : The single-step method is the simplest way to create a P&L statement. With this approach, you list all revenue items at the top of the statement and subtract all expenses to arrive at the net income or loss. It requires only a single calculation.

A Sankey is one of the best graph to show profit and loss insights. And this is because it provides micro-insights into the flow of revenue and expenses. For instance, North American sales territory is one of the significant contributors to the profit after tax.

Revenue is the total amount of income generated by the sale of goods or services related to the company's primary operations. Profit, which is typically called net profit or the bottom line, is the amount of income that remains after accounting for all expenses, debts, additional income streams, and operating costs.

What is the best graph to show sales data

The best graph to show monthly sales depends on the specific information you want to convey. If you want to analyze the overall trend and changes in sales over time, a line graph would be suitable. A bar graph is more appropriate for comparing monthly sales figures for different categories.Ask yourself how many variables you want to show, how many data points you want to display, and how you want to scale your axis. Line, bar, and column charts represent change over time. Pyramids and pie charts display parts of a whole. While scatter plots and treemaps are helpful if you have a lot of data to visualize.Here's a general step-by-step guide to creating a profit and loss statement:

How to do a P&L statement

How do you structure a profit and loss statement : How To Create a Profit and Loss Statement

How to plot a profit and loss account : How to create a profit and loss statement

Should profit be higher than revenue

Can Profit Be Higher Than Revenue Revenue sits at the top of a company's income statement, making it the top line. Profit, on the other hand, is referred to as the bottom line. Profit is lower than revenue because expenses and liabilities are deducted.

10%

An NYU report on U.S. margins revealed the average net profit margin is 7.71% across different industries. But that doesn't mean your ideal profit margin will align with this number. As a rule of thumb, 5% is a low margin, 10% is a healthy margin, and 20% is a high margin.For ROI metrics, consider using bar charts, line graphs, or sparklines to depict financial trends over time.

What type of graph is best : Bar charts are good for comparisons, while line charts work better for trends. Scatter plot charts are good for relationships and distributions, but pie charts should be used only for simple compositions — never for comparisons or distributions.