20 Countries with the Lowest Income Tax Rates in the World

Bulgaria.

Turkmenistan.

Guatemala. Personal Income Tax Rate: 7%

Brunei. Personal Income Tax Rate: 0%

Saudi Arabia. Personal Income Tax Rate: 0%

Oman. Personal Income Tax Rate: 0%

Kuwait. Personal Income Tax Rate: 0%

Qatar. Personal Income Tax Rate: 0%

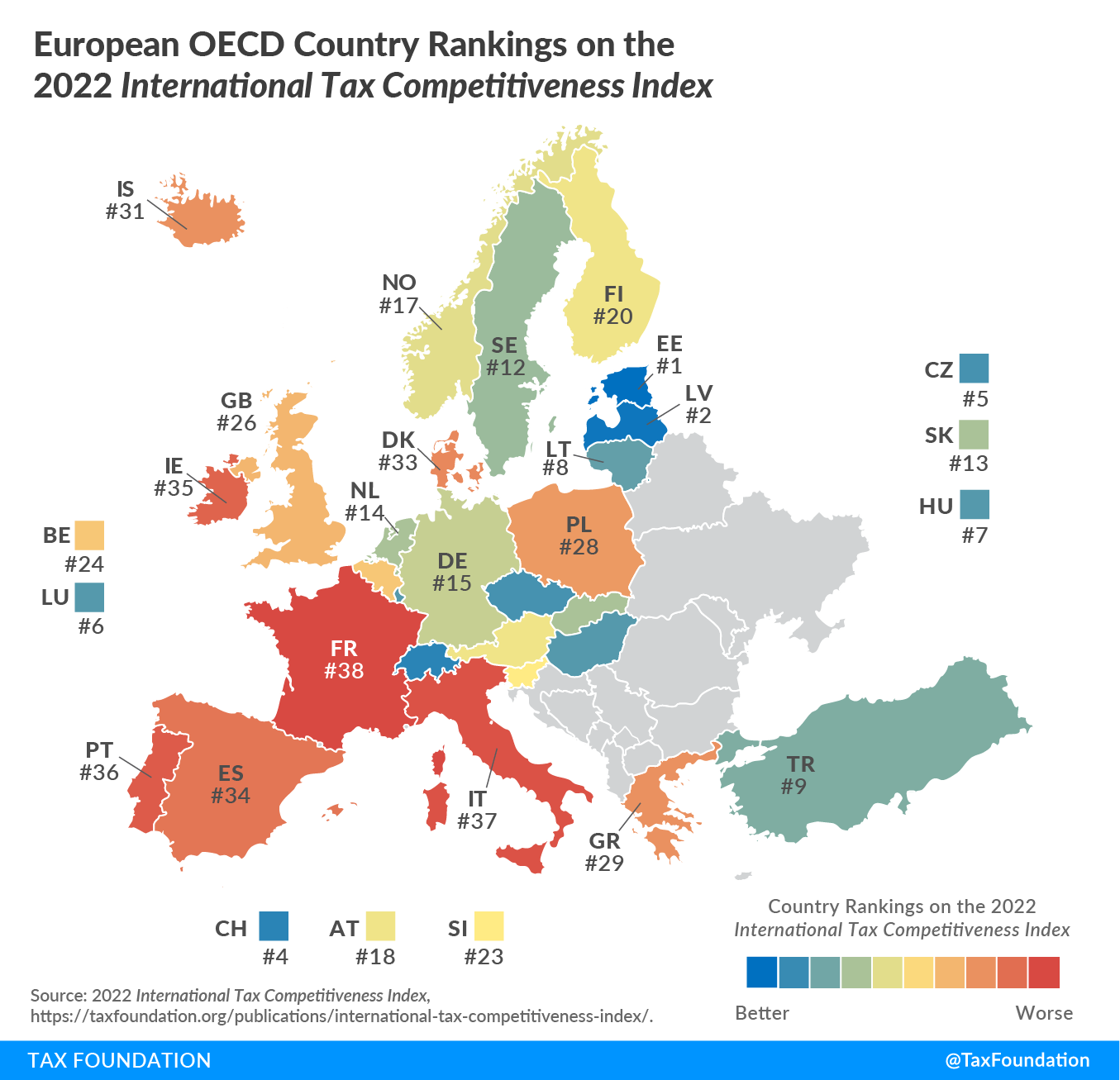

Hungary (15 percent), Estonia (20 percent), and the Czech Republic (23 percent) have the lowest top rates. European countries that are not part of the OECD tend to feature lower rates and tax personal income at a single rate.2023 Rankings

For the tenth year in a row, Estonia has the best tax code in the OECD. Its top score is driven by four positive features of its tax system. First, it has a 20 percent tax rate on corporate income that is only applied to distributed profits.

Where is the best place to live for tax purposes : MoneyGeek's analysis found that Wyoming is the most tax-friendly state in America, followed by Nevada, Tennessee, Florida and Alaska. Except for Arizona, states that received a grade of A all share something in common: no state income tax. Texas — which received a B — also has no state income tax.

Is Dubai really tax-free

There is currently no personal income tax in the United Arab Emirates. As such, there are no individual tax registration or reporting obligations.

Which countries are best for no tax : List of Top Tax-Free Countries in the World 2023

United Arab Emirates.

Bahamas.

Qatar.

Vanuatu.

Bahrain.

Maldives.

Somalia.

Personal Income Tax

The progressive tax of 23% applies to personal income above the statutory limit, which has been set at 36 times the average monthly salary in 2024. Therefore, if an individual's income exceeds 36 times the average wage, they must pay 23% tax on this excess income instead of the basic 15% tax. Denmark

Denmark is the European country with the highest top statutory income tax rate as of 2024, with the Nordic country having a top taxation band of 55.9 percent.

What place has the cheapest tax

Which States Have the Lowest Sales Tax

As of 2024, five states impose a 0.000% sales tax including Alaska, Delaware, Montana, New Hampshire, and Oregon.

Whether or not a state imposes a state sales tax, local municipalities and counties may impose excise or surtaxes.

What Is Considered a Good Salary for Expats in Dubai A good salary in Dubai ultimately depends on the kind of lifestyle you want to have. A comfortable monthly salary range in Dubai is about USD $4,900 to USD $8,168 (AED 18,000 – AED 30,000). The actual amount depends on your needs and circumstances.Qatar operates a territorial taxation system, which means an individual is taxable in Qatar if one has generated qualifying Qatar-source income, regardless of one's tax residence. Income tax is not imposed on employed individuals' salaries, wages, and allowances. All tax-resident individuals are taxed on their worldwide income and wealth. Non-tax-resident individuals are only taxed on Swiss sources of income and wealth.

Is Germany tax-free : All resident individuals are taxed on their worldwide income. Non-resident individuals are taxed (in case of investment and employment income usually by withholding) on German source income only. Taxable income covers income from the following categories: Agriculture and forestry.

What is a good salary in Prague : Prague, the capital city, stands as the epicenter of economic activity in the Czech Republic. The average salary in Prague is significantly higher than the national average, with figures often surpassing 50,000 CZK (approximately €1,971) per month.

Is Czech Republic tax friendly

Personal income tax rates

The Czech Republic applies progressive taxation on income of tax residents as follows: Gross annual income up to CZK 1,582,812 (the bracket is calculated as 36x average monthly salary) is subject to a 15% rate. Gross annual income exceeding this threshold is subject to a rate of 23%. The lowest tax rate on wages in the EU is set in Bulgaria and Romania – 10%. The highest taxes in Europe are paid by residents of Finland – here the collection can reach 56.5 % of profit. As a rule, the payment is imposed on the employer. Property, inheritance, gift.Here is the list of the countries with low corporate tax rates in Europe, which are perfect for people who wish to start their own businesses.

Ireland 🇮🇪

Cyprus 🇨🇾

Bulgaria 🇧🇬

Estonia 🇪🇪

Hungary 🇭🇺

Czech Republic 🇨🇿

Gibraltar 🇬🇮

Luxembourg 🇱🇺

Where is tax the most expensive : Top 10 Countries with the Highest Personal Income Tax Rates – Trading Economics 2021-23:

Antwort What is the best country to live in for low tax? Weitere Antworten – Which country pays the least taxes

20 Countries with the Lowest Income Tax Rates in the World

Hungary (15 percent), Estonia (20 percent), and the Czech Republic (23 percent) have the lowest top rates. European countries that are not part of the OECD tend to feature lower rates and tax personal income at a single rate.2023 Rankings

For the tenth year in a row, Estonia has the best tax code in the OECD. Its top score is driven by four positive features of its tax system. First, it has a 20 percent tax rate on corporate income that is only applied to distributed profits.

Where is the best place to live for tax purposes : MoneyGeek's analysis found that Wyoming is the most tax-friendly state in America, followed by Nevada, Tennessee, Florida and Alaska. Except for Arizona, states that received a grade of A all share something in common: no state income tax. Texas — which received a B — also has no state income tax.

Is Dubai really tax-free

There is currently no personal income tax in the United Arab Emirates. As such, there are no individual tax registration or reporting obligations.

Which countries are best for no tax : List of Top Tax-Free Countries in the World 2023

Personal Income Tax

The progressive tax of 23% applies to personal income above the statutory limit, which has been set at 36 times the average monthly salary in 2024. Therefore, if an individual's income exceeds 36 times the average wage, they must pay 23% tax on this excess income instead of the basic 15% tax.

Denmark

Denmark is the European country with the highest top statutory income tax rate as of 2024, with the Nordic country having a top taxation band of 55.9 percent.

What place has the cheapest tax

Which States Have the Lowest Sales Tax

What Is Considered a Good Salary for Expats in Dubai A good salary in Dubai ultimately depends on the kind of lifestyle you want to have. A comfortable monthly salary range in Dubai is about USD $4,900 to USD $8,168 (AED 18,000 – AED 30,000). The actual amount depends on your needs and circumstances.Qatar operates a territorial taxation system, which means an individual is taxable in Qatar if one has generated qualifying Qatar-source income, regardless of one's tax residence. Income tax is not imposed on employed individuals' salaries, wages, and allowances.

All tax-resident individuals are taxed on their worldwide income and wealth. Non-tax-resident individuals are only taxed on Swiss sources of income and wealth.

Is Germany tax-free : All resident individuals are taxed on their worldwide income. Non-resident individuals are taxed (in case of investment and employment income usually by withholding) on German source income only. Taxable income covers income from the following categories: Agriculture and forestry.

What is a good salary in Prague : Prague, the capital city, stands as the epicenter of economic activity in the Czech Republic. The average salary in Prague is significantly higher than the national average, with figures often surpassing 50,000 CZK (approximately €1,971) per month.

Is Czech Republic tax friendly

Personal income tax rates

The Czech Republic applies progressive taxation on income of tax residents as follows: Gross annual income up to CZK 1,582,812 (the bracket is calculated as 36x average monthly salary) is subject to a 15% rate. Gross annual income exceeding this threshold is subject to a rate of 23%.

The lowest tax rate on wages in the EU is set in Bulgaria and Romania – 10%. The highest taxes in Europe are paid by residents of Finland – here the collection can reach 56.5 % of profit. As a rule, the payment is imposed on the employer. Property, inheritance, gift.Here is the list of the countries with low corporate tax rates in Europe, which are perfect for people who wish to start their own businesses.

Where is tax the most expensive : Top 10 Countries with the Highest Personal Income Tax Rates – Trading Economics 2021-23: