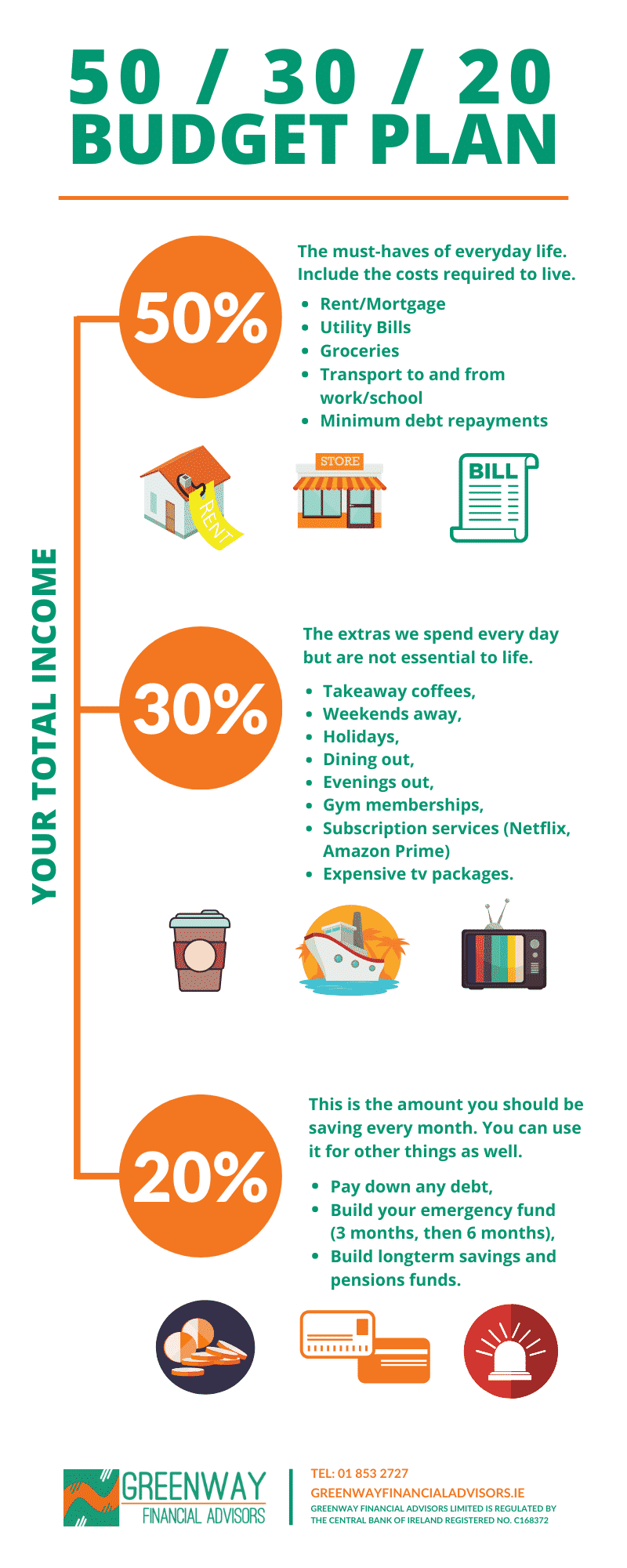

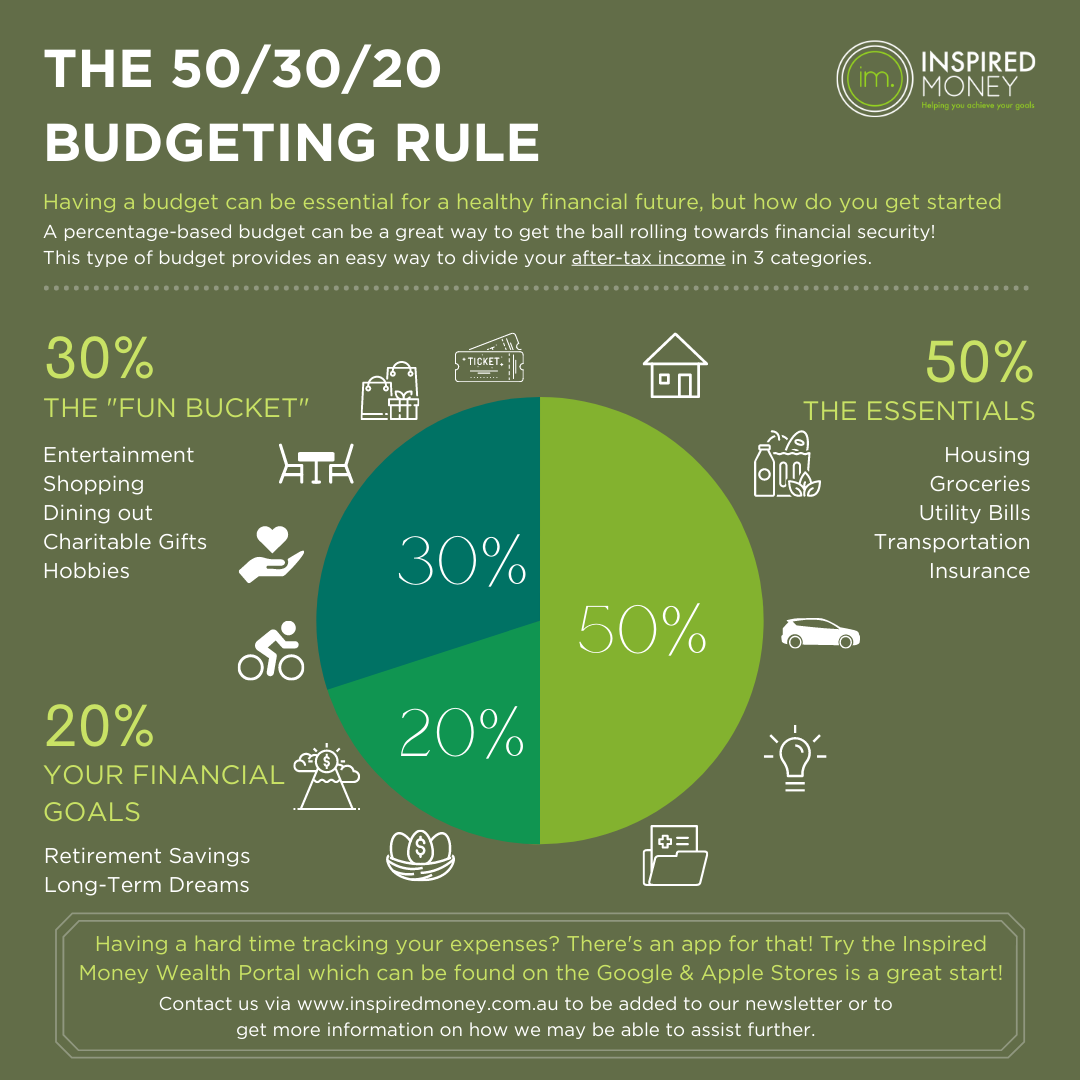

The 50/30/20 budget rule states that you should spend up to 50% of your after-tax income on needs and obligations that you must have or must do. The remaining half should be split between savings and debt repayment (20%) and everything else that you might want (30%).Put 60% of your income towards your needs (including debts), 20% towards your wants, and 20% towards your savings.A 50 30 20 budget divides your monthly income after tax into three clear areas.

50% of your income is used for needs.

30% is spent on any wants.

20% goes towards your savings.

What is the 50 40 10 rule : The 50/40/10 rule is a simple way to make a budget that doesn't require setting up specific budget categories. Instead, you spend 50% of your pay after taxes on needs, 40% on wants, and 10% on savings or paying off debt.

What is the 40 40 20 budget rule

The 40/40/20 rule comes in during the saving phase of his wealth creation formula. Cardone says that from your gross income, 40% should be set aside for taxes, 40% should be saved, and you should live off of the remaining 20%.

Is the 50/30/20 rule a good idea : The 50/30/20 rule can be a good budgeting method for some, but it may not work for your unique monthly expenses. Depending on your income and where you live, earmarking 50% of your income for your needs may not be enough.

The 70-20-10 budget formula divides your after-tax income into three buckets: 70% for living expenses, 20% for savings and debt, and 10% for additional savings and donations. By allocating your available income into these three distinct categories, you can better manage your money on a daily basis. The 40/40/20 rule comes in during the saving phase of his wealth creation formula. Cardone says that from your gross income, 40% should be set aside for taxes, 40% should be saved, and you should live off of the remaining 20%.

Is saving $1000 a month good in the UK

Absolutely. Saving £1,000 a month in the UK is a wise financial decision that can have a positive impact on your financial well-being.The 50/30/20 rule can be a good budgeting method for some, but it may not work for your unique monthly expenses. Depending on your income and where you live, earmarking 50% of your income for your needs may not be enough.The 50/30/20 rule can be a good budgeting method for some, but it may not work for your unique monthly expenses. Depending on your income and where you live, earmarking 50% of your income for your needs may not be enough. The 40/40/20 rule comes in during the saving phase of his wealth creation formula. Cardone says that from your gross income, 40% should be set aside for taxes, 40% should be saved, and you should live off of the remaining 20%.

What is the 70 20 10 rule : The 70-20-10 budget formula divides your after-tax income into three buckets: 70% for living expenses, 20% for savings and debt, and 10% for additional savings and donations. By allocating your available income into these three distinct categories, you can better manage your money on a daily basis.

What is the 10/20/30 rule money : 30% should go towards discretionary spending (such as dining out, entertainment, and shopping) – Hubble Money App is just for this. 20% should go towards savings or paying off debt. 10% should go towards charitable giving or other financial goals.

Is 50/30/20 or 70/20/10 better

The 70/20/10 Budget

This budget follows the same style as the 50/30/20, but the percentages are adjusted to better fit the average American's financial situation. “70/20/10 suggests a framework of 70% of your income on essentials and discretionary spending, 20% on savings and 10% on paying off your debt. In his free webinar last week, Market Briefs CEO Jaspreet Singh alerted me to a variation: the popular 75-15-10 rule. Singh called it leading your money. This iteration calls for you to put 75% of after-tax income to daily expenses, 15% to investing and 10% to savings.What's the 80-20 Rule The 80-20 rule is a principle that states 80% of all outcomes are derived from 20% of causes. It's used to determine the factors (typically, in a business situation) that are most responsible for success and then focus on them to improve results.

How do you master the 80 20 rule : Steps to apply the 80/20 Rule

Identify all your daily/weekly tasks.

Identify key tasks.

What are the tasks that give you more return

Brainstorm how you can reduce or transfer the tasks that give you less return.

Create a plan to do more that brings you more value.

Use 80/20 to prioritize any project you're working on.

Antwort What is the 50 30 20 rule of money? Weitere Antworten – How does the 50/30/20 rule work

The 50/30/20 budget rule states that you should spend up to 50% of your after-tax income on needs and obligations that you must have or must do. The remaining half should be split between savings and debt repayment (20%) and everything else that you might want (30%).Put 60% of your income towards your needs (including debts), 20% towards your wants, and 20% towards your savings.A 50 30 20 budget divides your monthly income after tax into three clear areas.

What is the 50 40 10 rule : The 50/40/10 rule is a simple way to make a budget that doesn't require setting up specific budget categories. Instead, you spend 50% of your pay after taxes on needs, 40% on wants, and 10% on savings or paying off debt.

What is the 40 40 20 budget rule

The 40/40/20 rule comes in during the saving phase of his wealth creation formula. Cardone says that from your gross income, 40% should be set aside for taxes, 40% should be saved, and you should live off of the remaining 20%.

Is the 50/30/20 rule a good idea : The 50/30/20 rule can be a good budgeting method for some, but it may not work for your unique monthly expenses. Depending on your income and where you live, earmarking 50% of your income for your needs may not be enough.

The 70-20-10 budget formula divides your after-tax income into three buckets: 70% for living expenses, 20% for savings and debt, and 10% for additional savings and donations. By allocating your available income into these three distinct categories, you can better manage your money on a daily basis.

The 40/40/20 rule comes in during the saving phase of his wealth creation formula. Cardone says that from your gross income, 40% should be set aside for taxes, 40% should be saved, and you should live off of the remaining 20%.

Is saving $1000 a month good in the UK

Absolutely. Saving £1,000 a month in the UK is a wise financial decision that can have a positive impact on your financial well-being.The 50/30/20 rule can be a good budgeting method for some, but it may not work for your unique monthly expenses. Depending on your income and where you live, earmarking 50% of your income for your needs may not be enough.The 50/30/20 rule can be a good budgeting method for some, but it may not work for your unique monthly expenses. Depending on your income and where you live, earmarking 50% of your income for your needs may not be enough.

The 40/40/20 rule comes in during the saving phase of his wealth creation formula. Cardone says that from your gross income, 40% should be set aside for taxes, 40% should be saved, and you should live off of the remaining 20%.

What is the 70 20 10 rule : The 70-20-10 budget formula divides your after-tax income into three buckets: 70% for living expenses, 20% for savings and debt, and 10% for additional savings and donations. By allocating your available income into these three distinct categories, you can better manage your money on a daily basis.

What is the 10/20/30 rule money : 30% should go towards discretionary spending (such as dining out, entertainment, and shopping) – Hubble Money App is just for this. 20% should go towards savings or paying off debt. 10% should go towards charitable giving or other financial goals.

Is 50/30/20 or 70/20/10 better

The 70/20/10 Budget

This budget follows the same style as the 50/30/20, but the percentages are adjusted to better fit the average American's financial situation. “70/20/10 suggests a framework of 70% of your income on essentials and discretionary spending, 20% on savings and 10% on paying off your debt.

In his free webinar last week, Market Briefs CEO Jaspreet Singh alerted me to a variation: the popular 75-15-10 rule. Singh called it leading your money. This iteration calls for you to put 75% of after-tax income to daily expenses, 15% to investing and 10% to savings.What's the 80-20 Rule The 80-20 rule is a principle that states 80% of all outcomes are derived from 20% of causes. It's used to determine the factors (typically, in a business situation) that are most responsible for success and then focus on them to improve results.

How do you master the 80 20 rule : Steps to apply the 80/20 Rule