This is a rule that aims to aid diversification in an investment portfolio. It states that one should not hold more than 5% of the total value of the portfolio in a single security.The Five Percent Rule is a simple strategy that involves investing no more than 5% of one's portfolio in any single investment. This approach is based on the principle that by limiting the exposure to any one investment, investors can reduce the risk of significant losses.No single asset can represent more than 10% of the fund's assets; holdings of more than 5% cannot in aggregate exceed 40% of the fund's assets. This is known as the "5/10/40" rule.

What is the 5/25 diversification rule : The Investment Company Act of 1940 implies that an allocation of 5% or more to a single security is uncomfortably large; to earn the diversified status, a mutual fund must limit the aggregate share of such positions to 25% of its assets.[3] The limits make some sense.

What is the 75 5 10 rule for diversified funds

Diversified management investment companies have assets that fall within the 75-5-10 rule. A 75-5-10 diversified management investment company will have 75% of its assets in other issuers and cash, no more than 5% of assets in any one company, and no more than 10% ownership of any company's outstanding voting stock.

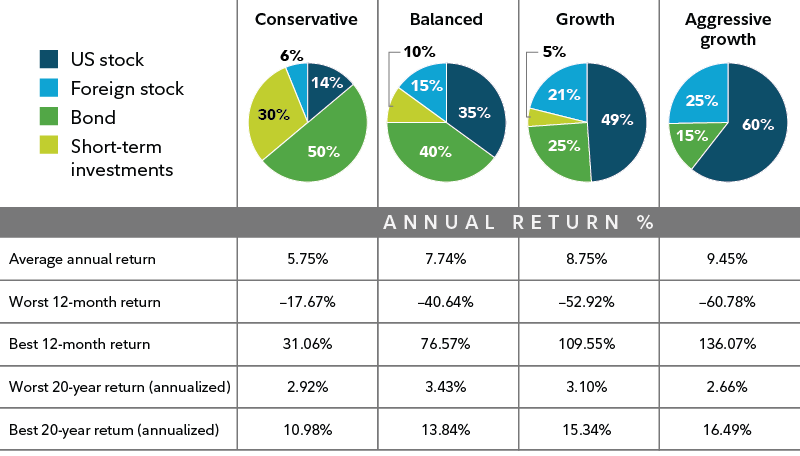

What is the 70 30 portfolio strategy : The 70/30 portfolio targets a 70% long term allocation to equities and 30% in all other asset classes – the actual portfolio allocation at any point in time will fluctuate to reflect prevailing investment opportunities.

The 1% method of trading is a very popular way to protect your investment against major losses. It is a method of trading where the trader never risks more than 1% of his investment capital. The main motive behind this rule is in terms of protection – you are not risking anything other than what is available. Clear guidelines: The 5-3-1 strategy provides clear and straightforward guidelines for traders. The principles of choosing five currency pairs, developing three trading strategies, and selecting one specific time of day offer a structured approach, reducing ambiguity and enhancing decision-making.

What does Warren Buffett say about diversification

“Diversification is a protection against ignorance,” Buffett said. “I mean, if you want to make sure that nothing bad happens to you relative to the market… There's nothing wrong with that. That's a perfectly sound approach for somebody who does not feel they know how to analyze businesses.”A 70/30 portfolio is an investment portfolio where 70% of investment capital is allocated to stocks and 30% to fixed-income securities, primarily bonds.What is 15-15-15 Rule The rule says to achieve the goal of earning Rs 1 crore, an investor should invest Rs 15,000 monthly through SIP for 15 years, considering a 15% annual return from an equity fund. Consistent adherence to this strategy can lead to significant wealth accumulation. This investment strategy seeks total return through exposure to a diversified portfolio of primarily equity, and to a lesser extent, Fixed Income asset classes with a target allocation of 80% equities and 20% Fixed Income. Target allocations can vary +/-5%.

What is the 80/20 rule investment portfolio : In investing, the 80-20 rule generally holds that 20% of the holdings in a portfolio are responsible for 80% of the portfolio's growth. On the flip side, 20% of a portfolio's holdings could be responsible for 80% of its losses.

Is there a 100% trading strategy : The market is unpredictable and constantly evolving, making it difficult for any single trading strategy to be effective in all conditions. A 100% trading strategy may work well in certain market environments but fail miserably in others.

What is the 70 30 trading strategy

The strategy is based on:

Portfolio management with 70% hedge and 30% spot delivery. Option to leave the trade mandate to the portfolio manager. The portfolio trades include purchasing and selling although with limited trading activity. Optimisation on product level: SYSTEM, EPAD, EEX, periods, base, peak. The 2% rule is a risk management principle that advises investors to limit the amount of capital they risk on any single trade or investment to no more than 2% of their total trading capital. This means that if a trade goes against them, the maximum loss incurred would be 2% of their total trading capital.It's generally good practice to diversify your portfolio by investing in a mix of different stocks, funds and other investments. But as the wealthiest people build their net worth, they often go all-in on their own projects, and then diversify as they start earning more.

What is Warren Buffett ratio : The Buffett Indicator is the ratio of total US stock market value divided by GDP. Named after Warren Buffett, who called the ratio "the best single measure of where valuations stand at any given moment".

Antwort What is the 5% rule for diversification? Weitere Antworten – What is the 5% portfolio rule

This is a rule that aims to aid diversification in an investment portfolio. It states that one should not hold more than 5% of the total value of the portfolio in a single security.The Five Percent Rule is a simple strategy that involves investing no more than 5% of one's portfolio in any single investment. This approach is based on the principle that by limiting the exposure to any one investment, investors can reduce the risk of significant losses.No single asset can represent more than 10% of the fund's assets; holdings of more than 5% cannot in aggregate exceed 40% of the fund's assets. This is known as the "5/10/40" rule.

What is the 5/25 diversification rule : The Investment Company Act of 1940 implies that an allocation of 5% or more to a single security is uncomfortably large; to earn the diversified status, a mutual fund must limit the aggregate share of such positions to 25% of its assets.[3] The limits make some sense.

What is the 75 5 10 rule for diversified funds

Diversified management investment companies have assets that fall within the 75-5-10 rule. A 75-5-10 diversified management investment company will have 75% of its assets in other issuers and cash, no more than 5% of assets in any one company, and no more than 10% ownership of any company's outstanding voting stock.

What is the 70 30 portfolio strategy : The 70/30 portfolio targets a 70% long term allocation to equities and 30% in all other asset classes – the actual portfolio allocation at any point in time will fluctuate to reflect prevailing investment opportunities.

The 1% method of trading is a very popular way to protect your investment against major losses. It is a method of trading where the trader never risks more than 1% of his investment capital. The main motive behind this rule is in terms of protection – you are not risking anything other than what is available.

Clear guidelines: The 5-3-1 strategy provides clear and straightforward guidelines for traders. The principles of choosing five currency pairs, developing three trading strategies, and selecting one specific time of day offer a structured approach, reducing ambiguity and enhancing decision-making.

What does Warren Buffett say about diversification

“Diversification is a protection against ignorance,” Buffett said. “I mean, if you want to make sure that nothing bad happens to you relative to the market… There's nothing wrong with that. That's a perfectly sound approach for somebody who does not feel they know how to analyze businesses.”A 70/30 portfolio is an investment portfolio where 70% of investment capital is allocated to stocks and 30% to fixed-income securities, primarily bonds.What is 15-15-15 Rule The rule says to achieve the goal of earning Rs 1 crore, an investor should invest Rs 15,000 monthly through SIP for 15 years, considering a 15% annual return from an equity fund. Consistent adherence to this strategy can lead to significant wealth accumulation.

This investment strategy seeks total return through exposure to a diversified portfolio of primarily equity, and to a lesser extent, Fixed Income asset classes with a target allocation of 80% equities and 20% Fixed Income. Target allocations can vary +/-5%.

What is the 80/20 rule investment portfolio : In investing, the 80-20 rule generally holds that 20% of the holdings in a portfolio are responsible for 80% of the portfolio's growth. On the flip side, 20% of a portfolio's holdings could be responsible for 80% of its losses.

Is there a 100% trading strategy : The market is unpredictable and constantly evolving, making it difficult for any single trading strategy to be effective in all conditions. A 100% trading strategy may work well in certain market environments but fail miserably in others.

What is the 70 30 trading strategy

The strategy is based on:

Portfolio management with 70% hedge and 30% spot delivery. Option to leave the trade mandate to the portfolio manager. The portfolio trades include purchasing and selling although with limited trading activity. Optimisation on product level: SYSTEM, EPAD, EEX, periods, base, peak.

The 2% rule is a risk management principle that advises investors to limit the amount of capital they risk on any single trade or investment to no more than 2% of their total trading capital. This means that if a trade goes against them, the maximum loss incurred would be 2% of their total trading capital.It's generally good practice to diversify your portfolio by investing in a mix of different stocks, funds and other investments. But as the wealthiest people build their net worth, they often go all-in on their own projects, and then diversify as they start earning more.

What is Warren Buffett ratio : The Buffett Indicator is the ratio of total US stock market value divided by GDP. Named after Warren Buffett, who called the ratio "the best single measure of where valuations stand at any given moment".