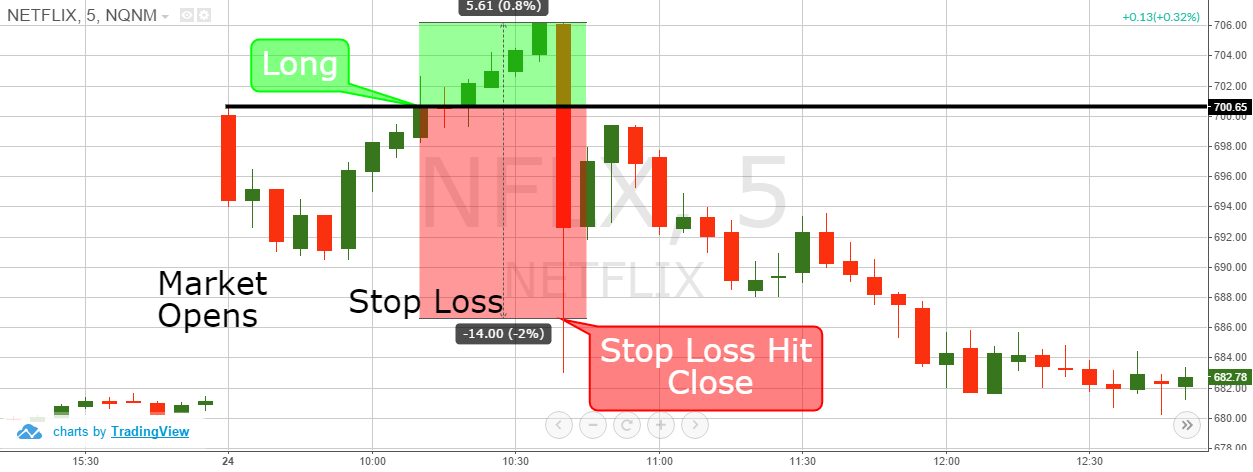

The percentage method involves setting a stop-loss level as a percentage of the purchase price. This method allows traders to adapt their risk management strategy based on the volatility of the stock. A common practice is to set the stop-loss level between 1% to 3% below the purchase price.One popular method is the 2% Rule, which means you never put more than 2% of your account equity at risk (Table 1). For example, if you are trading a $50,000 account, and you choose a risk management stop loss of 2%, you could risk up to $1,000 on any given trade.IBD states that "this rule was set specifically at 7%-8% because our research shows that successful stocks rarely fall in price more than 7% or 8% below a proper buy point. If you buy stocks at the pivot point, you may want to cut your losses even sooner. Eight percent is considered a maximum stop loss."

How to risk 1 percent per trade : Applying the 1% Rule in a Single Trade

Determine your risk capital, i.e., the total amount of money you're willing to risk in your trading.

Calculate 1% of your risk capital.

When you enter a trade, calculate your potential loss based on your stop loss level.

Can I risk 3% per trade

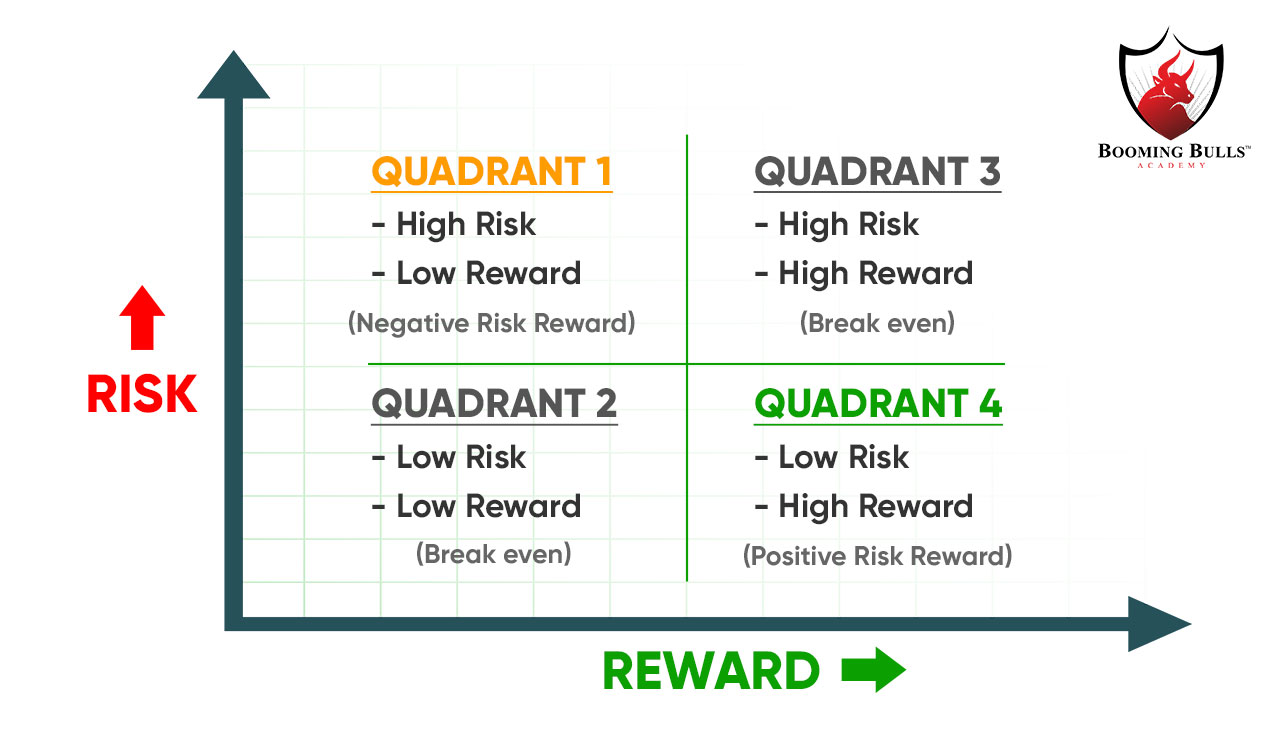

A trader should only use leverage when the advantage is clearly on their side. Once the amount of risk in terms of the number of pips is known, it is possible to determine the potential loss of capital. As a general rule, this loss should never be more than 3% of trading capital.

How do you calculate 2% risk in trading : Using the 2% Rule With a Stop Loss Order

Suppose that a trader has a $50,000 trading account and wants to trade Apple, Inc. (AAPL). Using the 2% rule, the trader can risk $1,000 of capital ($50,000 x 0.02%). If AAPL is trading at $170 and the trader wants to use a $15 stop loss, they can buy 67 shares ($1,000 / $15).

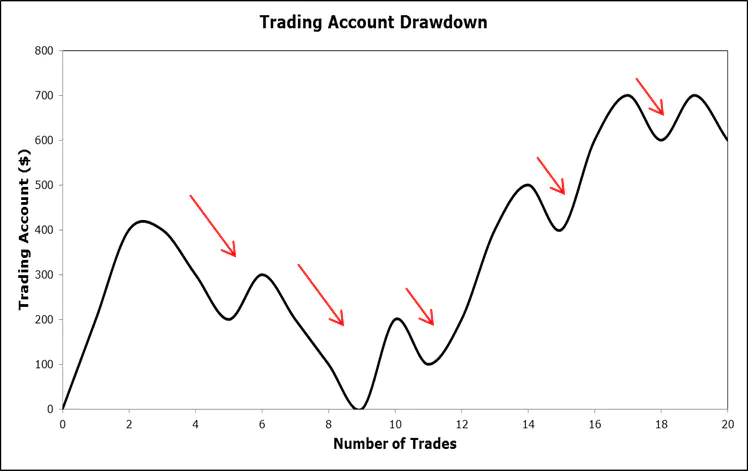

When applied to a 54 year period a simple stop-loss strategy provided higher returns while at the same time lowering losses substantially. A trailing stop loss is better than a traditional (loss from purchase price) stop-loss strategy. The best trailing stop-loss percentage to use is either 15% or 20% The 2% rule is a risk management principle that advises investors to limit the amount of capital they risk on any single trade or investment to no more than 2% of their total trading capital. This means that if a trade goes against them, the maximum loss incurred would be 2% of their total trading capital.

Is it 1% or 2% risk per trade

Calculate your maximum risk per trade

Most traders agree not to go much higher than that though, and here's why… With 2% risk per trade, even after 15 losses you've lost less than 25% of your trading capital. It's conceivable that you can win this money back.A good rule of thumb is to risk between 1% and 5% of your account balance per trade.The 2% rule in investing suggests that you should never risk more than 2% of your capital on any single trade or investment. This approach helps manage risk by limiting potential losses and preserving capital for future opportunities. For day traders and swing traders, the 1% risk rule means you use as much capital as required to initiate a trade, but your stop loss placement protects you from losing more than 1% of your account if the trade goes against you.

What is a 2% stop loss : The 2% rule is a risk management principle that advises investors to limit the amount of capital they risk on any single trade or investment to no more than 2% of their total trading capital. This means that if a trade goes against them, the maximum loss incurred would be 2% of their total trading capital.

Is 5% a good stop loss : An active trader might use a 5% level, while a long-term investor might choose 15% or more. Another thing to keep in mind is that, once you reach your stop price, your stop order becomes a market order. So, the price at which you sell may be much different from the stop price.

What is the 1% rule for stop-loss

For day traders and swing traders, the 1% risk rule means you use as much capital as required to initiate a trade, but your stop loss placement protects you from losing more than 1% of your account if the trade goes against you. The 2% rule is a risk management principle that advises investors to limit the amount of capital they risk on any single trade or investment to no more than 2% of their total trading capital. This means that if a trade goes against them, the maximum loss incurred would be 2% of their total trading capital.The 2% rule is a risk management principle that advises investors to limit the amount of capital they risk on any single trade or investment to no more than 2% of their total trading capital. This means that if a trade goes against them, the maximum loss incurred would be 2% of their total trading capital.

How to win one v all risk : There are two strategies that work well. One goes over America, one over Europe and Africa. Go America first. Use just the bare minimum of troops needed to deny your foes the continent bonus for Asia and Africa, The Rest goes into NA with a stronghold in your back.

Antwort What is the 2% rule in trading? Weitere Antworten – What is the risk percentage for stop loss

The percentage method involves setting a stop-loss level as a percentage of the purchase price. This method allows traders to adapt their risk management strategy based on the volatility of the stock. A common practice is to set the stop-loss level between 1% to 3% below the purchase price.One popular method is the 2% Rule, which means you never put more than 2% of your account equity at risk (Table 1). For example, if you are trading a $50,000 account, and you choose a risk management stop loss of 2%, you could risk up to $1,000 on any given trade.IBD states that "this rule was set specifically at 7%-8% because our research shows that successful stocks rarely fall in price more than 7% or 8% below a proper buy point. If you buy stocks at the pivot point, you may want to cut your losses even sooner. Eight percent is considered a maximum stop loss."

How to risk 1 percent per trade : Applying the 1% Rule in a Single Trade

Can I risk 3% per trade

A trader should only use leverage when the advantage is clearly on their side. Once the amount of risk in terms of the number of pips is known, it is possible to determine the potential loss of capital. As a general rule, this loss should never be more than 3% of trading capital.

How do you calculate 2% risk in trading : Using the 2% Rule With a Stop Loss Order

Suppose that a trader has a $50,000 trading account and wants to trade Apple, Inc. (AAPL). Using the 2% rule, the trader can risk $1,000 of capital ($50,000 x 0.02%). If AAPL is trading at $170 and the trader wants to use a $15 stop loss, they can buy 67 shares ($1,000 / $15).

When applied to a 54 year period a simple stop-loss strategy provided higher returns while at the same time lowering losses substantially. A trailing stop loss is better than a traditional (loss from purchase price) stop-loss strategy. The best trailing stop-loss percentage to use is either 15% or 20%

The 2% rule is a risk management principle that advises investors to limit the amount of capital they risk on any single trade or investment to no more than 2% of their total trading capital. This means that if a trade goes against them, the maximum loss incurred would be 2% of their total trading capital.

Is it 1% or 2% risk per trade

Calculate your maximum risk per trade

Most traders agree not to go much higher than that though, and here's why… With 2% risk per trade, even after 15 losses you've lost less than 25% of your trading capital. It's conceivable that you can win this money back.A good rule of thumb is to risk between 1% and 5% of your account balance per trade.The 2% rule in investing suggests that you should never risk more than 2% of your capital on any single trade or investment. This approach helps manage risk by limiting potential losses and preserving capital for future opportunities.

For day traders and swing traders, the 1% risk rule means you use as much capital as required to initiate a trade, but your stop loss placement protects you from losing more than 1% of your account if the trade goes against you.

What is a 2% stop loss : The 2% rule is a risk management principle that advises investors to limit the amount of capital they risk on any single trade or investment to no more than 2% of their total trading capital. This means that if a trade goes against them, the maximum loss incurred would be 2% of their total trading capital.

Is 5% a good stop loss : An active trader might use a 5% level, while a long-term investor might choose 15% or more. Another thing to keep in mind is that, once you reach your stop price, your stop order becomes a market order. So, the price at which you sell may be much different from the stop price.

What is the 1% rule for stop-loss

For day traders and swing traders, the 1% risk rule means you use as much capital as required to initiate a trade, but your stop loss placement protects you from losing more than 1% of your account if the trade goes against you.

The 2% rule is a risk management principle that advises investors to limit the amount of capital they risk on any single trade or investment to no more than 2% of their total trading capital. This means that if a trade goes against them, the maximum loss incurred would be 2% of their total trading capital.The 2% rule is a risk management principle that advises investors to limit the amount of capital they risk on any single trade or investment to no more than 2% of their total trading capital. This means that if a trade goes against them, the maximum loss incurred would be 2% of their total trading capital.

How to win one v all risk : There are two strategies that work well. One goes over America, one over Europe and Africa. Go America first. Use just the bare minimum of troops needed to deny your foes the continent bonus for Asia and Africa, The Rest goes into NA with a stronghold in your back.