The 3–5–7 rule in trading is a risk management principle that suggests allocating a certain percentage of your trading capital to different trades based on their risk levels. Here's how it typically works: 3% Rule: This suggests risking no more than 3% of your trading capital on any single trade.One popular method is the 2% Rule, which means you never put more than 2% of your account equity at risk (Table 1). For example, if you are trading a $50,000 account, and you choose a risk management stop loss of 2%, you could risk up to $1,000 on any given trade.Meaning of trading in English

the activity of buying and selling goods and/or services: She doesn't approve of Sunday trading (= shops being open on Sunday). the buying and selling of shares and money: The stock market moved ahead slightly in active trading today.

What is the 1% rule in trading : For day traders and swing traders, the 1% risk rule means you use as much capital as required to initiate a trade, but your stop loss placement protects you from losing more than 1% of your account if the trade goes against you.

What is the 3% rule in trading

The 3% rule states that you should never risk more than 3% of your whole trading capital on a single deal. In order to safeguard themselves against big losses, traders attempt to restrict exposures on a single deal.

Can I risk 3% per trade : A trader should only use leverage when the advantage is clearly on their side. Once the amount of risk in terms of the number of pips is known, it is possible to determine the potential loss of capital. As a general rule, this loss should never be more than 3% of trading capital.

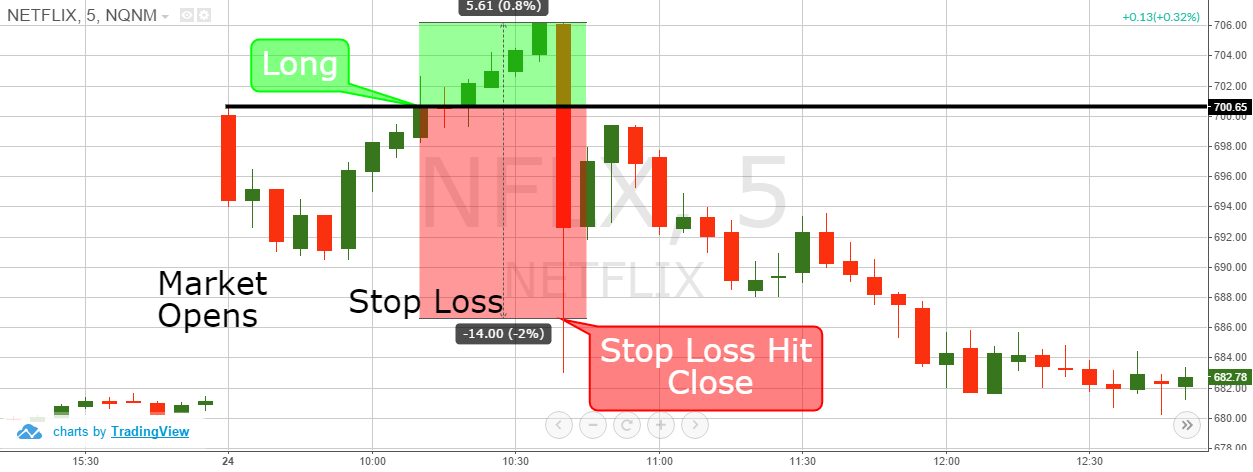

Using the 2% Rule With a Stop Loss Order

Suppose that a trader has a $50,000 trading account and wants to trade Apple, Inc. (AAPL). Using the 2% rule, the trader can risk $1,000 of capital ($50,000 x 0.02%). If AAPL is trading at $170 and the trader wants to use a $15 stop loss, they can buy 67 shares ($1,000 / $15). Making some trades to appease social forces is not gambling in and of itself if people actually know what they are doing. However, entering into a financial transaction without a solid investment understanding is gambling. Such people lack the knowledge to exert control over the profitability of their choices.

Is trading a good career

Key Takeaways

Trading is often viewed as a high barrier-to-entry profession, but as long as you have both ambition and patience, you can trade for a living (even with little to no money). Trading can become a full-time career opportunity, a part-time opportunity, or just a way to generate supplemental income.Enter the 1% rule, a risk management strategy that acts as a safety net, safeguarding your capital and fostering a disciplined approach to navigate the market's turbulent waters. In essence, the 1% rule dictates that you never risk more than 1% of your trading capital on a single trade.Calculate your maximum risk per trade

Most traders agree not to go much higher than that though, and here's why… With 2% risk per trade, even after 15 losses you've lost less than 25% of your trading capital. It's conceivable that you can win this money back. A good rule of thumb is to risk between 1% and 5% of your account balance per trade.

What is the 2% risk strategy : The 2% rule in investing suggests that you should never risk more than 2% of your capital on any single trade or investment. This approach helps manage risk by limiting potential losses and preserving capital for future opportunities.

How do you risk 1% when trading : The 1% risk rule means not risking more than 1% of account capital on a single trade. It doesn't mean only putting 1% of your capital into a trade. Put as much capital as you wish, but if the trade is losing more than 1% of your total capital, close the position.

Is trading luck or skill

There is an element of luck at play in the stock market. Of course, skill and hard work will play a part in your success, but other factors such as timing and luck also play a part in a stock's performance. For instance, there are times when stocks go on streaks and outperform themselves. Gambling vs. Day Trading. The main difference between day trading and gambling is that gamblers play available odds while traders strategize based on market trends, price movements, and past performances.It is no secret that trading can be a very stressful job. According to Business Insider, it is the second-most stressful job on Wall Street, just behind investment banking. Forex traders need to make a lot of decisions, and they must act quickly to make the best decisions.

Is trading really skill : To become a trader, an individual will need a background in engineering, maths, or hard science, instead of having only business or finance background. Traders will need both research as well as analytical skills to keep track of day-to-day chart patterns and economic factors that have an impact on financial markets.

Antwort What is the 2% rule in day trading? Weitere Antworten – What is the 3-5-7 rule in trading

The 3–5–7 rule in trading is a risk management principle that suggests allocating a certain percentage of your trading capital to different trades based on their risk levels. Here's how it typically works: 3% Rule: This suggests risking no more than 3% of your trading capital on any single trade.One popular method is the 2% Rule, which means you never put more than 2% of your account equity at risk (Table 1). For example, if you are trading a $50,000 account, and you choose a risk management stop loss of 2%, you could risk up to $1,000 on any given trade.Meaning of trading in English

the activity of buying and selling goods and/or services: She doesn't approve of Sunday trading (= shops being open on Sunday). the buying and selling of shares and money: The stock market moved ahead slightly in active trading today.

What is the 1% rule in trading : For day traders and swing traders, the 1% risk rule means you use as much capital as required to initiate a trade, but your stop loss placement protects you from losing more than 1% of your account if the trade goes against you.

What is the 3% rule in trading

The 3% rule states that you should never risk more than 3% of your whole trading capital on a single deal. In order to safeguard themselves against big losses, traders attempt to restrict exposures on a single deal.

Can I risk 3% per trade : A trader should only use leverage when the advantage is clearly on their side. Once the amount of risk in terms of the number of pips is known, it is possible to determine the potential loss of capital. As a general rule, this loss should never be more than 3% of trading capital.

Using the 2% Rule With a Stop Loss Order

Suppose that a trader has a $50,000 trading account and wants to trade Apple, Inc. (AAPL). Using the 2% rule, the trader can risk $1,000 of capital ($50,000 x 0.02%). If AAPL is trading at $170 and the trader wants to use a $15 stop loss, they can buy 67 shares ($1,000 / $15).

Making some trades to appease social forces is not gambling in and of itself if people actually know what they are doing. However, entering into a financial transaction without a solid investment understanding is gambling. Such people lack the knowledge to exert control over the profitability of their choices.

Is trading a good career

Key Takeaways

Trading is often viewed as a high barrier-to-entry profession, but as long as you have both ambition and patience, you can trade for a living (even with little to no money). Trading can become a full-time career opportunity, a part-time opportunity, or just a way to generate supplemental income.Enter the 1% rule, a risk management strategy that acts as a safety net, safeguarding your capital and fostering a disciplined approach to navigate the market's turbulent waters. In essence, the 1% rule dictates that you never risk more than 1% of your trading capital on a single trade.Calculate your maximum risk per trade

Most traders agree not to go much higher than that though, and here's why… With 2% risk per trade, even after 15 losses you've lost less than 25% of your trading capital. It's conceivable that you can win this money back.

A good rule of thumb is to risk between 1% and 5% of your account balance per trade.

What is the 2% risk strategy : The 2% rule in investing suggests that you should never risk more than 2% of your capital on any single trade or investment. This approach helps manage risk by limiting potential losses and preserving capital for future opportunities.

How do you risk 1% when trading : The 1% risk rule means not risking more than 1% of account capital on a single trade. It doesn't mean only putting 1% of your capital into a trade. Put as much capital as you wish, but if the trade is losing more than 1% of your total capital, close the position.

Is trading luck or skill

There is an element of luck at play in the stock market. Of course, skill and hard work will play a part in your success, but other factors such as timing and luck also play a part in a stock's performance. For instance, there are times when stocks go on streaks and outperform themselves.

Gambling vs. Day Trading. The main difference between day trading and gambling is that gamblers play available odds while traders strategize based on market trends, price movements, and past performances.It is no secret that trading can be a very stressful job. According to Business Insider, it is the second-most stressful job on Wall Street, just behind investment banking. Forex traders need to make a lot of decisions, and they must act quickly to make the best decisions.

Is trading really skill : To become a trader, an individual will need a background in engineering, maths, or hard science, instead of having only business or finance background. Traders will need both research as well as analytical skills to keep track of day-to-day chart patterns and economic factors that have an impact on financial markets.