The Dow Jones Industrial Average is a popular benchmark for blue chip stocks, and the index returned 268% over the same period. The Nasdaq Composite is the barometer for tech stocks, and its 20-year return of 687% led the three major indexes.The Nasdaq has an average annualized return of 10.4% for the past 30 years. On the other hand, the S&P 500 – an index that tracks 500 leading companies listed on U.S. stock exchanges – gained a cumulative 875% over the last 30 years.

What is the historical return of the Nasdaq : Average Nasdaq 100 Returns Based on QQQ

Returns have been calculated based on . Since 1985 (39 years) the Nasdaq 100 has produced an annualized return of 13.65% (not including dividends).

What is the S&P 500 10 year return

The historical average yearly return of the S&P 500 is 12.58% over the last 10 years, as of the end of April 2024. This assumes dividends are reinvested. Adjusted for inflation, the 10-year average stock market return (including dividends) is 9.52%.

What is a good 10 year return on stocks : 5-year, 10-year, 20-year and 30-year S&P 500 returns

Period (start-of-year to end-of-2023)

Average annual S&P 500 return

5 years (2019-2023)

15.36%

10 years (2014-2023)

11.02%

15 years (2009-2023)

12.63%

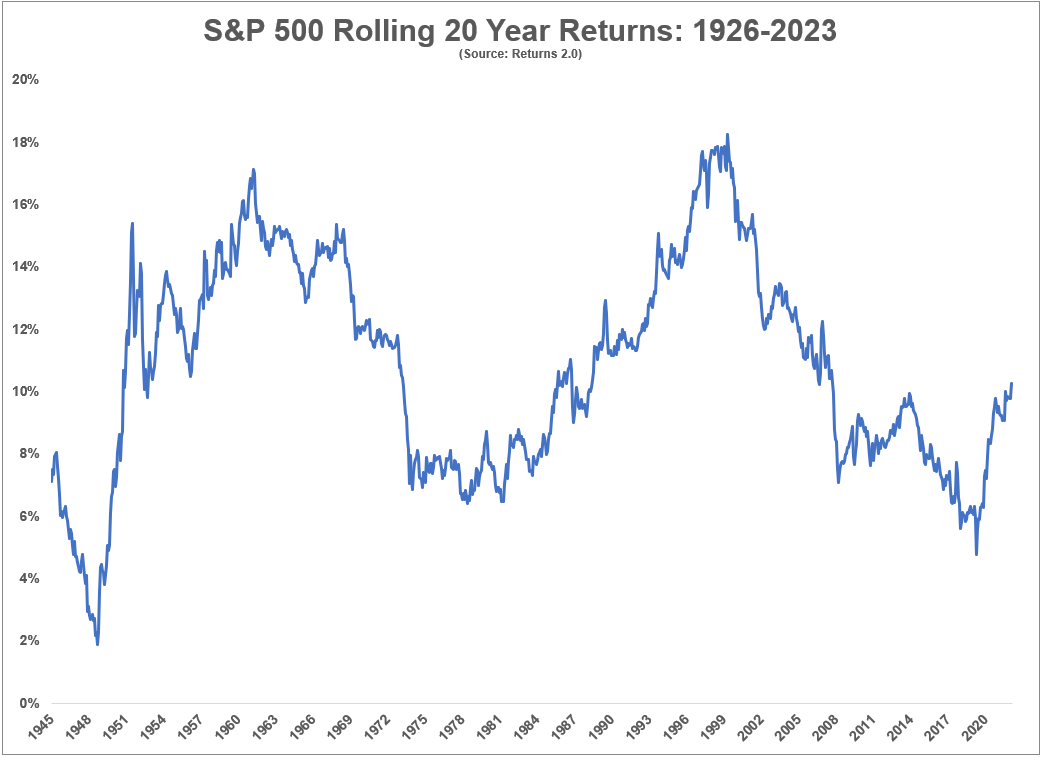

20 years (2004-2023)

9.00%

Invesco QQQ Market Price: YTD: 8.56%; 1YR: 39.27%; 3YR: 12.34%; 5YR: 20.62%; 10YR: 18.58%; Since Inception: 9.70%. SIP Returns (NAV as on 16th May, 2024)

Period Invested for

₹1000 SIP Started on

Absolute Returns

1 Year

16-May-23

17.39 %

2 Year

16-May-22

38.35 %

3 Year

14-May-21

39.07 %

5 Year

16-May-19

72.39 %

How much will stocks grow in 10 years

5-year, 10-year, 20-year and 30-year S&P 500 returns

Period (start-of-year to end-of-2023)

Average annual S&P 500 return

5 years (2019-2023)

15.36%

10 years (2014-2023)

11.02%

15 years (2009-2023)

12.63%

20 years (2004-2023)

9.00%

Ten Year Stock Price Total Return for SPDR S&P 500 ETF Trust is calculated as follows: Last Close Price [ 523.30 ] / Adj Prior Close Price [ 156.61 ] (-) 1 (=) Total Return [ 234.1% ] Prior price dividend adjustment factor is 0.84.General ROI: A positive ROI is generally considered good, with a normal ROI of 5-7% often seen as a reasonable expectation. However, a strong general ROI is something greater than 10%. Return on Stocks: On average, a ROI of 7% after inflation is often considered good, based on the historical returns of the market. The historical average yearly return of the S&P 500 is 12.58% over the last 10 years, as of the end of April 2024. This assumes dividends are reinvested. Adjusted for inflation, the 10-year average stock market return (including dividends) is 9.52%.

Which ETF has the best 10-year return : 1. VanEck Semiconductor ETF

10-year return: 24.37%

Assets under management: $10.9B.

Expense ratio: 0.35%

As of date: November 30, 2023.

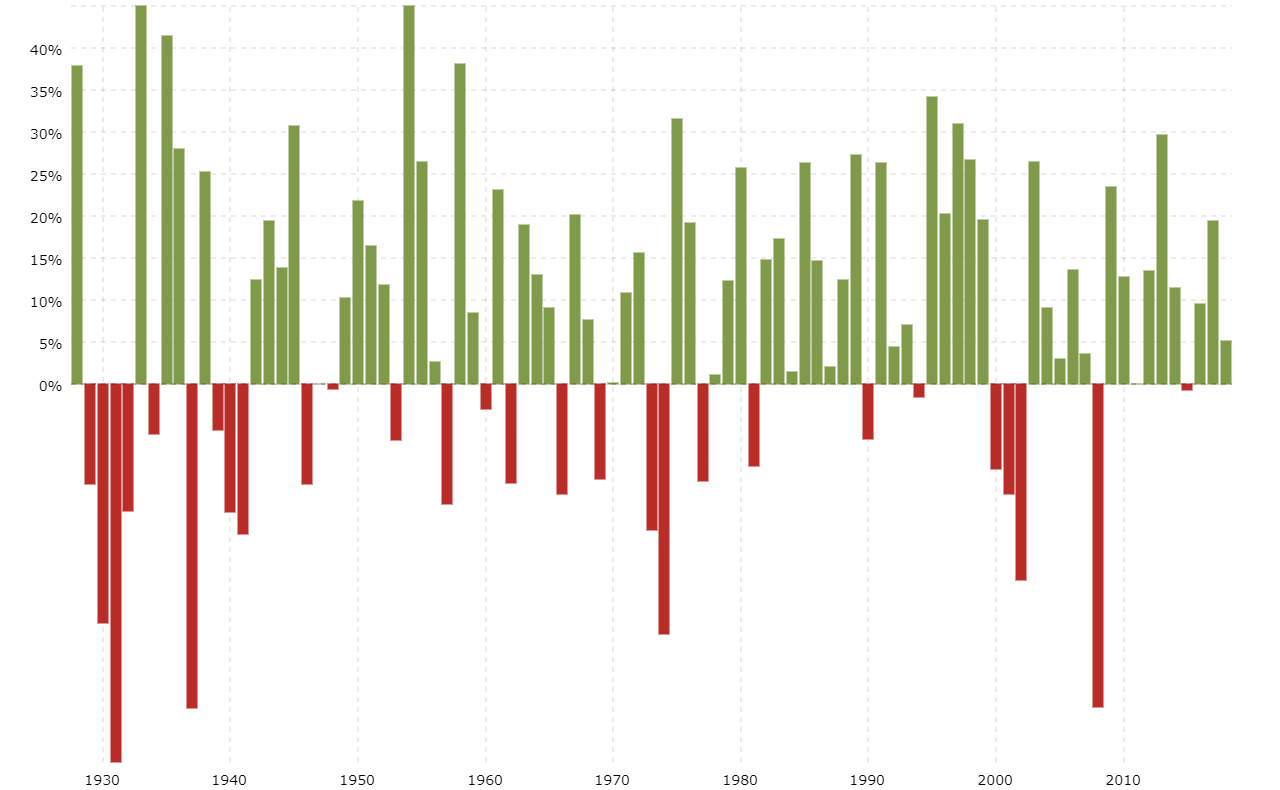

Is QQQ a safe long term investment : QQQ has also delivered solid performance over the years, returning 17.65% over the past 10 years and outpacing the S&P 500 by 5.88% in the same time frame, but it is important to keep in mind that the Nasdaq-100 has posted six annual losses since launching in 1985.

Is Nasdaq 100 good for long term

Performance Of Nasdaq 100 Index

The Nasdaq 100 index has done well in recent years when compared to Indian equity markets. Nasdaq 100 TRI index has delivered a CAGR of 34.6% over the past 5 years, while the NIFTY 50 TRI index has delivered a CAGR of 18.8%. Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498.How long has it historically taken a stock investment to double NYU business professor Aswath Damodaran has done the math. According to his math, since 1949 S&P 500 investments have doubled ten times, or an average of about seven years each time.

What is the S&P 500 3 year return : S&P 500 3 Year Return is at 20.44%, compared to 32.26% last month and 43.16% last year. This is lower than the long term average of 23.24%.

Antwort What is the 10 year average return for Nasdaq? Weitere Antworten – What is the 10 year average return on the Nasdaq

Average returns

687%

The Dow Jones Industrial Average is a popular benchmark for blue chip stocks, and the index returned 268% over the same period. The Nasdaq Composite is the barometer for tech stocks, and its 20-year return of 687% led the three major indexes.The Nasdaq has an average annualized return of 10.4% for the past 30 years. On the other hand, the S&P 500 – an index that tracks 500 leading companies listed on U.S. stock exchanges – gained a cumulative 875% over the last 30 years.

What is the historical return of the Nasdaq : Average Nasdaq 100 Returns Based on QQQ

Returns have been calculated based on . Since 1985 (39 years) the Nasdaq 100 has produced an annualized return of 13.65% (not including dividends).

What is the S&P 500 10 year return

The historical average yearly return of the S&P 500 is 12.58% over the last 10 years, as of the end of April 2024. This assumes dividends are reinvested. Adjusted for inflation, the 10-year average stock market return (including dividends) is 9.52%.

What is a good 10 year return on stocks : 5-year, 10-year, 20-year and 30-year S&P 500 returns

Invesco QQQ Market Price: YTD: 8.56%; 1YR: 39.27%; 3YR: 12.34%; 5YR: 20.62%; 10YR: 18.58%; Since Inception: 9.70%.

SIP Returns (NAV as on 16th May, 2024)

How much will stocks grow in 10 years

5-year, 10-year, 20-year and 30-year S&P 500 returns

Ten Year Stock Price Total Return for SPDR S&P 500 ETF Trust is calculated as follows: Last Close Price [ 523.30 ] / Adj Prior Close Price [ 156.61 ] (-) 1 (=) Total Return [ 234.1% ] Prior price dividend adjustment factor is 0.84.General ROI: A positive ROI is generally considered good, with a normal ROI of 5-7% often seen as a reasonable expectation. However, a strong general ROI is something greater than 10%. Return on Stocks: On average, a ROI of 7% after inflation is often considered good, based on the historical returns of the market.

The historical average yearly return of the S&P 500 is 12.58% over the last 10 years, as of the end of April 2024. This assumes dividends are reinvested. Adjusted for inflation, the 10-year average stock market return (including dividends) is 9.52%.

Which ETF has the best 10-year return : 1. VanEck Semiconductor ETF

Is QQQ a safe long term investment : QQQ has also delivered solid performance over the years, returning 17.65% over the past 10 years and outpacing the S&P 500 by 5.88% in the same time frame, but it is important to keep in mind that the Nasdaq-100 has posted six annual losses since launching in 1985.

Is Nasdaq 100 good for long term

Performance Of Nasdaq 100 Index

The Nasdaq 100 index has done well in recent years when compared to Indian equity markets. Nasdaq 100 TRI index has delivered a CAGR of 34.6% over the past 5 years, while the NIFTY 50 TRI index has delivered a CAGR of 18.8%.

Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498.How long has it historically taken a stock investment to double NYU business professor Aswath Damodaran has done the math. According to his math, since 1949 S&P 500 investments have doubled ten times, or an average of about seven years each time.

What is the S&P 500 3 year return : S&P 500 3 Year Return is at 20.44%, compared to 32.26% last month and 43.16% last year. This is lower than the long term average of 23.24%.