As of 1 February 2024, the Tax Free Shopping minimum spend in Italy has been lowered from €154,99 to just €70. Shop your favourite brands now for even less! From February, enjoy even more savings at our Designer Outlets in Italy with a major reduction of the Tax Free Shopping minmum spend from €154,99 to just €70.The standard VAT rate in Italy is 22%. Italy will reimburse between 13% and 15% of the amount you spend during your trip on products subject to standard VAT rates. The minimum purchase threshold is 154.95 EUR.Tax Free shopping allows customers from outside the European Union, and EU residents, to claim a VAT refund on purchases of personal goods – provided they're intended for personal use and carried in personal luggage and taken outside of the country.

How do you get a VAT refund : How to get a VAT refund

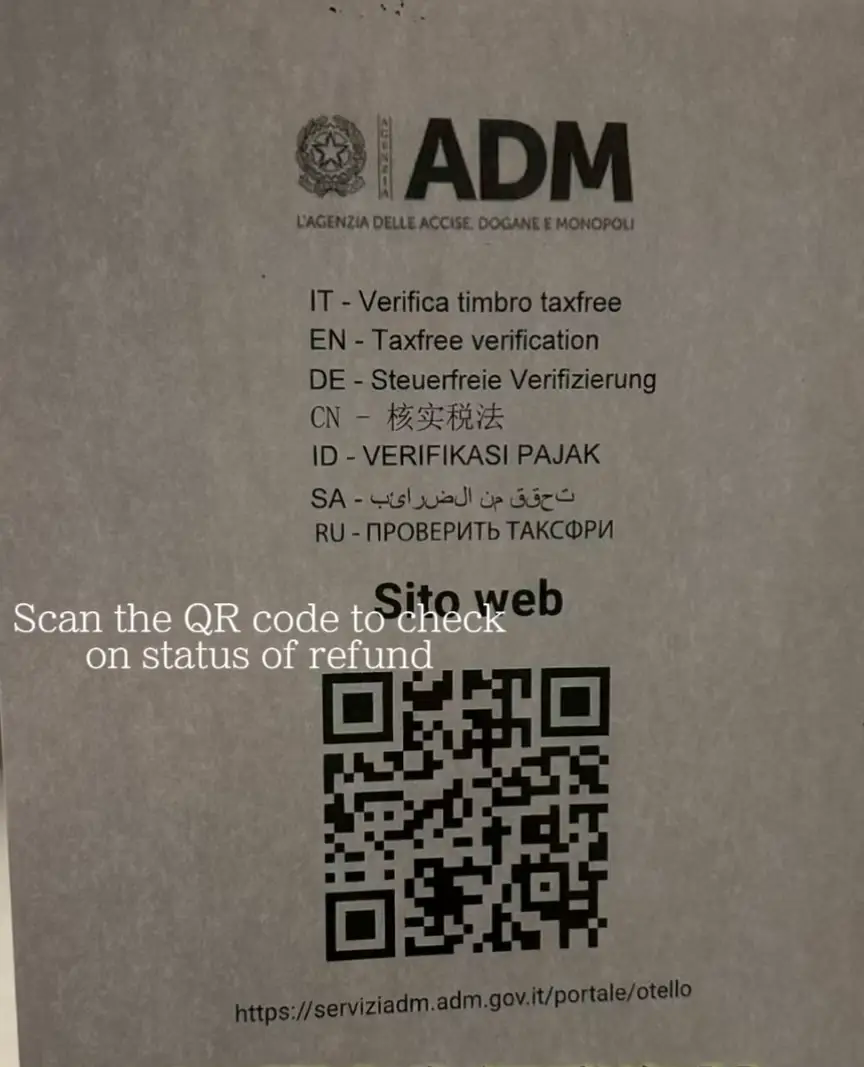

Typically, you have to pay the value-added tax at the time of purchase, and then apply for a refund from the shop.

Usually, your purchase must be over a certain amount in order to qualify for a VAT refund.

Spending on food and hotels often isn't eligible for VAT refunds.

How to claim tax back in Italy

You can get your VAT refund directly from one the tourism tax refund company. There, you can decide to receive the money whether by cash refund or credit card. In case you choose a credit card some fees will apply. Moreover you will need to wait 2 or 3 months before receiving the money.

How much VAT will I get back : To calculate VAT backwards simply : Take the sum you want to work backwards from divide it by 1.2 (1. + VAT Percentage), then subtract the divided number from the original number, that then equals the VAT. For example £60 / 1.2 (UK VAT rate) = £50 (price without VAT)

You can only reclaim VAT on goods and services that were exclusively used for your business. You can't reclaim VAT on goods and services that are for non-business use or are for client entertaining. To reclaim VAT as a business, you need to submit a VAT return to HMRC every three months. This will show how much VAT you've charged to customers and how much you've paid.

How much is VAT in Italy

22%

The standard VAT rate in Italy is 22%.

It applies to most goods and services. The two reduced VAT rates are 10% and 5%. The super-reduced rate is 4%. Italy also has some zero-rated goods, the sale of which must still be reported on your VAT return, even though no VAT is charged.Personal use and claiming back VAT

You can reclaim 50% of the VAT on the purchase price and the service plan. Similarly, if your office occupies 10% of the floor space in your home, you can reclaim 10% of the VAT on your utility bills.You must show the invoice, the refund form, the goods and any other necessary documents to the customs officers of the last EU country you leave. The customs officers must stamp the form as proof of export. Without the stamp, you will not obtain the refund. There are two tax return forms in Italy: Form 730 (in Italian) Redditi PF (in Italian)

How do I convert VAT back : Removing VAT Calculation (Reverse VAT Calculation)

In other words you can find the amount which excludes VAT by dividing the amount that includes VAT by 1.15. The Rand value of the VAT amount is then just equal to the original amount less the amount which excludes VAT.

What items qualify for VAT refund : So it's usually high-ticket items, like jewelry or fine clothing, that qualify for a VAT refund, not a paperback novel or suntan lotion. There are also a number of goods and services that are not eligible for refunds, including hotel rooms and meals.

How to do VAT return

Unless you're using the flat rate scheme, you can calculate your VAT return by following the steps below:

Add up the total VAT you've collected on sales (output VAT)

Add up the total VAT you've paid on business-related purchases and expenses (input VAT)

Deduct your input VAT figure from your output VAT figure.

CLAIM YOUR VAT REFUND

Present your claim at the VAT Refund Office. VAT Refund Offices are located at O R Tambo International Airport – Johannesburg, Cape Town International Airport and King Shaka International Airport – Durban. The location of the VAT Refund Office is clearly sign posted.The EU standard VAT rate is 21%, with member states setting their own levels to a minimum level of 15%. Luxembourg currently has the lowest rate in the EU at 17%, and Hungary has the highest at 27%.

How do I claim back airport tax : The procedures for claiming an airport tax refund vary from airline to airline. Some will refund it automatically, whereas others require you to fill out a form. Each airline should publish details of how to claim back APD tax on its own website. If you cannot find this, call the airline and request details.

Antwort What is tax-free in Italy? Weitere Antworten – How much is tax free in Italy

€70

As of 1 February 2024, the Tax Free Shopping minimum spend in Italy has been lowered from €154,99 to just €70. Shop your favourite brands now for even less! From February, enjoy even more savings at our Designer Outlets in Italy with a major reduction of the Tax Free Shopping minmum spend from €154,99 to just €70.The standard VAT rate in Italy is 22%. Italy will reimburse between 13% and 15% of the amount you spend during your trip on products subject to standard VAT rates. The minimum purchase threshold is 154.95 EUR.Tax Free shopping allows customers from outside the European Union, and EU residents, to claim a VAT refund on purchases of personal goods – provided they're intended for personal use and carried in personal luggage and taken outside of the country.

How do you get a VAT refund : How to get a VAT refund

How to claim tax back in Italy

You can get your VAT refund directly from one the tourism tax refund company. There, you can decide to receive the money whether by cash refund or credit card. In case you choose a credit card some fees will apply. Moreover you will need to wait 2 or 3 months before receiving the money.

How much VAT will I get back : To calculate VAT backwards simply : Take the sum you want to work backwards from divide it by 1.2 (1. + VAT Percentage), then subtract the divided number from the original number, that then equals the VAT. For example £60 / 1.2 (UK VAT rate) = £50 (price without VAT)

You can only reclaim VAT on goods and services that were exclusively used for your business. You can't reclaim VAT on goods and services that are for non-business use or are for client entertaining.

To reclaim VAT as a business, you need to submit a VAT return to HMRC every three months. This will show how much VAT you've charged to customers and how much you've paid.

How much is VAT in Italy

22%

The standard VAT rate in Italy is 22%.

It applies to most goods and services. The two reduced VAT rates are 10% and 5%. The super-reduced rate is 4%. Italy also has some zero-rated goods, the sale of which must still be reported on your VAT return, even though no VAT is charged.Personal use and claiming back VAT

You can reclaim 50% of the VAT on the purchase price and the service plan. Similarly, if your office occupies 10% of the floor space in your home, you can reclaim 10% of the VAT on your utility bills.You must show the invoice, the refund form, the goods and any other necessary documents to the customs officers of the last EU country you leave. The customs officers must stamp the form as proof of export. Without the stamp, you will not obtain the refund.

There are two tax return forms in Italy: Form 730 (in Italian) Redditi PF (in Italian)

How do I convert VAT back : Removing VAT Calculation (Reverse VAT Calculation)

In other words you can find the amount which excludes VAT by dividing the amount that includes VAT by 1.15. The Rand value of the VAT amount is then just equal to the original amount less the amount which excludes VAT.

What items qualify for VAT refund : So it's usually high-ticket items, like jewelry or fine clothing, that qualify for a VAT refund, not a paperback novel or suntan lotion. There are also a number of goods and services that are not eligible for refunds, including hotel rooms and meals.

How to do VAT return

Unless you're using the flat rate scheme, you can calculate your VAT return by following the steps below:

CLAIM YOUR VAT REFUND

Present your claim at the VAT Refund Office. VAT Refund Offices are located at O R Tambo International Airport – Johannesburg, Cape Town International Airport and King Shaka International Airport – Durban. The location of the VAT Refund Office is clearly sign posted.The EU standard VAT rate is 21%, with member states setting their own levels to a minimum level of 15%. Luxembourg currently has the lowest rate in the EU at 17%, and Hungary has the highest at 27%.

How do I claim back airport tax : The procedures for claiming an airport tax refund vary from airline to airline. Some will refund it automatically, whereas others require you to fill out a form. Each airline should publish details of how to claim back APD tax on its own website. If you cannot find this, call the airline and request details.