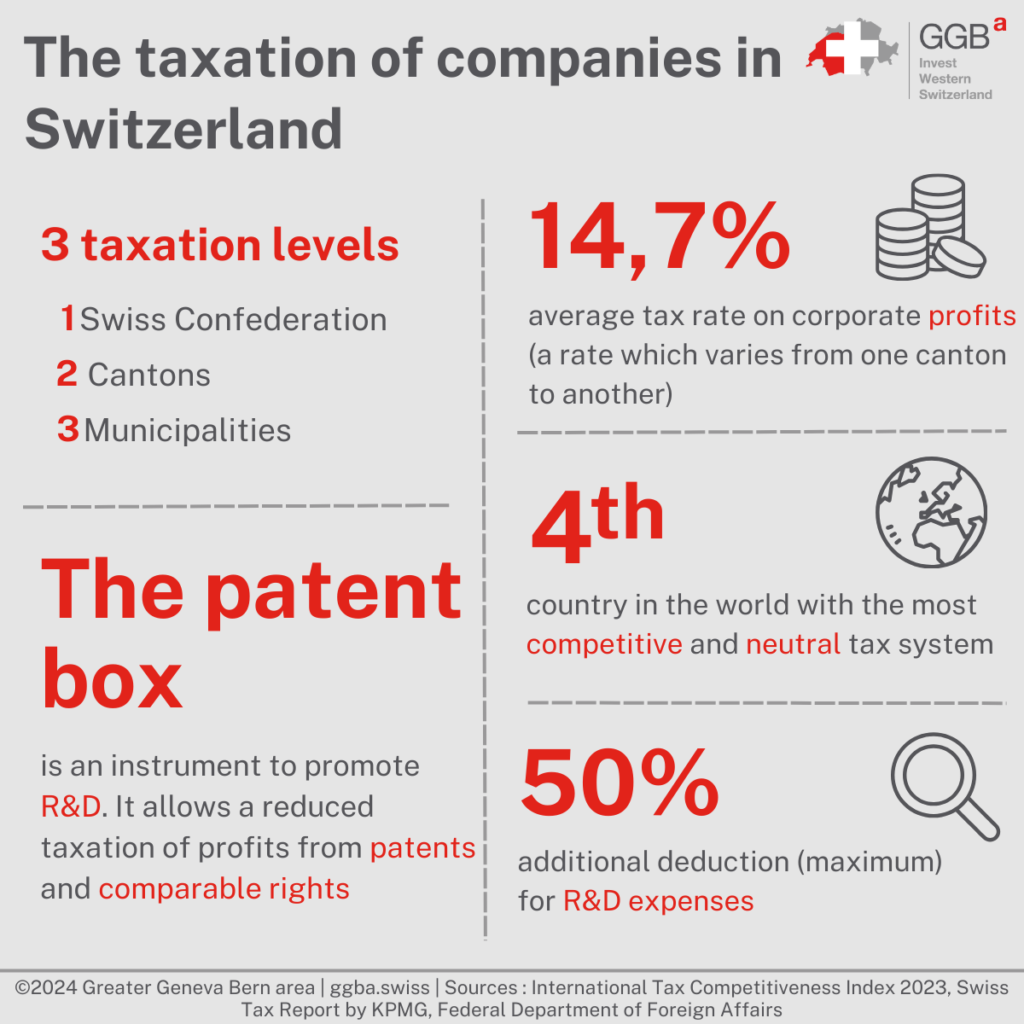

The European nation of Switzerland is considered to be an international tax haven due to low tax levels and privacy laws. Switzerland also has a history of favorable tax treaties, stable politics, and a wealth of advisors.8.1% Value-added tax (VAT)

As a matter of principle, proceeds of sales made and services provided in Switzerland are subject to VAT at the standard rate of 8.1% (7.7% until 31 December 2023). Goods for basic needs are subject to VAT at the reduced rate of 2.6% (2.5% until 31 December 2023).Highest Paying Jobs in Switzerland

Occupation

Yearly Average salary in Switzerland (in CHF)

Annual Salary in INR

Software Engineering

94,403

89.00 Lakhs

Manufacturing Engineer

92,136

87.00 Lakhs

Pharmaceutical

90,000

85.00 Lakhs

Sales and Marketing

90,000

85.00 Lakhs

How much tax do Swiss pay : In Switzerland, the average single worker faced a net average tax rate of 18.6% in 2023, compared with the OECD average of 24.9%. In other words, in Switzerland the take-home pay of an average single worker, after tax and benefits, was 81.4% of their gross wage, compared with the OECD average of 75.1%.

How much is Czech VAT

21% VAT Rates Czech Republic

VAT rate in Czech Republic is generally charged in a standard rate of 21% on supplies of goods and services. As provided under Article 47 on VAT Act, there are two reduced VAT rate in Czech Republic. A reduced VAT rate of 15% and 10%, both consolidated in 12% after 2024.

How much is tax free in Zurich : 300 CHF Switzerland will reimburse between 4.5% and 5.4% of the amount you spend during your trip on products subject to standard VAT rates. The minimum purchase threshold is 300 CHF.

According to the Swiss Federal Statistical Office and World Salaries, the average salary in Zürich is CHF 100,000 per year or CHF 51.28 per hour, which is roughly 113,579.20 USD. As you can see, the average salary in Zürich is very high compared to other countries. It's a good salary, yes. Let me give you more details: gross salary in Switzerland means in general: 120k divided by 13 (most companies pay two salaries by end of November combined) and then you have to deduct around 15% from the gross part monthly (social insurances)…

Is Switzerland expensive to live in

Switzerland has unavoidable expenses, like health insurance, internet, and electricity. These costs can quickly add up, so it's important to consider balancing them with investments such as vacation time or savings. On the bright side, Switzerland has a high cost of living because so many luxuries are available here.The Czech Republic applies progressive taxation on income of tax residents as follows: Gross annual income up to CZK 1,582,812 (the bracket is calculated as 36x average monthly salary) is subject to a 15% rate. Gross annual income exceeding this threshold is subject to a rate of 23%.Description. Individuals and legal persons are tax residents of the Czech Republic if certain conditions are met. The tax rate amounts to 15% for the part of the tax base up to an average salary multiplied by 48. The maximum overall rate of federal income tax is 11.5%. The various cantonal and municipal taxes are also levied at progressive rates, with a maximum combined cantonal and municipal rate of approximately 36%. In addition, cantonal and municipal net wealth taxes are levied.

What is 100k after tax in Zurich : Periodic Payroll Deductions Overview

Yearly

Monthly

Salary After Tax

61,360.73

5,113.39

Employer Payroll Costs

Old age, survivors and disability insurance

5,300.00

441.67

Unemployment Insurance

1,100.00

91.67

Is 500k a good salary in Switzerland : Is 400k to 500k chf considered as rich in Switzerland – Quora. >> Is 400k to 500k chf considered as rich in Switzerland Income per year Yes, that's a pretty high income, even in Switzerland.

How much salary to live comfortably in Switzerland

What to expect if you are family/ a single person living cost in Switzerland. If you are a family, you can expect to spend between 4000 and 8000 Swiss francs per month on living expenses. If you are a single person, you can expect to pay between 2500 and 4000 Swiss francs per month on living expenses. According to the Swiss Federal Statistical Office and World Salaries, the average salary in Zürich is CHF 100,000 per year or CHF 51.28 per hour, which is roughly 113,579.20 USD.Summary table : Average and minimum salaries in Switzerland per month in 2024

Category

Amount in CHF

Amount in USD (approx.)

Average Gross Monthly Salary

CHF 6,665

USD 7,439

– Average for Women

CHF 6,211

USD 6,935

– Average for Men

CHF 6,963

USD 7,776

Geneva Minimum Wage (Gross)

CHF 4,426

USD 4,940

Where is the lowest tax in Europe : Bulgaria Bulgaria and Romania (10 percent) levy the lowest rate, followed by Moldova (12 percent), Ukraine (19.5 percent), and Georgia (20 percent).

Antwort What is Switzerland tax rate? Weitere Antworten – Is Switzerland a high tax country

The European nation of Switzerland is considered to be an international tax haven due to low tax levels and privacy laws. Switzerland also has a history of favorable tax treaties, stable politics, and a wealth of advisors.8.1%

Value-added tax (VAT)

As a matter of principle, proceeds of sales made and services provided in Switzerland are subject to VAT at the standard rate of 8.1% (7.7% until 31 December 2023). Goods for basic needs are subject to VAT at the reduced rate of 2.6% (2.5% until 31 December 2023).Highest Paying Jobs in Switzerland

How much tax do Swiss pay : In Switzerland, the average single worker faced a net average tax rate of 18.6% in 2023, compared with the OECD average of 24.9%. In other words, in Switzerland the take-home pay of an average single worker, after tax and benefits, was 81.4% of their gross wage, compared with the OECD average of 75.1%.

How much is Czech VAT

21%

VAT Rates Czech Republic

VAT rate in Czech Republic is generally charged in a standard rate of 21% on supplies of goods and services. As provided under Article 47 on VAT Act, there are two reduced VAT rate in Czech Republic. A reduced VAT rate of 15% and 10%, both consolidated in 12% after 2024.

How much is tax free in Zurich : 300 CHF

Switzerland will reimburse between 4.5% and 5.4% of the amount you spend during your trip on products subject to standard VAT rates. The minimum purchase threshold is 300 CHF.

According to the Swiss Federal Statistical Office and World Salaries, the average salary in Zürich is CHF 100,000 per year or CHF 51.28 per hour, which is roughly 113,579.20 USD. As you can see, the average salary in Zürich is very high compared to other countries.

It's a good salary, yes. Let me give you more details: gross salary in Switzerland means in general: 120k divided by 13 (most companies pay two salaries by end of November combined) and then you have to deduct around 15% from the gross part monthly (social insurances)…

Is Switzerland expensive to live in

Switzerland has unavoidable expenses, like health insurance, internet, and electricity. These costs can quickly add up, so it's important to consider balancing them with investments such as vacation time or savings. On the bright side, Switzerland has a high cost of living because so many luxuries are available here.The Czech Republic applies progressive taxation on income of tax residents as follows: Gross annual income up to CZK 1,582,812 (the bracket is calculated as 36x average monthly salary) is subject to a 15% rate. Gross annual income exceeding this threshold is subject to a rate of 23%.Description. Individuals and legal persons are tax residents of the Czech Republic if certain conditions are met. The tax rate amounts to 15% for the part of the tax base up to an average salary multiplied by 48.

The maximum overall rate of federal income tax is 11.5%. The various cantonal and municipal taxes are also levied at progressive rates, with a maximum combined cantonal and municipal rate of approximately 36%. In addition, cantonal and municipal net wealth taxes are levied.

What is 100k after tax in Zurich : Periodic Payroll Deductions Overview

Is 500k a good salary in Switzerland : Is 400k to 500k chf considered as rich in Switzerland – Quora. >> Is 400k to 500k chf considered as rich in Switzerland Income per year Yes, that's a pretty high income, even in Switzerland.

How much salary to live comfortably in Switzerland

What to expect if you are family/ a single person living cost in Switzerland. If you are a family, you can expect to spend between 4000 and 8000 Swiss francs per month on living expenses. If you are a single person, you can expect to pay between 2500 and 4000 Swiss francs per month on living expenses.

According to the Swiss Federal Statistical Office and World Salaries, the average salary in Zürich is CHF 100,000 per year or CHF 51.28 per hour, which is roughly 113,579.20 USD.Summary table : Average and minimum salaries in Switzerland per month in 2024

Where is the lowest tax in Europe : Bulgaria

Bulgaria and Romania (10 percent) levy the lowest rate, followed by Moldova (12 percent), Ukraine (19.5 percent), and Georgia (20 percent).