The S&P 500's value is calculated based on the market cap of each company, which is equal to the share price of the company multiplied by the total number of shares outstanding.The S&P 500 Earnings Yield, reflects the sum of the underlying S&P 500 companies' earnings for the previous year, divided by the S&P 500 index level at the end of the year.The S&P 500 Index measures the value of the stocks of the 500 largest corporations by market capitalization listed on the New York Stock Exchange or Nasdaq. The intention of Standard & Poor's is to have a price that provides a quick look at the stock market and economy.

What is the rule for the S&P 500 index : The Index is constituted at the company level, not at the share line level. If one company listing is in the S&P 500, all other company listings are excluded from the S&P Completion Index. S&P 500 Top 10. The index measures the performance of 10 of the largest, by FMC, companies in the S&P 500.

What is S&P 500 calculator

The S&P 500 calculator below provides both the nominal and inflation-adjusted price and total return (assuming dividend reinvestment) of U.S. stocks (i.e. the S&P 500) over any time period from January 1871 to the present (see the default “End Month” below for the latest date available).

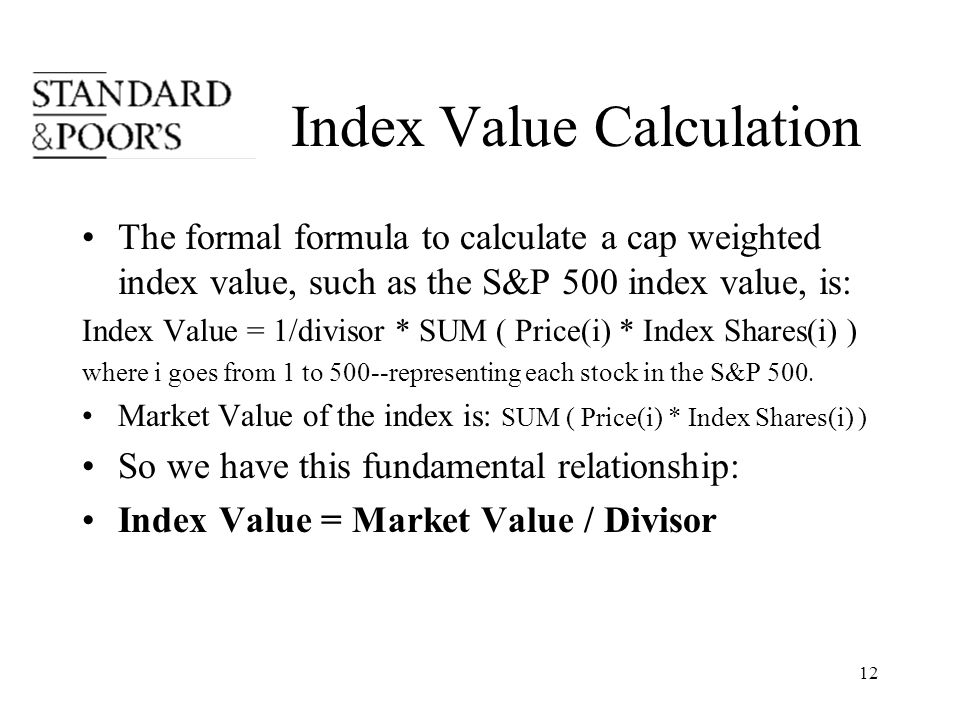

How is an index calculated : The calculation of a stock exchange index involves several steps:

Select the stocks to include in the index.

Assign a weight to each stock based on its market capitalization.

Calculate the index value by multiplying the price of each stock by its weight and adding up the results.

Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498.

The index is calculated by tracking prices of selected stocks (e.g., the top 30, as measured by prices of the largest companies, or top 50 oil-sector stocks) and based on pre-defined weighted average criteria, such as price-weighted, market-cap weighted, etc.

What is the method of the sp500 index

The value of the S&P 500 Index is computed by a free-float market capitalization-weighted methodology. 2 This is the method used by most of the world's leading indexes. The first step in this methodology is to compute the free-float market capitalization of each component in the index.INDEX(reference, row_num, [column_num], [area_num])

The reference form of the INDEX function has the following arguments: reference Required. A reference to one or more cell ranges. If you are entering a non-adjacent range for the reference, enclose reference in parentheses.The aggregative method is commonly used to calculate the price index. In this method, the index number (P) = the sum of all the values of all the commodities in the current year (P1) divided by the sum of all the values of the same commodities in the base year (P0) and multiplied by 100.

The short answer to what happens if you invest $500 a month is that you'll almost certainly build wealth over time. In fact, if you keep investing that $500 every month for 40 years, you could become a millionaire. More than a millionaire, in fact.

How much to invest to make $1,000,000 in 10 years : Now, let's consider how our calculations change if the time horizon is 10 years. If you are starting from scratch, you will need to invest about $4,757 at the end of every month for 10 years. Suppose you already have $100,000. Then you will only need $3,390 at the end of every month to become a millionaire in 10 years.

What is the formula for calculating the index : Calculate the index value by multiplying the price of each stock by its weight and adding up the results. For example, if the stock with a 10% weight is trading at $50 per share, its contribution to the index would be 10% x $50 = $5.

How is index level calculated

The index value is calculated by dividing the index market capitalization by the index divisor. An index's return can be calculated by comparing the index values from one period to the next.

The value of the S&P 500 Index is computed by a free-float market capitalization-weighted methodology. 2 This is the method used by most of the world's leading indexes. The first step in this methodology is to compute the free-float market capitalization of each component in the index.Among the key requirements are that a company has a sizeable enough market capitalization to qualify as a large-cap stock. It also must have sufficient float, or percentage of shares available for public trading. You can view the current thresholds for both of these criteria in the S&P 500 factsheet.

How to calculate index : To calculate the index, you can either:

Divide the column % of the crossover cell by the column % of the total cell for the relevant data point, and then multiply by 100.

Divide the row % of the crossover cell by the row % of the total cell for your audience, and then multiply by 100.

Antwort What is SP 500 index formula? Weitere Antworten – How is sp500 index calculated

S&P 500 Structure: Market Cap-Weighted Index

The S&P 500's value is calculated based on the market cap of each company, which is equal to the share price of the company multiplied by the total number of shares outstanding.The S&P 500 Earnings Yield, reflects the sum of the underlying S&P 500 companies' earnings for the previous year, divided by the S&P 500 index level at the end of the year.The S&P 500 Index measures the value of the stocks of the 500 largest corporations by market capitalization listed on the New York Stock Exchange or Nasdaq. The intention of Standard & Poor's is to have a price that provides a quick look at the stock market and economy.

What is the rule for the S&P 500 index : The Index is constituted at the company level, not at the share line level. If one company listing is in the S&P 500, all other company listings are excluded from the S&P Completion Index. S&P 500 Top 10. The index measures the performance of 10 of the largest, by FMC, companies in the S&P 500.

What is S&P 500 calculator

The S&P 500 calculator below provides both the nominal and inflation-adjusted price and total return (assuming dividend reinvestment) of U.S. stocks (i.e. the S&P 500) over any time period from January 1871 to the present (see the default “End Month” below for the latest date available).

How is an index calculated : The calculation of a stock exchange index involves several steps:

Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498.

The index is calculated by tracking prices of selected stocks (e.g., the top 30, as measured by prices of the largest companies, or top 50 oil-sector stocks) and based on pre-defined weighted average criteria, such as price-weighted, market-cap weighted, etc.

What is the method of the sp500 index

The value of the S&P 500 Index is computed by a free-float market capitalization-weighted methodology. 2 This is the method used by most of the world's leading indexes. The first step in this methodology is to compute the free-float market capitalization of each component in the index.INDEX(reference, row_num, [column_num], [area_num])

The reference form of the INDEX function has the following arguments: reference Required. A reference to one or more cell ranges. If you are entering a non-adjacent range for the reference, enclose reference in parentheses.The aggregative method is commonly used to calculate the price index. In this method, the index number (P) = the sum of all the values of all the commodities in the current year (P1) divided by the sum of all the values of the same commodities in the base year (P0) and multiplied by 100.

The short answer to what happens if you invest $500 a month is that you'll almost certainly build wealth over time. In fact, if you keep investing that $500 every month for 40 years, you could become a millionaire. More than a millionaire, in fact.

How much to invest to make $1,000,000 in 10 years : Now, let's consider how our calculations change if the time horizon is 10 years. If you are starting from scratch, you will need to invest about $4,757 at the end of every month for 10 years. Suppose you already have $100,000. Then you will only need $3,390 at the end of every month to become a millionaire in 10 years.

What is the formula for calculating the index : Calculate the index value by multiplying the price of each stock by its weight and adding up the results. For example, if the stock with a 10% weight is trading at $50 per share, its contribution to the index would be 10% x $50 = $5.

How is index level calculated

The index value is calculated by dividing the index market capitalization by the index divisor. An index's return can be calculated by comparing the index values from one period to the next.

The value of the S&P 500 Index is computed by a free-float market capitalization-weighted methodology. 2 This is the method used by most of the world's leading indexes. The first step in this methodology is to compute the free-float market capitalization of each component in the index.Among the key requirements are that a company has a sizeable enough market capitalization to qualify as a large-cap stock. It also must have sufficient float, or percentage of shares available for public trading. You can view the current thresholds for both of these criteria in the S&P 500 factsheet.

How to calculate index : To calculate the index, you can either: