Standard & Poor's (S&P) is a company well known around the world as a creator of financial market indices—widely used as investment benchmarks—a data source, and an issuer of credit ratings for companies and debt obligations. It's perhaps best-known for the popular and often-cited S&P 500 Index.The S&P 500 is now 20% overvalued based on calculations comparing the stock market with the bond market, says Jack Ablin, chief investment officer at Cresset Capital Management. That's a scary pronouncement as it means a 20% crash is needed just to make the S&P 500 fairly priced.In 1941, Standard Statistics merged with Poor's Publishing to become Standard & Poor's and established itself as a company that specializes in providing indexes and market data. Then, in 1957, Standard & Poor's formalized the S&P 500 index we see today.

What does S&P 500 mean : The S&P 500 is a stock market index that measures the performance of about 500 companies in the U.S. It includes companies across 11 sectors to offer a picture of the health of the U.S. stock market and the broader economy.

Why is S&P 500 so strong

Dow Jones, S&P 500 and Nasdaq Composite simultaneously close at record highs for first time in almost two months. All three major U.S. stock indexes finished at their highest-ever levels on Wednesday, fueled by signs of slowing inflation on a monthly basis in April's consumer price index.

What is the most expensive stock on S&P : Berkshire Hathaway is the most expensive stock listed on U.S. exchanges. At the time of this writing, Berkshire Hathaway stock was trading at $623,000 a share — but that price is for its Class A stock (BRK. A). Retail investors can buy its Class B stock (BRK.

McGraw-Hill, a publishing house, acquired Standard & Poor's Corp., owner of the S&P 500 index, in 1966. Today, the S&P 500 is maintained by S&P Dow Jones Indices—a joint venture owned by S&P Global (previously McGraw Hill Financial), CME Group, and News Corp. Is S&P Global a good company to work for S&P Global has an overall rating of 4.1 out of 5, based on over 7,394 reviews left anonymously by employees. 85% of employees would recommend working at S&P Global to a friend and 76% have a positive outlook for the business. This rating has been stable over the past 12 months.

How is the S&P calculated

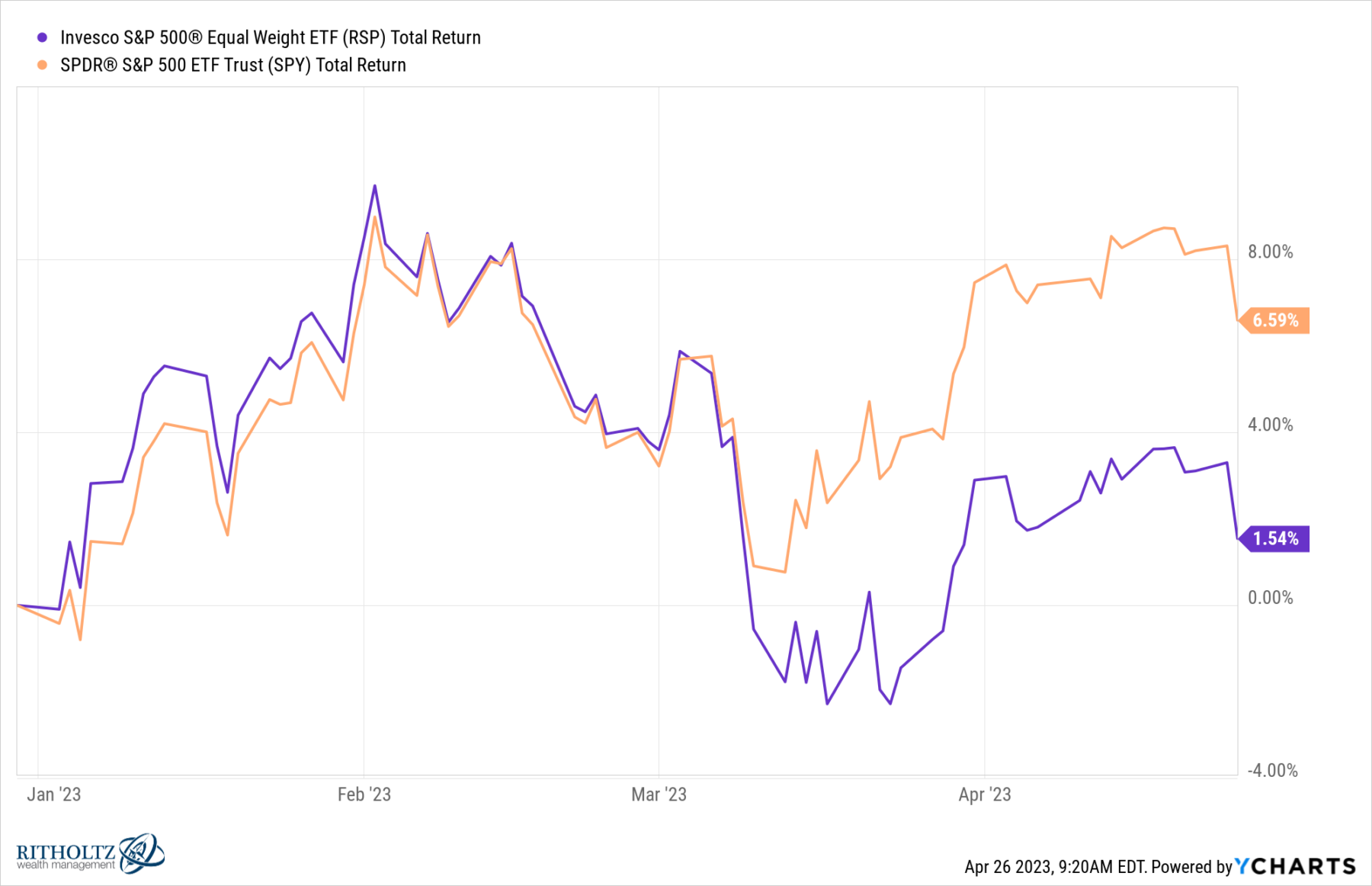

The S&P 500's value is calculated by multiplying the market capitalization of each constituent company by the total number of shares outstanding. Market cap equals each company's share price multiplied by the total number of its shares outstanding. Shares outstanding are the stock that is held by shareholders.It is one of the most commonly followed equity indices and includes approximately 80% of the total market capitalization of U.S. public companies, with an aggregate market cap of more than $43 trillion as of January 2024. The S&P 500 index is a free-float weighted/capitalization-weighted index.Over time, the S&P 500 has delivered strong returns to investors. Those who remained invested enjoyed the benefits of compounding, or the process of earning returns on the returns you've already accumulated. “Since 1970, it has delivered an average 11% return per year, including dividends,” said Reynolds. S&P 500 companies by weight

Key points. The S&P 500 index is often used as a proxy for the broader U.S. stock market.

Microsoft (MSFT) Index weight: 7.09%

Apple (AAPL) Index weight: 5.65%

Nvidia Corp. (NVDA)

Amazon.com Inc (AMZN)

Meta Platforms Class A (META)

Alphabet Class A (GOOGL)

Berkshire Hathaway Class B (BRK.B)

Does the S&P ever split : To compare, last year just four S&P 500 companies split their shares, the lowest level since the same number in 2019. Back in 2022 and 2021 10 S&P 500 companies split their shares in each year.

Who is S&P named after : S&P Global (formerly Standard & Poor's), which sponsors a number of other market indexes—and also operates one of the “Big Three” credit rating agencies—traces its roots to an investment information service begun in 1860 by Henry Varnum Poor. In 1941, Poor's original company, Poor's Publishing, merged with Standard…

Is S&P 500 only American companies

All S&P 500 constituents must be American companies and they must have market caps of at least $14.6 billion. A company's stock must be "highly liquid" and have a public float of at least 10% of its shares outstanding. S&P Global Reviews FAQs

S&P Global has an overall rating of 4.1 out of 5, based on over 7,371 reviews left anonymously by employees. 85% of employees would recommend working at S&P Global to a friend and 76% have a positive outlook for the business. This rating has been stable over the past 12 months.Douglas L. Peterson S&P Global

Headquarters at 55 Water Street

Area served

Worldwide

Key people

Douglas L. Peterson (president & CEO)

Products

Financial information and analytics

Revenue

US$12.5 billion (2023)

Why is S&P called Standard and Poor : In 1941, Paul Talbot Babson purchased Poor's Publishing and merged it with Standard Statistics to become Standard & Poor's Corp.

Antwort What is S and P stand for? Weitere Antworten – What do S and P stand for

Standard & Poor’s

Standard & Poor's (S&P) is a company well known around the world as a creator of financial market indices—widely used as investment benchmarks—a data source, and an issuer of credit ratings for companies and debt obligations. It's perhaps best-known for the popular and often-cited S&P 500 Index.The S&P 500 is now 20% overvalued based on calculations comparing the stock market with the bond market, says Jack Ablin, chief investment officer at Cresset Capital Management. That's a scary pronouncement as it means a 20% crash is needed just to make the S&P 500 fairly priced.In 1941, Standard Statistics merged with Poor's Publishing to become Standard & Poor's and established itself as a company that specializes in providing indexes and market data. Then, in 1957, Standard & Poor's formalized the S&P 500 index we see today.

What does S&P 500 mean : The S&P 500 is a stock market index that measures the performance of about 500 companies in the U.S. It includes companies across 11 sectors to offer a picture of the health of the U.S. stock market and the broader economy.

Why is S&P 500 so strong

Dow Jones, S&P 500 and Nasdaq Composite simultaneously close at record highs for first time in almost two months. All three major U.S. stock indexes finished at their highest-ever levels on Wednesday, fueled by signs of slowing inflation on a monthly basis in April's consumer price index.

What is the most expensive stock on S&P : Berkshire Hathaway is the most expensive stock listed on U.S. exchanges. At the time of this writing, Berkshire Hathaway stock was trading at $623,000 a share — but that price is for its Class A stock (BRK. A). Retail investors can buy its Class B stock (BRK.

McGraw-Hill, a publishing house, acquired Standard & Poor's Corp., owner of the S&P 500 index, in 1966. Today, the S&P 500 is maintained by S&P Dow Jones Indices—a joint venture owned by S&P Global (previously McGraw Hill Financial), CME Group, and News Corp.

Is S&P Global a good company to work for S&P Global has an overall rating of 4.1 out of 5, based on over 7,394 reviews left anonymously by employees. 85% of employees would recommend working at S&P Global to a friend and 76% have a positive outlook for the business. This rating has been stable over the past 12 months.

How is the S&P calculated

The S&P 500's value is calculated by multiplying the market capitalization of each constituent company by the total number of shares outstanding. Market cap equals each company's share price multiplied by the total number of its shares outstanding. Shares outstanding are the stock that is held by shareholders.It is one of the most commonly followed equity indices and includes approximately 80% of the total market capitalization of U.S. public companies, with an aggregate market cap of more than $43 trillion as of January 2024. The S&P 500 index is a free-float weighted/capitalization-weighted index.Over time, the S&P 500 has delivered strong returns to investors. Those who remained invested enjoyed the benefits of compounding, or the process of earning returns on the returns you've already accumulated. “Since 1970, it has delivered an average 11% return per year, including dividends,” said Reynolds.

S&P 500 companies by weight

Does the S&P ever split : To compare, last year just four S&P 500 companies split their shares, the lowest level since the same number in 2019. Back in 2022 and 2021 10 S&P 500 companies split their shares in each year.

Who is S&P named after : S&P Global (formerly Standard & Poor's), which sponsors a number of other market indexes—and also operates one of the “Big Three” credit rating agencies—traces its roots to an investment information service begun in 1860 by Henry Varnum Poor. In 1941, Poor's original company, Poor's Publishing, merged with Standard…

Is S&P 500 only American companies

All S&P 500 constituents must be American companies and they must have market caps of at least $14.6 billion. A company's stock must be "highly liquid" and have a public float of at least 10% of its shares outstanding.

S&P Global Reviews FAQs

S&P Global has an overall rating of 4.1 out of 5, based on over 7,371 reviews left anonymously by employees. 85% of employees would recommend working at S&P Global to a friend and 76% have a positive outlook for the business. This rating has been stable over the past 12 months.Douglas L. Peterson

S&P Global

Why is S&P called Standard and Poor : In 1941, Paul Talbot Babson purchased Poor's Publishing and merged it with Standard Statistics to become Standard & Poor's Corp.