The Nasdaq returned 264% over the last decade, compounding at 13.8% annually. Investors can get direct exposure to the index with the Fidelity Nasdaq Composite ETF (NASDAQ: ONEQ).Performance

5 Day

2.61%

1 Month

8.50%

3 Month

5.59%

YTD

10.98%

1 Year

34.83%

ZS. Zscaler, Inc. Common Stock.

CRWD. CrowdStrike Holdings, Inc. Class A Common Stock.

GFS. GlobalFoundries Inc. Ordinary Shares.

GEHC. GE HealthCare Technologies Inc. Common Stock.

AAPL. Apple Inc. Common Stock.

CMCSA. Comcast Corporation Class A Common Stock.

PCAR. PACCAR Inc.

LRCX. Lam Research Corporation Common Stock.

How can I invest in Nasdaq : A popular and effective way to invest in the Nasdaq is via either an exchange-traded fund (ETF) or an index tracker fund. These are 'passive' investments which rely on computer algorithms to replicate a particular index.

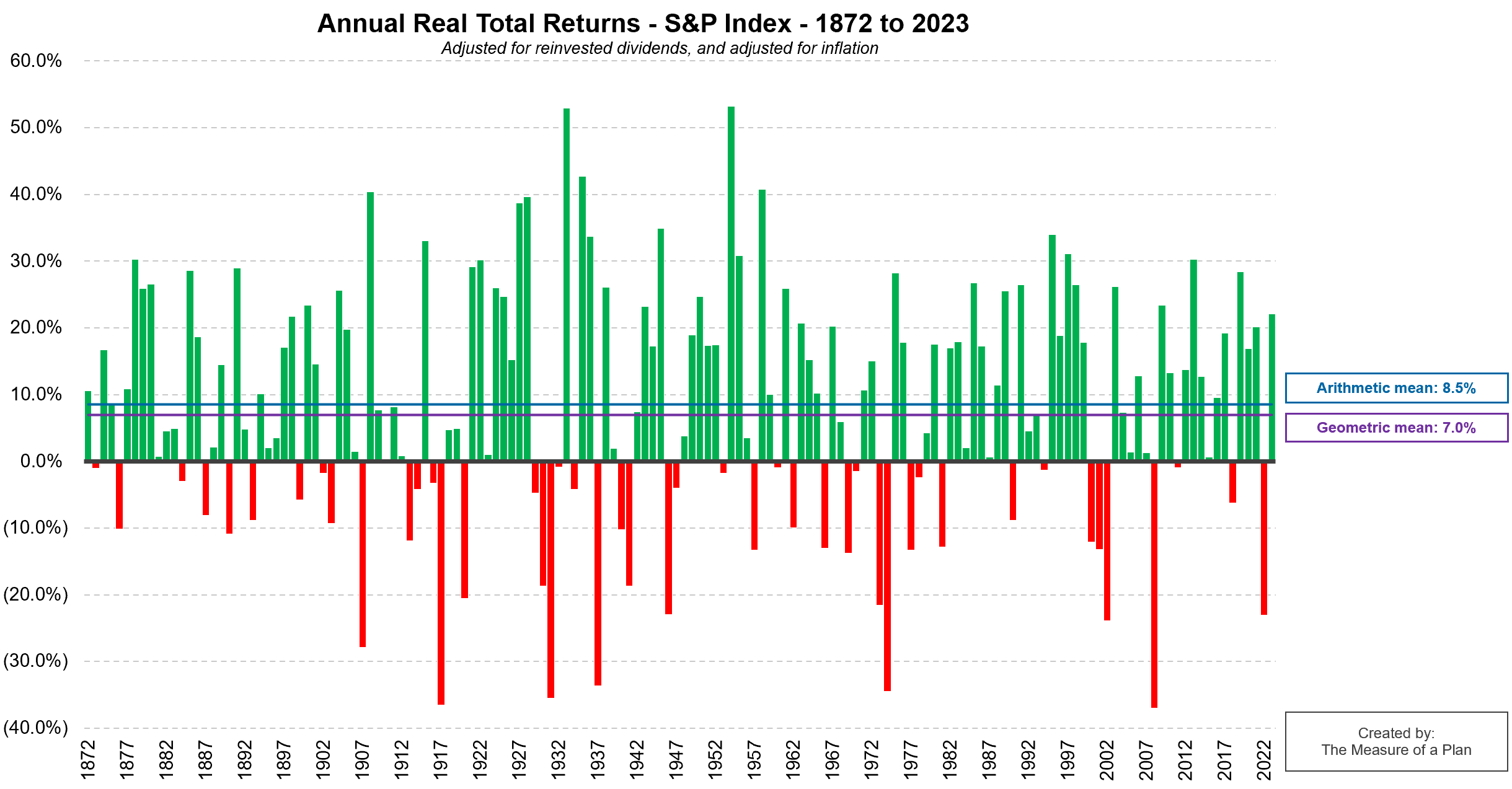

What is the S&P 500 10 year return

The historical average yearly return of the S&P 500 is 12.58% over the last 10 years, as of the end of April 2024. This assumes dividends are reinvested. Adjusted for inflation, the 10-year average stock market return (including dividends) is 9.52%.

What is a good 10 year return on stocks : 5-year, 10-year, 20-year and 30-year S&P 500 returns

Period (start-of-year to end-of-2023)

Average annual S&P 500 return

5 years (2019-2023)

15.36%

10 years (2014-2023)

11.02%

15 years (2009-2023)

12.63%

20 years (2004-2023)

9.00%

687%

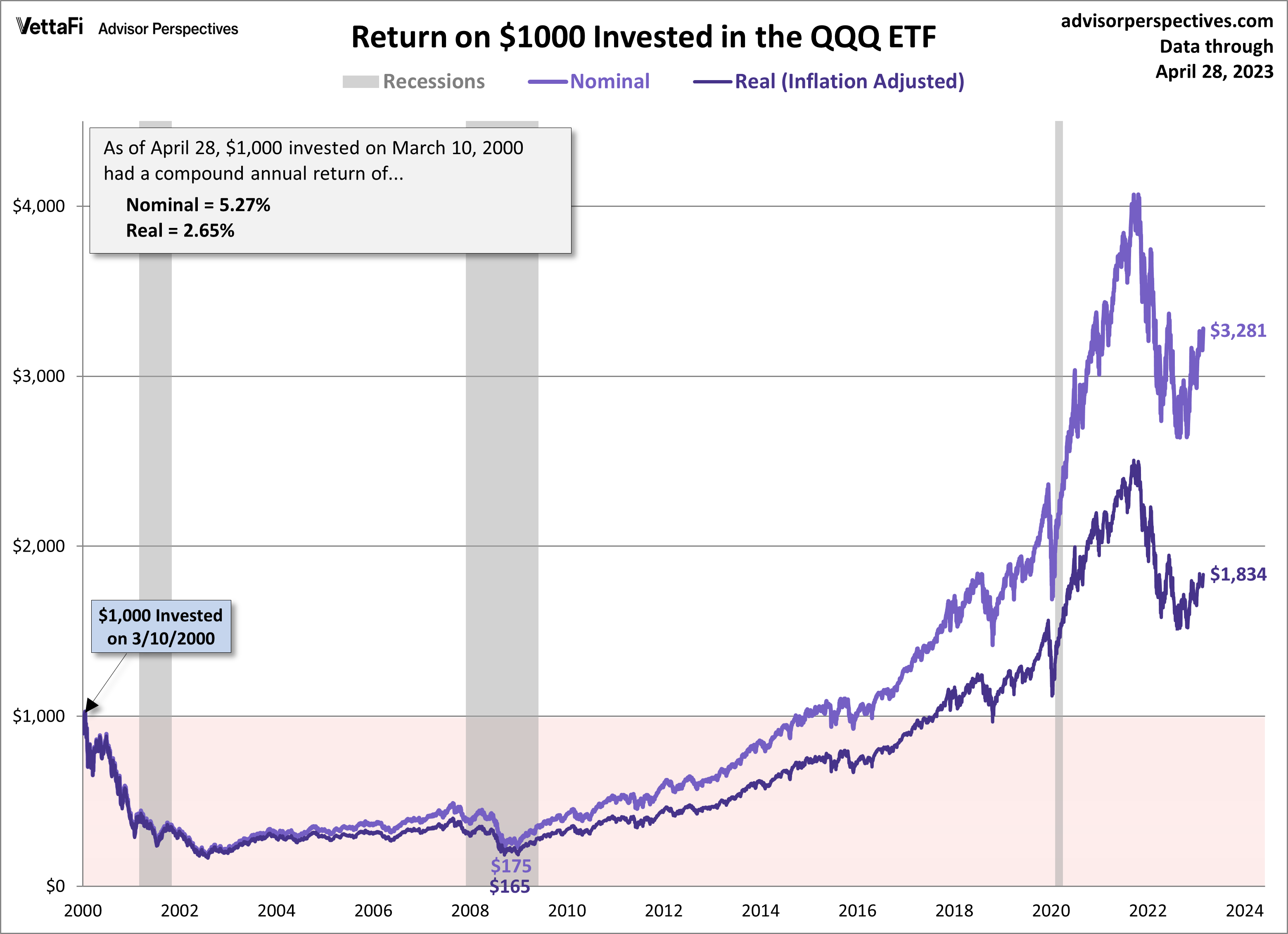

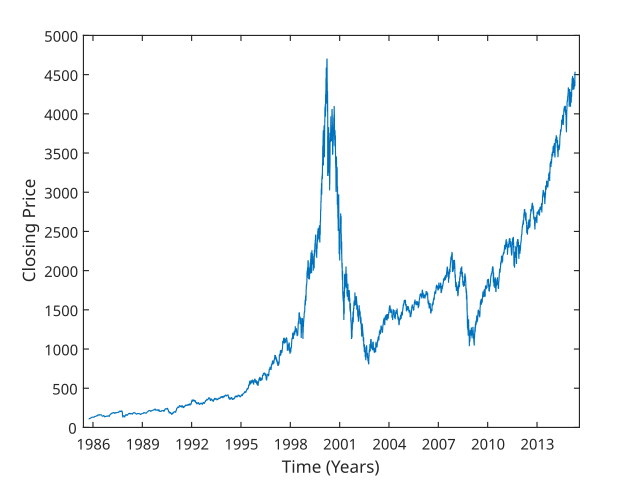

The Dow Jones Industrial Average is a popular benchmark for blue chip stocks, and the index returned 268% over the same period. The Nasdaq Composite is the barometer for tech stocks, and its 20-year return of 687% led the three major indexes. Nasdaq's analyst rating consensus is a Moderate Buy.

Is Nasdaq a buy

The financial health and growth prospects of NDAQ, demonstrate its potential to underperform the market. It currently has a Growth Score of C. Recent price changes and earnings estimate revisions indicate this would not be a good stock for momentum investors with a Momentum Score of D.S&P 500 Index Versus Nasdaq 100 Performance

Nasdaq 100 has outperformed S&P by a wide margin. The average 10-year return of Nasdaq 100 over these 15 years was around 9%, while that of S&P 500 was about 5%.Nasdaq has a solid track record of beating estimates in the last four reported quarters. Return on equity, reflecting the company's efficiency in utilizing shareholders' funds, was 19.3% in the trailing 12 months, better than the industry average of 13.1%. Annualized total return represents the geometric average amount that an investment has earned each year over a specific period. By calculating a geometric average, the annualized total return formula accounts for compounding when depicting the yearly earnings the investment would generate over the holding period.

What is the lowest 10 year return on the stock market : The worst 10 year annual return was a loss of almost 5% per year ending in the summer of 1939. That was bad enough for a 10 year total return of -40%.

Is 7% return on investment realistic : General ROI: A positive ROI is generally considered good, with a normal ROI of 5-7% often seen as a reasonable expectation. However, a strong general ROI is something greater than 10%. Return on Stocks: On average, a ROI of 7% after inflation is often considered good, based on the historical returns of the market.

What is the S&P 500 10 year annual return

The historical average yearly return of the S&P 500 is 12.58% over the last 10 years, as of the end of April 2024. This assumes dividends are reinvested. Adjusted for inflation, the 10-year average stock market return (including dividends) is 9.52%. Average Stock Market Return Over the Last 30 Years

The Nasdaq has an average annualized return of 10.4% for the past 30 years. On the other hand, the S&P 500 – an index that tracks 500 leading companies listed on U.S. stock exchanges – gained a cumulative 875% over the last 30 years.The historical average yearly return of the S&P 500 is 12.58% over the last 10 years, as of the end of April 2024. This assumes dividends are reinvested. Adjusted for inflation, the 10-year average stock market return (including dividends) is 9.52%.

Is Nasdaq 100 a buy : With a proven history of high index performance, the Nasdaq-100® is the best way to invest in some of the top non-financial companies listed on Nasdaq.

Antwort What is Nasdaq 10 year return? Weitere Antworten – What is the 10 year total return on the Nasdaq

The Nasdaq returned 264% over the last decade, compounding at 13.8% annually. Investors can get direct exposure to the index with the Fidelity Nasdaq Composite ETF (NASDAQ: ONEQ).Performance

How can I invest in Nasdaq : A popular and effective way to invest in the Nasdaq is via either an exchange-traded fund (ETF) or an index tracker fund. These are 'passive' investments which rely on computer algorithms to replicate a particular index.

What is the S&P 500 10 year return

The historical average yearly return of the S&P 500 is 12.58% over the last 10 years, as of the end of April 2024. This assumes dividends are reinvested. Adjusted for inflation, the 10-year average stock market return (including dividends) is 9.52%.

What is a good 10 year return on stocks : 5-year, 10-year, 20-year and 30-year S&P 500 returns

687%

The Dow Jones Industrial Average is a popular benchmark for blue chip stocks, and the index returned 268% over the same period. The Nasdaq Composite is the barometer for tech stocks, and its 20-year return of 687% led the three major indexes.

Nasdaq's analyst rating consensus is a Moderate Buy.

Is Nasdaq a buy

The financial health and growth prospects of NDAQ, demonstrate its potential to underperform the market. It currently has a Growth Score of C. Recent price changes and earnings estimate revisions indicate this would not be a good stock for momentum investors with a Momentum Score of D.S&P 500 Index Versus Nasdaq 100 Performance

Nasdaq 100 has outperformed S&P by a wide margin. The average 10-year return of Nasdaq 100 over these 15 years was around 9%, while that of S&P 500 was about 5%.Nasdaq has a solid track record of beating estimates in the last four reported quarters. Return on equity, reflecting the company's efficiency in utilizing shareholders' funds, was 19.3% in the trailing 12 months, better than the industry average of 13.1%.

Annualized total return represents the geometric average amount that an investment has earned each year over a specific period. By calculating a geometric average, the annualized total return formula accounts for compounding when depicting the yearly earnings the investment would generate over the holding period.

What is the lowest 10 year return on the stock market : The worst 10 year annual return was a loss of almost 5% per year ending in the summer of 1939. That was bad enough for a 10 year total return of -40%.

Is 7% return on investment realistic : General ROI: A positive ROI is generally considered good, with a normal ROI of 5-7% often seen as a reasonable expectation. However, a strong general ROI is something greater than 10%. Return on Stocks: On average, a ROI of 7% after inflation is often considered good, based on the historical returns of the market.

What is the S&P 500 10 year annual return

The historical average yearly return of the S&P 500 is 12.58% over the last 10 years, as of the end of April 2024. This assumes dividends are reinvested. Adjusted for inflation, the 10-year average stock market return (including dividends) is 9.52%.

Average Stock Market Return Over the Last 30 Years

The Nasdaq has an average annualized return of 10.4% for the past 30 years. On the other hand, the S&P 500 – an index that tracks 500 leading companies listed on U.S. stock exchanges – gained a cumulative 875% over the last 30 years.The historical average yearly return of the S&P 500 is 12.58% over the last 10 years, as of the end of April 2024. This assumes dividends are reinvested. Adjusted for inflation, the 10-year average stock market return (including dividends) is 9.52%.

Is Nasdaq 100 a buy : With a proven history of high index performance, the Nasdaq-100® is the best way to invest in some of the top non-financial companies listed on Nasdaq.