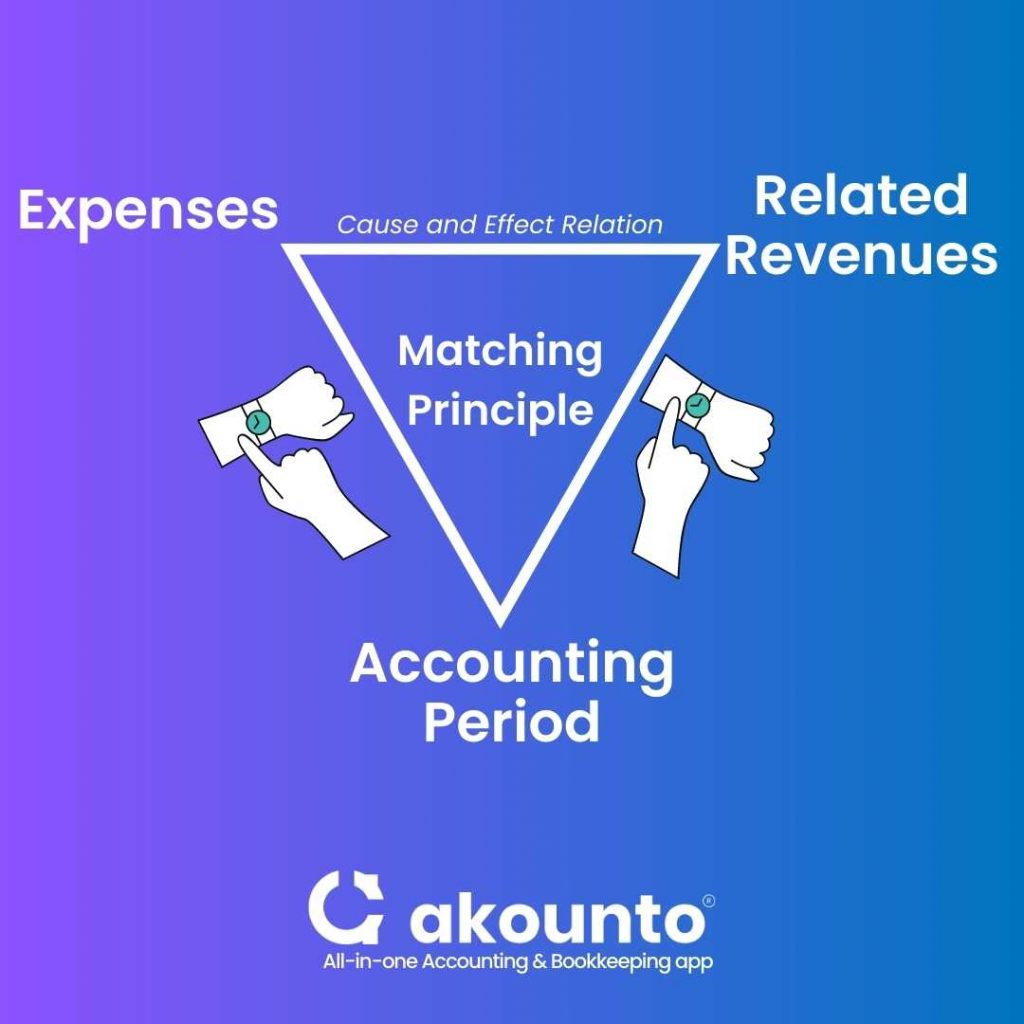

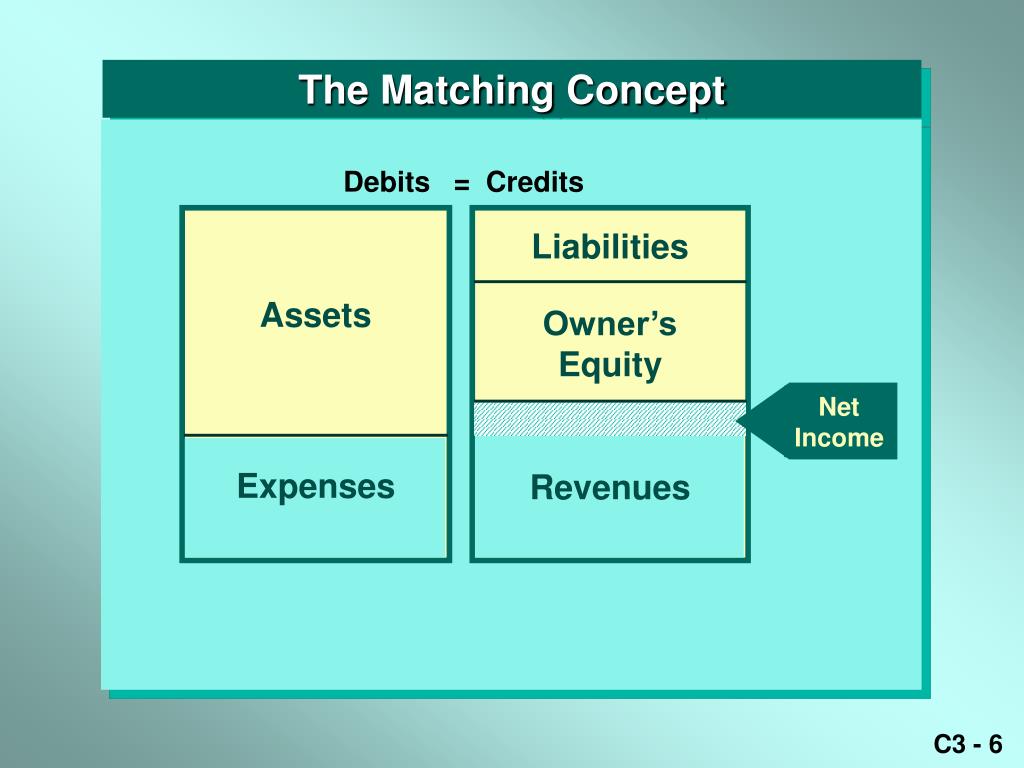

Matching concept states that expenses that are incurred in an accounting period should be matching with the revenue earned during that period.For instance, if a company makes a sale in December but receives payment in January of the following year, the sale's revenue is recognized in December by applying the matching concept in accounting.The matching concept is an accounting practice whereby firms recognize revenues and their related expenses in the same accounting period. Firms report "revenues," that is, along with the "expenses" that brought them. The purpose of the matching concept is to avoid misstating earnings for a period.

What is the matching principle of GAAP : The matching principle is part of the Generally Accepted Accounting Principles (GAAP), based on the cause-and-effect relationship between spending and earning. It requires that any business expenses incurred must be recorded in the same period as related revenues.

What do you mean by matching approach

The matching approach, also known as hedging approach, is a type of technique used by the management to lower the risk of financing and the funds used to do it. The matching approach implies that a firm must use its short term funds to finance the current assets and the long term funds to finance the long term assets.

What is the difference between accrual concept and matching concept : Difference Between Accrual and Matching Concept

The accrual concept refers to recording the transactions whenever they are incurred or earned, regardless of actual outflow or inflow of cash. On the other hand, the matching concept specifically focuses on recognition and recording transactions of expenses in business.

Businesses primarily use the matching concept in accounting to ensure financial statement consistency. For instance, the income statement, balance sheet, and so on. Recognizing expenses at the incorrect time can greatly distort the financial statements. A company's financial position may become inaccurate as a result. Entity matching (EM) [12] is the task of finding different records that refer to the same real-world entity. For example, consider two restaurant tables A and B in Figure 1. Although record a1 and record b1 do not match exactly, they refer to the same real-world restaurant. EM has numerous applications in data science.

What is the difference between matching concept and realization concept

The matching accounting concept follows the realization concept. First, the revenue is recognized and then we match the costs associated with the revenue. So costs are matched with revenue, the reverse would be an incorrect system.The accrual concept refers to recording the transactions whenever they are incurred or earned, regardless of actual outflow or inflow of cash. On the other hand, the matching concept specifically focuses on recognition and recording transactions of expenses in business.What are the 5 basic principles of accounting

Revenue Recognition Principle. When you are recording information about your business, you need to consider the revenue recognition principle.

Cost Principle.

Matching Principle.

Full Disclosure Principle.

Objectivity Principle.

Matching strategy examples

An example of a matching strategy is purchasing a zero coupon nominal Treasury to pay off your mortgage balance in your targeted retirement year.

What do you mean by matching : : going together well : suitably paired or used together. matching colors.

What is the difference between prudence and matching concept : The matching concept helps to ensure that the financial statements accurately reflect the company's profitability. Prudence concept is an accounting principle that states that assets and income should not be overstated, and liabilities and expenses should not be understated.

What are the disadvantages of matching concept

Matching principle limitations

There are some limitations to this concept, including the following: More challenging when there is no direct cause-and-effect relationship between revenues and expenses. Doesn't work as well when related revenue is spread out over time, as with marketing or advertising costs. Challenges of the Matching Principle

Estimation can lead to inaccurate cost allocation. Violating the matching principal can result in inaccurate financial reports when costs are not matched to the revenue they generate.Examples of an entity are a single person, single product, or single organization. Entity type. A person, organization, object type, or concept about which information is stored. Describes the type of the information that is being mastered.

Why is entity matching important : Entity matching (EM) is a critical part of data integration and cleaning. In many applications, the users need to un- derstand why two entities are considered a match, which reveals the need for interpretable and concise EM rules.

Antwort What is concept matching? Weitere Antworten – What is meant by the matching concept

Matching concept states that expenses that are incurred in an accounting period should be matching with the revenue earned during that period.For instance, if a company makes a sale in December but receives payment in January of the following year, the sale's revenue is recognized in December by applying the matching concept in accounting.The matching concept is an accounting practice whereby firms recognize revenues and their related expenses in the same accounting period. Firms report "revenues," that is, along with the "expenses" that brought them. The purpose of the matching concept is to avoid misstating earnings for a period.

What is the matching principle of GAAP : The matching principle is part of the Generally Accepted Accounting Principles (GAAP), based on the cause-and-effect relationship between spending and earning. It requires that any business expenses incurred must be recorded in the same period as related revenues.

What do you mean by matching approach

The matching approach, also known as hedging approach, is a type of technique used by the management to lower the risk of financing and the funds used to do it. The matching approach implies that a firm must use its short term funds to finance the current assets and the long term funds to finance the long term assets.

What is the difference between accrual concept and matching concept : Difference Between Accrual and Matching Concept

The accrual concept refers to recording the transactions whenever they are incurred or earned, regardless of actual outflow or inflow of cash. On the other hand, the matching concept specifically focuses on recognition and recording transactions of expenses in business.

Businesses primarily use the matching concept in accounting to ensure financial statement consistency. For instance, the income statement, balance sheet, and so on. Recognizing expenses at the incorrect time can greatly distort the financial statements. A company's financial position may become inaccurate as a result.

Entity matching (EM) [12] is the task of finding different records that refer to the same real-world entity. For example, consider two restaurant tables A and B in Figure 1. Although record a1 and record b1 do not match exactly, they refer to the same real-world restaurant. EM has numerous applications in data science.

What is the difference between matching concept and realization concept

The matching accounting concept follows the realization concept. First, the revenue is recognized and then we match the costs associated with the revenue. So costs are matched with revenue, the reverse would be an incorrect system.The accrual concept refers to recording the transactions whenever they are incurred or earned, regardless of actual outflow or inflow of cash. On the other hand, the matching concept specifically focuses on recognition and recording transactions of expenses in business.What are the 5 basic principles of accounting

Matching strategy examples

An example of a matching strategy is purchasing a zero coupon nominal Treasury to pay off your mortgage balance in your targeted retirement year.

What do you mean by matching : : going together well : suitably paired or used together. matching colors.

What is the difference between prudence and matching concept : The matching concept helps to ensure that the financial statements accurately reflect the company's profitability. Prudence concept is an accounting principle that states that assets and income should not be overstated, and liabilities and expenses should not be understated.

What are the disadvantages of matching concept

Matching principle limitations

There are some limitations to this concept, including the following: More challenging when there is no direct cause-and-effect relationship between revenues and expenses. Doesn't work as well when related revenue is spread out over time, as with marketing or advertising costs.

Challenges of the Matching Principle

Estimation can lead to inaccurate cost allocation. Violating the matching principal can result in inaccurate financial reports when costs are not matched to the revenue they generate.Examples of an entity are a single person, single product, or single organization. Entity type. A person, organization, object type, or concept about which information is stored. Describes the type of the information that is being mastered.

Why is entity matching important : Entity matching (EM) is a critical part of data integration and cleaning. In many applications, the users need to un- derstand why two entities are considered a match, which reveals the need for interpretable and concise EM rules.