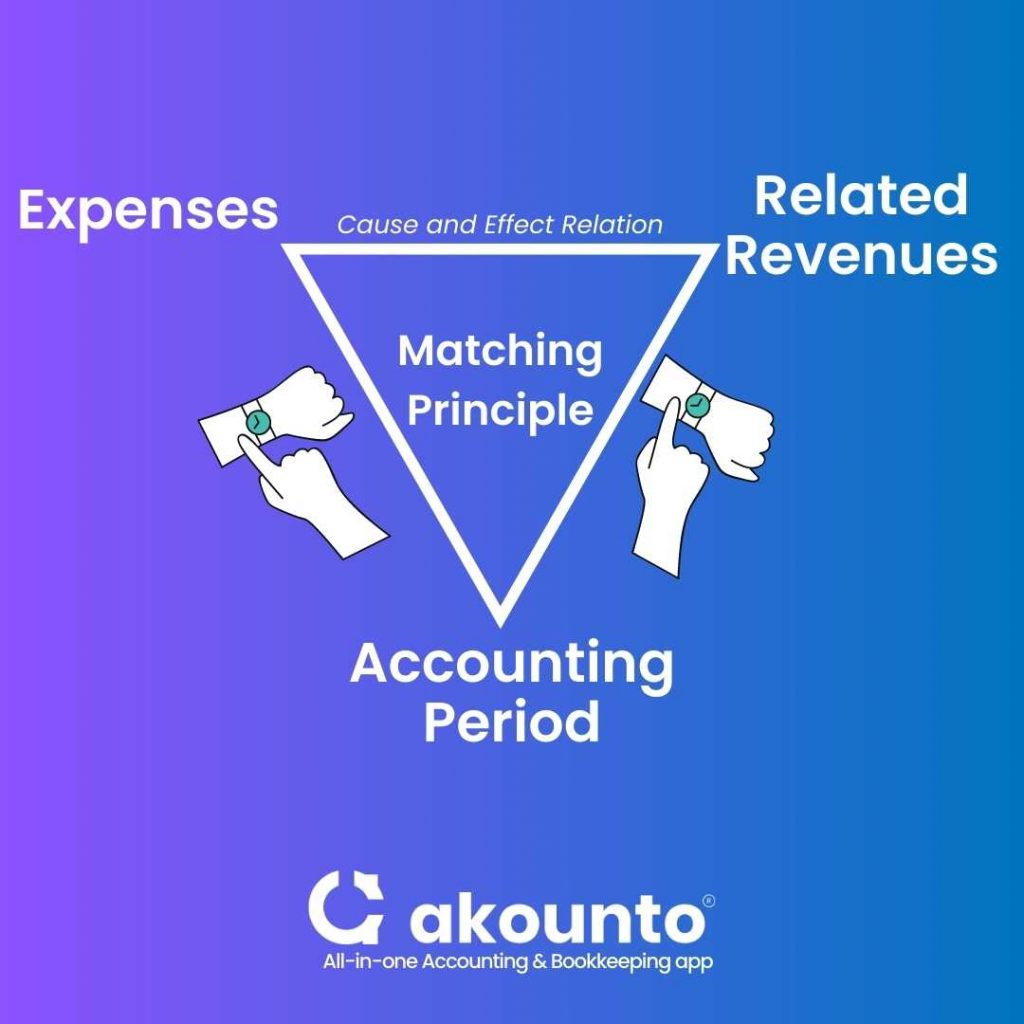

The matching principle is an accounting concept that dictates that companies report expenses at the same time as the revenues they are related to. Revenues and expenses are matched on the income statement for a period of time (e.g., a year, quarter, or month).Accrual accounting is an accounting method where revenue or expenses are recorded when a transaction occurs vs. when payment is received or made. The method follows the matching principle, which says that revenues and expenses should be recognized in the same period.An accrual is an accounting term used to describe the process of recording income or expenses when they occur, rather than when payment is made or received. This means that a company can record income or expenses before they are actually received or paid.

What is the accrual matching process : Matching principle is especially important in the concept of accrual accounting. Matching principle states that business should match related revenues and expenses in the same period. They do this in order to link the costs of an asset or revenue to its benefits.

What is an example of a matching concept

Example: A pharmaceutical company in Hyderabad produces medicine costing INR 50 lakhs in February but sells it in March. The INR 50 lakhs production cost is recognized in March, when the revenue from the sale is recorded, ensuring the matching of costs with related revenues.

What is an example of an accrual principle : For example, if a company provides a service to a customer in December, but does not receive payment until January of the following year, the revenue from that service would be recorded as an accrual in December, when it was earned.

Example: A textile manufacturer sells clothing worth INR 10 lakhs in July. The cost to manufacture these clothes was INR 6 lakhs. According to the Matching Principle, the INR 6 lakhs cost (COGS) is recognized in July, alongside the revenue, to match the expense with the revenue it generated accurately. Examples of the Accrual Principle

Examples of the proper usage of the accrual principle are: Record revenue when you invoice the customer, rather than when the customer pays you. Record an expense when you incur it, rather than when you pay for it.

What is an example of an accrual concept

An example of an accrued expense for accounts payable could be the cost of electricity that the utility company has used to power its operations, but has not yet paid for. In this case, the utility company would make a journal entry to record the cost of the electricity as an accrued expense.The matching principle, a fundamental rule in the accrual-based accounting system, requires expenses to be recognized in the same period as the applicable revenue. For instance, the direct cost of a product is expensed on the income statement only if the product is sold and delivered to the customer.The matching approach, also known as hedging approach, is a type of technique used by the management to lower the risk of financing and the funds used to do it. The matching approach implies that a firm must use its short term funds to finance the current assets and the long term funds to finance the long term assets. Example: A textile manufacturer sells clothing worth INR 10 lakhs in July. The cost to manufacture these clothes was INR 6 lakhs. According to the Matching Principle, the INR 6 lakhs cost (COGS) is recognized in July, alongside the revenue, to match the expense with the revenue it generated accurately.

What is an example of a matching strategy : Matching strategy examples

An example of a matching strategy is purchasing a zero coupon nominal Treasury to pay off your mortgage balance in your targeted retirement year.

What type of account is accrual : Accrual accounting is an accounting method that recognizes revenue in the period in which it's earned and realizable, but not necessarily when the cash is actually received. Similarly, expenses are recognized in the period in which the related revenue is recognized rather than when the related cash is paid.

What is a matching method

We define “matching” broadly to be any method that aims to equate (or “balance”) the distribution of covariates in the treated and control groups. This may involve 1:1 matching, weighting, or subclassification. There are many types of accruals, but most fall under one of the two main types: revenue accruals and expense accruals.The goal of matching is to reduce bias for the estimated treatment effect in an observational-data study, by finding, for every treated unit, one (or more) non-treated unit(s) with similar observable characteristics against which the covariates are balanced out.

When to use the matching method : The choice of matching method depends on the goals of the analysis (e.g., the estimand, whether low bias or high precision is important) and the unique qualities of each dataset to be analyzed, so there is no single optimal choice for any given analysis.

Antwort What is accrual and matching concept? Weitere Antworten – What is a matching concept in accounting

The matching principle is an accounting concept that dictates that companies report expenses at the same time as the revenues they are related to. Revenues and expenses are matched on the income statement for a period of time (e.g., a year, quarter, or month).Accrual accounting is an accounting method where revenue or expenses are recorded when a transaction occurs vs. when payment is received or made. The method follows the matching principle, which says that revenues and expenses should be recognized in the same period.An accrual is an accounting term used to describe the process of recording income or expenses when they occur, rather than when payment is made or received. This means that a company can record income or expenses before they are actually received or paid.

What is the accrual matching process : Matching principle is especially important in the concept of accrual accounting. Matching principle states that business should match related revenues and expenses in the same period. They do this in order to link the costs of an asset or revenue to its benefits.

What is an example of a matching concept

Example: A pharmaceutical company in Hyderabad produces medicine costing INR 50 lakhs in February but sells it in March. The INR 50 lakhs production cost is recognized in March, when the revenue from the sale is recorded, ensuring the matching of costs with related revenues.

What is an example of an accrual principle : For example, if a company provides a service to a customer in December, but does not receive payment until January of the following year, the revenue from that service would be recorded as an accrual in December, when it was earned.

Example: A textile manufacturer sells clothing worth INR 10 lakhs in July. The cost to manufacture these clothes was INR 6 lakhs. According to the Matching Principle, the INR 6 lakhs cost (COGS) is recognized in July, alongside the revenue, to match the expense with the revenue it generated accurately.

Examples of the Accrual Principle

Examples of the proper usage of the accrual principle are: Record revenue when you invoice the customer, rather than when the customer pays you. Record an expense when you incur it, rather than when you pay for it.

What is an example of an accrual concept

An example of an accrued expense for accounts payable could be the cost of electricity that the utility company has used to power its operations, but has not yet paid for. In this case, the utility company would make a journal entry to record the cost of the electricity as an accrued expense.The matching principle, a fundamental rule in the accrual-based accounting system, requires expenses to be recognized in the same period as the applicable revenue. For instance, the direct cost of a product is expensed on the income statement only if the product is sold and delivered to the customer.The matching approach, also known as hedging approach, is a type of technique used by the management to lower the risk of financing and the funds used to do it. The matching approach implies that a firm must use its short term funds to finance the current assets and the long term funds to finance the long term assets.

Example: A textile manufacturer sells clothing worth INR 10 lakhs in July. The cost to manufacture these clothes was INR 6 lakhs. According to the Matching Principle, the INR 6 lakhs cost (COGS) is recognized in July, alongside the revenue, to match the expense with the revenue it generated accurately.

What is an example of a matching strategy : Matching strategy examples

An example of a matching strategy is purchasing a zero coupon nominal Treasury to pay off your mortgage balance in your targeted retirement year.

What type of account is accrual : Accrual accounting is an accounting method that recognizes revenue in the period in which it's earned and realizable, but not necessarily when the cash is actually received. Similarly, expenses are recognized in the period in which the related revenue is recognized rather than when the related cash is paid.

What is a matching method

We define “matching” broadly to be any method that aims to equate (or “balance”) the distribution of covariates in the treated and control groups. This may involve 1:1 matching, weighting, or subclassification.

There are many types of accruals, but most fall under one of the two main types: revenue accruals and expense accruals.The goal of matching is to reduce bias for the estimated treatment effect in an observational-data study, by finding, for every treated unit, one (or more) non-treated unit(s) with similar observable characteristics against which the covariates are balanced out.

When to use the matching method : The choice of matching method depends on the goals of the analysis (e.g., the estimand, whether low bias or high precision is important) and the unique qualities of each dataset to be analyzed, so there is no single optimal choice for any given analysis.