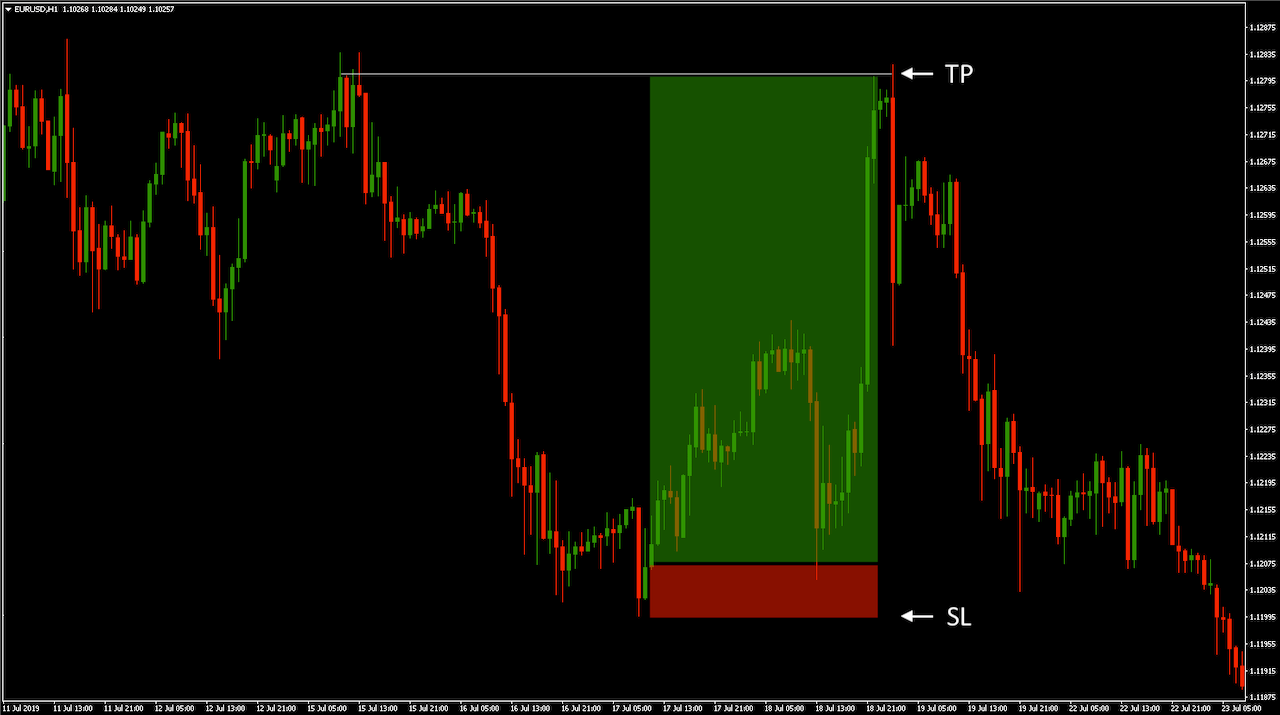

This method allows traders to adapt their risk management strategy based on the volatility of the stock. A common practice is to set the stop-loss level between 1% to 3% below the purchase price. For example, if you buy a stock at Rs. 300 per share, a 2% stop loss would be triggered at Rs.A percentage-based stop loss is usually set 10 to 15 per cent below your purchase price, depending on the volatility of the stock, as this allows for short-term fluctuations in the price as the stock settles into a trend.Choosing a 20% trailing stop is excessive. Based on the recent trends, the average pullback is about 6%, with bigger ones near 8%. A better trailing stop loss would be 10% to 12%. This gives the trade room to move but also gets the trader out quickly if the price drops by more than 12%.

Why does my stop loss always hit : When you use a stop loss order properly you can minimize your risk and stay in the industry for the long haul. If you are using a stop loss order incorrectly you will find that it is always getting hit, then the trade reverses and moves immediately back in your direction.

Is 20% stop loss good

When applied to a 54 year period a simple stop-loss strategy provided higher returns while at the same time lowering losses substantially. A trailing stop loss is better than a traditional (loss from purchase price) stop-loss strategy. The best trailing stop-loss percentage to use is either 15% or 20%

Is 5% a good stop loss : An active trader might use a 5% level, while a long-term investor might choose 15% or more. Another thing to keep in mind is that, once you reach your stop price, your stop order becomes a market order. So, the price at which you sell may be much different from the stop price.

When applied to a 54 year period a simple stop-loss strategy provided higher returns while at the same time lowering losses substantially. A trailing stop loss is better than a traditional (loss from purchase price) stop-loss strategy. The best trailing stop-loss percentage to use is either 15% or 20% An active trader might use a 5% level, while a long-term investor might choose 15% or more. Another thing to keep in mind is that, once you reach your stop price, your stop order becomes a market order. So, the price at which you sell may be much different from the stop price.

Is 5% a good trailing stop-loss

Because the orders are flexible, you can choose where you want to set the baseline percentage at which stocks should be sold. For example, if you're less comfortable with risk you might set a trailing stop at 5% or less. But if you're a more aggressive portfolio, you may bump the order up to 20% or 30%.The 1% risk rule means not risking more than 1% of account capital on a single trade. It doesn't mean only putting 1% of your capital into a trade. Put as much capital as you wish, but if the trade is losing more than 1% of your total capital, close the position.IBD states that "this rule was set specifically at 7%-8% because our research shows that successful stocks rarely fall in price more than 7% or 8% below a proper buy point. If you buy stocks at the pivot point, you may want to cut your losses even sooner. Eight percent is considered a maximum stop loss." The 6% stop-loss rule is another risk management strategy used in trading. It involves setting your stop-loss order at a level where, if the trade moves against you, you would only lose a maximum of 6% of your total trading capital on that particular trade.

What is the 80% rule in day trading : Definition of '80% Rule'

The 80% Rule is a Market Profile concept and strategy. If the market opens (or moves outside of the value area ) and then moves back into the value area for two consecutive 30-min-bars, then the 80% rule states that there is a high probability of completely filling the value area.

What is the 5-3-1 rule trading : Clear guidelines: The 5-3-1 strategy provides clear and straightforward guidelines for traders. The principles of choosing five currency pairs, developing three trading strategies, and selecting one specific time of day offer a structured approach, reducing ambiguity and enhancing decision-making.

Is 5% a good trailing stop loss

Because the orders are flexible, you can choose where you want to set the baseline percentage at which stocks should be sold. For example, if you're less comfortable with risk you might set a trailing stop at 5% or less. But if you're a more aggressive portfolio, you may bump the order up to 20% or 30%. The golden rule of Stop Losses is that they should never be moved away from the market once the trade is opened. If a trader feels that their stop loss is incorrectly placed, they are recognising that the foundations of their trade are incorrect and therefore they should close out.Why Do You Need 25k To Day Trade The $25k requirement for day trading is a rule set by FINRA. It's designed to protect investors from the risks of day trading. By requiring a minimum equity of $25k, FINRA ensures that investors have enough capital to absorb potential losses.

Is 1% a day good for day trading : Take 1% of whatever your account equity is. This is how much you can lose on a single trade. As your account equity changes, so will the amount you can risk. For day trading, I use 1% of my daily starting equity and that's how much I risk per trade all day.

Antwort What is a good stop-loss for day trading? Weitere Antworten – What should be the ideal stop loss

This method allows traders to adapt their risk management strategy based on the volatility of the stock. A common practice is to set the stop-loss level between 1% to 3% below the purchase price. For example, if you buy a stock at Rs. 300 per share, a 2% stop loss would be triggered at Rs.A percentage-based stop loss is usually set 10 to 15 per cent below your purchase price, depending on the volatility of the stock, as this allows for short-term fluctuations in the price as the stock settles into a trend.Choosing a 20% trailing stop is excessive. Based on the recent trends, the average pullback is about 6%, with bigger ones near 8%. A better trailing stop loss would be 10% to 12%. This gives the trade room to move but also gets the trader out quickly if the price drops by more than 12%.

Why does my stop loss always hit : When you use a stop loss order properly you can minimize your risk and stay in the industry for the long haul. If you are using a stop loss order incorrectly you will find that it is always getting hit, then the trade reverses and moves immediately back in your direction.

Is 20% stop loss good

When applied to a 54 year period a simple stop-loss strategy provided higher returns while at the same time lowering losses substantially. A trailing stop loss is better than a traditional (loss from purchase price) stop-loss strategy. The best trailing stop-loss percentage to use is either 15% or 20%

Is 5% a good stop loss : An active trader might use a 5% level, while a long-term investor might choose 15% or more. Another thing to keep in mind is that, once you reach your stop price, your stop order becomes a market order. So, the price at which you sell may be much different from the stop price.

When applied to a 54 year period a simple stop-loss strategy provided higher returns while at the same time lowering losses substantially. A trailing stop loss is better than a traditional (loss from purchase price) stop-loss strategy. The best trailing stop-loss percentage to use is either 15% or 20%

An active trader might use a 5% level, while a long-term investor might choose 15% or more. Another thing to keep in mind is that, once you reach your stop price, your stop order becomes a market order. So, the price at which you sell may be much different from the stop price.

Is 5% a good trailing stop-loss

Because the orders are flexible, you can choose where you want to set the baseline percentage at which stocks should be sold. For example, if you're less comfortable with risk you might set a trailing stop at 5% or less. But if you're a more aggressive portfolio, you may bump the order up to 20% or 30%.The 1% risk rule means not risking more than 1% of account capital on a single trade. It doesn't mean only putting 1% of your capital into a trade. Put as much capital as you wish, but if the trade is losing more than 1% of your total capital, close the position.IBD states that "this rule was set specifically at 7%-8% because our research shows that successful stocks rarely fall in price more than 7% or 8% below a proper buy point. If you buy stocks at the pivot point, you may want to cut your losses even sooner. Eight percent is considered a maximum stop loss."

The 6% stop-loss rule is another risk management strategy used in trading. It involves setting your stop-loss order at a level where, if the trade moves against you, you would only lose a maximum of 6% of your total trading capital on that particular trade.

What is the 80% rule in day trading : Definition of '80% Rule'

The 80% Rule is a Market Profile concept and strategy. If the market opens (or moves outside of the value area ) and then moves back into the value area for two consecutive 30-min-bars, then the 80% rule states that there is a high probability of completely filling the value area.

What is the 5-3-1 rule trading : Clear guidelines: The 5-3-1 strategy provides clear and straightforward guidelines for traders. The principles of choosing five currency pairs, developing three trading strategies, and selecting one specific time of day offer a structured approach, reducing ambiguity and enhancing decision-making.

Is 5% a good trailing stop loss

Because the orders are flexible, you can choose where you want to set the baseline percentage at which stocks should be sold. For example, if you're less comfortable with risk you might set a trailing stop at 5% or less. But if you're a more aggressive portfolio, you may bump the order up to 20% or 30%.

The golden rule of Stop Losses is that they should never be moved away from the market once the trade is opened. If a trader feels that their stop loss is incorrectly placed, they are recognising that the foundations of their trade are incorrect and therefore they should close out.Why Do You Need 25k To Day Trade The $25k requirement for day trading is a rule set by FINRA. It's designed to protect investors from the risks of day trading. By requiring a minimum equity of $25k, FINRA ensures that investors have enough capital to absorb potential losses.

Is 1% a day good for day trading : Take 1% of whatever your account equity is. This is how much you can lose on a single trade. As your account equity changes, so will the amount you can risk. For day trading, I use 1% of my daily starting equity and that's how much I risk per trade all day.