It's basically a mathematical formula used to calculate the ROI (Rate of Return) you'd expect to receive from a property you plan to purchase. Calculation Example: If the current market value of a property is $1 million and has an NOI (Net Operating Income) of $70,000, then the cap rate is 7% or 1,000,000 ÷ 70,000 = 7.Generally, a high capitalization rate will indicate a higher level of risk, while a lower capitalization rate indicates lower returns but lower risk. That said, many analysts consider a "good" cap rate to be around 5% to 10%, while a 4% cap rate indicates lower risk but a longer timeline to recoup an investment.It's generally better to have a lower cap rate than a higher one. A lower cap rate implies that the property is more valuable and less risky due to type, class, and market. While a higher cap rate offers investors a higher return, that property investment typically has a higher risk profile.

What is a 10 percent cap rate : For example, a 10% cap rate is the same as a 10-multiple. An investor who pays $10 million for a building at a 10% cap rate would expect to generate $1 million of net operating income from that property each year.

Is 12 a good cap rate

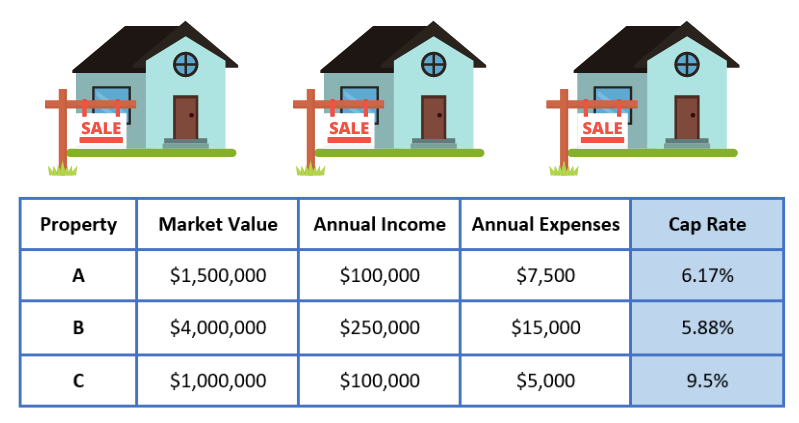

To calculate cap rate, follow this formula: (Gross income – expenses = net income) / purchase price * 100. Cap rates between 4% and 12% are generally considered good, but it's important to remember that other factors, such as potential improvements, should also be considered when evaluating a property.

What cap rate is too high : In real estate, a low (less than 5%) cap rate often reflects a lower risk profile, whereas a higher cap rate (greater than 7%) is often considered a riskier investment. Whether an investor deems a cap rate “good” is a direct reflection of whether or not they think the investment's return matches its perceived risk.

The ROI focuses on your individual investment based on how much you invest in the property and can guide you with your down payment. Overall, the ROI is the most important calculation, but the cap rate is a great place to start and helps you narrow your options. If the cap rate (capitalization rate) of a property is lower than the interest rate on a loan used to purchase it, it generally indicates that the property's income, after accounting for operating expenses, is not sufficient to cover the cost of the debt.

Is 13 a good cap rate

What is a Good Cap Rate The ideal cap rate is widely accepted as between 5% to 10% in the commercial real estate (CRE) market. But of course, there are broad number of factors, such as property type, classification and asset class, that influence what a “good” cap rate is.Cap rates between 4% and 12% are generally considered good, but it's important to remember that other factors, such as potential improvements, should also be considered when evaluating a property. Cap rate does not account for changes in cash flow due to improvements or renovations, and it does not consider leverage.Real estate investments often target an IRR in the range of 10% to 20%. However, these numbers can vary: Conservative Investments: For lower-risk, stable properties, a good IRR might be around 8% to 12%. Moderate Risk: Many investors aim for an IRR in the range of 15% to 20% for moderate-risk projects. Limitations of cap rates: While cap rates are a useful tool for evaluating potential investments, they have some limitations. For example, they don't take into account factors like property appreciation or depreciation, and financing costs.

Can cap rates be negative : While negative cap rates are mathematically possible, they make no financial sense. The calculated business value becomes a negative number – an impossible result. The reason for this confusing situation is that the earnings growth rate is overstated, given the company's discount rate.

What is a cap rate for dummies : Also known as the cap rate, it is the measure of profitability of an investment. Cap rates tell you how much you'd make on an investment if you paid all cash for it; financing and taxation are not included. cap rate = net operating income @@ds sales price.

What is the cap rate if a building sells for $2000000 with an NOI of $200,000

Cap rates, or capitalization rates, are a ratio of the Net Operating Income, or NOI of a building, divided by the value of the property. For example, if the property is on the market for $2 million, and it generated a net operating income of $200,000, it would have a cap rate of 10%. What's a Good IRR in Venture According to research by Industry Ventures on historical venture returns, GPs should target an IRR of at least 30% when investing at the seed stage. Industry Ventures suggests targeting an IRR of 20% for later stages, given that those investments are generally less risky.For one thing, it depends on the time horizon. 100% is a day is a very high IRR, 100% in a century is very low. Or over a year, for example, if a $1 investment returns $2 at the end, that's 100%; but it's not significantly different from an investment that returns $1.99 or $2.01.

Can a cap rate be negative : While negative cap rates are mathematically possible, they make no financial sense. The calculated business value becomes a negative number – an impossible result. The reason for this confusing situation is that the earnings growth rate is overstated, given the company's discount rate.

Antwort What is a good cap rate? Weitere Antworten – What does 7 cap rate mean

It's basically a mathematical formula used to calculate the ROI (Rate of Return) you'd expect to receive from a property you plan to purchase. Calculation Example: If the current market value of a property is $1 million and has an NOI (Net Operating Income) of $70,000, then the cap rate is 7% or 1,000,000 ÷ 70,000 = 7.Generally, a high capitalization rate will indicate a higher level of risk, while a lower capitalization rate indicates lower returns but lower risk. That said, many analysts consider a "good" cap rate to be around 5% to 10%, while a 4% cap rate indicates lower risk but a longer timeline to recoup an investment.It's generally better to have a lower cap rate than a higher one. A lower cap rate implies that the property is more valuable and less risky due to type, class, and market. While a higher cap rate offers investors a higher return, that property investment typically has a higher risk profile.

What is a 10 percent cap rate : For example, a 10% cap rate is the same as a 10-multiple. An investor who pays $10 million for a building at a 10% cap rate would expect to generate $1 million of net operating income from that property each year.

Is 12 a good cap rate

To calculate cap rate, follow this formula: (Gross income – expenses = net income) / purchase price * 100. Cap rates between 4% and 12% are generally considered good, but it's important to remember that other factors, such as potential improvements, should also be considered when evaluating a property.

What cap rate is too high : In real estate, a low (less than 5%) cap rate often reflects a lower risk profile, whereas a higher cap rate (greater than 7%) is often considered a riskier investment. Whether an investor deems a cap rate “good” is a direct reflection of whether or not they think the investment's return matches its perceived risk.

The ROI focuses on your individual investment based on how much you invest in the property and can guide you with your down payment. Overall, the ROI is the most important calculation, but the cap rate is a great place to start and helps you narrow your options.

If the cap rate (capitalization rate) of a property is lower than the interest rate on a loan used to purchase it, it generally indicates that the property's income, after accounting for operating expenses, is not sufficient to cover the cost of the debt.

Is 13 a good cap rate

What is a Good Cap Rate The ideal cap rate is widely accepted as between 5% to 10% in the commercial real estate (CRE) market. But of course, there are broad number of factors, such as property type, classification and asset class, that influence what a “good” cap rate is.Cap rates between 4% and 12% are generally considered good, but it's important to remember that other factors, such as potential improvements, should also be considered when evaluating a property. Cap rate does not account for changes in cash flow due to improvements or renovations, and it does not consider leverage.Real estate investments often target an IRR in the range of 10% to 20%. However, these numbers can vary: Conservative Investments: For lower-risk, stable properties, a good IRR might be around 8% to 12%. Moderate Risk: Many investors aim for an IRR in the range of 15% to 20% for moderate-risk projects.

Limitations of cap rates: While cap rates are a useful tool for evaluating potential investments, they have some limitations. For example, they don't take into account factors like property appreciation or depreciation, and financing costs.

Can cap rates be negative : While negative cap rates are mathematically possible, they make no financial sense. The calculated business value becomes a negative number – an impossible result. The reason for this confusing situation is that the earnings growth rate is overstated, given the company's discount rate.

What is a cap rate for dummies : Also known as the cap rate, it is the measure of profitability of an investment. Cap rates tell you how much you'd make on an investment if you paid all cash for it; financing and taxation are not included. cap rate = net operating income @@ds sales price.

What is the cap rate if a building sells for $2000000 with an NOI of $200,000

Cap rates, or capitalization rates, are a ratio of the Net Operating Income, or NOI of a building, divided by the value of the property. For example, if the property is on the market for $2 million, and it generated a net operating income of $200,000, it would have a cap rate of 10%.

What's a Good IRR in Venture According to research by Industry Ventures on historical venture returns, GPs should target an IRR of at least 30% when investing at the seed stage. Industry Ventures suggests targeting an IRR of 20% for later stages, given that those investments are generally less risky.For one thing, it depends on the time horizon. 100% is a day is a very high IRR, 100% in a century is very low. Or over a year, for example, if a $1 investment returns $2 at the end, that's 100%; but it's not significantly different from an investment that returns $1.99 or $2.01.

Can a cap rate be negative : While negative cap rates are mathematically possible, they make no financial sense. The calculated business value becomes a negative number – an impossible result. The reason for this confusing situation is that the earnings growth rate is overstated, given the company's discount rate.