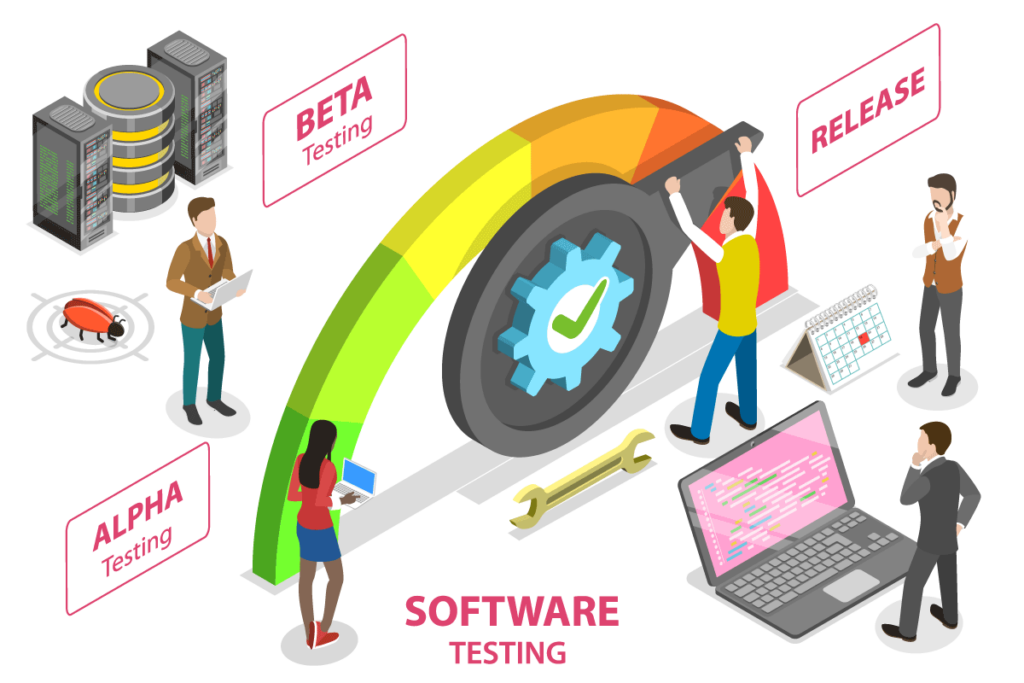

How much does a Beta Tester make As of May 11, 2024, the average hourly pay for a Beta Tester in the United States is $18.29 an hour.A beta tester uses and examines pre-release software to identify errors, missteps, or bugs that may hinder end-user, or customer experience. The insight gathered during beta testing allows development teams to adapt to end-users' needs.Once you have found the products you are interested in testing, look up who their developer is. If they were looking to bring on beta testers they will probably have an online application. If not, simply send an email. Briefly explain your interest, testing experience and skills in volunteering as a tester.

What makes a good beta tester : “Ultimately, good testers are those who are engaged with the test. You don't have to log in every single day, but you should use the product daily. Quality is always better than quantity, and we're looking for testers that give thoughtful feedback.”

Is beta testing easy

Technical beta testing

That's because a technical beta relies on using tech-savvy testers who can purposely set about searching for complex bugs. There's no guarantee that every potential tester knows their way around bugs, which is why it's difficult to use an open beta model for technical betas.

Are beta testers free : Beta testing is a free or low-cost way to generate feedback on your startup or new product idea. It also provides insights about your target audience that you can use to drive successful outcomes.

Beta testers provide feedback on the product or service being tested, which companies can use to improve the overall user experience and functionality of their product before it's released. A resume sample for Beta Tester should mention skills like computer competences, time management, confidentiality, reporting, and recordkeeping. Employers choose candidates whose resumes make display of at least a high school diploma, depending on testing requirements.

Is 1.5 a high beta

A beta value of 1.5 implies that the stock is 50% more volatile than the broader market. That means higher than average risk and the potential for greater upside.For example, a portfolio with an overall beta of +0.7 would be expected to earn 70% of the market's return under normal circumstances. Portfolios, however, can also have betas greater than 1.0, such that a portfolio with a beta of +1.25 would be expected to earn 125% of the market's return and so on.A resume sample for Beta Tester should mention skills like computer competences, time management, confidentiality, reporting, and recordkeeping. Employers choose candidates whose resumes make display of at least a high school diploma, depending on testing requirements. Beta testers can be paid or unpaid, depending on the company and the specific beta testing program. Some companies offer rewards, such as early access to the product being tested or a discount on the final product, as a way to incentivize beta testers to participate in the program.

Is beta testing safe : Similarly, beta-level software exposes you to greater risk, not only because it's expected still to contain plenty of bugs, but also because beta software is generally expected to collect much more information than a finished app, as part of tracking down any faulty behaviour.

Is being a beta tester hard : However, beta testing is not easy since there isn't one formula that works for every product. You need to tailor your beta test according to your requirements. While beta testing is a standard practice among product teams, we find that there is still some misunderstanding surrounding it.

Is 0.8 beta good

Low Beta Stocks

If a stock has a beta value less than 1.0, this is considered to be a good beta value for a stock, because it indicates that stock has a price volatility lower than the market index. In this way, a stock with a beta value less than 1.0 can be referred to as a low beta stock. To figure the expected return for an investment's level of risk, analysts use beta, which measures an asset's volatility and can be used to gauge risk. If a stock has a beta of 1.2, it might be considered 20 percent riskier than the benchmark and therefore should compensate investors with a higher expected return.If a stock had a beta of 0.5, we would expect it to be half as volatile as the market: A market return of 10% would mean a 5% gain for the company. Here is a basic guide to beta levels: Negative beta: A beta less than 0, which would indicate an inverse relation to the market, is possible but highly unlikely.

Is 1.3 a high beta : If a stock has a beta above 1, it's more volatile than the overall market. For example, if an asset has a beta of 1.3, it's theoretically 30% more volatile than the market.

Antwort What is a beta tester? Weitere Antworten – Do beta testers get paid

How much does a Beta Tester make As of May 11, 2024, the average hourly pay for a Beta Tester in the United States is $18.29 an hour.A beta tester uses and examines pre-release software to identify errors, missteps, or bugs that may hinder end-user, or customer experience. The insight gathered during beta testing allows development teams to adapt to end-users' needs.Once you have found the products you are interested in testing, look up who their developer is. If they were looking to bring on beta testers they will probably have an online application. If not, simply send an email. Briefly explain your interest, testing experience and skills in volunteering as a tester.

What makes a good beta tester : “Ultimately, good testers are those who are engaged with the test. You don't have to log in every single day, but you should use the product daily. Quality is always better than quantity, and we're looking for testers that give thoughtful feedback.”

Is beta testing easy

Technical beta testing

That's because a technical beta relies on using tech-savvy testers who can purposely set about searching for complex bugs. There's no guarantee that every potential tester knows their way around bugs, which is why it's difficult to use an open beta model for technical betas.

Are beta testers free : Beta testing is a free or low-cost way to generate feedback on your startup or new product idea. It also provides insights about your target audience that you can use to drive successful outcomes.

Beta testers provide feedback on the product or service being tested, which companies can use to improve the overall user experience and functionality of their product before it's released.

A resume sample for Beta Tester should mention skills like computer competences, time management, confidentiality, reporting, and recordkeeping. Employers choose candidates whose resumes make display of at least a high school diploma, depending on testing requirements.

Is 1.5 a high beta

A beta value of 1.5 implies that the stock is 50% more volatile than the broader market. That means higher than average risk and the potential for greater upside.For example, a portfolio with an overall beta of +0.7 would be expected to earn 70% of the market's return under normal circumstances. Portfolios, however, can also have betas greater than 1.0, such that a portfolio with a beta of +1.25 would be expected to earn 125% of the market's return and so on.A resume sample for Beta Tester should mention skills like computer competences, time management, confidentiality, reporting, and recordkeeping. Employers choose candidates whose resumes make display of at least a high school diploma, depending on testing requirements.

Beta testers can be paid or unpaid, depending on the company and the specific beta testing program. Some companies offer rewards, such as early access to the product being tested or a discount on the final product, as a way to incentivize beta testers to participate in the program.

Is beta testing safe : Similarly, beta-level software exposes you to greater risk, not only because it's expected still to contain plenty of bugs, but also because beta software is generally expected to collect much more information than a finished app, as part of tracking down any faulty behaviour.

Is being a beta tester hard : However, beta testing is not easy since there isn't one formula that works for every product. You need to tailor your beta test according to your requirements. While beta testing is a standard practice among product teams, we find that there is still some misunderstanding surrounding it.

Is 0.8 beta good

Low Beta Stocks

If a stock has a beta value less than 1.0, this is considered to be a good beta value for a stock, because it indicates that stock has a price volatility lower than the market index. In this way, a stock with a beta value less than 1.0 can be referred to as a low beta stock.

To figure the expected return for an investment's level of risk, analysts use beta, which measures an asset's volatility and can be used to gauge risk. If a stock has a beta of 1.2, it might be considered 20 percent riskier than the benchmark and therefore should compensate investors with a higher expected return.If a stock had a beta of 0.5, we would expect it to be half as volatile as the market: A market return of 10% would mean a 5% gain for the company. Here is a basic guide to beta levels: Negative beta: A beta less than 0, which would indicate an inverse relation to the market, is possible but highly unlikely.

Is 1.3 a high beta : If a stock has a beta above 1, it's more volatile than the overall market. For example, if an asset has a beta of 1.3, it's theoretically 30% more volatile than the market.