This growth rate is the compound annual growth rate of cash dividends per common share of stock over the last 5 years.Dividend growth investing is a popular strategy with many investors. It entails buying shares in companies with a record of paying regular and increasing dividends. An added component is using the payouts to reinvest in the company's shares—or shares of other companies with similar dividend track records.An average dividend growth rate is 8% to 10%. However, this can vary greatly among different stocks and industries.

What is 5 yr dgr : Dividend Growth 5yr = The geometric average dividend growth rate over the past 5 years. Dividend Growth 5yr is the geometric average dividend growth rate over the past 5 years, shown as a percentage, for example 3.32%.

Is 5% a good dividend

Yields from 2% to 6% are generally considered to be a good dividend yield, but there are plenty of factors to consider when deciding if a stock's yield makes it a good investment.

Is dividend growth investing worth it : Stocks and mutual funds that distribute dividends are generally on sound financial ground, but not always. Stocks that pay dividends typically provide stability to a portfolio but may not outperform high-quality growth stocks.

Dividend growth formula

Arithmetic mean method formula: Where D2 equals the company's dividend for a specific period and D1 equals the company's dividends for a period before D2. DGR = [(Recent dividend (D2) – Previous dividend (D1)) x 100] / Previous dividend. Suppose instead of investing in a portfolio of bonds, as in the previous example, you invest in healthy dividend-paying equities with a 4% yield. These equities should grow their dividend payout at least 3% annually, which would cover the inflation rate and would likely grow at 5% annually through those same 12 years.

What is the average dividend growth of the S&P 500

S&P 500 Dividend Yield (I:SP500DYT)

S&P 500 Dividend Yield is at 1.35%, compared to 1.47% last month and 1.66% last year. This is lower than the long term average of 1.84%.During the past 5 years, the average Dividends Per Share Growth Rate was 3.30% per year. During the past 10 years, the average Dividends Per Share Growth Rate was 4.70% per year.A range of 0% to 35% is considered a good payout. A payout in that range is usually observed when a company just initiates a dividend. Typical characteristics of companies in this range are “value” stocks. A stock dividend is a payment to shareholders that consists of additional shares rather than cash. The distributions are paid in fractions per existing share. For example, if a company issues a stock dividend of 5%, it will pay 0.05 shares for every share owned by a shareholder.

Can you live off dividends : Depending on how much money you have in those stocks or funds, their growth over time, and how much you reinvest your dividends, you could be generating enough money to live off of each year, without having any other retirement plan.

Do dividend stocks outperform the S&P 500 : Not necessarily. While dividend ETFs can offer stable income, their growth potential is generally lower over the long run. That said, dividend ETFs may outperform the S&P 500 during particular time frames, such as during a recession or a period of easing interest rates.

What is the difference between dividend growth and dividend yield

Dividend yield is the amount that a company pays out in dividends compared to its stock price. Dividend growth is the increase in the value of dividends that a company pays out over a period of time. S&P 500 Dividend Yield is at 1.35%, compared to 1.47% last month and 1.66% last year. This is lower than the long term average of 1.84%.The truth is that most investors won't have the money to generate $1,000 per month in dividends; not at first, anyway. Even if you find a market-beating series of investments that average 3% annual yield, you would still need $400,000 in up-front capital to hit your targets.

How much dividend on 1 million : Stocks in the S&P 500 index currently yield about 1.5% on aggregate. That means, if you have $1 million invested in a mutual fund or exchange-traded fund that tracks the index, you could expect annual dividend income of about $15,000.

Antwort What is a 5-year dividend growth? Weitere Antworten – What does 5 year dividend growth mean

5-Year Annual Dividend Growth Rate (%)

This growth rate is the compound annual growth rate of cash dividends per common share of stock over the last 5 years.Dividend growth investing is a popular strategy with many investors. It entails buying shares in companies with a record of paying regular and increasing dividends. An added component is using the payouts to reinvest in the company's shares—or shares of other companies with similar dividend track records.An average dividend growth rate is 8% to 10%. However, this can vary greatly among different stocks and industries.

What is 5 yr dgr : Dividend Growth 5yr = The geometric average dividend growth rate over the past 5 years. Dividend Growth 5yr is the geometric average dividend growth rate over the past 5 years, shown as a percentage, for example 3.32%.

Is 5% a good dividend

Yields from 2% to 6% are generally considered to be a good dividend yield, but there are plenty of factors to consider when deciding if a stock's yield makes it a good investment.

Is dividend growth investing worth it : Stocks and mutual funds that distribute dividends are generally on sound financial ground, but not always. Stocks that pay dividends typically provide stability to a portfolio but may not outperform high-quality growth stocks.

Dividend growth formula

Arithmetic mean method formula: Where D2 equals the company's dividend for a specific period and D1 equals the company's dividends for a period before D2. DGR = [(Recent dividend (D2) – Previous dividend (D1)) x 100] / Previous dividend.

Suppose instead of investing in a portfolio of bonds, as in the previous example, you invest in healthy dividend-paying equities with a 4% yield. These equities should grow their dividend payout at least 3% annually, which would cover the inflation rate and would likely grow at 5% annually through those same 12 years.

What is the average dividend growth of the S&P 500

S&P 500 Dividend Yield (I:SP500DYT)

S&P 500 Dividend Yield is at 1.35%, compared to 1.47% last month and 1.66% last year. This is lower than the long term average of 1.84%.During the past 5 years, the average Dividends Per Share Growth Rate was 3.30% per year. During the past 10 years, the average Dividends Per Share Growth Rate was 4.70% per year.A range of 0% to 35% is considered a good payout. A payout in that range is usually observed when a company just initiates a dividend. Typical characteristics of companies in this range are “value” stocks.

:max_bytes(150000):strip_icc()/ge_div-5bfd6e4fc9e77c0026ef110d)

A stock dividend is a payment to shareholders that consists of additional shares rather than cash. The distributions are paid in fractions per existing share. For example, if a company issues a stock dividend of 5%, it will pay 0.05 shares for every share owned by a shareholder.

Can you live off dividends : Depending on how much money you have in those stocks or funds, their growth over time, and how much you reinvest your dividends, you could be generating enough money to live off of each year, without having any other retirement plan.

Do dividend stocks outperform the S&P 500 : Not necessarily. While dividend ETFs can offer stable income, their growth potential is generally lower over the long run. That said, dividend ETFs may outperform the S&P 500 during particular time frames, such as during a recession or a period of easing interest rates.

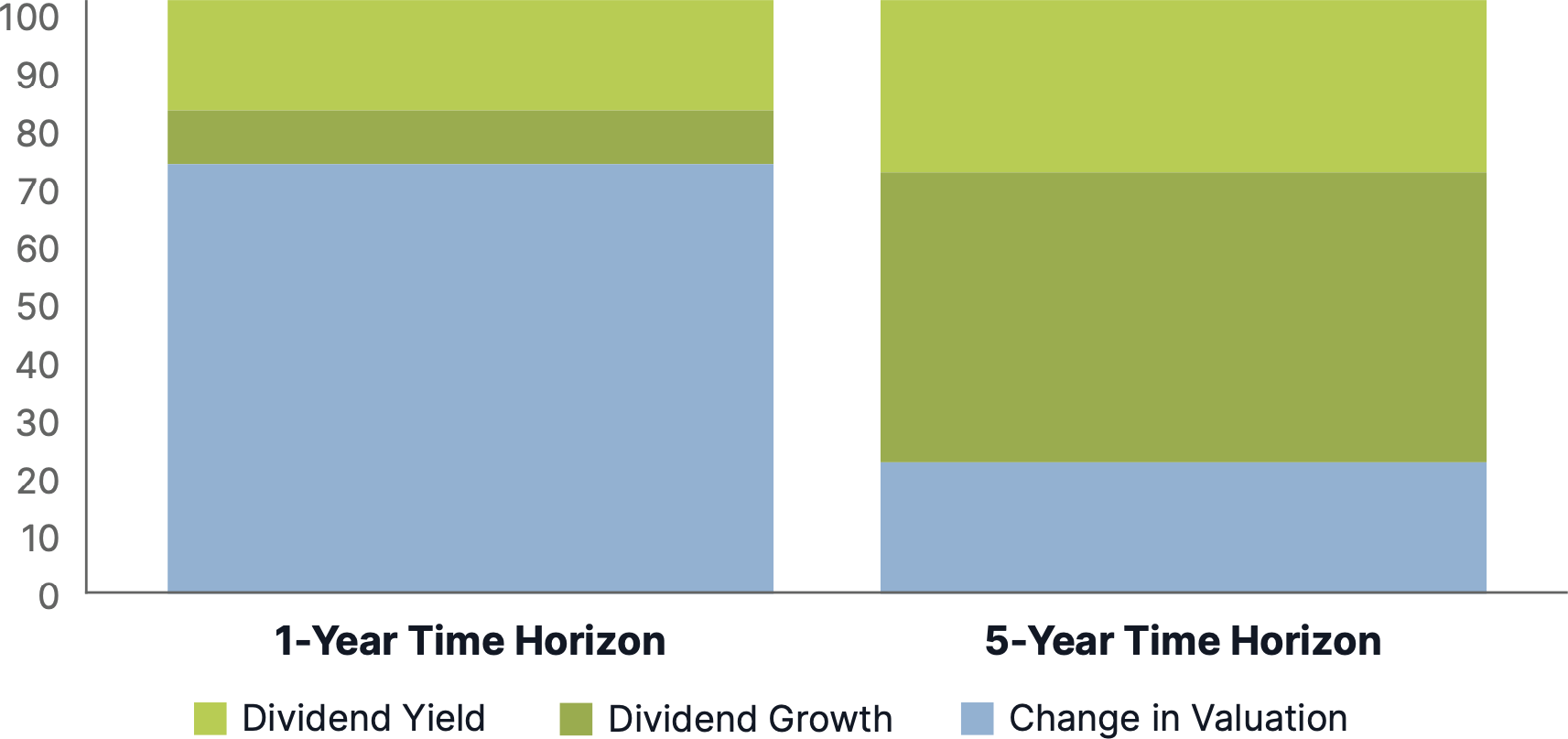

What is the difference between dividend growth and dividend yield

Dividend yield is the amount that a company pays out in dividends compared to its stock price. Dividend growth is the increase in the value of dividends that a company pays out over a period of time.

S&P 500 Dividend Yield is at 1.35%, compared to 1.47% last month and 1.66% last year. This is lower than the long term average of 1.84%.The truth is that most investors won't have the money to generate $1,000 per month in dividends; not at first, anyway. Even if you find a market-beating series of investments that average 3% annual yield, you would still need $400,000 in up-front capital to hit your targets.

How much dividend on 1 million : Stocks in the S&P 500 index currently yield about 1.5% on aggregate. That means, if you have $1 million invested in a mutual fund or exchange-traded fund that tracks the index, you could expect annual dividend income of about $15,000.