The general definition of a market correction is a market decline that is more than 10%, but less than 20%. A bear market is usually defined as a decline of 20% or greater. The market is represented by the S&P 500 index.Key Takeaways

A bull market is when stock prices are on the rise and economically sound, while a bear market is when prices are in decline. The origin of these expressions is unclear, but one reason could be that bulls attack by bringing their horns upward, while bears attack by swiping their paws downward.Bear Market Definition

Economists define a bear market as a decline of 20% or more of a major stock market index, such as the DJIA or S&P 500, for a sustained period. A bear market is the opposite of a bull market, a period marked by market gains of 20% or more.

When was the last bear market :

Start and End Date

% Price Decline

Length in Days

1/4/2002–10/9/2002

-33.75

278

10/9/2007–11/20/2008

-51.93

408

1/6/2009–3/9/2009

-27.62

62

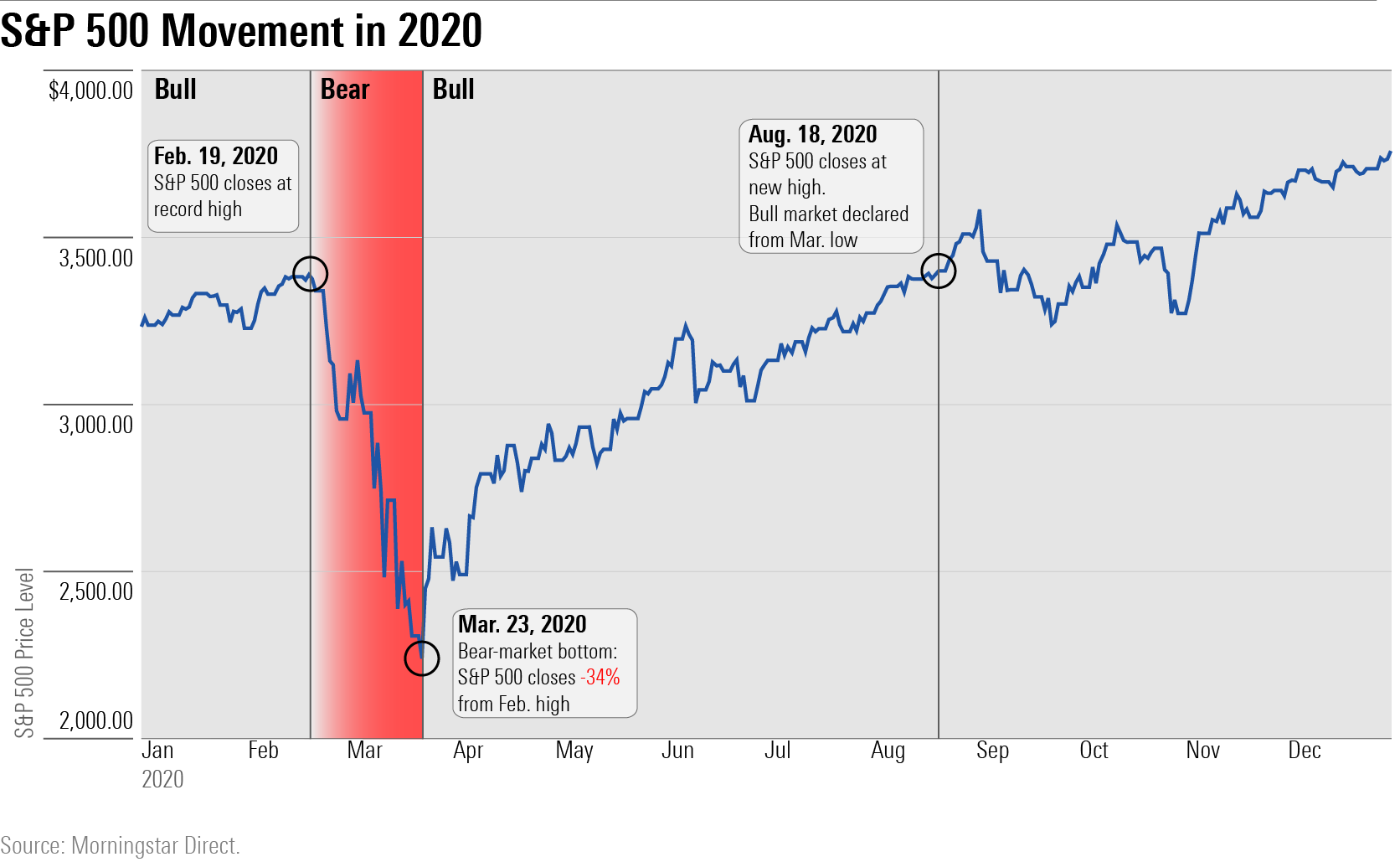

2/19/2020–3/23/2020

-33.92

33

What percentage is a bear market correction

A bear market of at least a 20% decline will occur again at some point, but it's important to keep it in perspective. The average bear market has lasted only about 15 months, according to the Schwab Center for Financial Research, and 80% of corrections since 1974 have not led to a bear market.

What is the S&P 500 correction : "A correction is when a broad measure of the market – the S&P 500, for example – declines at least 10% but less than 20%," states Dan Tolomay, chief investment officer at Trust Company of the South. Sign up for stock news with our Invested newsletter. Corrections can also happen to individual assets.

One definition of a bear market says markets are in bear territory when stocks, on average, fall at least 20% off their high. But 20% is an arbitrary number, just as a 10% decline is an arbitrary benchmark for a correction. Another definition of a bear market is when investors are more risk-averse than risk-seeking. Bull markets tend to last longer than bear markets with an average duration of 6.6 years. The average duration of a bear market is 1.3 years. The average cumulative gain over the course of a bull market is 339%. The average cumulative loss over the course of a bear market is 38%.

What percent defines a bear market

A bear market is a downward trend in financial markets, indicating a weakening economy and a loss of investor confidence. Generally, a market is considered a bear market when prices have declined more than 20%. Bear markets can be as short as a few weeks or as long as a several years.A bull market is a period of time in financial markets when the price of an asset or security rises continuously. The commonly accepted definition of a bull market is when stock prices rise by 20%. Traders employ a variety of strategies, such as increased buy and hold and retracement, to profit off bull markets.Since 1950, the S&P 500 index has declined by 20% or more on 12 different occasions. The average stock market price decline is -33.38% and the average length of a market crash is 342 days. Bear market history

There were 12 bear markets between 1928 and 1945 (pre-World War II), taking place roughly every 1.4 years. Since 1945, there have been 15, lasting from just a month to 1.7 years.

What is a bear market 20% : A bear market is a downward trend in financial markets, indicating a weakening economy and a loss of investor confidence. Generally, a market is considered a bear market when prices have declined more than 20%. Bear markets can be as short as a few weeks or as long as a several years.

What percentage is a pullback : 5-10%

A pullback is a market drop of 5-10% and is very short term. It is a dip from a recent high during an ongoing bull market while upward momentum is still intact, and is a normal adjustment to a market cycle. The drops typically do not change the market sentiment or outlook.

What is a 10 percent correction in the stock market

"A correction is when a broad measure of the market – the S&P 500, for example – declines at least 10% but less than 20%," states Dan Tolomay, chief investment officer at Trust Company of the South. Sign up for stock news with our Invested newsletter. Corrections can also happen to individual assets. How Common Are 20% Declines in the Stock Market 20% drops in the S&P 500 are still common. Expect one to two within a five-year period. That said, most 20% declines are great long-term buying opportunities because there are relatively a small number of 20% declines that drop beyond 30% (but it does happen).2%

Use. The key active ingredients of bear spray are 1–2% capsaicin, and related capsaicinoids. Bear spray is intended to deter an aggressive or charging bear; a user points the canister at an aggressive bear and sprays the contents for 2–3 seconds.

Will 2024 be a bull or bear market : With stock indexes at all-time highs, it seems we are in the midst of a new bull market. While much of the market's recent gains have come from a handful of stocks, the rally has begun to broaden in recent months. Expectations of an earnings rebound in 2024 suggest earnings could continue to drive the market higher.

Antwort What is a 20% correction called? Weitere Antworten – What is the difference between a bear market and a correction

The general definition of a market correction is a market decline that is more than 10%, but less than 20%. A bear market is usually defined as a decline of 20% or greater. The market is represented by the S&P 500 index.Key Takeaways

A bull market is when stock prices are on the rise and economically sound, while a bear market is when prices are in decline. The origin of these expressions is unclear, but one reason could be that bulls attack by bringing their horns upward, while bears attack by swiping their paws downward.Bear Market Definition

Economists define a bear market as a decline of 20% or more of a major stock market index, such as the DJIA or S&P 500, for a sustained period. A bear market is the opposite of a bull market, a period marked by market gains of 20% or more.

When was the last bear market :

What percentage is a bear market correction

A bear market of at least a 20% decline will occur again at some point, but it's important to keep it in perspective. The average bear market has lasted only about 15 months, according to the Schwab Center for Financial Research, and 80% of corrections since 1974 have not led to a bear market.

What is the S&P 500 correction : "A correction is when a broad measure of the market – the S&P 500, for example – declines at least 10% but less than 20%," states Dan Tolomay, chief investment officer at Trust Company of the South. Sign up for stock news with our Invested newsletter. Corrections can also happen to individual assets.

One definition of a bear market says markets are in bear territory when stocks, on average, fall at least 20% off their high. But 20% is an arbitrary number, just as a 10% decline is an arbitrary benchmark for a correction. Another definition of a bear market is when investors are more risk-averse than risk-seeking.

Bull markets tend to last longer than bear markets with an average duration of 6.6 years. The average duration of a bear market is 1.3 years. The average cumulative gain over the course of a bull market is 339%. The average cumulative loss over the course of a bear market is 38%.

What percent defines a bear market

A bear market is a downward trend in financial markets, indicating a weakening economy and a loss of investor confidence. Generally, a market is considered a bear market when prices have declined more than 20%. Bear markets can be as short as a few weeks or as long as a several years.A bull market is a period of time in financial markets when the price of an asset or security rises continuously. The commonly accepted definition of a bull market is when stock prices rise by 20%. Traders employ a variety of strategies, such as increased buy and hold and retracement, to profit off bull markets.Since 1950, the S&P 500 index has declined by 20% or more on 12 different occasions. The average stock market price decline is -33.38% and the average length of a market crash is 342 days.

Bear market history

There were 12 bear markets between 1928 and 1945 (pre-World War II), taking place roughly every 1.4 years. Since 1945, there have been 15, lasting from just a month to 1.7 years.

What is a bear market 20% : A bear market is a downward trend in financial markets, indicating a weakening economy and a loss of investor confidence. Generally, a market is considered a bear market when prices have declined more than 20%. Bear markets can be as short as a few weeks or as long as a several years.

What percentage is a pullback : 5-10%

A pullback is a market drop of 5-10% and is very short term. It is a dip from a recent high during an ongoing bull market while upward momentum is still intact, and is a normal adjustment to a market cycle. The drops typically do not change the market sentiment or outlook.

What is a 10 percent correction in the stock market

"A correction is when a broad measure of the market – the S&P 500, for example – declines at least 10% but less than 20%," states Dan Tolomay, chief investment officer at Trust Company of the South. Sign up for stock news with our Invested newsletter. Corrections can also happen to individual assets.

How Common Are 20% Declines in the Stock Market 20% drops in the S&P 500 are still common. Expect one to two within a five-year period. That said, most 20% declines are great long-term buying opportunities because there are relatively a small number of 20% declines that drop beyond 30% (but it does happen).2%

Use. The key active ingredients of bear spray are 1–2% capsaicin, and related capsaicinoids. Bear spray is intended to deter an aggressive or charging bear; a user points the canister at an aggressive bear and sprays the contents for 2–3 seconds.

Will 2024 be a bull or bear market : With stock indexes at all-time highs, it seems we are in the midst of a new bull market. While much of the market's recent gains have come from a handful of stocks, the rally has begun to broaden in recent months. Expectations of an earnings rebound in 2024 suggest earnings could continue to drive the market higher.