Generally speaking, a dividend payout ratio of 30-50% is considered healthy, while anything over 50% could be unsustainable.A Payout Ratio, also commonly referred to as Dividend Pay-out Ratio (DPR), is a financial metric which indicates what portion of a company's earnings is distributed among its shareholders in the form of dividend payments. The total dividend payout is calculated as a percentage of its total earnings.A payout ratio over 100 may indicate that the dividend is in jeopardy, because no company can continue to pay out more than it earns indefinitely. A very high payout ratio can be a sign to investigate further, but it's not necessarily a signal to run screaming.

What is the payoff ratio : Payoff Ratio is the system's average percentage profit per trade divided by the average percentage loss per trade.

What does a 50% payout ratio mean

Say a company earns $100 million this year and makes $50 million in dividend payments to its shareholders. In this case, its dividend payout ratio would be 50%. You can also use per-share amounts to get the same result. This can be simpler since companies report dividends and earnings in per-share amounts.

What is 80% payout ratio : The dividend payout ratio is one metric that can be used to determine how much a company pays out to its shareholders in relation to the overall earnings it generates. For example, if a company has an EPS (earnings per share) of $1.00 and pays out dividends of $0.80, its dividend payout ratio would be 80%.

Say a company earns $100 million this year and makes $50 million in dividend payments to its shareholders. In this case, its dividend payout ratio would be 50%. You can also use per-share amounts to get the same result. This can be simpler since companies report dividends and earnings in per-share amounts. Furthermore, if a company, be it any stage of maturity, has a 100% or above dividend payout ratio, it means that such a company is paying more than it is earning. Such a payout strategy is widely considered unsustainable.

What does 100% payout ratio mean

Generally speaking, companies with the best long-term records of dividend payments have stable payout ratios over many years. But a payout ratio greater than 100% suggests a company is paying out more in dividends than its earnings can support and might be cause for concern regarding sustainability.Payout Ratio Basics

If a company has a dividend payout ratio over 100% then that means that the company is paying out more to its shareholders than earnings coming in. This is typically not a good recipe for the company's financial health; it can be a sign that the dividend payment will be cut in the future.Let's imagine a company earns $2.00 per share this year and pays out $0.80 per share. The firm's payout ratio is $0.80 divided by $2.00 or 40%. Many firms adopt what is known as a payout policy, which simply tells shareholders that the firm expects to pay out some constant percentage of their earnings as a dividend. The dividend payout ratio is 0% for companies that do not pay dividends and 100% for companies that pay out their entire net income as dividends.

What does 40% dividend mean : Dividend is that portion of profit which is distributed to shareholders. Paid-up capital means the total amount of called up share capital which is actually paid to the company by the members. Dividend is declared on the paid-up form of capital. Thus the company will provide dividend of 40% on paid-up capital.

What is a 50 payout ratio : A mid-50% payout ratio signals positive intent from the company to declare dividend payouts and also retain to grow. Target payout ratios vary by industry. A payout ratio that's slightly less than the industry average is always preferred.

What does 50% dividend mean

The dividend yield—displayed as a percentage—is the amount of money a company pays shareholders for owning a share of its stock divided by its current stock price. Mature companies are the most likely to pay dividends. Companies in the utility and consumer staple industries often have relatively higher dividend yields. If a company's payout ratio is 30%, then it indicates that the company has channeled 30% of the earnings is made to be paid as dividends. Thereby, the remaining 70% of net income the company keeps with itself.A range of 0% to 35% is considered a good payout. A payout in that range is usually observed when a company just initiates a dividend. Typical characteristics of companies in this range are “value” stocks.

What is 100 percent dividend : Simply put, 100% stock dividend is 1:1 or 1 for 1 bonus share, as explained above, if you held 100 shares after 1:1 bonus you would have 200 shares (100 original, another 100 as bonus). The impact on the stock price is that the price becomes 1/2 the price of the stock before bonus (supply has doubled).

Antwort What is 60% payout ratio? Weitere Antworten – What is a good payout ratio

30-50%

Generally speaking, a dividend payout ratio of 30-50% is considered healthy, while anything over 50% could be unsustainable.A Payout Ratio, also commonly referred to as Dividend Pay-out Ratio (DPR), is a financial metric which indicates what portion of a company's earnings is distributed among its shareholders in the form of dividend payments. The total dividend payout is calculated as a percentage of its total earnings.A payout ratio over 100 may indicate that the dividend is in jeopardy, because no company can continue to pay out more than it earns indefinitely. A very high payout ratio can be a sign to investigate further, but it's not necessarily a signal to run screaming.

What is the payoff ratio : Payoff Ratio is the system's average percentage profit per trade divided by the average percentage loss per trade.

What does a 50% payout ratio mean

Say a company earns $100 million this year and makes $50 million in dividend payments to its shareholders. In this case, its dividend payout ratio would be 50%. You can also use per-share amounts to get the same result. This can be simpler since companies report dividends and earnings in per-share amounts.

What is 80% payout ratio : The dividend payout ratio is one metric that can be used to determine how much a company pays out to its shareholders in relation to the overall earnings it generates. For example, if a company has an EPS (earnings per share) of $1.00 and pays out dividends of $0.80, its dividend payout ratio would be 80%.

Say a company earns $100 million this year and makes $50 million in dividend payments to its shareholders. In this case, its dividend payout ratio would be 50%. You can also use per-share amounts to get the same result. This can be simpler since companies report dividends and earnings in per-share amounts.

Furthermore, if a company, be it any stage of maturity, has a 100% or above dividend payout ratio, it means that such a company is paying more than it is earning. Such a payout strategy is widely considered unsustainable.

What does 100% payout ratio mean

Generally speaking, companies with the best long-term records of dividend payments have stable payout ratios over many years. But a payout ratio greater than 100% suggests a company is paying out more in dividends than its earnings can support and might be cause for concern regarding sustainability.Payout Ratio Basics

If a company has a dividend payout ratio over 100% then that means that the company is paying out more to its shareholders than earnings coming in. This is typically not a good recipe for the company's financial health; it can be a sign that the dividend payment will be cut in the future.Let's imagine a company earns $2.00 per share this year and pays out $0.80 per share. The firm's payout ratio is $0.80 divided by $2.00 or 40%. Many firms adopt what is known as a payout policy, which simply tells shareholders that the firm expects to pay out some constant percentage of their earnings as a dividend.

The dividend payout ratio is 0% for companies that do not pay dividends and 100% for companies that pay out their entire net income as dividends.

What does 40% dividend mean : Dividend is that portion of profit which is distributed to shareholders. Paid-up capital means the total amount of called up share capital which is actually paid to the company by the members. Dividend is declared on the paid-up form of capital. Thus the company will provide dividend of 40% on paid-up capital.

What is a 50 payout ratio : A mid-50% payout ratio signals positive intent from the company to declare dividend payouts and also retain to grow. Target payout ratios vary by industry. A payout ratio that's slightly less than the industry average is always preferred.

What does 50% dividend mean

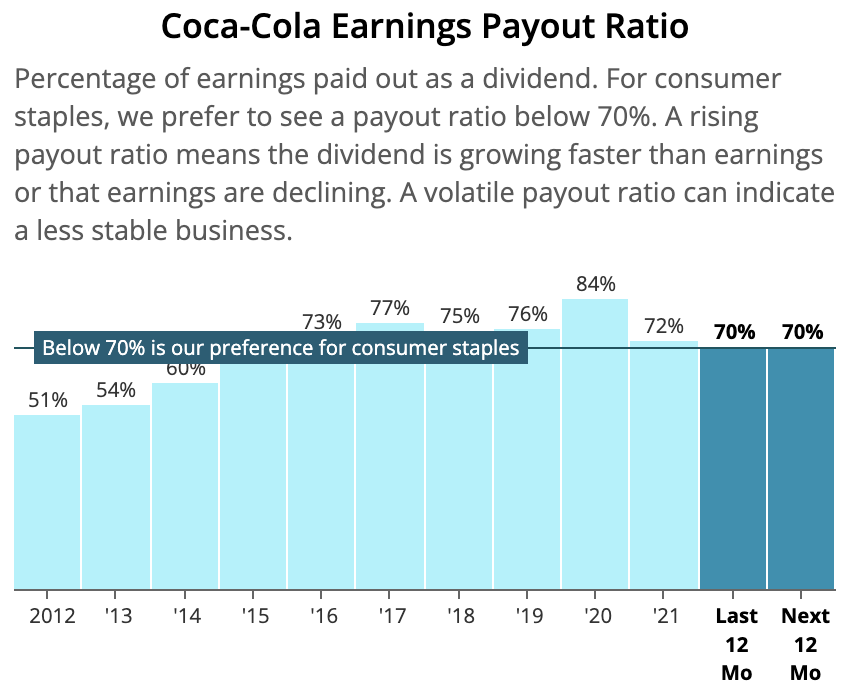

The dividend yield—displayed as a percentage—is the amount of money a company pays shareholders for owning a share of its stock divided by its current stock price. Mature companies are the most likely to pay dividends. Companies in the utility and consumer staple industries often have relatively higher dividend yields.

If a company's payout ratio is 30%, then it indicates that the company has channeled 30% of the earnings is made to be paid as dividends. Thereby, the remaining 70% of net income the company keeps with itself.A range of 0% to 35% is considered a good payout. A payout in that range is usually observed when a company just initiates a dividend. Typical characteristics of companies in this range are “value” stocks.

What is 100 percent dividend : Simply put, 100% stock dividend is 1:1 or 1 for 1 bonus share, as explained above, if you held 100 shares after 1:1 bonus you would have 200 shares (100 original, another 100 as bonus). The impact on the stock price is that the price becomes 1/2 the price of the stock before bonus (supply has doubled).