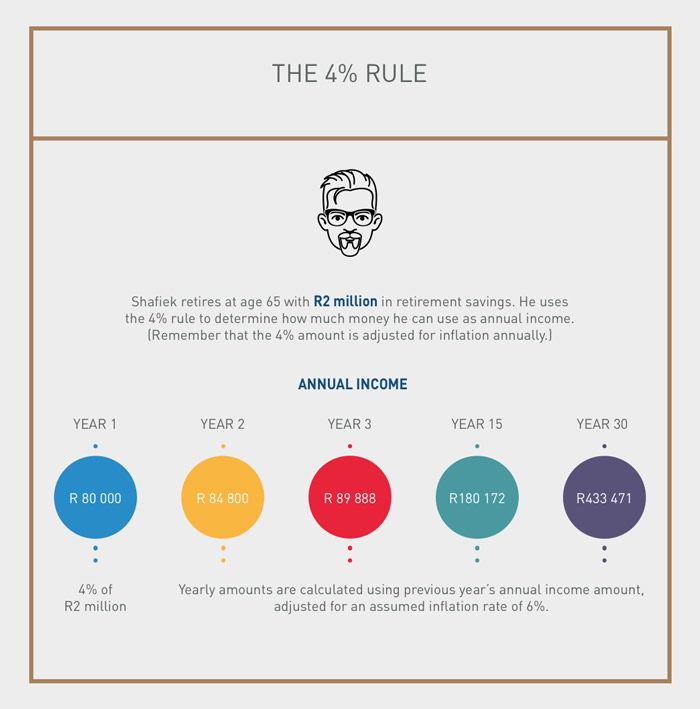

To achieve early retirement, F.I.R.E. investors cut costs aggressively and save large percentages of their income. Their milestone for financial independence is a portfolio large enough to sustain their spending with inflation- adjusted withdrawals equal to 4% of the portfolio's initial value—the so-called 4% rule.3 Steps to Successfully Build Wealth

Making Money. Building wealth starts with cash flow – money coming in and money going out.

Saving Money.

Making Wise Choices.

The 4% rule comes with a major caveat: It's not really a “rule” since everyone's situation is different. If you have a large retirement investment portfolio, you might not need to spend 4% of it every year. If you have limited savings, 4% might not come close to covering your needs.

Is the 4% rule too low : For those retirees, the 4% rule likely will provide an outdated recommendation. “It's going to be too low for most people who are retiring at a reasonable age,” Blanchett said.

What is the number 1 key to building wealth

While get-rich-quick schemes sometimes may be enticing, the tried-and-true way to build wealth is through regular saving and investing—and patiently allowing that money to grow over time. It's fine to start small. The important thing is to start and to start early. Earn money and then save and invest it smartly.

What are the 7 stages of wealth : 7 Stages of Financial Well-Being ®

Financial Chaos. In Financial Chaos, you're having a very tough time financially despite earning a good income.

Financial Avoidance.

Financial Awareness.

Financial Stability.

Financial Security.

Financial Freedom.

Financial Fulfillment.

Specifically, lower forecasts for returns on investments indicated the 4% rule might need to be adjusted down. For instance, a few years ago, Morningstar began an annual analysis of safe withdrawal rates. In 2021, the investment firm pegged the safe rate at 3.3%. In 2022, 3.8% was determined to be the safe rate. You can probably retire at 55 if you have $4 million in savings. This amount, according to conventional estimates, can reliably produce enough income to pay for a comfortable retirement.

Is $4 million enough to retire at 65

Like any basic rule of thumb, this one comes with plenty of qualifications and exceptions, but it can be a useful place to start. Now, 4% of $4 million is $160,000, so as long as you expect your retirement to last for about 30 years and that amount sounds like enough-or more than enough-for you, you're in a good place.According to CNN Money, the average net worth for the following ages in 2023 are: $9,000 for ages 25-34. $52,000 for ages 35-44, $100,000 for ages 45-54. $180,000 for ages 55-64.You need more money than ever to enter the ranks of the top 1% of the richest Americans. To join the club of the wealthiest citizens in the U.S., you'll need at least $5.8 million, up about 15% up from $5.1 million one year ago, according to global real estate company Knight Frank's 2024 Wealth Report. They spend less than they earn. They save their money and make their savings grow. They manage their finances carefully. They seize investment or business opportunities when they arise.

What car does a rich man drive : According to an Experian Automotive study cited by the Financial Times, while society's rich are more likely to buy luxury brand cars than its less well-off, 61% of people who earn more than $250,000 are more likely to be driving Hondas, Fords and Toyotas.

Is $3 million enough to retire at 50 : Can I retire at 50 with $3 million As mentioned above, $3 million can easily carry you through 40 years of retirement, making leaving the workforce at 50 a plausible option.

Is $10 million enough to retire at 70

A $10 million nest egg will pay for a comfortable retirement for the majority of retirement savers. However, whether that much is enough to fund any specific retiree's golden years depends on a number of factors. At age 45, $10 million is more than enough to fund a very comfortable retirement. Whether it's enough to fund your retirement will depend entirely on your own, personal needs. If you're considering trying to retire at 45, take the time to consider your life and your budget to decide if you're able to make it work.Spending Needs and Savings Longevity:

For a $3 million retirement fund, anticipate a monthly income of $6,250 over 40 years, barring investment growth or loss. Factors such as lifestyle choices, inflation, and healthcare costs will influence how long your savings last.

Can I retire at 55 with $1 million : It's definitely possible, but there are several factors to consider—including cost of living, the taxes you'll owe on your withdrawals, and how you want to live in retirement—when thinking about how much money you'll need to retire in the future.

Antwort What is 4% rule in investing? Weitere Antworten – What is the 4% rule simple path to wealth

To achieve early retirement, F.I.R.E. investors cut costs aggressively and save large percentages of their income. Their milestone for financial independence is a portfolio large enough to sustain their spending with inflation- adjusted withdrawals equal to 4% of the portfolio's initial value—the so-called 4% rule.3 Steps to Successfully Build Wealth

The 4% rule comes with a major caveat: It's not really a “rule” since everyone's situation is different. If you have a large retirement investment portfolio, you might not need to spend 4% of it every year. If you have limited savings, 4% might not come close to covering your needs.

Is the 4% rule too low : For those retirees, the 4% rule likely will provide an outdated recommendation. “It's going to be too low for most people who are retiring at a reasonable age,” Blanchett said.

What is the number 1 key to building wealth

While get-rich-quick schemes sometimes may be enticing, the tried-and-true way to build wealth is through regular saving and investing—and patiently allowing that money to grow over time. It's fine to start small. The important thing is to start and to start early. Earn money and then save and invest it smartly.

What are the 7 stages of wealth : 7 Stages of Financial Well-Being ®

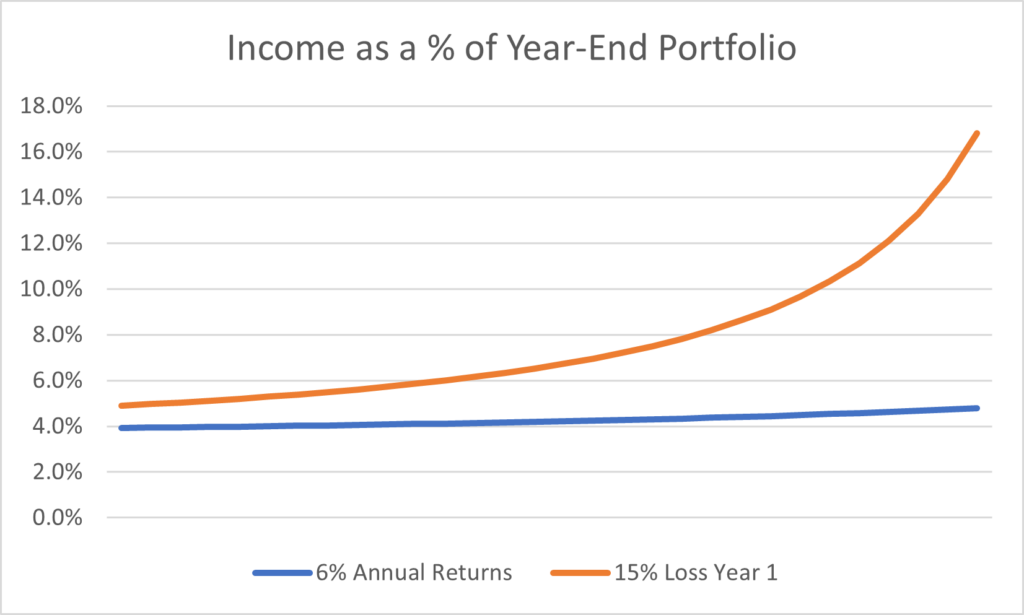

Specifically, lower forecasts for returns on investments indicated the 4% rule might need to be adjusted down. For instance, a few years ago, Morningstar began an annual analysis of safe withdrawal rates. In 2021, the investment firm pegged the safe rate at 3.3%. In 2022, 3.8% was determined to be the safe rate.

You can probably retire at 55 if you have $4 million in savings. This amount, according to conventional estimates, can reliably produce enough income to pay for a comfortable retirement.

Is $4 million enough to retire at 65

Like any basic rule of thumb, this one comes with plenty of qualifications and exceptions, but it can be a useful place to start. Now, 4% of $4 million is $160,000, so as long as you expect your retirement to last for about 30 years and that amount sounds like enough-or more than enough-for you, you're in a good place.According to CNN Money, the average net worth for the following ages in 2023 are: $9,000 for ages 25-34. $52,000 for ages 35-44, $100,000 for ages 45-54. $180,000 for ages 55-64.You need more money than ever to enter the ranks of the top 1% of the richest Americans. To join the club of the wealthiest citizens in the U.S., you'll need at least $5.8 million, up about 15% up from $5.1 million one year ago, according to global real estate company Knight Frank's 2024 Wealth Report.

They spend less than they earn. They save their money and make their savings grow. They manage their finances carefully. They seize investment or business opportunities when they arise.

What car does a rich man drive : According to an Experian Automotive study cited by the Financial Times, while society's rich are more likely to buy luxury brand cars than its less well-off, 61% of people who earn more than $250,000 are more likely to be driving Hondas, Fords and Toyotas.

Is $3 million enough to retire at 50 : Can I retire at 50 with $3 million As mentioned above, $3 million can easily carry you through 40 years of retirement, making leaving the workforce at 50 a plausible option.

Is $10 million enough to retire at 70

A $10 million nest egg will pay for a comfortable retirement for the majority of retirement savers. However, whether that much is enough to fund any specific retiree's golden years depends on a number of factors.

At age 45, $10 million is more than enough to fund a very comfortable retirement. Whether it's enough to fund your retirement will depend entirely on your own, personal needs. If you're considering trying to retire at 45, take the time to consider your life and your budget to decide if you're able to make it work.Spending Needs and Savings Longevity:

For a $3 million retirement fund, anticipate a monthly income of $6,250 over 40 years, barring investment growth or loss. Factors such as lifestyle choices, inflation, and healthcare costs will influence how long your savings last.

Can I retire at 55 with $1 million : It's definitely possible, but there are several factors to consider—including cost of living, the taxes you'll owe on your withdrawals, and how you want to live in retirement—when thinking about how much money you'll need to retire in the future.