A 3 way matching is the process of matching purchase orders (PO), goods receipt note, and the supplier's invoice to eliminate fraud, save money, and maintain adequate records for the audit trail. 3-way matching is usually done before issuing payment to the supplier post delivery.What is Accounts Payable The Accounts Payable department is responsible for the financial, administrative and clerical support of a company. They are in charge of making payments owed by the company to suppliers and other creditors, paying vendor invoices or bills, and recording the company's short-term debts.SAP Three way match is based on PO Line item (If a PO has multiple line items, Three way match is achieved in each line items) Buyer of the Purchase order ensures three way match in SAP & Buyer resolves the discrepancy by correcting PO,GR or IR.

What is an example of a 3-way match : An Example of a 3-Way Match

They verify that the quantity and details match those specified on the invoice — in this case, that the order is for 1,500 circuit boards at a rate of $3 each, totaling $4,500 altogether. Next, they check the PO and invoice against the order receipt (or receiving report).

Is accounts payable a difficult job

“This role is primarily focused on data entry and management to ensure that all aspects of a company's accounts are maintained correctly which can make the job difficult because minor mistakes can have extreme consequences,” said an article at Zippia.com, a job placement company.

Is accounts payable a good career : Working as an accounts payable specialist can be a rewarding way to contribute to an organization's success, and it can lead to further steps in a financial reporting career.

An Example of a 3-Way Match

They verify that the quantity and details match those specified on the invoice — in this case, that the order is for 1,500 circuit boards at a rate of $3 each, totaling $4,500 altogether. Next, they check the PO and invoice against the order receipt (or receiving report). 2-way matching in accounts payable makes sure all data on the purchase order and invoice aligns. 3-way matching in accounts payable goes one step further and makes certain the data on the purchase order, invoice and sales receipt are the same.

What is a 3-way match in accounting

In accounting, one of the most common types of invoice matching is called the 3-way match. Three-way match is the process of comparing the purchase order, invoice, and goods receipt to make sure they match, prior to approving the invoice.A three-way match can assist in deciding whether only a portion of the invoice should be paid or the whole amount should be paid. The invoices must fall within the matching limits for the verification to succeed.While managing APs is simply a matter of making payments, and recording due and completed payments, managing your AR requires some extra effort on your part. Handling your accounts receivables involves several steps from the moment you send an invoice to your customer, to the moment you update your accounts. Accounts Payable Specialist Salary

Annual Salary

Monthly Pay

Top Earners

$61,000

$5,083

75th Percentile

$54,500

$4,541

Average

$49,286

$4,107

25th Percentile

$42,500

$3,541

What is the highest salary in accounts payable : Highest salary that a Accounts Payable Specialist can earn is ₹9.0 Lakhs per year (₹75.0k per month).

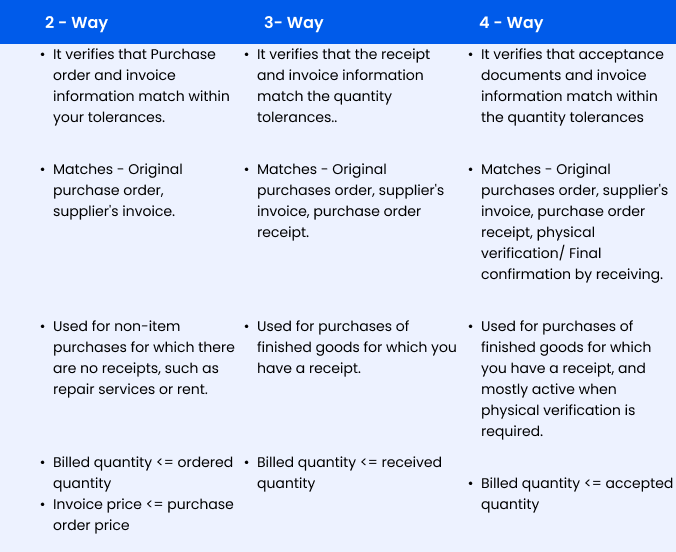

What is 3-way and 4-way matching in accounts payable : The 2-way matching process involves matching only the purchase order and invoice. In the case of 3-way matching, the invoice is also matched with the goods receipt note besides the purchase order. In 4-way matching, the goods are further matched with the inspection report.

What is 2-way and 3-way and 4-way matching in accounts payable

With the help of 2-way matching, you can make sure that all your data on the purchase order and your invoice aligns. And with the help of 3-way matching, you go with the one step further and can make your certain data on the purchase order, invoice, and the sales receipt the same. What is 2-Way vs. 3-Way Matching in Accounts Payable 2-way matching in accounts payable makes sure all data on the purchase order and invoice aligns. 3-way matching in accounts payable goes one step further and makes certain the data on the purchase order, invoice and sales receipt are the same.Who Are the Stakeholders in Three-Way Matching

Stakeholder

Role

Purchaser

Issues PO stating item requested, quantity and price.

Receiver

Checks quantity delivered.

Finance team

Confirms invoice is legitimate and reflects delivery, and then issues payment.

Vendor

Fulfills the PO.

5. 5. 2022

What is the 3 way match problem : One of the primary issues encountered during three-way invoice matching is discrepancies in quantity. This occurs when the quantity of goods or services received does not match the quantity stated on the purchase order or the invoice.

Antwort What is 3 way matching in SAP accounts payable? Weitere Antworten – What is 3 way matching in accounts payable in SAP

A 3 way matching is the process of matching purchase orders (PO), goods receipt note, and the supplier's invoice to eliminate fraud, save money, and maintain adequate records for the audit trail. 3-way matching is usually done before issuing payment to the supplier post delivery.What is Accounts Payable The Accounts Payable department is responsible for the financial, administrative and clerical support of a company. They are in charge of making payments owed by the company to suppliers and other creditors, paying vendor invoices or bills, and recording the company's short-term debts.SAP Three way match is based on PO Line item (If a PO has multiple line items, Three way match is achieved in each line items) Buyer of the Purchase order ensures three way match in SAP & Buyer resolves the discrepancy by correcting PO,GR or IR.

What is an example of a 3-way match : An Example of a 3-Way Match

They verify that the quantity and details match those specified on the invoice — in this case, that the order is for 1,500 circuit boards at a rate of $3 each, totaling $4,500 altogether. Next, they check the PO and invoice against the order receipt (or receiving report).

Is accounts payable a difficult job

“This role is primarily focused on data entry and management to ensure that all aspects of a company's accounts are maintained correctly which can make the job difficult because minor mistakes can have extreme consequences,” said an article at Zippia.com, a job placement company.

Is accounts payable a good career : Working as an accounts payable specialist can be a rewarding way to contribute to an organization's success, and it can lead to further steps in a financial reporting career.

An Example of a 3-Way Match

They verify that the quantity and details match those specified on the invoice — in this case, that the order is for 1,500 circuit boards at a rate of $3 each, totaling $4,500 altogether. Next, they check the PO and invoice against the order receipt (or receiving report).

2-way matching in accounts payable makes sure all data on the purchase order and invoice aligns. 3-way matching in accounts payable goes one step further and makes certain the data on the purchase order, invoice and sales receipt are the same.

What is a 3-way match in accounting

In accounting, one of the most common types of invoice matching is called the 3-way match. Three-way match is the process of comparing the purchase order, invoice, and goods receipt to make sure they match, prior to approving the invoice.A three-way match can assist in deciding whether only a portion of the invoice should be paid or the whole amount should be paid. The invoices must fall within the matching limits for the verification to succeed.While managing APs is simply a matter of making payments, and recording due and completed payments, managing your AR requires some extra effort on your part. Handling your accounts receivables involves several steps from the moment you send an invoice to your customer, to the moment you update your accounts.

Accounts Payable Specialist Salary

What is the highest salary in accounts payable : Highest salary that a Accounts Payable Specialist can earn is ₹9.0 Lakhs per year (₹75.0k per month).

What is 3-way and 4-way matching in accounts payable : The 2-way matching process involves matching only the purchase order and invoice. In the case of 3-way matching, the invoice is also matched with the goods receipt note besides the purchase order. In 4-way matching, the goods are further matched with the inspection report.

What is 2-way and 3-way and 4-way matching in accounts payable

With the help of 2-way matching, you can make sure that all your data on the purchase order and your invoice aligns. And with the help of 3-way matching, you go with the one step further and can make your certain data on the purchase order, invoice, and the sales receipt the same.

What is 2-Way vs. 3-Way Matching in Accounts Payable 2-way matching in accounts payable makes sure all data on the purchase order and invoice aligns. 3-way matching in accounts payable goes one step further and makes certain the data on the purchase order, invoice and sales receipt are the same.Who Are the Stakeholders in Three-Way Matching

5. 5. 2022

What is the 3 way match problem : One of the primary issues encountered during three-way invoice matching is discrepancies in quantity. This occurs when the quantity of goods or services received does not match the quantity stated on the purchase order or the invoice.