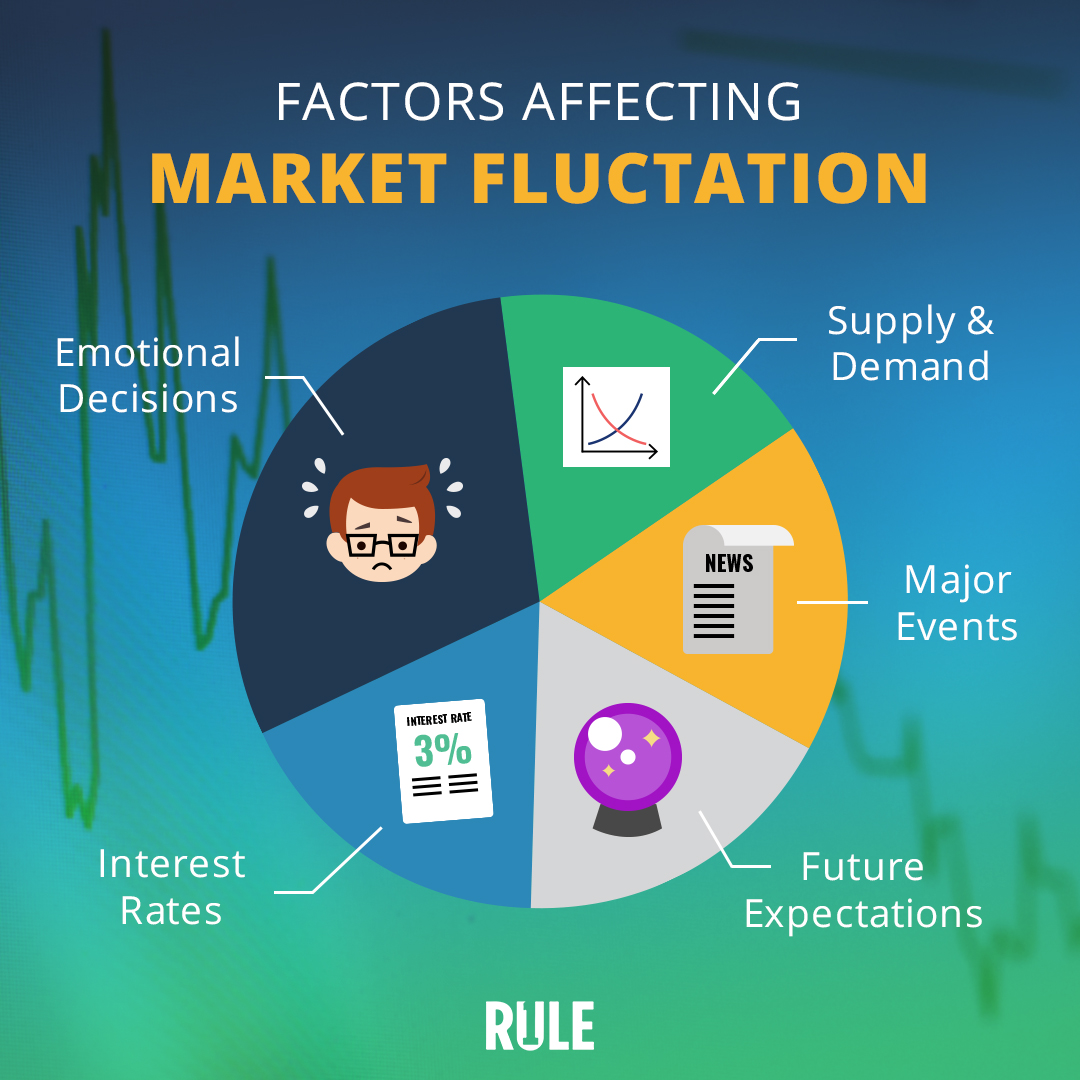

There are four main factors that can affect stock prices:

Company news and performance.

Industry performance.

Investor sentiment.

Economic factors.

At the most fundamental level, supply and demand in the market determine stock price. Price times the number of shares outstanding (market capitalization) is the value of a company. Comparing just the share price of two companies is meaningless.One of the main factors affecting the share market is the imbalance between supply and demand, which leads to the increase or decrease in the price of stocks. In addition, factors such as economic data and interest rates affect the demand for stocks, leading to fluctuations in their value.

How do economic factors affect stock market : Economic strength

Indicators such as GDP growth rate, inflation rate, spending and unemployment rate reflect economic health. A movement in these indicators causes the markets to respond rapidly. A positive outlook reflected by strong indicators can boost investor confidence and drive the markets upwards.

Why are stocks falling

According to the astute observations of our esteemed stock market experts, the ongoing Lok Sabha elections, FIIs' selling, bounce back in the US dollar rates, hawkish US Fed fueling treasury yields, unimpressive Q4 results 2024 season and rising India VIX Index are some of the primary reasons that have been dragging …

Why do stocks fall after good earnings : When a company releases an earnings report, a fundamental reaction is often the most common. As such, good earnings that miss expectations can result in a downgrade of value. If a firm issues an earnings report that does not meet Street expectations, the stock's price will usually drop.

However, when recent data showed hotter-than-expected economic growth and a pickup in inflation, investors remained bullish. They simply shifted the narrative, indicating their belief that a reaccelerating economy and strong company profits will lift markets. High demand is the primary driver of what makes a stock price go up. The higher the demand, the higher the price investors will be willing to pay for each share (and the higher the price owners will be demanding to sell their shares). Similarly, low demand is the primary driver of what makes a stock price go down.

How does inflation affect the stock market

How Does Inflation Affect Stocks Inflation hurts stocks overall because consumer spending drops. Value stocks may do well because their prices haven't kept up with their peers. Growth stocks tend to be shunned by investors.Share price is ultimately determined by supply and demand in the marketplace. The more shares in circulation there are relative to demand for this stock, the lower its price will fall. The more demand there is relative to shares in circulation, the higher its price will climb.Based on the stock market's historic performance, there's never necessarily a bad time to buy — as long as you keep a long-term outlook. The market can be volatile in the short term (even in strong economic times), but it has a perfect track record of seeing positive returns over many years. Taking the loss could allow you to get your portfolio back on track more quickly—and potentially offset capital gains and/or ordinary income.

What causes stocks to drop : If demand for a limited number of shares outpaces the supply, then the stock price normally rises. And if the supply is greater than demand, the stock price typically falls.

What makes stock prices drop : Conversely, a loss of confidence can lead investors to sell, pushing down the stock price. Factors that can affect sentiment toward a stock include quarterly earnings reports beating or falling short of expectations, analyst upgrades or downgrades, and positive or negative business developments.

What drives stock prices

Supply and demand is a key factor in determining stock prices. “The price of a stock is determined by how many people want the stock and how much of it there is,” explained William Haight, a director at Capital Choice Financial Group in Phoenix. “If more people want to buy a stock, then the price will go up. The share market is down today due to a combination of factors including rising volatility, ongoing Lok Sabha elections, non-impressive Q4 results, continuous selling by FIIs, and the US dollar rates sustaining above 105 mark.The stock market goes up because businesses get bigger and earn more money over time. If you own stocks, you get to take part in that growth. You benefit from the profits, cash flows, innovation, and growth of corporations.

Do stocks go up when inflation is high : Analysts suggest that the short-term dynamic is less favourable, and that the relationship between equity prices and inflation is (quite frequently) an inverse correlation – ie as inflation rises, stock prices fall, or as inflation falls, stock prices rise.

Antwort What factors affect stock market? Weitere Antworten – What are the three main factors that affect stock

There are four main factors that can affect stock prices:

At the most fundamental level, supply and demand in the market determine stock price. Price times the number of shares outstanding (market capitalization) is the value of a company. Comparing just the share price of two companies is meaningless.One of the main factors affecting the share market is the imbalance between supply and demand, which leads to the increase or decrease in the price of stocks. In addition, factors such as economic data and interest rates affect the demand for stocks, leading to fluctuations in their value.

How do economic factors affect stock market : Economic strength

Indicators such as GDP growth rate, inflation rate, spending and unemployment rate reflect economic health. A movement in these indicators causes the markets to respond rapidly. A positive outlook reflected by strong indicators can boost investor confidence and drive the markets upwards.

Why are stocks falling

According to the astute observations of our esteemed stock market experts, the ongoing Lok Sabha elections, FIIs' selling, bounce back in the US dollar rates, hawkish US Fed fueling treasury yields, unimpressive Q4 results 2024 season and rising India VIX Index are some of the primary reasons that have been dragging …

Why do stocks fall after good earnings : When a company releases an earnings report, a fundamental reaction is often the most common. As such, good earnings that miss expectations can result in a downgrade of value. If a firm issues an earnings report that does not meet Street expectations, the stock's price will usually drop.

However, when recent data showed hotter-than-expected economic growth and a pickup in inflation, investors remained bullish. They simply shifted the narrative, indicating their belief that a reaccelerating economy and strong company profits will lift markets.

:max_bytes(150000):strip_icc()/stockmarketmove.asp_V2-a2296bb60f344769832be9f288e42700.png)

High demand is the primary driver of what makes a stock price go up. The higher the demand, the higher the price investors will be willing to pay for each share (and the higher the price owners will be demanding to sell their shares). Similarly, low demand is the primary driver of what makes a stock price go down.

How does inflation affect the stock market

How Does Inflation Affect Stocks Inflation hurts stocks overall because consumer spending drops. Value stocks may do well because their prices haven't kept up with their peers. Growth stocks tend to be shunned by investors.Share price is ultimately determined by supply and demand in the marketplace. The more shares in circulation there are relative to demand for this stock, the lower its price will fall. The more demand there is relative to shares in circulation, the higher its price will climb.Based on the stock market's historic performance, there's never necessarily a bad time to buy — as long as you keep a long-term outlook. The market can be volatile in the short term (even in strong economic times), but it has a perfect track record of seeing positive returns over many years.

Taking the loss could allow you to get your portfolio back on track more quickly—and potentially offset capital gains and/or ordinary income.

What causes stocks to drop : If demand for a limited number of shares outpaces the supply, then the stock price normally rises. And if the supply is greater than demand, the stock price typically falls.

What makes stock prices drop : Conversely, a loss of confidence can lead investors to sell, pushing down the stock price. Factors that can affect sentiment toward a stock include quarterly earnings reports beating or falling short of expectations, analyst upgrades or downgrades, and positive or negative business developments.

What drives stock prices

Supply and demand is a key factor in determining stock prices. “The price of a stock is determined by how many people want the stock and how much of it there is,” explained William Haight, a director at Capital Choice Financial Group in Phoenix. “If more people want to buy a stock, then the price will go up.

The share market is down today due to a combination of factors including rising volatility, ongoing Lok Sabha elections, non-impressive Q4 results, continuous selling by FIIs, and the US dollar rates sustaining above 105 mark.The stock market goes up because businesses get bigger and earn more money over time. If you own stocks, you get to take part in that growth. You benefit from the profits, cash flows, innovation, and growth of corporations.

Do stocks go up when inflation is high : Analysts suggest that the short-term dynamic is less favourable, and that the relationship between equity prices and inflation is (quite frequently) an inverse correlation – ie as inflation rises, stock prices fall, or as inflation falls, stock prices rise.