Standard & Poor's (S&P) is a company well known around the world as a creator of financial market indices—widely used as investment benchmarks—a data source, and an issuer of credit ratings for companies and debt obligations.In 1941, Poor's Publishing merged with Standard Statistics Company to form Standard & Poor's. On Monday, March 4, 1957, the index was expanded to its current 500 companies and was renamed the S&P 500 Stock Composite Index.In terms of sector diversification, the S&P Global 100 Index has a broader sector mix than that of the S&P 500. The top 10 holdings span across not just I.T. but also Consumer Discretionary, Energy, Health Care, Consumer Staples, and Financials, as of 30 June 2022.

What is the full form of the S&P 500 index : What Is the S&P 500 Index The S&P 500 Index, or Standard & Poor's 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.

What is the P in stocks

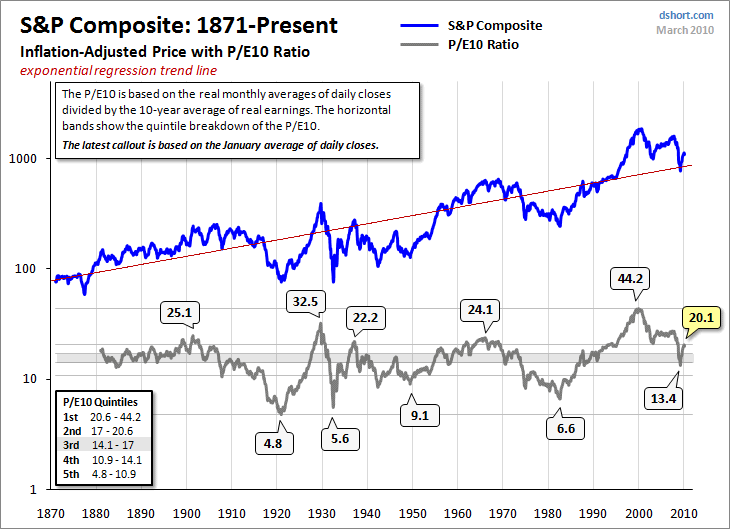

The P/E for a stock is computed by dividing the price of a stock (the "P") by the company's annual earnings per share (the "E").

What is P in share market : The price-to-earnings (P/E) ratio is the proportion of a company's share price to its earnings per share. A high P/E ratio could mean that a company's stock is overvalued or that investors expect high growth rates.

The SPDR S&P 500 ETF Trust (SPY), also known as SPY, is an exchange-traded fund that tracks the performance of the S&P 500 index. The S&P 500 is a stock market index that measures the performance of 500 large cap publicly traded companies in the United States. McGraw-Hill, a publishing house, acquired Standard & Poor's Corp., owner of the S&P 500 index, in 1966. Today, the S&P 500 is maintained by S&P Dow Jones Indices—a joint venture owned by S&P Global (previously McGraw Hill Financial), CME Group, and News Corp.

Is spgi better than spy

SPY – Performance Comparison. In the year-to-date period, SPGI achieves a -1.83% return, which is significantly lower than SPY's 9.92% return. Over the past 10 years, SPGI has outperformed SPY with an annualized return of 19.79%, while SPY has yielded a comparatively lower 12.64% annualized return.Basic Info

S&P 500 P/E Ratio is at a current level of 24.79, up from 23.27 last quarter and up from 22.23 one year ago. This is a change of 6.51% from last quarter and 11.53% from one year ago. The S&P 500 PE Ratio is the price to earnings ratio of the constituents of the S&P 500.The price of the S&P 500 index that you see quoted – for example, 4,301.56 – is measured in points, not dollars. That's the weighted average value of all the index's components. As the component stocks move up or down, the index rises or falls according to the calculation. The S&P 500 is an index that tracks the stock market's performance based on the share price fluctuations of 500 of the largest companies in the United States. It's a weighted index based on market cap, which means more valuable companies have a greater influence on the index's direction.

What is a Class P stock : P-Class. This is a no-load class that offers shares with a fee structure that includes a . 25% 12b-1 fee. P-Class shares are onlyavailable for purchase through financial intermediaries.

Why are some stocks in P : Shares are traded in pence on the LSE instead of pounds because of the decimalisation of GBP in 1971. At the time there were very few companies with share prices over the £1 level. So share prices were quoted in pence to offer brokers and investors better pricing.

What does P mean in UK stock market

pence

On the London Stock Exchange, UK stock prices are quoted in pence. You'll see this price when you're trading shares. So, the price of a stock could be quoted as 'GBX 520'. This means the stock costs £5.20. Similarly, if a stock is quoted as costing 'GBX 1,190', it will cost you £11.90 to buy one share. SPY is owned by its investors — the shareholders of the fund. When you buy shares of SPY, you become an owner of the fund and are entitled to a share of the fund's assets and earnings.The SPDR S&P 500 ETF Trust (SPY), also known as SPY, is an exchange-traded fund that tracks the performance of the S&P 500 index. The S&P 500 is a stock market index that measures the performance of 500 large cap publicly traded companies in the United States.

Who is S&P named after : S&P Global (formerly Standard & Poor's), which sponsors a number of other market indexes—and also operates one of the “Big Three” credit rating agencies—traces its roots to an investment information service begun in 1860 by Henry Varnum Poor. In 1941, Poor's original company, Poor's Publishing, merged with Standard…

Antwort What does the P in S&P stand for? Weitere Antworten – What does S&P stand for

Standard & Poor’s

Standard & Poor's (S&P) is a company well known around the world as a creator of financial market indices—widely used as investment benchmarks—a data source, and an issuer of credit ratings for companies and debt obligations.In 1941, Poor's Publishing merged with Standard Statistics Company to form Standard & Poor's. On Monday, March 4, 1957, the index was expanded to its current 500 companies and was renamed the S&P 500 Stock Composite Index.In terms of sector diversification, the S&P Global 100 Index has a broader sector mix than that of the S&P 500. The top 10 holdings span across not just I.T. but also Consumer Discretionary, Energy, Health Care, Consumer Staples, and Financials, as of 30 June 2022.

:max_bytes(150000):strip_icc()/eminioptions-c8a2a64cc63f47fcab749baead93b8c0.jpeg)

What is the full form of the S&P 500 index : What Is the S&P 500 Index The S&P 500 Index, or Standard & Poor's 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.

What is the P in stocks

The P/E for a stock is computed by dividing the price of a stock (the "P") by the company's annual earnings per share (the "E").

What is P in share market : The price-to-earnings (P/E) ratio is the proportion of a company's share price to its earnings per share. A high P/E ratio could mean that a company's stock is overvalued or that investors expect high growth rates.

The SPDR S&P 500 ETF Trust (SPY), also known as SPY, is an exchange-traded fund that tracks the performance of the S&P 500 index. The S&P 500 is a stock market index that measures the performance of 500 large cap publicly traded companies in the United States.

:max_bytes(150000):strip_icc()/dotdash-history-sp-500-dividend-yield-FINAL-328ee74ab3d54ff1a015335a5e8dc788.jpg)

McGraw-Hill, a publishing house, acquired Standard & Poor's Corp., owner of the S&P 500 index, in 1966. Today, the S&P 500 is maintained by S&P Dow Jones Indices—a joint venture owned by S&P Global (previously McGraw Hill Financial), CME Group, and News Corp.

Is spgi better than spy

SPY – Performance Comparison. In the year-to-date period, SPGI achieves a -1.83% return, which is significantly lower than SPY's 9.92% return. Over the past 10 years, SPGI has outperformed SPY with an annualized return of 19.79%, while SPY has yielded a comparatively lower 12.64% annualized return.Basic Info

S&P 500 P/E Ratio is at a current level of 24.79, up from 23.27 last quarter and up from 22.23 one year ago. This is a change of 6.51% from last quarter and 11.53% from one year ago. The S&P 500 PE Ratio is the price to earnings ratio of the constituents of the S&P 500.The price of the S&P 500 index that you see quoted – for example, 4,301.56 – is measured in points, not dollars. That's the weighted average value of all the index's components. As the component stocks move up or down, the index rises or falls according to the calculation.

The S&P 500 is an index that tracks the stock market's performance based on the share price fluctuations of 500 of the largest companies in the United States. It's a weighted index based on market cap, which means more valuable companies have a greater influence on the index's direction.

What is a Class P stock : P-Class. This is a no-load class that offers shares with a fee structure that includes a . 25% 12b-1 fee. P-Class shares are onlyavailable for purchase through financial intermediaries.

Why are some stocks in P : Shares are traded in pence on the LSE instead of pounds because of the decimalisation of GBP in 1971. At the time there were very few companies with share prices over the £1 level. So share prices were quoted in pence to offer brokers and investors better pricing.

What does P mean in UK stock market

pence

On the London Stock Exchange, UK stock prices are quoted in pence. You'll see this price when you're trading shares. So, the price of a stock could be quoted as 'GBX 520'. This means the stock costs £5.20. Similarly, if a stock is quoted as costing 'GBX 1,190', it will cost you £11.90 to buy one share.

SPY is owned by its investors — the shareholders of the fund. When you buy shares of SPY, you become an owner of the fund and are entitled to a share of the fund's assets and earnings.The SPDR S&P 500 ETF Trust (SPY), also known as SPY, is an exchange-traded fund that tracks the performance of the S&P 500 index. The S&P 500 is a stock market index that measures the performance of 500 large cap publicly traded companies in the United States.

Who is S&P named after : S&P Global (formerly Standard & Poor's), which sponsors a number of other market indexes—and also operates one of the “Big Three” credit rating agencies—traces its roots to an investment information service begun in 1860 by Henry Varnum Poor. In 1941, Poor's original company, Poor's Publishing, merged with Standard…