What Is the Meaning of Dow in the Stock Market The Dow Jones Industrial Average, or the Dow for short, is one way of measuring the stock market's overall direction. It includes the prices of 30 of the most actively traded stocks. When the Dow goes up, it is considered bullish, and most stocks usually do well.Key Takeaways. The Dow Jones Industrial Average (DJIA) measures the daily price movements of 30 large American companies on the Nasdaq and the New York Stock Exchange. The components are chosen from all the major sectors of the economy, with the exception of the transportation and utility industries.While most professional investors look at the S&P 500 — a much broader measure of what's happening on Wall Street — everyday Americans look to the Dow. The number of Google searches for “Dow Jones” is always higher than the searches for “S&P 500,” said Nick Colas, co-founder of market research firm DataTrek.

What is the Dow best described as : The Dow Jones Industrial Average is a widely-watched benchmark index in the U.S. for blue-chip stocks. The DJIA is a price-weighted index that tracks 30 large, publicly-owned companies trading on the New York Stock Exchange and the Nasdaq. The DJIA's composition can change over time based on economic trends.

What do the Dow Jones and S&P 500 tell us

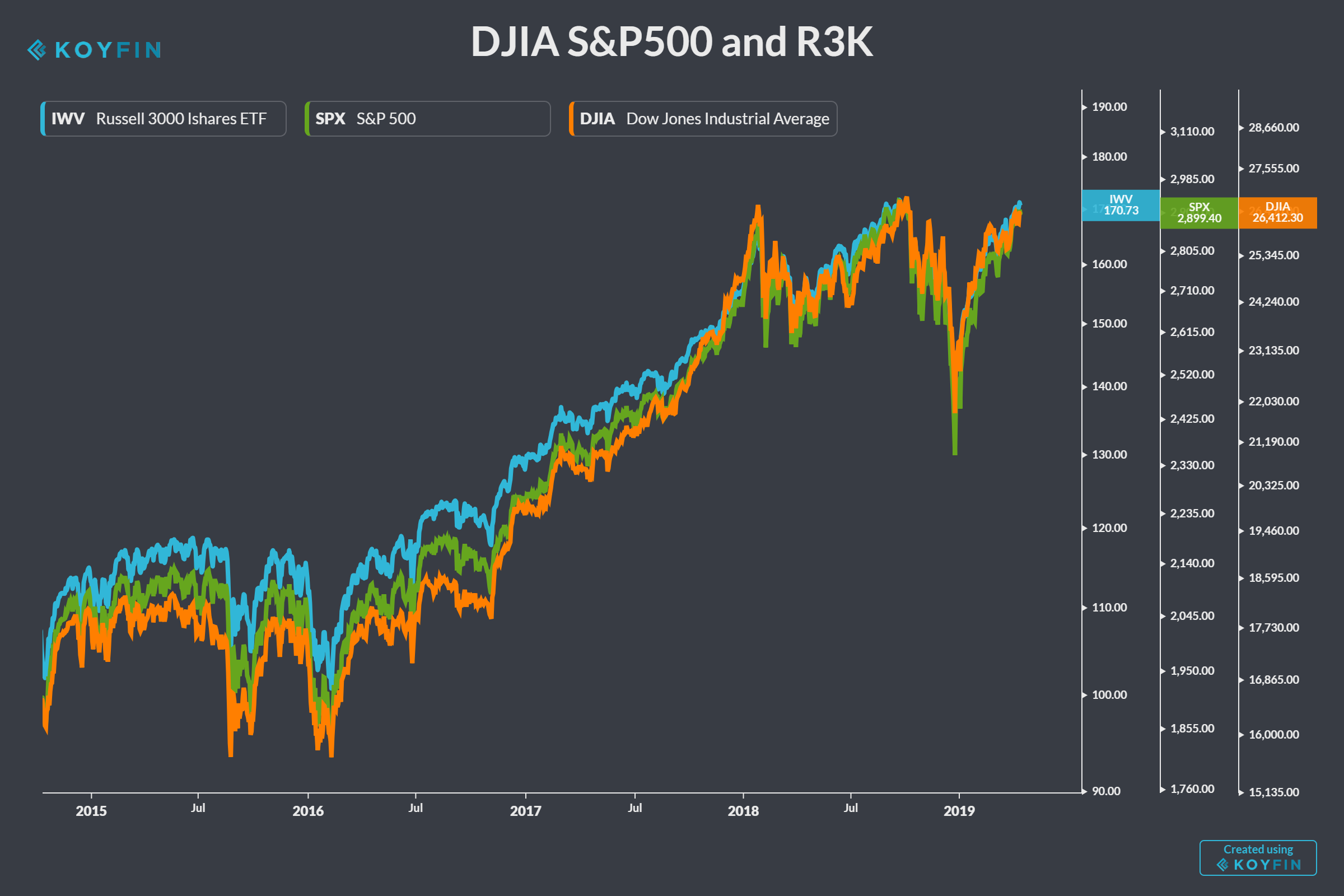

The Dow tracks 30 large U.S. companies but has limited representation. The Nasdaq indexes, associated with the Nasdaq exchange, focus more heavily on tech and other stocks. The S&P 500, with 500 large U.S. companies, offers a more comprehensive market view, weighted by market capitalization.

What does it mean when the Dow goes up : When the Dow gains or loses a point, it reflects changes in the prices of its component stocks. The index is price-weighted, meaning it moves in line with the price changes of its components on a point basis, adjusted by a divisor.

The goal of Dow Theory is to identify the overall direction of the stock market, or the primary trend. By analyzing the movements of the major stock indexes, such as the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA). Dow Chemical Company, American chemical and plastics manufacturer that is one of the world's leading suppliers of chemicals, plastics, synthetic fibres, and agricultural products. Headquarters are in Midland, Michigan. Dow Chemical Company was founded in 1897 by chemist Herbert H.

What’s more important Dow or S&P

While both the DJIA and S&P 500 are used by investors to determine the general trend of the U.S. stock market, the S&P 500 is more encompassing, as it is based on a larger sample of total U.S. stocks.According to this principle, traders and investors must assume a trend to be in place unless clear and compelling evidence of a reversal emerges. The Dow Theory emphasises identifying important indicators and signals to confirm a reversal to aid investors and traders in planning their strategies.Simply put, the Dow Jones is an index that measures the performance of 30 large, publicly-traded companies listed on the stock exchanges in the United States. Dow Futures are financial futures which allow an investor to hedge with or speculate on the future value of various components of the Dow Jones Industrial Average market index. The futures instruments are derived from the Dow Jones Industrial Average as E-mini Dow Futures.

What is the Dow Jones Buffett indicator : The Buffett Indicator-the ratio of the stock market's total value to GDP, which Warren Buffett (BRK. A) (BRK.B) said is "probably the best single measure of where valuations stand at any given moment"-is now higher and more bearish than it was at the January 2022 market top.

What does Dow Theory emphasize : It emphasizes analyzing market trends using the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA). Traders look for confirmation between these two averages to identify buy or sell signals. For example, if both averages reach new highs, it suggests a bullish trend.

What is the primary purpose of Dow Theory

The Dow Theory attempts to identify the primary trend a market is in. It is comprised of three primary trends, each made up of secondary and minor trends. The theory assumes that the market already has knowledge of every possible factor and that prices reflect current information. In addition to representing 30 of the most highly capitalized and influential companies in the U.S. economy, the Dow is also the financial media's most referenced U.S. market index and remains a good indicator of general market trends.The Dow tracks 30 large U.S. companies but has limited representation. The Nasdaq indexes, associated with the Nasdaq exchange, focus more heavily on tech and other stocks. The S&P 500, with 500 large U.S. companies, offers a more comprehensive market view, weighted by market capitalization.

Is Dow safer than S&P : They also tend to have similar, though not identical, levels of volatility. But there are important differences in performance that reflect the differences in their composition and style. The Dow contains far fewer stocks than the S&P 500, and as a result, can exhibit higher risk.

Antwort What does the Dow tell us? Weitere Antworten – What does the Dow Jones indicate

What Is the Meaning of Dow in the Stock Market The Dow Jones Industrial Average, or the Dow for short, is one way of measuring the stock market's overall direction. It includes the prices of 30 of the most actively traded stocks. When the Dow goes up, it is considered bullish, and most stocks usually do well.Key Takeaways. The Dow Jones Industrial Average (DJIA) measures the daily price movements of 30 large American companies on the Nasdaq and the New York Stock Exchange. The components are chosen from all the major sectors of the economy, with the exception of the transportation and utility industries.While most professional investors look at the S&P 500 — a much broader measure of what's happening on Wall Street — everyday Americans look to the Dow. The number of Google searches for “Dow Jones” is always higher than the searches for “S&P 500,” said Nick Colas, co-founder of market research firm DataTrek.

What is the Dow best described as : The Dow Jones Industrial Average is a widely-watched benchmark index in the U.S. for blue-chip stocks. The DJIA is a price-weighted index that tracks 30 large, publicly-owned companies trading on the New York Stock Exchange and the Nasdaq. The DJIA's composition can change over time based on economic trends.

What do the Dow Jones and S&P 500 tell us

The Dow tracks 30 large U.S. companies but has limited representation. The Nasdaq indexes, associated with the Nasdaq exchange, focus more heavily on tech and other stocks. The S&P 500, with 500 large U.S. companies, offers a more comprehensive market view, weighted by market capitalization.

What does it mean when the Dow goes up : When the Dow gains or loses a point, it reflects changes in the prices of its component stocks. The index is price-weighted, meaning it moves in line with the price changes of its components on a point basis, adjusted by a divisor.

The goal of Dow Theory is to identify the overall direction of the stock market, or the primary trend. By analyzing the movements of the major stock indexes, such as the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA).

Dow Chemical Company, American chemical and plastics manufacturer that is one of the world's leading suppliers of chemicals, plastics, synthetic fibres, and agricultural products. Headquarters are in Midland, Michigan. Dow Chemical Company was founded in 1897 by chemist Herbert H.

What’s more important Dow or S&P

While both the DJIA and S&P 500 are used by investors to determine the general trend of the U.S. stock market, the S&P 500 is more encompassing, as it is based on a larger sample of total U.S. stocks.According to this principle, traders and investors must assume a trend to be in place unless clear and compelling evidence of a reversal emerges. The Dow Theory emphasises identifying important indicators and signals to confirm a reversal to aid investors and traders in planning their strategies.Simply put, the Dow Jones is an index that measures the performance of 30 large, publicly-traded companies listed on the stock exchanges in the United States.

Dow Futures are financial futures which allow an investor to hedge with or speculate on the future value of various components of the Dow Jones Industrial Average market index. The futures instruments are derived from the Dow Jones Industrial Average as E-mini Dow Futures.

What is the Dow Jones Buffett indicator : The Buffett Indicator-the ratio of the stock market's total value to GDP, which Warren Buffett (BRK. A) (BRK.B) said is "probably the best single measure of where valuations stand at any given moment"-is now higher and more bearish than it was at the January 2022 market top.

What does Dow Theory emphasize : It emphasizes analyzing market trends using the Dow Jones Industrial Average (DJIA) and the Dow Jones Transportation Average (DJTA). Traders look for confirmation between these two averages to identify buy or sell signals. For example, if both averages reach new highs, it suggests a bullish trend.

What is the primary purpose of Dow Theory

The Dow Theory attempts to identify the primary trend a market is in. It is comprised of three primary trends, each made up of secondary and minor trends. The theory assumes that the market already has knowledge of every possible factor and that prices reflect current information.

In addition to representing 30 of the most highly capitalized and influential companies in the U.S. economy, the Dow is also the financial media's most referenced U.S. market index and remains a good indicator of general market trends.The Dow tracks 30 large U.S. companies but has limited representation. The Nasdaq indexes, associated with the Nasdaq exchange, focus more heavily on tech and other stocks. The S&P 500, with 500 large U.S. companies, offers a more comprehensive market view, weighted by market capitalization.

Is Dow safer than S&P : They also tend to have similar, though not identical, levels of volatility. But there are important differences in performance that reflect the differences in their composition and style. The Dow contains far fewer stocks than the S&P 500, and as a result, can exhibit higher risk.