A mid-50% payout ratio signals positive intent from the company to declare dividend payouts and also retain to grow. Target payout ratios vary by industry. A payout ratio that's slightly less than the industry average is always preferred.30-50%

Generally speaking, a dividend payout ratio of 30-50% is considered healthy, while anything over 50% could be unsustainable.A payout ratio over 100 may indicate that the dividend is in jeopardy, because no company can continue to pay out more than it earns indefinitely.

What is considered a low payout ratio : A range of 35% to 55% is considered healthy and appropriate from a dividend investor's point of view. A company that is likely to distribute roughly half of its earnings as dividends means that the company is well established and a leader in its industry.

What is 80% payout ratio

The dividend payout ratio is one metric that can be used to determine how much a company pays out to its shareholders in relation to the overall earnings it generates. For example, if a company has an EPS (earnings per share) of $1.00 and pays out dividends of $0.80, its dividend payout ratio would be 80%.

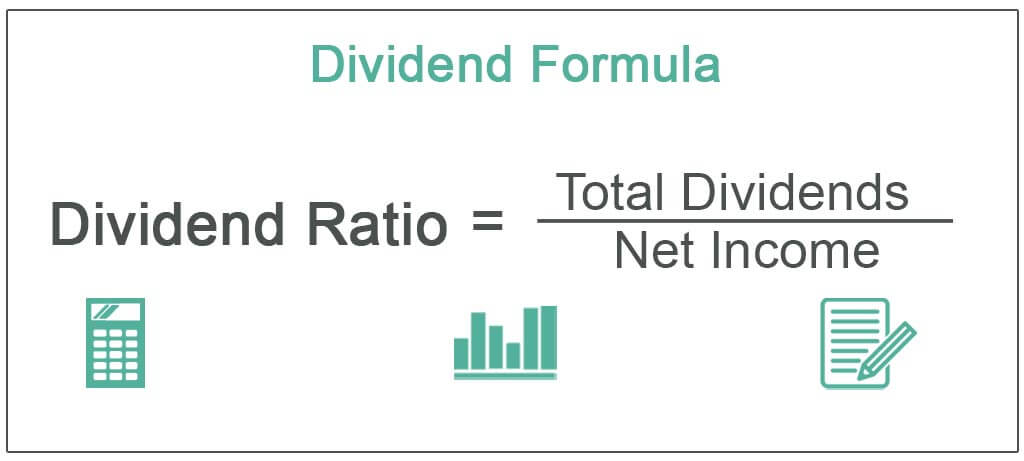

How do you analyze payout ratio : How Is the Payout Ratio Calculated The payout ratio shows the proportion of earnings a company pays its shareholders in the form of dividends, expressed as a percentage of the company's total earnings. The calculation is derived by dividing the total dividends being paid out by the net income generated.

Dividend Data

Welltower Inc.'s ( WELL ) dividend yield is 2.46%, which means that for every $100 invested in the company's stock, investors would receive $2.46 in dividends per year. Welltower Inc.'s payout ratio is 297.25% which means that 297.25% of the company's earnings are paid out as dividends. The maximum payout ratio is the percentage of eligible retained income that an FDIC-supervised institution can pay out in the form of distributions and discretionary bonus payments during the current calendar quarter.

What is a 30 percent dividend payout ratio

If a company's payout ratio is 30%, then it indicates that the company has channeled 30% of the earnings is made to be paid as dividends. Thereby, the remaining 70% of net income the company keeps with itself.Generally speaking, companies with the best long-term records of dividend payments have stable payout ratios over many years. But a payout ratio greater than 100% suggests a company is paying out more in dividends than its earnings can support and might be cause for concern regarding sustainability.Let's imagine a company earns $2.00 per share this year and pays out $0.80 per share. The firm's payout ratio is $0.80 divided by $2.00 or 40%. Many firms adopt what is known as a payout policy, which simply tells shareholders that the firm expects to pay out some constant percentage of their earnings as a dividend. Dividends are a post-tax appropriation and is paid out to shareholders and expressed either in rupee terms or in percentage terms. For example if the face value of the stock is Rs. 10 and the company announces 30% dividend then it means that a dividend of Rs. 3 per share will be paid out to shareholders.

What does 40% dividend mean : Dividend is that portion of profit which is distributed to shareholders. Paid-up capital means the total amount of called up share capital which is actually paid to the company by the members. Dividend is declared on the paid-up form of capital. Thus the company will provide dividend of 40% on paid-up capital.

What is a 40% dividend policy : Answer and Explanation: The dividend payout policy indicates that 40% of annual net income will be distributed to shareholders in terms of dividends. With that being said, 60% of the net income is reinvested in the existing operation to finance its business growth in the future.

What is the meaning of 50 percent dividend

This means that 50% of the company's profits are paid out to shareholders through tips. Another way to think about it is like a company's "sharing plan" or "sharing jar" with its shareholders. The payout ratio tells you what percentage of the company's profits they share with their shareholders as dividends. The dividend yield—displayed as a percentage—is the amount of money a company pays shareholders for owning a share of its stock divided by its current stock price. Mature companies are the most likely to pay dividends. Companies in the utility and consumer staple industries often have relatively higher dividend yields.If a company has one million shares outstanding and declares a 50-cent dividend, then an investor with 100 shares receives $50 and the company pays out a total of $500,000.

What is the 50% dividend exclusion : The criteria for each level of dividend exclusion are as follows: When a corporation owns less than a 20% stake of the other business, it is allowed to deduct 50% of the dividends received from it.

Antwort What does a 50% payout ratio mean? Weitere Antworten – What is a 50 payout ratio

A mid-50% payout ratio signals positive intent from the company to declare dividend payouts and also retain to grow. Target payout ratios vary by industry. A payout ratio that's slightly less than the industry average is always preferred.30-50%

Generally speaking, a dividend payout ratio of 30-50% is considered healthy, while anything over 50% could be unsustainable.A payout ratio over 100 may indicate that the dividend is in jeopardy, because no company can continue to pay out more than it earns indefinitely.

What is considered a low payout ratio : A range of 35% to 55% is considered healthy and appropriate from a dividend investor's point of view. A company that is likely to distribute roughly half of its earnings as dividends means that the company is well established and a leader in its industry.

What is 80% payout ratio

The dividend payout ratio is one metric that can be used to determine how much a company pays out to its shareholders in relation to the overall earnings it generates. For example, if a company has an EPS (earnings per share) of $1.00 and pays out dividends of $0.80, its dividend payout ratio would be 80%.

How do you analyze payout ratio : How Is the Payout Ratio Calculated The payout ratio shows the proportion of earnings a company pays its shareholders in the form of dividends, expressed as a percentage of the company's total earnings. The calculation is derived by dividing the total dividends being paid out by the net income generated.

Dividend Data

Welltower Inc.'s ( WELL ) dividend yield is 2.46%, which means that for every $100 invested in the company's stock, investors would receive $2.46 in dividends per year. Welltower Inc.'s payout ratio is 297.25% which means that 297.25% of the company's earnings are paid out as dividends.

The maximum payout ratio is the percentage of eligible retained income that an FDIC-supervised institution can pay out in the form of distributions and discretionary bonus payments during the current calendar quarter.

What is a 30 percent dividend payout ratio

If a company's payout ratio is 30%, then it indicates that the company has channeled 30% of the earnings is made to be paid as dividends. Thereby, the remaining 70% of net income the company keeps with itself.Generally speaking, companies with the best long-term records of dividend payments have stable payout ratios over many years. But a payout ratio greater than 100% suggests a company is paying out more in dividends than its earnings can support and might be cause for concern regarding sustainability.Let's imagine a company earns $2.00 per share this year and pays out $0.80 per share. The firm's payout ratio is $0.80 divided by $2.00 or 40%. Many firms adopt what is known as a payout policy, which simply tells shareholders that the firm expects to pay out some constant percentage of their earnings as a dividend.

Dividends are a post-tax appropriation and is paid out to shareholders and expressed either in rupee terms or in percentage terms. For example if the face value of the stock is Rs. 10 and the company announces 30% dividend then it means that a dividend of Rs. 3 per share will be paid out to shareholders.

What does 40% dividend mean : Dividend is that portion of profit which is distributed to shareholders. Paid-up capital means the total amount of called up share capital which is actually paid to the company by the members. Dividend is declared on the paid-up form of capital. Thus the company will provide dividend of 40% on paid-up capital.

What is a 40% dividend policy : Answer and Explanation: The dividend payout policy indicates that 40% of annual net income will be distributed to shareholders in terms of dividends. With that being said, 60% of the net income is reinvested in the existing operation to finance its business growth in the future.

What is the meaning of 50 percent dividend

This means that 50% of the company's profits are paid out to shareholders through tips. Another way to think about it is like a company's "sharing plan" or "sharing jar" with its shareholders. The payout ratio tells you what percentage of the company's profits they share with their shareholders as dividends.

:max_bytes(150000):strip_icc()/dti-0c7453b83dae4648a4cf19c5a66fad20.jpg)

The dividend yield—displayed as a percentage—is the amount of money a company pays shareholders for owning a share of its stock divided by its current stock price. Mature companies are the most likely to pay dividends. Companies in the utility and consumer staple industries often have relatively higher dividend yields.If a company has one million shares outstanding and declares a 50-cent dividend, then an investor with 100 shares receives $50 and the company pays out a total of $500,000.

What is the 50% dividend exclusion : The criteria for each level of dividend exclusion are as follows: When a corporation owns less than a 20% stake of the other business, it is allowed to deduct 50% of the dividends received from it.