Key Points. Beating the S&P 500 consistently is no easy task, and most funds fail. One ETF that is focused on growth and value has achieved this feat. This fund also trades at a cheaper valuation than the S&P 500 right now.And there's one ETF that specializes in those stocks. That's the Invesco S&P 500 GARP ETF (NYSEMKT: SPGP), which has beaten the S&P 500 in seven of the last 10 years and has steadily outperformed it over the last decade, as you can see from the chart below.In theory, if you invest only in the top performers in the S&P 500, you will beat the S&P 500. The problem is, the list of top performers changes all the time, so you would really need to stay on top of that. Or, invest in growing companies that are not part of the index. Sounds easy, but in reality, it is very hard.

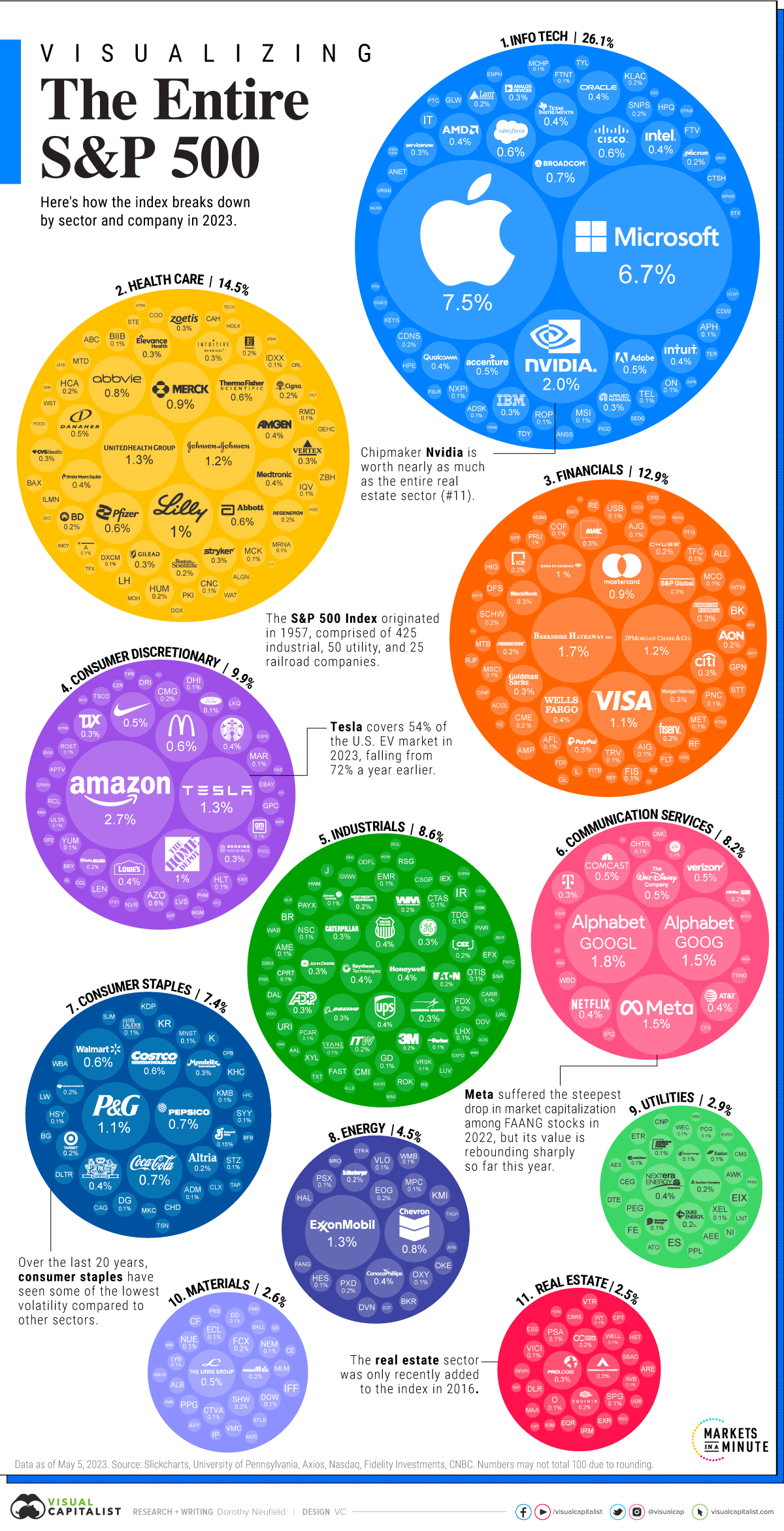

Why would investors compare their performance to the S&P 500 : The key advantage of using the S&P 500 as a benchmark is the wide market breadth of the large-cap companies included in the index. The index can provide a broad view of the economic health of the U.S. because it covers so many companies in so many different sectors.

Can S&P 500 go to zero

Can an S&P 500 index fund investor lose all their money Anything is possible, of course, but it's highly unlikely. For an S&P 500 investor to lose all of their money, every stock in the 500 company index would have to crash to zero.

Is there anything better than SP500 : Key Points. The S&P 500's track record is impressive, but the Vanguard Growth ETF has outperformed it. The Vanguard Growth ETF leans heavily toward tech businesses that exhibit faster revenue and earnings gains. No matter what investments you choose, it's always smart to keep a long-term mindset.

The S&P 500's track record is impressive, but the Vanguard Growth ETF has outperformed it. The Vanguard Growth ETF leans heavily toward tech businesses that exhibit faster revenue and earnings gains. No matter what investments you choose, it's always smart to keep a long-term mindset. Invesco S&P 500 Quality ETF (NYSEARCA:SPHQ) stands out as one of the best ETFs to beat the S&P 500 over the next decade.

Can S&P 500 reach $5,000

S&P 500 reaches 5,000 for first time. Here's what it means for the market.Key Points. Less than 10% of active large-cap fund managers have outperformed the S&P 500 over the last 15 years. The biggest drag on investment returns is unavoidable, but you can minimize it if you're smart. Here's what to look for when choosing a simple investment that can beat the Wall Street pros.Key Points. Less than 10% of active large-cap fund managers have outperformed the S&P 500 over the last 15 years. The biggest drag on investment returns is unavoidable, but you can minimize it if you're smart. Here's what to look for when choosing a simple investment that can beat the Wall Street pros. The Barriers

Investment fees are one major barrier to beating the market. If you take the popular advice to invest in an S&P 500 index fund rather than on individual stocks, your fund's performance should be identical to the performance of the S&P 500, for better or worse.

How much will S&P be worth in 10 years : Stock market forecast for the next decade

Year

Price

2027

6200

2028

6725

2029

7300

2030

8900

Is S and P 500 good investment : Over time, the S&P 500 has delivered strong returns to investors. Those who remained invested enjoyed the benefits of compounding, or the process of earning returns on the returns you've already accumulated. “Since 1970, it has delivered an average 11% return per year, including dividends,” said Reynolds.

Who has beaten the S&P 500

That makes outperforming the S&P 500 on a consistent basis no small task. The one fund that has beaten the index in nine of the past 10 years is the Technology Select Sector SPDR Fund (NYSEMKT: XLK). The best performing Sector in the last 10 years is Information Technology, that granded a +19.94% annualized return. The worst is Energy, with a +4.01% annualized return in the last 10 years. The main S&P 500 Sectors can be easily replicated by ETFs.Choosing your investments

Investing in an S&P 500 fund can instantly diversify your portfolio and is generally considered less risky. S&P 500 index funds or ETFs will track the performance of the S&P 500, which means when the S&P 500 does well, your investment will, too. (The opposite is also true, of course.)

Will S&P 500 hit $10,000 : The S&P 500 could approach or exceed the 10,000 level by the early to mid-2030s. Many investors take it as a given that—since returns on the S&P 500 have been strong for 10-plus years—stocks are expensive and over-owned.

Antwort What can beat S&P 500? Weitere Antworten – Is it possible to beat the S&P 500

Key Points. Beating the S&P 500 consistently is no easy task, and most funds fail. One ETF that is focused on growth and value has achieved this feat. This fund also trades at a cheaper valuation than the S&P 500 right now.And there's one ETF that specializes in those stocks. That's the Invesco S&P 500 GARP ETF (NYSEMKT: SPGP), which has beaten the S&P 500 in seven of the last 10 years and has steadily outperformed it over the last decade, as you can see from the chart below.In theory, if you invest only in the top performers in the S&P 500, you will beat the S&P 500. The problem is, the list of top performers changes all the time, so you would really need to stay on top of that. Or, invest in growing companies that are not part of the index. Sounds easy, but in reality, it is very hard.

Why would investors compare their performance to the S&P 500 : The key advantage of using the S&P 500 as a benchmark is the wide market breadth of the large-cap companies included in the index. The index can provide a broad view of the economic health of the U.S. because it covers so many companies in so many different sectors.

Can S&P 500 go to zero

Can an S&P 500 index fund investor lose all their money Anything is possible, of course, but it's highly unlikely. For an S&P 500 investor to lose all of their money, every stock in the 500 company index would have to crash to zero.

Is there anything better than SP500 : Key Points. The S&P 500's track record is impressive, but the Vanguard Growth ETF has outperformed it. The Vanguard Growth ETF leans heavily toward tech businesses that exhibit faster revenue and earnings gains. No matter what investments you choose, it's always smart to keep a long-term mindset.

The S&P 500's track record is impressive, but the Vanguard Growth ETF has outperformed it. The Vanguard Growth ETF leans heavily toward tech businesses that exhibit faster revenue and earnings gains. No matter what investments you choose, it's always smart to keep a long-term mindset.

Invesco S&P 500 Quality ETF (NYSEARCA:SPHQ) stands out as one of the best ETFs to beat the S&P 500 over the next decade.

Can S&P 500 reach $5,000

S&P 500 reaches 5,000 for first time. Here's what it means for the market.Key Points. Less than 10% of active large-cap fund managers have outperformed the S&P 500 over the last 15 years. The biggest drag on investment returns is unavoidable, but you can minimize it if you're smart. Here's what to look for when choosing a simple investment that can beat the Wall Street pros.Key Points. Less than 10% of active large-cap fund managers have outperformed the S&P 500 over the last 15 years. The biggest drag on investment returns is unavoidable, but you can minimize it if you're smart. Here's what to look for when choosing a simple investment that can beat the Wall Street pros.

The Barriers

Investment fees are one major barrier to beating the market. If you take the popular advice to invest in an S&P 500 index fund rather than on individual stocks, your fund's performance should be identical to the performance of the S&P 500, for better or worse.

How much will S&P be worth in 10 years : Stock market forecast for the next decade

Is S and P 500 good investment : Over time, the S&P 500 has delivered strong returns to investors. Those who remained invested enjoyed the benefits of compounding, or the process of earning returns on the returns you've already accumulated. “Since 1970, it has delivered an average 11% return per year, including dividends,” said Reynolds.

Who has beaten the S&P 500

That makes outperforming the S&P 500 on a consistent basis no small task. The one fund that has beaten the index in nine of the past 10 years is the Technology Select Sector SPDR Fund (NYSEMKT: XLK).

The best performing Sector in the last 10 years is Information Technology, that granded a +19.94% annualized return. The worst is Energy, with a +4.01% annualized return in the last 10 years. The main S&P 500 Sectors can be easily replicated by ETFs.Choosing your investments

Investing in an S&P 500 fund can instantly diversify your portfolio and is generally considered less risky. S&P 500 index funds or ETFs will track the performance of the S&P 500, which means when the S&P 500 does well, your investment will, too. (The opposite is also true, of course.)

Will S&P 500 hit $10,000 : The S&P 500 could approach or exceed the 10,000 level by the early to mid-2030s. Many investors take it as a given that—since returns on the S&P 500 have been strong for 10-plus years—stocks are expensive and over-owned.