Capital One 360 Checking: Best online checking account.

Chase Total Checking®: Best for a large branch network.

Axos Bank Rewards Checking: Best for online account options.

Discover® Bank: Best for doing all of your banking at one place.

Synchrony Bank: Best high-yield savings account.

How Many Banks are There in the U.S. In December 2022, the FDIC listed 4,715 banks in total in the United States. That's more than 250 fewer than 2021 (4,983 banks). The average asset size across the top 250 banks listed is approximately $83 billion.JPMorgan Chase, the financial institution that owns Chase Bank, topped our experts' list because it's designated as the world's most systemically important bank on the 2023 G-SIB list. This designation means it has the highest loss absorbency requirements of any bank, providing more protection against financial crisis.

Which is the No. 1 bank of the USA : Chase Bank Biggest Banks in the U.S.

Rank by Asset Size

Bank Name

Customer Count

1.

Chase Bank

80 million

2.

Bank of America

68 million

3.

Wells Fargo

70 million

4.

Citibank

200 million accounts globally

What banks are most at risk

Which Bank Stocks Are Most at Risk of a Liquidity Crisis

Zions Bancorp NA. (ZION)

Signature Bank. (SBNY)

Huntington Bancshares Inc. (HBAN)

SVB Financial Group. (SIVBQ)

First Republic Bank. (FRCB)

Which is the No 1 bank of USA : Chase Bank Biggest Banks in the U.S.

Rank by Asset Size

Bank Name

Customer Count

1.

Chase Bank

80 million

2.

Bank of America

68 million

3.

Wells Fargo

70 million

4.

Citibank

200 million accounts globally

Which of the Big Four is the best bank for saving

Rank

Big Four Bank

Household deposits (billion)

1

CBA

$388.466

2

Westpac

$301.516

3

NAB

$201.982

4

ANZ

$171.563

22. 4. 2024 Republic First Bank reported unrealized securities losses in excess of its equity as early as June 2022. State regulators closed Republic First Bank in April 2024, marking the first bank failure of the year.

What are the top 3 banks in America

Summary of the Largest Banks in the U.S.

Ranking

Bank

Total Assets

1

JPMorgan Chase

$3.3 trillion

2

Bank of America

$2.4 trillion

3

Wells Fargo

$1.7 trillion

4

Citibank

$1.6 trillion

The top five banks in America are JPMorgan Chase, Bank of America, Citibank, Wells Fargo and U.S. Bank. These are the largest U.S. banks by assets and among the largest in the world.The Big Six refers to the major banks of Canada. The list includes the TD, Royal Bank, the Bank of Montreal, Scotiabank, CIBC, and the National Bank. A Schedule II bank is a subsidiary of a foreign bank that is authorized to accept deposits within Canada and is regulated by the federal Bank Act. Consulting firm Klaros Group analyzed about 4,000 U.S. banks and found 282 banks face the dual threat of commercial real estate loans and potential losses tied to higher interest rates. The majority of those banks are smaller lenders with less than $10 billion in assets.

What are the 5c banks : Learn what they are so you can improve your eligibility when you present yourself to lenders.

Capacity. To evaluate capacity, or your ability to repay a loan, lenders look at revenue, expenses, cash flow and repayment timing in your business plan.

Capital.

Collateral.

Conditions.

Character.

Which banks are collapsing in 2024 : The news: Last Friday, Pennsylvania financial regulators seized and shut down Philadelphia-based Republic First Bank in the first FDIC-insured bank failure of 2024.

What is 4c in banking

Standards may differ from lender to lender, but there are four core components — the four C's — that lenders will evaluate in determining whether they will make a loan: capacity, capital, collateral and credit. New Zealand Bank Codes

Bank Name

Bank Code

Branch Range

TSB Bank

15

1501 – 1599

Westpac Bank

03

0301 – 0399

The Co-operative Bank

11

1101 – 1199

SBS Bank

03

0311 – 0315

The lender will typically follow what is called the Five Cs of Credit: Character, Capacity, Capital, Collateral and Conditions. Examining each of these things helps the lender determine the level of risk associated with providing the borrower with the requested funds.

Antwort What are the top 10 banks in the US? Weitere Antworten – What is the best bank in the US

Best Banks of May 2024

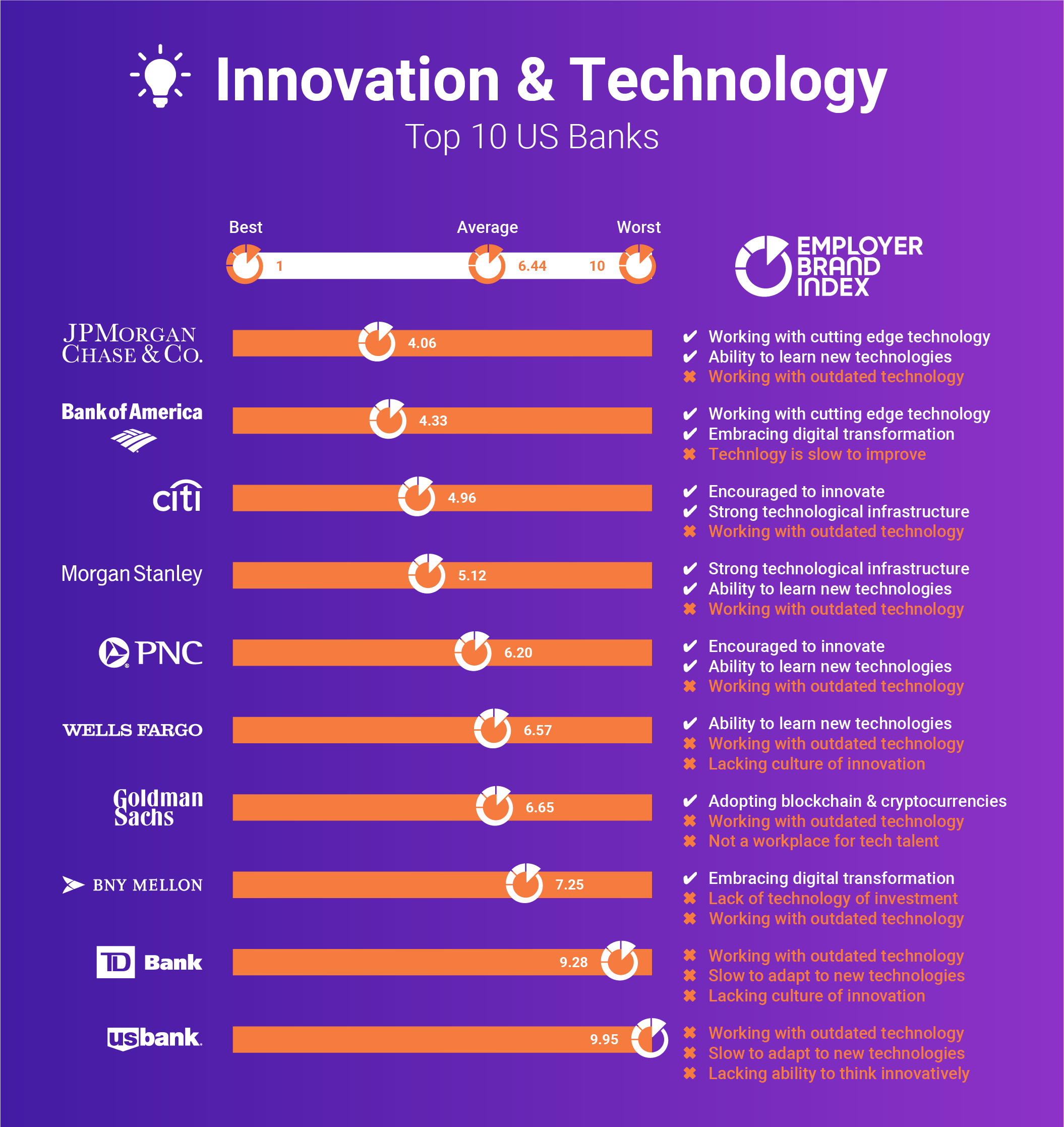

How Many Banks are There in the U.S. In December 2022, the FDIC listed 4,715 banks in total in the United States. That's more than 250 fewer than 2021 (4,983 banks). The average asset size across the top 250 banks listed is approximately $83 billion.JPMorgan Chase, the financial institution that owns Chase Bank, topped our experts' list because it's designated as the world's most systemically important bank on the 2023 G-SIB list. This designation means it has the highest loss absorbency requirements of any bank, providing more protection against financial crisis.

Which is the No. 1 bank of the USA : Chase Bank

Biggest Banks in the U.S.

What banks are most at risk

Which Bank Stocks Are Most at Risk of a Liquidity Crisis

Which is the No 1 bank of USA : Chase Bank

Biggest Banks in the U.S.

Which of the Big Four is the best bank for saving

22. 4. 2024

Republic First Bank reported unrealized securities losses in excess of its equity as early as June 2022. State regulators closed Republic First Bank in April 2024, marking the first bank failure of the year.

What are the top 3 banks in America

Summary of the Largest Banks in the U.S.

The top five banks in America are JPMorgan Chase, Bank of America, Citibank, Wells Fargo and U.S. Bank. These are the largest U.S. banks by assets and among the largest in the world.The Big Six refers to the major banks of Canada. The list includes the TD, Royal Bank, the Bank of Montreal, Scotiabank, CIBC, and the National Bank. A Schedule II bank is a subsidiary of a foreign bank that is authorized to accept deposits within Canada and is regulated by the federal Bank Act.

Consulting firm Klaros Group analyzed about 4,000 U.S. banks and found 282 banks face the dual threat of commercial real estate loans and potential losses tied to higher interest rates. The majority of those banks are smaller lenders with less than $10 billion in assets.

What are the 5c banks : Learn what they are so you can improve your eligibility when you present yourself to lenders.

Which banks are collapsing in 2024 : The news: Last Friday, Pennsylvania financial regulators seized and shut down Philadelphia-based Republic First Bank in the first FDIC-insured bank failure of 2024.

What is 4c in banking

Standards may differ from lender to lender, but there are four core components — the four C's — that lenders will evaluate in determining whether they will make a loan: capacity, capital, collateral and credit.

New Zealand Bank Codes

The lender will typically follow what is called the Five Cs of Credit: Character, Capacity, Capital, Collateral and Conditions. Examining each of these things helps the lender determine the level of risk associated with providing the borrower with the requested funds.

What bank is 12 : ASB Bank

New Zealand Bank Codes