If you want to capture gains of a broad swath of the market, then the S&P 500 is your best bet. However, if you are interested in a safe strategy that mirrors price movements of well-established blue-chip stocks, then the Dow is a good choice.Meta Platforms Inc. lost $232 billion in one day, making it the largest single-day loss in stock market history.The Bottom Line. The Dow posted its all-time high during intraday trading on May 16, 2024, reaching a peak of 40,051.05 points. The highest close occurred the day before when the index closed at 39,908.00 points. The peak was led in part by optimism that the Federal Reserve could cut interest rates later this year.

What is the difference between the Dow Jones and the Nasdaq : The Dow tracks 30 large U.S. companies but has limited representation. The Nasdaq indexes, associated with the Nasdaq exchange, focus more heavily on tech and other stocks. The S&P 500, with 500 large U.S. companies, offers a more comprehensive market view, weighted by market capitalization.

Why is the Dow Jones more popular than the S&P

In these circumstances, one contributing factor is that historically The Dow has been somewhat more value-oriented, tracking well-established large-cap companies whose prices can tend to be less volatile. The S&P 500, while more diversified than The Dow, is sometimes more volatile.

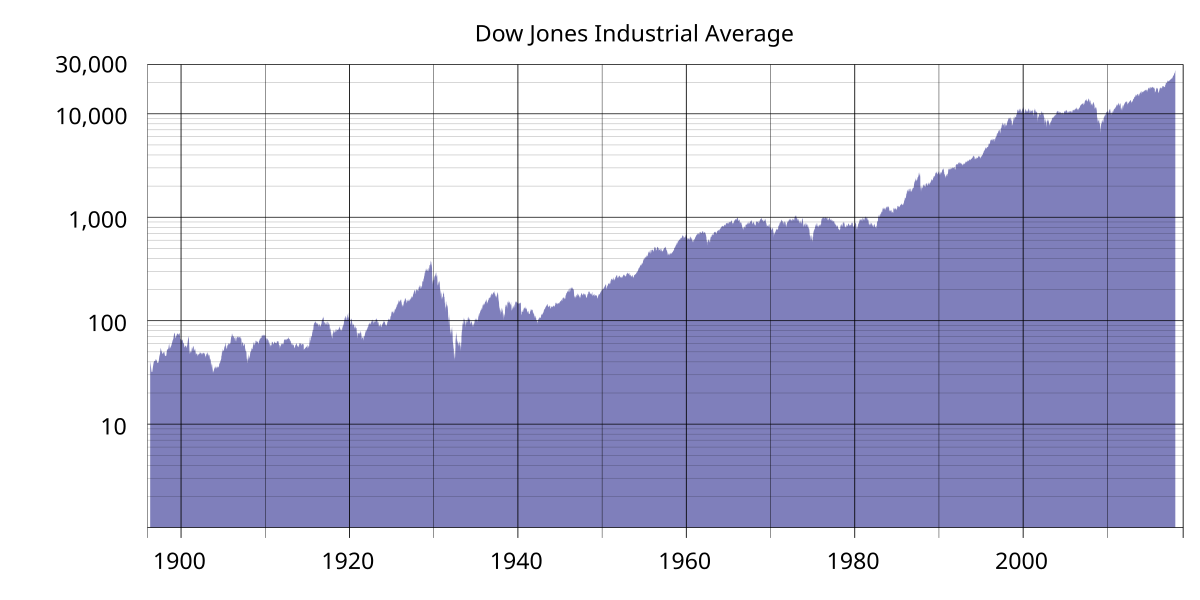

Is the DJIA a good investment : In general, the benefits of investing in the Dow Jones Industrial Average outweigh the disadvantages. Consistent long-term returns: the Dow Jones has a long history of strong performance, with an average annual return of around 10% since its inception in 1896.

One of the biggest reasons traders lose money is a lack of knowledge and education. Many people are drawn to trading because they believe it's a way to make quick money without investing much time or effort. However, this is a dangerous misconception that often leads to losses. Another reason why day traders tend to lose money is that it's very different from long-term investing. While traders take advantage of price swings (which means they have to make specific predictions), investors tend to buy a diversified basket of assets for the long haul.

Did the Dow ever hit $40,000

The Dow Jones Industrial Average closed above the 40,000 mark Friday for the first time in its 139-year history. The blue-chip index initially crossed the key threshold early Thursday but ended that day lower.This achievement comes just over three years after the Dow first closed above 30,000 in November 2020 and less than three months after it surpassed 39,000 in February 2024.What exchange does Apple stock trade on Apple stock is traded on the NASDAQ Global Select Market under the ticker symbol AAPL. The Dow contains far fewer stocks than the S&P 500, and as a result, can exhibit higher risk.

Why might an investor prefer the S&P 500 over the DJIA Chegg : Because the S&P 5 0 0 has a greater number of companies and covers a wider range of industries, providing a more diverse and representative sample of the market.

What was the largest percentage loss Dow Jones : The statistic shows the worst days of the Dow Jones Industrial Average index from 1897 to 2023. The worst day in the history of the index was October 19 1987, when the index value decreased by 22.61 percent.

What are the disadvantages of the DJIA

Limitations of the DJIA

Many critics argue that the Dow does not significantly represent the state of the U.S. economy as it consists of only 30 large-cap U.S. companies. They believe the number of companies is too small and it neglects companies of different sizes. Some argue that the DJIA is not an accurate representation of the overall market performance due to its narrow focus on just 30 large, blue-chip companies. Critics also claim that the DJIA is not a true reflection of the economy, as it does not account for inflation or changes in the US population.The most common reason for failure in trading is the lack of discipline. Most traders trade without a proper strategic approach to the market. Successful trading depends on three practices.

Do 90% of people lose money in the stock market : About 90% of investors lose money trading stocks. That's 9 out of every 10 people — both newbies and seasoned professionals — losing their hard earned dollars by trying to outsmart an unpredictable and extremely volatile machine.

Antwort What are the flaws of the Dow Jones? Weitere Antworten – Should I invest in Dow Jones or S&P 500

If you want to capture gains of a broad swath of the market, then the S&P 500 is your best bet. However, if you are interested in a safe strategy that mirrors price movements of well-established blue-chip stocks, then the Dow is a good choice.Meta Platforms Inc. lost $232 billion in one day, making it the largest single-day loss in stock market history.The Bottom Line. The Dow posted its all-time high during intraday trading on May 16, 2024, reaching a peak of 40,051.05 points. The highest close occurred the day before when the index closed at 39,908.00 points. The peak was led in part by optimism that the Federal Reserve could cut interest rates later this year.

What is the difference between the Dow Jones and the Nasdaq : The Dow tracks 30 large U.S. companies but has limited representation. The Nasdaq indexes, associated with the Nasdaq exchange, focus more heavily on tech and other stocks. The S&P 500, with 500 large U.S. companies, offers a more comprehensive market view, weighted by market capitalization.

Why is the Dow Jones more popular than the S&P

In these circumstances, one contributing factor is that historically The Dow has been somewhat more value-oriented, tracking well-established large-cap companies whose prices can tend to be less volatile. The S&P 500, while more diversified than The Dow, is sometimes more volatile.

Is the DJIA a good investment : In general, the benefits of investing in the Dow Jones Industrial Average outweigh the disadvantages. Consistent long-term returns: the Dow Jones has a long history of strong performance, with an average annual return of around 10% since its inception in 1896.

One of the biggest reasons traders lose money is a lack of knowledge and education. Many people are drawn to trading because they believe it's a way to make quick money without investing much time or effort. However, this is a dangerous misconception that often leads to losses.

Another reason why day traders tend to lose money is that it's very different from long-term investing. While traders take advantage of price swings (which means they have to make specific predictions), investors tend to buy a diversified basket of assets for the long haul.

Did the Dow ever hit $40,000

The Dow Jones Industrial Average closed above the 40,000 mark Friday for the first time in its 139-year history. The blue-chip index initially crossed the key threshold early Thursday but ended that day lower.This achievement comes just over three years after the Dow first closed above 30,000 in November 2020 and less than three months after it surpassed 39,000 in February 2024.What exchange does Apple stock trade on Apple stock is traded on the NASDAQ Global Select Market under the ticker symbol AAPL.

The Dow contains far fewer stocks than the S&P 500, and as a result, can exhibit higher risk.

Why might an investor prefer the S&P 500 over the DJIA Chegg : Because the S&P 5 0 0 has a greater number of companies and covers a wider range of industries, providing a more diverse and representative sample of the market.

What was the largest percentage loss Dow Jones : The statistic shows the worst days of the Dow Jones Industrial Average index from 1897 to 2023. The worst day in the history of the index was October 19 1987, when the index value decreased by 22.61 percent.

What are the disadvantages of the DJIA

Limitations of the DJIA

Many critics argue that the Dow does not significantly represent the state of the U.S. economy as it consists of only 30 large-cap U.S. companies. They believe the number of companies is too small and it neglects companies of different sizes.

Some argue that the DJIA is not an accurate representation of the overall market performance due to its narrow focus on just 30 large, blue-chip companies. Critics also claim that the DJIA is not a true reflection of the economy, as it does not account for inflation or changes in the US population.The most common reason for failure in trading is the lack of discipline. Most traders trade without a proper strategic approach to the market. Successful trading depends on three practices.

Do 90% of people lose money in the stock market : About 90% of investors lose money trading stocks. That's 9 out of every 10 people — both newbies and seasoned professionals — losing their hard earned dollars by trying to outsmart an unpredictable and extremely volatile machine.