The Dow®, S&P 500®, and Nasdaq are examples of stock market indices. A stock market index measures the performance of a collection of stocks.The S&P is a float-weighted index, meaning the market capitalizations of the companies in the index are adjusted by the number of shares available for public trading. Because of its depth and diversity, the S&P 500 is widely considered one of the best gauges of large U.S. stocks, and even the entire equities market.The S&P 500 is a stock market index that is viewed as a measure of how well the stock market is performing overall. It includes around 500 of the largest U.S. companies.

What is the S&P 500 an example of equity index : Equity Index refers to a stock market index that tracks the performance of a selected group of stocks, such as the S&P 500, Nasdaq, or Dow Jones Industrial Average.

What are the Dow and the S&P 500 Quizlet

The Standard & Poor's 500, often abbreviated as the S&P 500 is an American stock market index based on the market capitalizations of 500 large companies having common stock listed on the NYSE or NASDAQ. Dow Jones Industrial Average.

What type of fund follows the S and P 500 the Nasdaq or the Dow : Index funds by definition aim to mirror a particular market index, whether that is the Dow Jones Industrial Average, the Nasdaq Composite Index or the S&P 500.

The Dow tracks 30 large U.S. companies but has limited representation. The Nasdaq indexes, associated with the Nasdaq exchange, focus more heavily on tech and other stocks. The S&P 500, with 500 large U.S. companies, offers a more comprehensive market view, weighted by market capitalization.

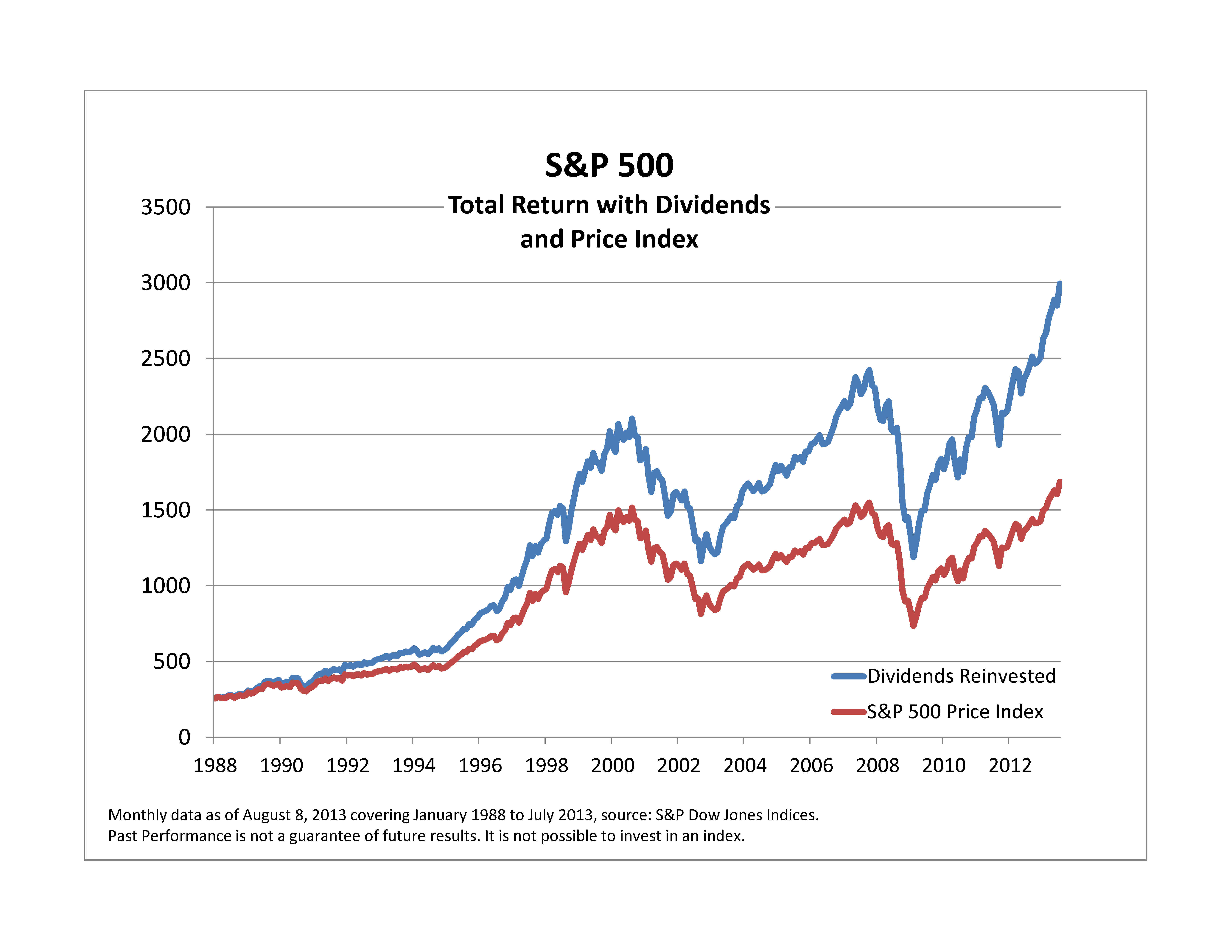

Since its inception in 1957, the index has seen an annualized average return of about 10%. The S&P is seen as an accurate representation of the U.S. economy; periods of economic growth and recessions are reflected in the index fund throughout history.

What are the Dow Jones and the S&P 500 example of and why are they important

The Dow Jones Industrial Average (The Dow or DJIA) and the S&P 500 are quintessential market benchmarks. Both underlie a number of investment products, are published by S&P Dow Jones Indices, and track the stocks of large U.S. companies.Key Takeaways

The DJIA tracks the stock prices of 30 of the biggest American companies. The S&P 500 tracks 500 large-cap American stocks. Both offer a big-picture view of the state of the stock markets in general.The Dow Jones Industrial Average

Also known as “the Dow,” this index tracks the prices of 30, large-company, U.S. stocks. Business reporters use the Dow to offer a quick, general indicator of overall market conditions.

Key Takeaways

The DJIA tracks the stock prices of 30 of the biggest American companies. The S&P 500 tracks 500 large-cap American stocks. Both offer a big-picture view of the state of the stock markets in general.

Are companies in the Dow also in the S&P 500 : The S&P 500 is a stock market index maintained by S&P Dow Jones Indices. It comprises 503 common stocks which are issued by 500 large-cap companies traded on American stock exchanges (including the 30 companies that compose the Dow Jones Industrial Average).

What is the Dow vs Nasdaq vs S&P : The Dow, for example, has higher weightings in financials, healthcare, consumer discretionary, and industrials than the S&P 500 and Nasdaq Composite, but lower weightings in high-growth sectors like tech and communications (with the latter including Alphabet, Meta Platforms, Netflix, and other growth stocks).

What are the S&P 500 companies

S&P 500 ETF Components

#

Company

Portfolio%

1

Microsoft Corp

7.00%

2

Apple Inc.

6.18%

3

Nvidia Corp

5.12%

4

Amazon.com Inc

3.79%

DOW JONES STOCKS

Name

Latest Price Previous Close

1 Year +/- %

Microsoft

420.21 420.21

111.34 35.72%

Nike

92.18 92.18

-24.81 -21.30%

Procter & Gamble

167.64 167.64

10.77 6.92%

Salesforce

285.61 285.61

82.98 40.57%

The Dow Jones Industrial Average (DJIA), also commonly referred to as “the Dow Jones” or simply “the Dow,” is one of the most popular and widely recognized stock market indices. It measures the daily stock market movements of 30 U.S. publicly-traded companies listed on the NASDAQ or the New York Stock Exchange (NYSE).

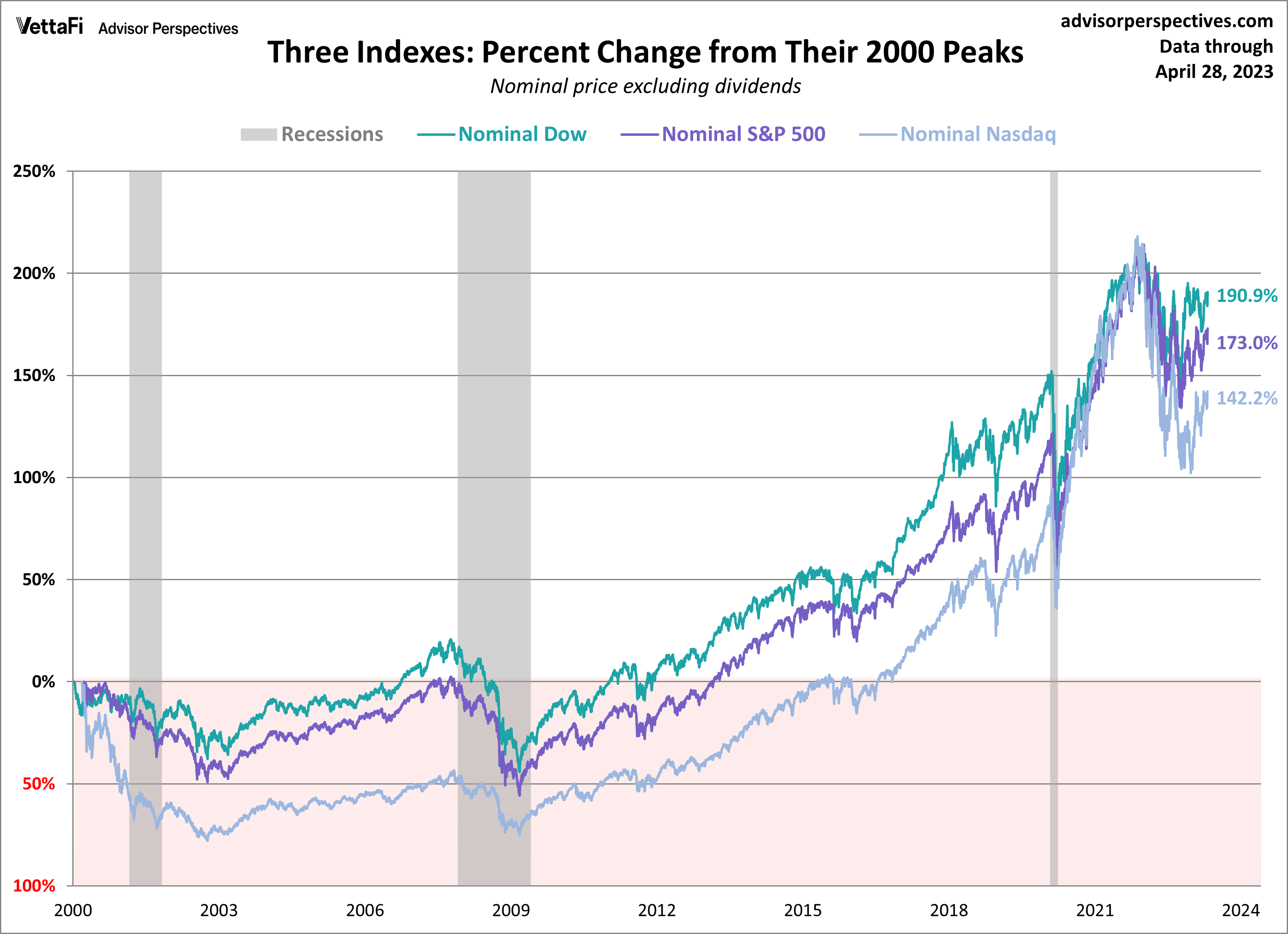

Is the Dow or S&P better : HOW DIFFERENT ARE THE DOW AND THE S&P 500 Their performances have historically tracked relatively closely with each other, but the S&P 500 has been better recently. Its 27.5% rise for the last 12 months easily tops the 19.7% gain for the Dow.

Antwort What are the Dow and the S&P 500 examples of? Weitere Antworten – What are the Dow and the S&P 500 examples of

stock market indices

The Dow®, S&P 500®, and Nasdaq are examples of stock market indices. A stock market index measures the performance of a collection of stocks.The S&P is a float-weighted index, meaning the market capitalizations of the companies in the index are adjusted by the number of shares available for public trading. Because of its depth and diversity, the S&P 500 is widely considered one of the best gauges of large U.S. stocks, and even the entire equities market.The S&P 500 is a stock market index that is viewed as a measure of how well the stock market is performing overall. It includes around 500 of the largest U.S. companies.

What is the S&P 500 an example of equity index : Equity Index refers to a stock market index that tracks the performance of a selected group of stocks, such as the S&P 500, Nasdaq, or Dow Jones Industrial Average.

What are the Dow and the S&P 500 Quizlet

The Standard & Poor's 500, often abbreviated as the S&P 500 is an American stock market index based on the market capitalizations of 500 large companies having common stock listed on the NYSE or NASDAQ. Dow Jones Industrial Average.

What type of fund follows the S and P 500 the Nasdaq or the Dow : Index funds by definition aim to mirror a particular market index, whether that is the Dow Jones Industrial Average, the Nasdaq Composite Index or the S&P 500.

The Dow tracks 30 large U.S. companies but has limited representation. The Nasdaq indexes, associated with the Nasdaq exchange, focus more heavily on tech and other stocks. The S&P 500, with 500 large U.S. companies, offers a more comprehensive market view, weighted by market capitalization.

Since its inception in 1957, the index has seen an annualized average return of about 10%. The S&P is seen as an accurate representation of the U.S. economy; periods of economic growth and recessions are reflected in the index fund throughout history.

What are the Dow Jones and the S&P 500 example of and why are they important

The Dow Jones Industrial Average (The Dow or DJIA) and the S&P 500 are quintessential market benchmarks. Both underlie a number of investment products, are published by S&P Dow Jones Indices, and track the stocks of large U.S. companies.Key Takeaways

The DJIA tracks the stock prices of 30 of the biggest American companies. The S&P 500 tracks 500 large-cap American stocks. Both offer a big-picture view of the state of the stock markets in general.The Dow Jones Industrial Average

Also known as “the Dow,” this index tracks the prices of 30, large-company, U.S. stocks. Business reporters use the Dow to offer a quick, general indicator of overall market conditions.

Key Takeaways

The DJIA tracks the stock prices of 30 of the biggest American companies. The S&P 500 tracks 500 large-cap American stocks. Both offer a big-picture view of the state of the stock markets in general.

Are companies in the Dow also in the S&P 500 : The S&P 500 is a stock market index maintained by S&P Dow Jones Indices. It comprises 503 common stocks which are issued by 500 large-cap companies traded on American stock exchanges (including the 30 companies that compose the Dow Jones Industrial Average).

What is the Dow vs Nasdaq vs S&P : The Dow, for example, has higher weightings in financials, healthcare, consumer discretionary, and industrials than the S&P 500 and Nasdaq Composite, but lower weightings in high-growth sectors like tech and communications (with the latter including Alphabet, Meta Platforms, Netflix, and other growth stocks).

What are the S&P 500 companies

S&P 500 ETF Components

DOW JONES STOCKS

The Dow Jones Industrial Average (DJIA), also commonly referred to as “the Dow Jones” or simply “the Dow,” is one of the most popular and widely recognized stock market indices. It measures the daily stock market movements of 30 U.S. publicly-traded companies listed on the NASDAQ or the New York Stock Exchange (NYSE).

Is the Dow or S&P better : HOW DIFFERENT ARE THE DOW AND THE S&P 500 Their performances have historically tracked relatively closely with each other, but the S&P 500 has been better recently. Its 27.5% rise for the last 12 months easily tops the 19.7% gain for the Dow.