In its most basic sense, accounting describes the process of tracking an individual or company's monetary transactions. Accountants record and analyze these transactions to generate an overall picture of their employer's financial health.

Personal Accounts. Ledger accounts that contain transactions related to individuals or other organizations with whom your business has direct transactions are known as personal accounts.

Real Accounts.

Nominal Accounts.

Recording Financial Transactions

One of the main objectives of accounting is maintaining systematic and chronological records of financial transactions. Accounting ensures that financial information is properly documented in a way that businesses can assess it to improve their financial health.

What are the rules for recording transactions : Take a look at the three main rules of accounting:

Debit the receiver and credit the giver.

Debit what comes in and credit what goes out.

Debit expenses and losses, credit income and gains.

What are the 5 basic accounts

5 types of accounts in accounting

Assets. Asset accounts usually include the tangible and intangible items your company owns.

Expenses. An expense account can include the products or services a company purchases to help generate additional income.

Income.

Liabilities.

Equity.

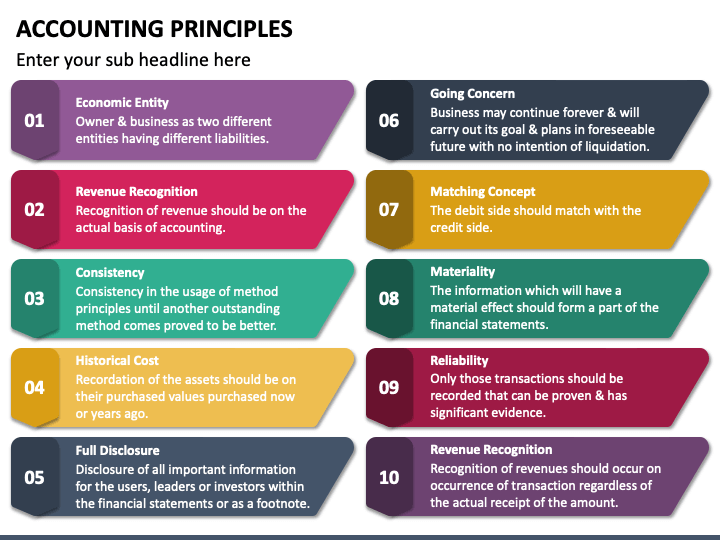

What are the 5 basic accounting principles : What are the 5 basic principles of accounting

Revenue Recognition Principle. When you are recording information about your business, you need to consider the revenue recognition principle.

Cost Principle.

Matching Principle.

Full Disclosure Principle.

Objectivity Principle.

The three major areas of accounting are:

Cost accounting.

Financial accounting.

Management accounting.

The three golden rules of accounting are (1) debit all expenses and losses, credit all incomes and gains, (2) debit the receiver, credit the giver, and (3) debit what comes in, credit what goes out.

What are the 5 basic principles of accounting

What are the 5 basic principles of accounting

Revenue Recognition Principle. When you are recording information about your business, you need to consider the revenue recognition principle.

Cost Principle.

Matching Principle.

Full Disclosure Principle.

Objectivity Principle.

The three golden rules of accounting are (1) debit all expenses and losses, credit all incomes and gains, (2) debit the receiver, credit the giver, and (3) debit what comes in, credit what goes out. These rules are the basis of double-entry accounting, first attributed to Luca Pacioli.The three golden rules of accounting are (1) debit all expenses and losses, credit all incomes and gains, (2) debit the receiver, credit the giver, and (3) debit what comes in, credit what goes out. These rules are the basis of double-entry accounting, first attributed to Luca Pacioli. Here are the 13 principles: -Accrual principle -Conservatism principle -Consistency principle -Cost principle -Economic entity principle -Full disclosure principle -Going concern principle -Matching principle -Materiality principle -Monetary unit principle -Reliability principle -Revenue recognition principle -Time …

What is a golden rule of account : The three golden rules of accounting are (1) debit all expenses and losses, credit all incomes and gains, (2) debit the receiver, credit the giver, and (3) debit what comes in, credit what goes out.

What are the 5 key of accounting : Although the guidelines for accountants are extensive, there are five main principles that underpin accounting practices and the preparation of financial statements. These are the accrual principle, the matching principle, the historic cost principle, the conservatism principle and the principle of substance over form.

What is the big 3 in accounting

The Big Three is one of the names given to the three largest strategy consulting firms by revenue: McKinsey, Boston Consulting Group (BCG), and Bain & Company. They are also referred to as MBB. The Big Four consists of the four largest accounting firms by revenue: PwC, Deloitte, EY, and KPMG. The two main accounting methods are cash accounting and accrual accounting. Cash accounting records revenues and expenses when they are received and paid. Accrual accounting records revenues and expenses when they occur.Single Platinum rule: – Credit is addition and Debit is deletion while considering all Assets (including cash) of the company as prepaid expenses. This rule can be applied in all transactions un- conditionally, which always stands true as the traditional three golden rules.

How can I learn accounting easily : How to Learn Financial Accounting

Learn How to Read and Analyze Financial Statements.

Antwort What are the 4 basic accounting rules? Weitere Antworten – What are the basics of accounting

In its most basic sense, accounting describes the process of tracking an individual or company's monetary transactions. Accountants record and analyze these transactions to generate an overall picture of their employer's financial health.

Recording Financial Transactions

One of the main objectives of accounting is maintaining systematic and chronological records of financial transactions. Accounting ensures that financial information is properly documented in a way that businesses can assess it to improve their financial health.

What are the rules for recording transactions : Take a look at the three main rules of accounting:

What are the 5 basic accounts

5 types of accounts in accounting

What are the 5 basic accounting principles : What are the 5 basic principles of accounting

The three major areas of accounting are:

The three golden rules of accounting are (1) debit all expenses and losses, credit all incomes and gains, (2) debit the receiver, credit the giver, and (3) debit what comes in, credit what goes out.

What are the 5 basic principles of accounting

What are the 5 basic principles of accounting

The three golden rules of accounting are (1) debit all expenses and losses, credit all incomes and gains, (2) debit the receiver, credit the giver, and (3) debit what comes in, credit what goes out. These rules are the basis of double-entry accounting, first attributed to Luca Pacioli.The three golden rules of accounting are (1) debit all expenses and losses, credit all incomes and gains, (2) debit the receiver, credit the giver, and (3) debit what comes in, credit what goes out. These rules are the basis of double-entry accounting, first attributed to Luca Pacioli.

Here are the 13 principles: -Accrual principle -Conservatism principle -Consistency principle -Cost principle -Economic entity principle -Full disclosure principle -Going concern principle -Matching principle -Materiality principle -Monetary unit principle -Reliability principle -Revenue recognition principle -Time …

What is a golden rule of account : The three golden rules of accounting are (1) debit all expenses and losses, credit all incomes and gains, (2) debit the receiver, credit the giver, and (3) debit what comes in, credit what goes out.

What are the 5 key of accounting : Although the guidelines for accountants are extensive, there are five main principles that underpin accounting practices and the preparation of financial statements. These are the accrual principle, the matching principle, the historic cost principle, the conservatism principle and the principle of substance over form.

What is the big 3 in accounting

The Big Three is one of the names given to the three largest strategy consulting firms by revenue: McKinsey, Boston Consulting Group (BCG), and Bain & Company. They are also referred to as MBB. The Big Four consists of the four largest accounting firms by revenue: PwC, Deloitte, EY, and KPMG.

The two main accounting methods are cash accounting and accrual accounting. Cash accounting records revenues and expenses when they are received and paid. Accrual accounting records revenues and expenses when they occur.Single Platinum rule: – Credit is addition and Debit is deletion while considering all Assets (including cash) of the company as prepaid expenses. This rule can be applied in all transactions un- conditionally, which always stands true as the traditional three golden rules.

How can I learn accounting easily : How to Learn Financial Accounting