There are three common types of businesses—sole proprietorship, partnership, and corporation—and each comes with its own set of advantages and disadvantages. Here's a rundown of what you need to know about each one.Sole Proprietorship

Sole Proprietorship. This is the simplest and most common form used when starting a new business. Sole proprietorships are set up to allow individuals to own and operate a business by themselves. A sole proprietor has total control, receives all profits from, and is responsible for taxes and liabilities of the business …Distinct from the three levels of leadership (e.g., supervisor, manager, leader), the three levels of ownership are entrepreneur, owner/operator and businessperson. To be optimally successful, adept owners proceed through that hierarchy steadily. Failure to do so stunts both the owner and the organization's growth.

What is the basic form of ownership : A sole proprietorship is the easiest and simplest form of business ownership. It is owned by one person. There is no distinction between the person and the business.

Which form of ownership is the best

Corporations offer the strongest protection to its owners from personal liability, but the cost to form a corporation is higher than other structures. Corporations also require more extensive record-keeping, operational processes, and reporting.

What are 5 disadvantages of a partnership : On the other hand, the disadvantages of a business partnership include:

Potential liabilities.

A loss of autonomy.

Emotional issues.

Conflict and disagreements.

Future selling complications.

A lack of stability.

Higher taxes.

Splitting profits.

Fee Simple Absolute Estate

Fee Simple Absolute Estate

Simply put, an owner with a fee simple absolute has control of the ENTIRE bundle of sticks. It is the strongest form of ownership and nobody can possess more than a fee simple absolute interest in the land. [3] It is the most extensive interest an individual can possess. The subject of ownership is of two types material and immaterial things. Material ownership is that which is tangible like property, land, car, book, etc. Immaterial ownership is that which is intangible like patent, copyright, trademark, etc.

What are the four forms of ownership

4 Ownership structures and legal forms

Sole trader – a person who is running a business as an individual.

Limited company – an organisation set up by its owners to run their business.

Business partnerships – an arrangement where two or more individuals share the ownership of a business.

The correct answer is option D) Sole proprietorship. Under a sole proprietorship, there is unlimited liability. If we say unlimited liability it means the owner handles all debts incurred in the business, and he/she must pay off those debts if business assets cannot suffice the debts from the creditors.You want your business to succeed, and a business partnership with the right professional may help it do just that. A strategic business partnership should be a mutually beneficial alliance where both professionals share business ideas, knowledge, resources, risks and rewards. Unequal Workloads Lead to Frustration

Another common cause of partnership disputes is when one partner is shouldering more of the workload than the other. This can provoke resentment and frustration, which can be damaging to the partnership. It is crucial to avoid conflicts if the business is successful.

Which is the most complicated form of ownership : corporation form

A corporation form of business has to follow numerous rules and regulations due to which, its formation is complex as compared to the other forms of business. Hence, corporation is considered to have a separate legal existence with a complex procedure of formation or incorporation.

What are the 4 basic patterns of business ownership : Common types of business ownership

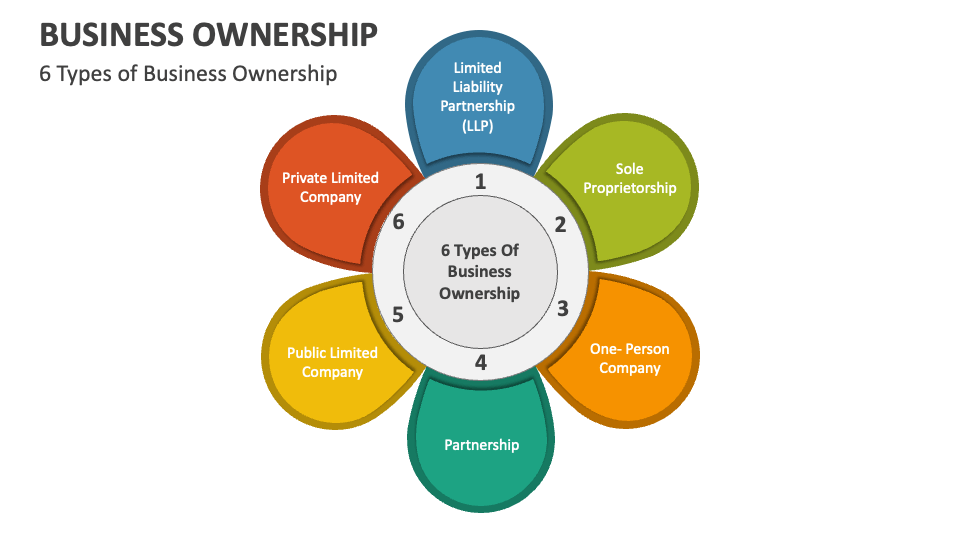

The most common forms of business ownership are sole proprietorship, partnership, limited liability partnership, limited liability company (LLC), series LLC, and corporations, which can be taxed as C corporations or S corporations.

What are the 4 types of business

The most common forms of business are the sole proprietorship, partnership, corporation, and S corporation. A limited liability company (LLC) is a business structure allowed by state statute. Legal and tax considerations enter into selecting a business structure. C-Corporation

This separation creates liability protection. Although this asset protection is not bulletproof, business creditors cannot easily seize your personal assets to pay bad debt, and your personal assets are most likely safe from lawsuits against the corporation.Equities are generally considered the riskiest class of assets. Dividends aside, they offer no guarantees, and investors' money is subject to the successes and failures of private businesses in a fiercely competitive marketplace. Equity investing involves buying stock in a private company or group of companies.

Is 50/50 partnership a good idea : A business with equal 50%/50% partners is a unique relationship. Neither partner can do anything without the approval of the other unless they establish clear, distinct areas of responsibility. Even then, a lot of people worry about the power struggles that will ensue with 50%/50% business relationships.

Antwort What are the 3 main types of business ownership? Weitere Antworten – What are the three main types of business ownership

There are three common types of businesses—sole proprietorship, partnership, and corporation—and each comes with its own set of advantages and disadvantages. Here's a rundown of what you need to know about each one.Sole Proprietorship

Sole Proprietorship. This is the simplest and most common form used when starting a new business. Sole proprietorships are set up to allow individuals to own and operate a business by themselves. A sole proprietor has total control, receives all profits from, and is responsible for taxes and liabilities of the business …Distinct from the three levels of leadership (e.g., supervisor, manager, leader), the three levels of ownership are entrepreneur, owner/operator and businessperson. To be optimally successful, adept owners proceed through that hierarchy steadily. Failure to do so stunts both the owner and the organization's growth.

What is the basic form of ownership : A sole proprietorship is the easiest and simplest form of business ownership. It is owned by one person. There is no distinction between the person and the business.

Which form of ownership is the best

Corporations offer the strongest protection to its owners from personal liability, but the cost to form a corporation is higher than other structures. Corporations also require more extensive record-keeping, operational processes, and reporting.

What are 5 disadvantages of a partnership : On the other hand, the disadvantages of a business partnership include:

Fee Simple Absolute Estate

Fee Simple Absolute Estate

Simply put, an owner with a fee simple absolute has control of the ENTIRE bundle of sticks. It is the strongest form of ownership and nobody can possess more than a fee simple absolute interest in the land. [3] It is the most extensive interest an individual can possess.

The subject of ownership is of two types material and immaterial things. Material ownership is that which is tangible like property, land, car, book, etc. Immaterial ownership is that which is intangible like patent, copyright, trademark, etc.

What are the four forms of ownership

4 Ownership structures and legal forms

The correct answer is option D) Sole proprietorship. Under a sole proprietorship, there is unlimited liability. If we say unlimited liability it means the owner handles all debts incurred in the business, and he/she must pay off those debts if business assets cannot suffice the debts from the creditors.You want your business to succeed, and a business partnership with the right professional may help it do just that. A strategic business partnership should be a mutually beneficial alliance where both professionals share business ideas, knowledge, resources, risks and rewards.

Unequal Workloads Lead to Frustration

Another common cause of partnership disputes is when one partner is shouldering more of the workload than the other. This can provoke resentment and frustration, which can be damaging to the partnership. It is crucial to avoid conflicts if the business is successful.

Which is the most complicated form of ownership : corporation form

A corporation form of business has to follow numerous rules and regulations due to which, its formation is complex as compared to the other forms of business. Hence, corporation is considered to have a separate legal existence with a complex procedure of formation or incorporation.

What are the 4 basic patterns of business ownership : Common types of business ownership

The most common forms of business ownership are sole proprietorship, partnership, limited liability partnership, limited liability company (LLC), series LLC, and corporations, which can be taxed as C corporations or S corporations.

What are the 4 types of business

The most common forms of business are the sole proprietorship, partnership, corporation, and S corporation. A limited liability company (LLC) is a business structure allowed by state statute. Legal and tax considerations enter into selecting a business structure.

C-Corporation

This separation creates liability protection. Although this asset protection is not bulletproof, business creditors cannot easily seize your personal assets to pay bad debt, and your personal assets are most likely safe from lawsuits against the corporation.Equities are generally considered the riskiest class of assets. Dividends aside, they offer no guarantees, and investors' money is subject to the successes and failures of private businesses in a fiercely competitive marketplace. Equity investing involves buying stock in a private company or group of companies.

Is 50/50 partnership a good idea : A business with equal 50%/50% partners is a unique relationship. Neither partner can do anything without the approval of the other unless they establish clear, distinct areas of responsibility. Even then, a lot of people worry about the power struggles that will ensue with 50%/50% business relationships.