The result is the DJIA is affected only by changes in the stock prices, and stocks with a higher share price have a larger impact on the Dow's movements.The Dow Jones Index is affected by several factors, like rising/falling inflation, geopolitical tensions/relaxation, and global trade disputes. Investors closely monitor the Dow Jones Index as it provides valuable insights into the overall health of the US market.While stock selection for The Dow is not governed by a strict set of rules, the committee focuses on an eligible company's reputation, its history of sustained growth, its interest to investors, and its sector representation of the broader market.

What is the Dow Jones index strategy : Dow theory trading strategy

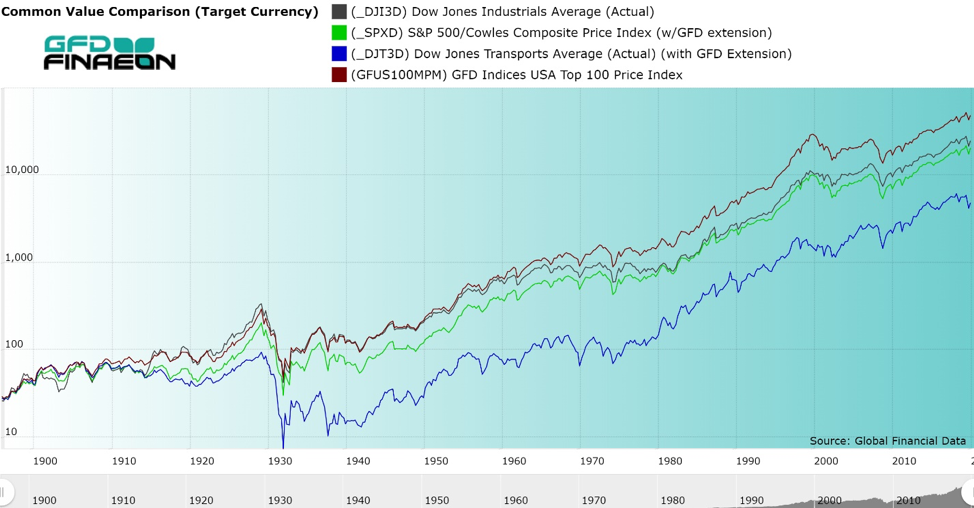

Dow theory says that the market is in an upward trend if one of its averages goes above a previous important high and is accompanied or followed by a similar movement in the other average.

What causes the Dow to go up

By this we mean that share prices change because of supply and demand. If more people want to buy a stock (demand) than sell it (supply), then the price moves up. Conversely, if more people wanted to sell a stock than buy it, there would be greater supply than demand, and the price would fall.

What moves the Dow Jones the most : What moves the Dow Jones price

Monetary and economic releases. Federal Reserve monetary policy often has a notable impact on the DJIA.

Dow Jones weighting.

Market moving events.

Stock prices change everyday by market forces. By this we mean that share prices change because of supply and demand. The index is maintained by S&P Dow Jones Indices, an entity majority-owned by S&P Global. Its components are selected by a committee. The ten components with the largest dividend yields are commonly referred to as the Dogs of the Dow.

What makes a Dow Jones go up and down

Stock prices change everyday by market forces. By this we mean that share prices change because of supply and demand.For each share they buy, an investor owns a piece of that company. In large part, supply and demand dictate the per-share price of a stock. If demand for a limited number of shares outpaces the supply, then the stock price normally rises. And if the supply is greater than demand, the stock price typically falls.How Are Dow Jones Futures Prices Determined The Dow Jones Index value is determined very simply, as it tracks the performance of the 30 stocks within the index. It's important to note that the Dow is a price-weighted index, which means stocks with higher share prices are given greater weight in the index. By this we mean that share prices change because of supply and demand. If more people want to buy a stock (demand) than sell it (supply), then the price moves up. Conversely, if more people wanted to sell a stock than buy it, there would be greater supply than demand, and the price would fall.

What actually affects stock price : Stock prices change everyday by market forces. By this we mean that share prices change because of supply and demand. If more people want to buy a stock (demand) than sell it (supply), then the price moves up.

How do you predict if a stock will go up or down : The price of a stock is largely determined by supply and demand. If demand is high, the price tends to go up, and if supply is high, the price tends to go down.

What controls the Dow

The index is maintained by S&P Dow Jones Indices, an entity majority-owned by S&P Global. Its components are selected by a committee. The ten components with the largest dividend yields are commonly referred to as the Dogs of the Dow. For each share they buy, an investor owns a piece of that company. In large part, supply and demand dictate the per-share price of a stock. If demand for a limited number of shares outpaces the supply, then the stock price normally rises. And if the supply is greater than demand, the stock price typically falls.At the most fundamental level, supply and demand in the market determine stock price. Price times the number of shares outstanding (market capitalization) is the value of a company. Comparing just the share price of two companies is meaningless.

How to know if the stock market will go up or down : If demand for a limited number of shares outpaces the supply, then the stock price normally rises. And if the supply is greater than demand, the stock price typically falls.

Antwort What affects Dow Jones index? Weitere Antworten – What affects the Dow Jones the most

The result is the DJIA is affected only by changes in the stock prices, and stocks with a higher share price have a larger impact on the Dow's movements.The Dow Jones Index is affected by several factors, like rising/falling inflation, geopolitical tensions/relaxation, and global trade disputes. Investors closely monitor the Dow Jones Index as it provides valuable insights into the overall health of the US market.While stock selection for The Dow is not governed by a strict set of rules, the committee focuses on an eligible company's reputation, its history of sustained growth, its interest to investors, and its sector representation of the broader market.

What is the Dow Jones index strategy : Dow theory trading strategy

Dow theory says that the market is in an upward trend if one of its averages goes above a previous important high and is accompanied or followed by a similar movement in the other average.

What causes the Dow to go up

By this we mean that share prices change because of supply and demand. If more people want to buy a stock (demand) than sell it (supply), then the price moves up. Conversely, if more people wanted to sell a stock than buy it, there would be greater supply than demand, and the price would fall.

What moves the Dow Jones the most : What moves the Dow Jones price

Stock prices change everyday by market forces. By this we mean that share prices change because of supply and demand.

The index is maintained by S&P Dow Jones Indices, an entity majority-owned by S&P Global. Its components are selected by a committee. The ten components with the largest dividend yields are commonly referred to as the Dogs of the Dow.

What makes a Dow Jones go up and down

Stock prices change everyday by market forces. By this we mean that share prices change because of supply and demand.For each share they buy, an investor owns a piece of that company. In large part, supply and demand dictate the per-share price of a stock. If demand for a limited number of shares outpaces the supply, then the stock price normally rises. And if the supply is greater than demand, the stock price typically falls.How Are Dow Jones Futures Prices Determined The Dow Jones Index value is determined very simply, as it tracks the performance of the 30 stocks within the index. It's important to note that the Dow is a price-weighted index, which means stocks with higher share prices are given greater weight in the index.

By this we mean that share prices change because of supply and demand. If more people want to buy a stock (demand) than sell it (supply), then the price moves up. Conversely, if more people wanted to sell a stock than buy it, there would be greater supply than demand, and the price would fall.

What actually affects stock price : Stock prices change everyday by market forces. By this we mean that share prices change because of supply and demand. If more people want to buy a stock (demand) than sell it (supply), then the price moves up.

How do you predict if a stock will go up or down : The price of a stock is largely determined by supply and demand. If demand is high, the price tends to go up, and if supply is high, the price tends to go down.

What controls the Dow

The index is maintained by S&P Dow Jones Indices, an entity majority-owned by S&P Global. Its components are selected by a committee. The ten components with the largest dividend yields are commonly referred to as the Dogs of the Dow.

For each share they buy, an investor owns a piece of that company. In large part, supply and demand dictate the per-share price of a stock. If demand for a limited number of shares outpaces the supply, then the stock price normally rises. And if the supply is greater than demand, the stock price typically falls.At the most fundamental level, supply and demand in the market determine stock price. Price times the number of shares outstanding (market capitalization) is the value of a company. Comparing just the share price of two companies is meaningless.

How to know if the stock market will go up or down : If demand for a limited number of shares outpaces the supply, then the stock price normally rises. And if the supply is greater than demand, the stock price typically falls.