While selling stocks during a market downturn might make you feel better temporarily, doing so reactively because stocks are tumbling isn't a good long-term investment strategy.When To Sell And Take A Loss. According to IBD founder William O'Neil's rule in "How to Make Money in Stocks," you should sell a stock when you are down 7% or 8% from your purchase price, no exceptions.A reminder: You have not lost money until you sell your stocks. So yes, even when the line curve is plummeting, you have not technically lost money. Highs and lows are normal. Historically, the stock market value has increased over time, with an average of 9.90% in annual returns in the S&P 500 index from 1928 to 2023.

What is the 3-5-7 rule in trading : The 3–5–7 rule in trading is a risk management principle that suggests allocating a certain percentage of your trading capital to different trades based on their risk levels. Here's how it typically works: 3% Rule: This suggests risking no more than 3% of your trading capital on any single trade.

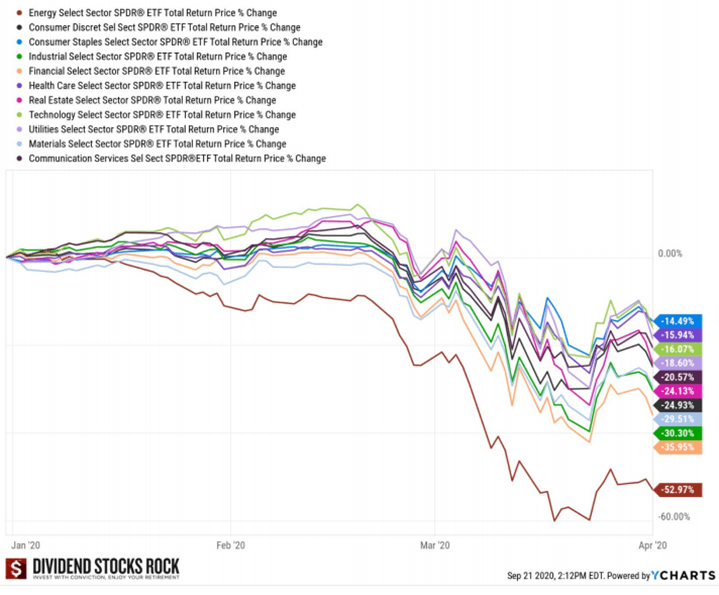

Should I hold a losing stock

An investor may also continue to hold if the stock pays a healthy dividend. Generally, though, if the stock breaks a technical marker or the company is not performing well, it is better to sell at a small loss than to let the position tie up your money and potentially fall even further.

What is the 3 day rule in stocks : The 3-Day Rule in stock trading refers to the settlement rule that requires the finalization of a transaction within three business days after the trade date. This rule impacts how payments and orders are processed, requiring traders to have funds or credit in their accounts to cover purchases by the settlement date.

Taking the loss could allow you to get your portfolio back on track more quickly—and potentially offset capital gains and/or ordinary income. When to Sell Stocks — for Profit or Loss

Your investment thesis has changed. The reasons why you bought a stock may no longer apply.

The company is being acquired.

You need the money or soon will.

You need to rebalance your portfolio.

You identify opportunities to better invest your money elsewhere.

Can a stock go to zero

If a stock falls to or close to zero, it means that the company is effectively bankrupt and has no value to shareholders. “A company typically goes to zero when it becomes bankrupt or is technically insolvent, such as Silicon Valley Bank,” says Darren Sissons, partner and portfolio manager at Campbell, Lee & Ross.If certain shares have consistently underperformed with little hope of recovery, it may be wise to sell them. Selling under-performers can free up capital that could be better invested elsewhere and allow you to use capital losses to offset gains for tax purposes.There's a saying in the industry that's fairly common, the '90-90-90 rule'. It goes along the lines, 90% of traders lose 90% of their money in the first 90 days. If you're reading this then you're probably in one of those 90's… Make no mistake, the entire industry is set up that way to achieve exactly that, 90-90-90. It may make sense to sell the stock as soon as the technical level is breached on the downside. If a stock breaks through a key resistance level on the upside, it may signal more gains and a higher trading range for the stock, which means it's advisable to sell part of the position rather than all of it.

Can stocks go to zero : When a stock's price falls to zero, a shareholder's holdings in this stock become worthless. Major stock exchanges actually delist shares once they fall below specific price values.

What is 90% rule in trading : It is a high-stakes game where many are lured by the promise of quick riches but ultimately face harsh realities. One of the harsh realities of trading is the “Rule of 90,” which suggests that 90% of new traders lose 90% of their starting capital within 90 days of their first trade.

What is the 80% rule in day trading

Definition of '80% Rule'

The 80% Rule is a Market Profile concept and strategy. If the market opens (or moves outside of the value area ) and then moves back into the value area for two consecutive 30-min-bars, then the 80% rule states that there is a high probability of completely filling the value area. To make money in stocks, you must protect the money you already have. That brings us to the cardinal rule of selling. Always sell a stock it if falls 7%-8% below what you paid for it. This basic principle helps you always cap your potential downside.If you want to mess around with a small amount of money you're OK with losing, that's fine. But long-term investing is a far more certain path to wealth in the stock market. Day trading as an investment strategy is generally a bad idea. Don't sell just because your stocks went down.

At what point should you sell your shares : It's common for investors to sell shares when they've reached a certain profit goal. Suppose a particular stock has experienced significant growth and achieved the return you aimed for. In that case, you might decide to sell and secure your gains.

Antwort Should I sell my stock if it keeps going down? Weitere Antworten – Should I sell a stock that keeps going down

While selling stocks during a market downturn might make you feel better temporarily, doing so reactively because stocks are tumbling isn't a good long-term investment strategy.When To Sell And Take A Loss. According to IBD founder William O'Neil's rule in "How to Make Money in Stocks," you should sell a stock when you are down 7% or 8% from your purchase price, no exceptions.A reminder: You have not lost money until you sell your stocks. So yes, even when the line curve is plummeting, you have not technically lost money. Highs and lows are normal. Historically, the stock market value has increased over time, with an average of 9.90% in annual returns in the S&P 500 index from 1928 to 2023.

What is the 3-5-7 rule in trading : The 3–5–7 rule in trading is a risk management principle that suggests allocating a certain percentage of your trading capital to different trades based on their risk levels. Here's how it typically works: 3% Rule: This suggests risking no more than 3% of your trading capital on any single trade.

Should I hold a losing stock

An investor may also continue to hold if the stock pays a healthy dividend. Generally, though, if the stock breaks a technical marker or the company is not performing well, it is better to sell at a small loss than to let the position tie up your money and potentially fall even further.

What is the 3 day rule in stocks : The 3-Day Rule in stock trading refers to the settlement rule that requires the finalization of a transaction within three business days after the trade date. This rule impacts how payments and orders are processed, requiring traders to have funds or credit in their accounts to cover purchases by the settlement date.

Taking the loss could allow you to get your portfolio back on track more quickly—and potentially offset capital gains and/or ordinary income.

When to Sell Stocks — for Profit or Loss

Can a stock go to zero

If a stock falls to or close to zero, it means that the company is effectively bankrupt and has no value to shareholders. “A company typically goes to zero when it becomes bankrupt or is technically insolvent, such as Silicon Valley Bank,” says Darren Sissons, partner and portfolio manager at Campbell, Lee & Ross.If certain shares have consistently underperformed with little hope of recovery, it may be wise to sell them. Selling under-performers can free up capital that could be better invested elsewhere and allow you to use capital losses to offset gains for tax purposes.There's a saying in the industry that's fairly common, the '90-90-90 rule'. It goes along the lines, 90% of traders lose 90% of their money in the first 90 days. If you're reading this then you're probably in one of those 90's… Make no mistake, the entire industry is set up that way to achieve exactly that, 90-90-90.

It may make sense to sell the stock as soon as the technical level is breached on the downside. If a stock breaks through a key resistance level on the upside, it may signal more gains and a higher trading range for the stock, which means it's advisable to sell part of the position rather than all of it.

Can stocks go to zero : When a stock's price falls to zero, a shareholder's holdings in this stock become worthless. Major stock exchanges actually delist shares once they fall below specific price values.

What is 90% rule in trading : It is a high-stakes game where many are lured by the promise of quick riches but ultimately face harsh realities. One of the harsh realities of trading is the “Rule of 90,” which suggests that 90% of new traders lose 90% of their starting capital within 90 days of their first trade.

What is the 80% rule in day trading

Definition of '80% Rule'

The 80% Rule is a Market Profile concept and strategy. If the market opens (or moves outside of the value area ) and then moves back into the value area for two consecutive 30-min-bars, then the 80% rule states that there is a high probability of completely filling the value area.

To make money in stocks, you must protect the money you already have. That brings us to the cardinal rule of selling. Always sell a stock it if falls 7%-8% below what you paid for it. This basic principle helps you always cap your potential downside.If you want to mess around with a small amount of money you're OK with losing, that's fine. But long-term investing is a far more certain path to wealth in the stock market. Day trading as an investment strategy is generally a bad idea. Don't sell just because your stocks went down.

At what point should you sell your shares : It's common for investors to sell shares when they've reached a certain profit goal. Suppose a particular stock has experienced significant growth and achieved the return you aimed for. In that case, you might decide to sell and secure your gains.