Getting a head start on investing can really pay off, too. Money invested in your 20s cancould compound for decades, making it a great time to invest for long-term goals.Start saving and investing in your 20s by contributing to a retirement plan, investing in index funds and ETFs, automating your investment management with a robo-advisor and increasing your savings rate over time.5-year, 10-year, 20-year and 30-year S&P 500 returns

Period (start-of-year to end-of-2023)

Average annual S&P 500 return

15 years (2009-2023)

12.63%

20 years (2004-2023)

9.00%

25 years (1999-2023)

7.18%

30 years (1994-2023)

9.67%

What age should you buy stocks : 18 years old

To start investing in stocks on their own, your kid will need a brokerage account, and they must be at least 18 years old to open one. They can start earlier than this, but they'll need a parent or guardian to open a custodial account for them.

Is 21 too late to start investing

Here's the real truth: It's never too late to start growing your money. And while time does matter when it comes to investing, it doesn't need to matter in the way you might think. You may be surprised at the impact just a few years can have on your savings.

Should a 19 year old invest : There are many reasons why teens should invest. The most significant advantage is the time they have to allow their investments to grow and increase in value. Sometimes it might seem confusing where to begin, but it does not have to be.

The median salary of 20- to 24-year-olds is $720 per week, which translates to $38,012 per year. Many Americans start out their careers in their 20s and don't earn as much as they will once they reach their 30s.

Investing $1 a day not only allows you to start taking advantage of compound interest. It also helps you to get comfortable with investing and develop the habit of putting your money to work for you. As you can see, that single dollar can make a huge difference in helping you to become more financially secure.

How to turn $20 into $100

Some of the best ways to turn $20 into $100 include:

Buying and flipping stuff online.

In-person retail arbitrage.

Investing in dividend paying stocks.

Selling food and beverages to people.

Investing your money into real estate with companies like Arrived or Fundrise.

Here are seven ways for college students to get started in investing, from the super-safe to the bold.

Consider starting with a high-yield savings account or CDs.

Turn to a free or low-cost broker.

Invest a little each month.

Buy an S&P 500 index fund.

Sign up for a robo-advisor.

Turn to an investing app.

Open an IRA.

There are many reasons why teens should invest. The most significant advantage is the time they have to allow their investments to grow and increase in value. Sometimes it might seem confusing where to begin, but it does not have to be.

Meanwhile, you might have a fairly large savings balance to the tune of $20,000. That's definitely a lot of money. And in some cases, that might constitute a really robust emergency fund. But in some situations, a $20,000 emergency fund might also leave you short.

What is the right age to invest : You cannot hold shares or investment funds yourself until you are 18. However, that does not mean they cannot benefit from starting at a younger age, as long as parents or guardians are involved too.

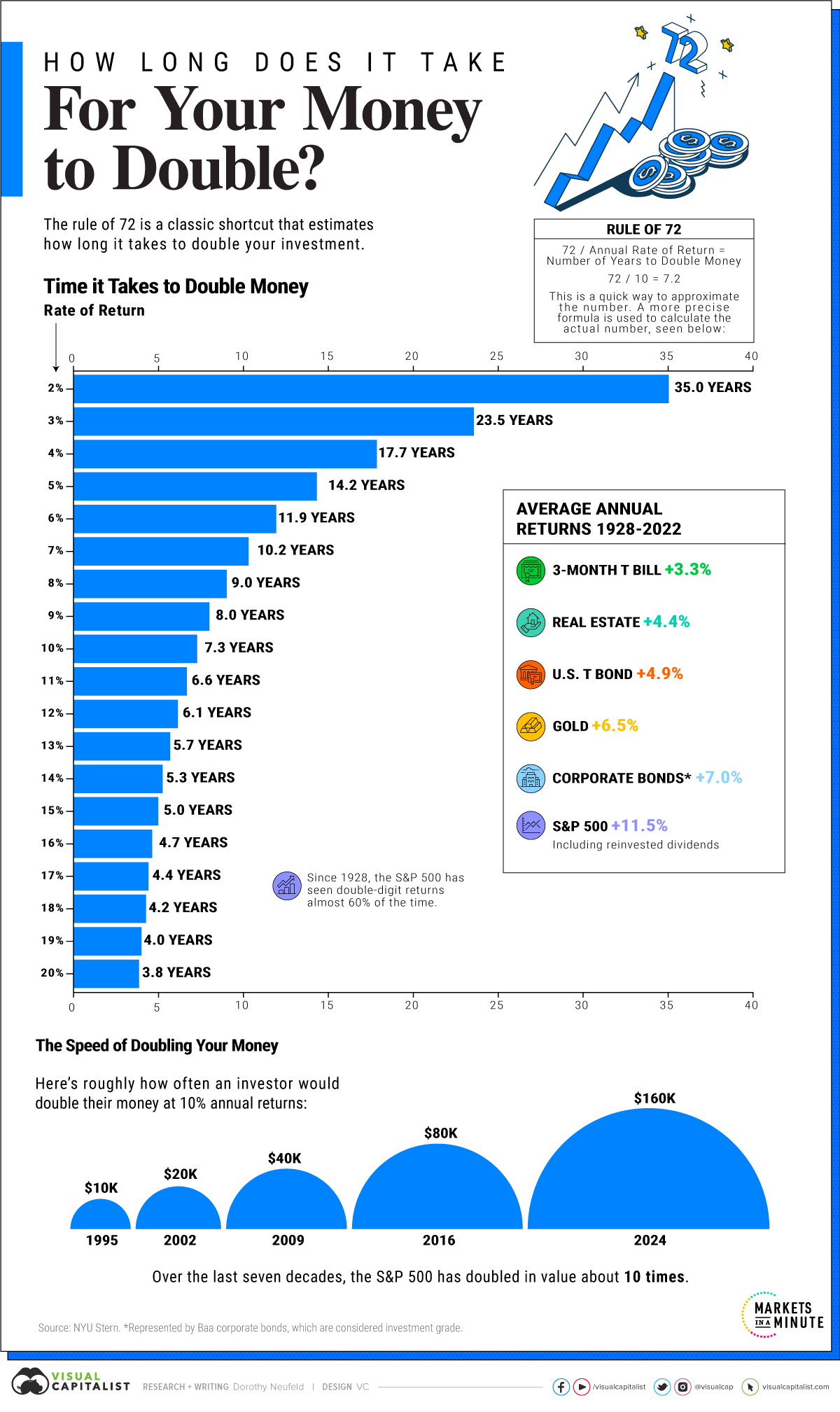

Why invest at 18 : The longer you allow an investment to compound, the more valuable it can become. Teens can let the wonders of compounding interest work to their advantage for a longer period, which could make them wealthier by the time they hit retirement.

What age is too late to start investing

It's never too late to start investing, but starting in your late 60s will impact the options you have. Consider Social Security strategies, income sources and appropriate asset allocation. A financial advisor may be able to help you project out your investment and income plan into the coming decades.

Meanwhile, you might have a fairly large savings balance to the tune of $20,000. That's definitely a lot of money. And in some cases, that might constitute a really robust emergency fund. But in some situations, a $20,000 emergency fund might also leave you short.The Ideal Number

Age

Income

Net Worth

20

$25,000

$50,000

30

$25,000

$75,000

40

$25,000

$100,000

50

$25,000

$125,000

Is $100 too little to invest : Investing just $100 a month can actually do a whole lot to help you grow rich over time. In fact, the table below shows how much your $100 monthly investment could turn into over time, assuming you earn a 10% average annual return.

Antwort Should a 20 year old invest in stocks? Weitere Antworten – Should I invest in stocks at 20

Getting a head start on investing can really pay off, too. Money invested in your 20s cancould compound for decades, making it a great time to invest for long-term goals.Start saving and investing in your 20s by contributing to a retirement plan, investing in index funds and ETFs, automating your investment management with a robo-advisor and increasing your savings rate over time.5-year, 10-year, 20-year and 30-year S&P 500 returns

What age should you buy stocks : 18 years old

To start investing in stocks on their own, your kid will need a brokerage account, and they must be at least 18 years old to open one. They can start earlier than this, but they'll need a parent or guardian to open a custodial account for them.

Is 21 too late to start investing

Here's the real truth: It's never too late to start growing your money. And while time does matter when it comes to investing, it doesn't need to matter in the way you might think. You may be surprised at the impact just a few years can have on your savings.

Should a 19 year old invest : There are many reasons why teens should invest. The most significant advantage is the time they have to allow their investments to grow and increase in value. Sometimes it might seem confusing where to begin, but it does not have to be.

The median salary of 20- to 24-year-olds is $720 per week, which translates to $38,012 per year. Many Americans start out their careers in their 20s and don't earn as much as they will once they reach their 30s.

Investing $1 a day not only allows you to start taking advantage of compound interest. It also helps you to get comfortable with investing and develop the habit of putting your money to work for you. As you can see, that single dollar can make a huge difference in helping you to become more financially secure.

How to turn $20 into $100

Some of the best ways to turn $20 into $100 include:

Here are seven ways for college students to get started in investing, from the super-safe to the bold.

There are many reasons why teens should invest. The most significant advantage is the time they have to allow their investments to grow and increase in value. Sometimes it might seem confusing where to begin, but it does not have to be.

Meanwhile, you might have a fairly large savings balance to the tune of $20,000. That's definitely a lot of money. And in some cases, that might constitute a really robust emergency fund. But in some situations, a $20,000 emergency fund might also leave you short.

What is the right age to invest : You cannot hold shares or investment funds yourself until you are 18. However, that does not mean they cannot benefit from starting at a younger age, as long as parents or guardians are involved too.

Why invest at 18 : The longer you allow an investment to compound, the more valuable it can become. Teens can let the wonders of compounding interest work to their advantage for a longer period, which could make them wealthier by the time they hit retirement.

What age is too late to start investing

It's never too late to start investing, but starting in your late 60s will impact the options you have. Consider Social Security strategies, income sources and appropriate asset allocation. A financial advisor may be able to help you project out your investment and income plan into the coming decades.

Meanwhile, you might have a fairly large savings balance to the tune of $20,000. That's definitely a lot of money. And in some cases, that might constitute a really robust emergency fund. But in some situations, a $20,000 emergency fund might also leave you short.The Ideal Number

Is $100 too little to invest : Investing just $100 a month can actually do a whole lot to help you grow rich over time. In fact, the table below shows how much your $100 monthly investment could turn into over time, assuming you earn a 10% average annual return.