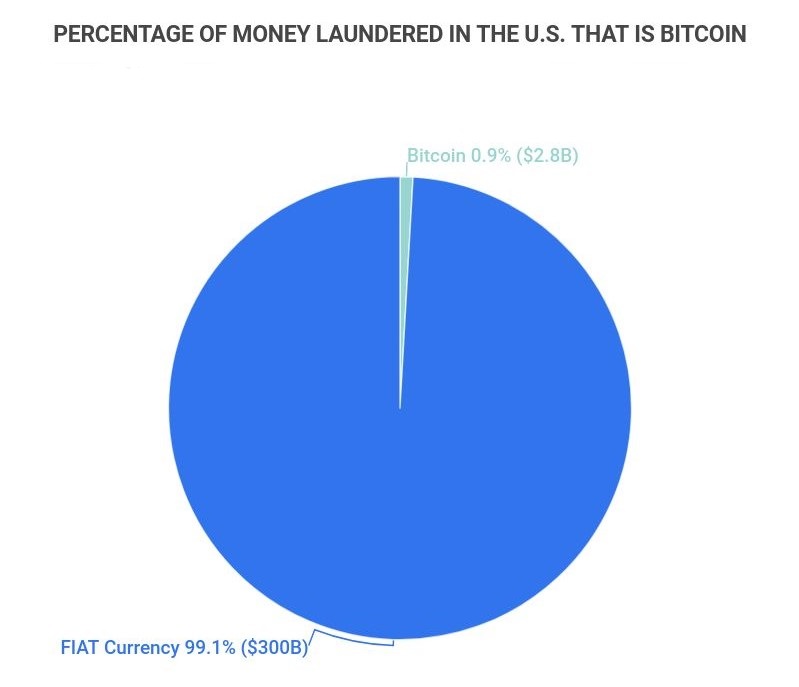

According to our extensive research: Approximately $300 billion is laundered through the United States each year. Worldwide, criminals launder between $800 million and $2 trillion each year.The Top 10 Countries With The Highest Money Laundering Risk

JURISDICTION

OVERALL SCORE

Haiti

8.25

Chad

8.14

Myanmar

8.13

The Democratic Republic Of The Congo

8.10

Money laundering is more about the intent than the amount of money, but you will likely be investigated for money laundering if you bring more than $10,000 in cash into or out of the United States, deposit $10,000 or more in cash into a bank account, or if you spend more than $300,000 in cash on a real estate purchase.

Is money laundering still common : Cash is also still widely used in the criminal economy. The physical transportation of cash across an international border is one of the oldest forms of money laundering and still widely used today.

What city is the money laundering capital of the world

London

The statement that London is the "world's capital for money laundering" has been widely used by many in politics, media and those in the academic world.

What is the fastest growing financial crime in the US : As the fastest-growing financial crime in the United States, synthetic identity fraud bears a staggering $6 billion cost to banks. To perpetrate the crime, malicious actors leverage a combination of real and fake information to fabricate a synthetic identity, also known as a “Frankenstein ID.”

This list is often externally referred to as the black list.

Democratic People's Republic of Korea.

Iran.

Myanmar.

Risk and Compliance Questions and Answers

Bulgaria.

Burkina Faso.

Cameroon.

Croatia.

Democratic People's Republic of Korea (DPRK)*

Democratic Republic of the Congo.

Haiti.

Iran*

How much cash deposit is suspicious in USA

$10,000

Banks report individuals who deposit $10,000 or more in cash. The IRS typically shares suspicious deposit or withdrawal activity with local and state authorities, Castaneda says. The federal law extends to businesses that receive funds to purchase more expensive items, such as cars, homes or other big amenities.Money Laundering under California Penal Code Section 186.10 PC contains the following elements: The defendant completed a transaction or a series of transactions through a financial institution. The total amount of the transaction(s) must be more than $5,000 in a seven day period OR more than $25,000 in a 30 day period.Money Laundering through New Payment Systems Increasing proliferation of new non-cash payment methods such as prepaid cards, internet payments, and mobile payments has opened up new gateways for money launderers. They do this by breaking up large amounts into smaller deposits in multiple bank accounts. The second stage is layering, which involves moving the money around to distance it from the fraudsters. The final stage is called integration, where the money is brought back to the perpetrators as clean money.

Is the UK a money laundering country : United Kingdom is categorised by the US State Department as a Country/Jurisdiction of Primary Concern in respect of Money Laundering and Financial Crimes.

What is the biggest money laundering case in the US : Biggest Money Laundering Cases of All Time

By far the most common form of property crime in 2022 was larceny/theft, followed by motor vehicle theft and burglary. Among violent crimes, aggravated assault was the most common offense, followed by robbery, rape, and murder/nonnegligent manslaughter. The U.S. government maintains several lists that could reasonably be called blacklists. They publicly identify individuals or entities that are restricted or banned from conducting business in the U.S. or with U.S. entities.Latest version of the list of high-risk third countries

High-risk third country

Date of entry into force

Haiti

13 March 2022

Iran

23 September 2016

Jamaica

1 October 2020

Mali

13 March 2022

What countries are low risk AML : This list is often externally referred to as the 'grey list'.

Antwort Is there a lot of money laundering in the US? Weitere Antworten – How common is money laundering in the US

According to our extensive research: Approximately $300 billion is laundered through the United States each year. Worldwide, criminals launder between $800 million and $2 trillion each year.The Top 10 Countries With The Highest Money Laundering Risk

Money laundering is more about the intent than the amount of money, but you will likely be investigated for money laundering if you bring more than $10,000 in cash into or out of the United States, deposit $10,000 or more in cash into a bank account, or if you spend more than $300,000 in cash on a real estate purchase.

Is money laundering still common : Cash is also still widely used in the criminal economy. The physical transportation of cash across an international border is one of the oldest forms of money laundering and still widely used today.

What city is the money laundering capital of the world

London

The statement that London is the "world's capital for money laundering" has been widely used by many in politics, media and those in the academic world.

What is the fastest growing financial crime in the US : As the fastest-growing financial crime in the United States, synthetic identity fraud bears a staggering $6 billion cost to banks. To perpetrate the crime, malicious actors leverage a combination of real and fake information to fabricate a synthetic identity, also known as a “Frankenstein ID.”

This list is often externally referred to as the black list.

Risk and Compliance Questions and Answers

How much cash deposit is suspicious in USA

$10,000

Banks report individuals who deposit $10,000 or more in cash. The IRS typically shares suspicious deposit or withdrawal activity with local and state authorities, Castaneda says. The federal law extends to businesses that receive funds to purchase more expensive items, such as cars, homes or other big amenities.Money Laundering under California Penal Code Section 186.10 PC contains the following elements: The defendant completed a transaction or a series of transactions through a financial institution. The total amount of the transaction(s) must be more than $5,000 in a seven day period OR more than $25,000 in a 30 day period.Money Laundering through New Payment Systems Increasing proliferation of new non-cash payment methods such as prepaid cards, internet payments, and mobile payments has opened up new gateways for money launderers.

They do this by breaking up large amounts into smaller deposits in multiple bank accounts. The second stage is layering, which involves moving the money around to distance it from the fraudsters. The final stage is called integration, where the money is brought back to the perpetrators as clean money.

Is the UK a money laundering country : United Kingdom is categorised by the US State Department as a Country/Jurisdiction of Primary Concern in respect of Money Laundering and Financial Crimes.

What is the biggest money laundering case in the US : Biggest Money Laundering Cases of All Time

What are the top 3 crimes in America

By far the most common form of property crime in 2022 was larceny/theft, followed by motor vehicle theft and burglary. Among violent crimes, aggravated assault was the most common offense, followed by robbery, rape, and murder/nonnegligent manslaughter.

:max_bytes(150000):strip_icc()/AML-7a3c35887ed946d1ba9cb56fae105db5.jpg)

The U.S. government maintains several lists that could reasonably be called blacklists. They publicly identify individuals or entities that are restricted or banned from conducting business in the U.S. or with U.S. entities.Latest version of the list of high-risk third countries

What countries are low risk AML : This list is often externally referred to as the 'grey list'.