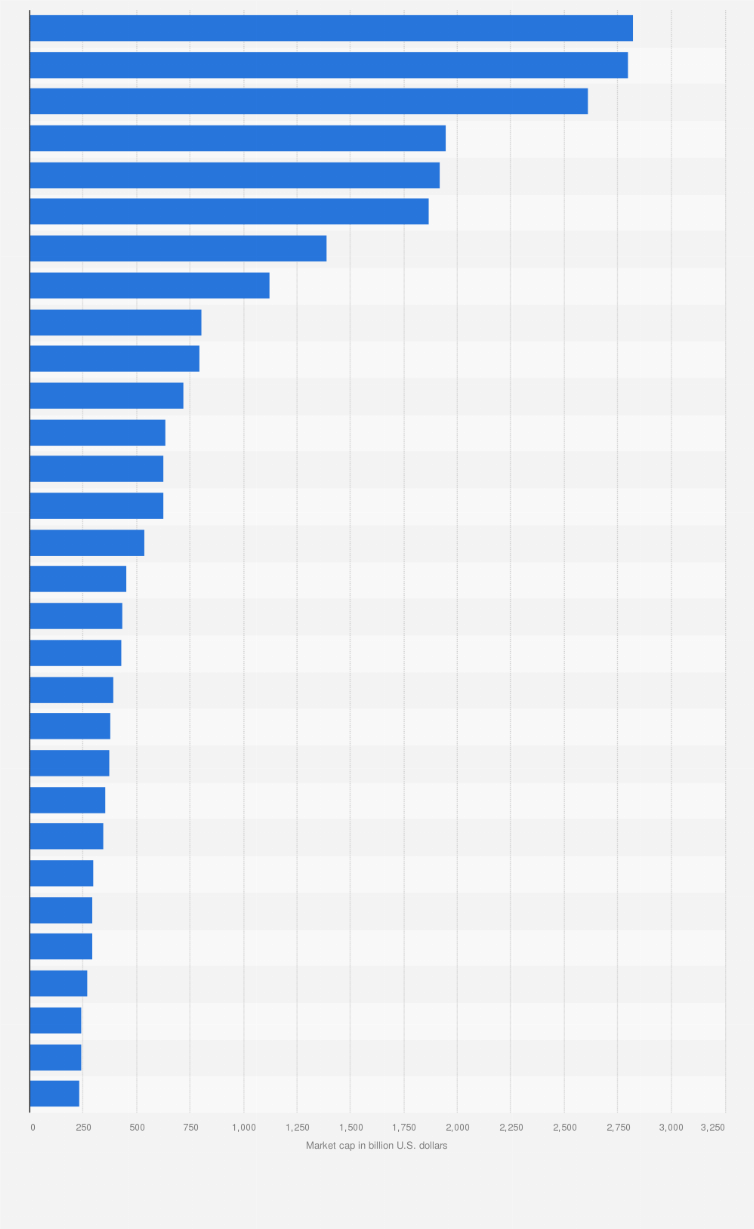

Large-cap stocks are represented by the S&P 500; mid-cap stocks by the S&P MidCap 400 Index; and small-cap stocks by the S&P SmallCap 600 Index. These indexes are unmanaged and do not take into account the fees, expenses, and taxes associated with investing.As the list below shows, the biggest companies also represent the biggest industry sector in the S&P 500: information technology. This is followed by health care, consumer discretionary, financials, communications services, industrials, consumer staples, energy, real estate, materials, and utilities.

10 Smallest Companies in the S&P500 Index. Business & Books. ·

495. Comerica Inc. ($CMA)

496. Mohawk Industries Inc. ($MHK)

497. Organon & Co ($OGN) Sector: Healthcare.

498. Ralph Lauren Corp ($RL) Sector: Consumer Cyclical.

499. Zions Bancorp ($ZION)

500. Fox Corp Class B ($FOX)

501. Lincoln National Corp ($LNC)

Where can I buy a S&P 500 : Open an investment account: Select a reputable brokerage platform that offers access to the S&P 500. Companies such as Schwab, Fidelity or Vanguard offer their own proprietary S&P 500 index funds, as do many others. Create an account, complete the necessary paperwork and fund your account to begin investing.

Is S&P small-cap or large-cap

The S&P 500 is used for large cap. Russell MidCap is used for mid cap. Russell 2000 is used for small cap. All data are as of January 19, 2024.

How do you know if a stock is large-cap or mid-cap : And based on the market cap, the company is either categorized under small cap, mid cap, or large cap respectively. The first 100 companies ranked according to their market capitalization by the stock exchanges are known as large cap companies. These stocks have a market cap of more than Rs. 20,000.

The S&P 500 Index, or Standard & Poor's 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S. The S&P 500 is a stock market index maintained by S&P Dow Jones Indices. It comprises 503 common stocks which are issued by 500 large-cap companies traded on American stock exchanges (including the 30 companies that compose the Dow Jones Industrial Average).

Can you buy small amounts of S&P 500

If you are investing in an S&P 500 index fund:

If your index fund has no minimum, you can usually purchase in any dollar amount. If your index fund has a minimum, then you have to purchase at least the minimum amount. If your index fund has an expense ratio, you'll be charged that as a fee.The S&P 500 is a stock market index maintained by S&P Dow Jones Indices. It comprises 503 common stocks which are issued by 500 large-cap companies traded on American stock exchanges (including the 30 companies that compose the Dow Jones Industrial Average).You can't directly invest in the S&P 500 because it's an index, but you can invest in one of the many funds that use it as a benchmark and follow its composition and performance. Large-cap corporations, or those with larger market capitalizations of $10 billion or more, tend to grow more slowly than small caps, which have values between $250 million and $2 billion.

How to know if a stock is small-cap or mid-cap : Large cap: Companies ranked between 1 and 100, when sorted by market capitalisation. Mid cap: Companies ranked between 101 and 250, when sorted by market capitalisation. Small cap: Companies ranked beyond 250, when sorted by market capitalisation.

Is S and P 500 the same as total stock : Pretty much by definition, the S&P 500 is made up of large-cap companies. A total market index is mostly large-cap stocks, but by definition includes all the mid-cap and small-cap stocks as well.

Is S&P 500 a stock or fund

The S&P 500 hit a new all-time high on May 15, 2024. The S&P 500 is a stock market index composed of about 500 publicly traded companies. You cannot directly invest in the index itself. You can buy individual stocks of companies in the S&P 500, or buy an S&P 500 index fund or ETF. The index serves as a gauge for the U.S. mid-cap equities sector and is the most widely followed mid-cap index.Through its Schwab Stock Slices™ program, Charles Schwab offers fractional shares of any stock on the S&P 500. You can choose a single slice (fractional share) to up to 30 slices, with rates as low as $5 a slice. Similar to traditional stocks, fractional shares at Schwab are traded commission-free online.

Is it OK to only invest in S&P 500 : Investing only in the S&P 500 does not provide the broad diversification that minimizes risk. Economic downturns and bear markets can still deliver large losses. The past performance of the S&P 500 is not a guarantee of future performance (yeap, and we'll get back to that!)

Antwort Is the S&P 500 only large-cap stocks? Weitere Antworten – Is the S&P 500 all large cap

Large-cap stocks are represented by the S&P 500; mid-cap stocks by the S&P MidCap 400 Index; and small-cap stocks by the S&P SmallCap 600 Index. These indexes are unmanaged and do not take into account the fees, expenses, and taxes associated with investing.As the list below shows, the biggest companies also represent the biggest industry sector in the S&P 500: information technology. This is followed by health care, consumer discretionary, financials, communications services, industrials, consumer staples, energy, real estate, materials, and utilities.

Where can I buy a S&P 500 : Open an investment account: Select a reputable brokerage platform that offers access to the S&P 500. Companies such as Schwab, Fidelity or Vanguard offer their own proprietary S&P 500 index funds, as do many others. Create an account, complete the necessary paperwork and fund your account to begin investing.

Is S&P small-cap or large-cap

The S&P 500 is used for large cap. Russell MidCap is used for mid cap. Russell 2000 is used for small cap. All data are as of January 19, 2024.

How do you know if a stock is large-cap or mid-cap : And based on the market cap, the company is either categorized under small cap, mid cap, or large cap respectively. The first 100 companies ranked according to their market capitalization by the stock exchanges are known as large cap companies. These stocks have a market cap of more than Rs. 20,000.

The S&P 500 Index, or Standard & Poor's 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.

The S&P 500 is a stock market index maintained by S&P Dow Jones Indices. It comprises 503 common stocks which are issued by 500 large-cap companies traded on American stock exchanges (including the 30 companies that compose the Dow Jones Industrial Average).

Can you buy small amounts of S&P 500

If you are investing in an S&P 500 index fund:

If your index fund has no minimum, you can usually purchase in any dollar amount. If your index fund has a minimum, then you have to purchase at least the minimum amount. If your index fund has an expense ratio, you'll be charged that as a fee.The S&P 500 is a stock market index maintained by S&P Dow Jones Indices. It comprises 503 common stocks which are issued by 500 large-cap companies traded on American stock exchanges (including the 30 companies that compose the Dow Jones Industrial Average).You can't directly invest in the S&P 500 because it's an index, but you can invest in one of the many funds that use it as a benchmark and follow its composition and performance.

Large-cap corporations, or those with larger market capitalizations of $10 billion or more, tend to grow more slowly than small caps, which have values between $250 million and $2 billion.

How to know if a stock is small-cap or mid-cap : Large cap: Companies ranked between 1 and 100, when sorted by market capitalisation. Mid cap: Companies ranked between 101 and 250, when sorted by market capitalisation. Small cap: Companies ranked beyond 250, when sorted by market capitalisation.

Is S and P 500 the same as total stock : Pretty much by definition, the S&P 500 is made up of large-cap companies. A total market index is mostly large-cap stocks, but by definition includes all the mid-cap and small-cap stocks as well.

Is S&P 500 a stock or fund

The S&P 500 hit a new all-time high on May 15, 2024. The S&P 500 is a stock market index composed of about 500 publicly traded companies. You cannot directly invest in the index itself. You can buy individual stocks of companies in the S&P 500, or buy an S&P 500 index fund or ETF.

The index serves as a gauge for the U.S. mid-cap equities sector and is the most widely followed mid-cap index.Through its Schwab Stock Slices™ program, Charles Schwab offers fractional shares of any stock on the S&P 500. You can choose a single slice (fractional share) to up to 30 slices, with rates as low as $5 a slice. Similar to traditional stocks, fractional shares at Schwab are traded commission-free online.

Is it OK to only invest in S&P 500 : Investing only in the S&P 500 does not provide the broad diversification that minimizes risk. Economic downturns and bear markets can still deliver large losses. The past performance of the S&P 500 is not a guarantee of future performance (yeap, and we'll get back to that!)