HOW DIFFERENT ARE THE DOW AND THE S&P 500 Their performances have historically tracked relatively closely with each other, but the S&P 500 has been better recently. Its 27.5% rise for the last 12 months easily tops the 19.7% gain for the Dow.There is a reason, though, why the Dow is the financial media's most referenced U.S. market index. Despite all the criticism, it has actually proven to be a fairly reliable indicator of where the stock market and economy are heading.It is a momentum indicator which indicates the current closing price of the stock in relation to its high & low of the past 14 days. Its purpose is to tell whether a stock is trading near the high or the low, or somewhere in between of its recent trading range.

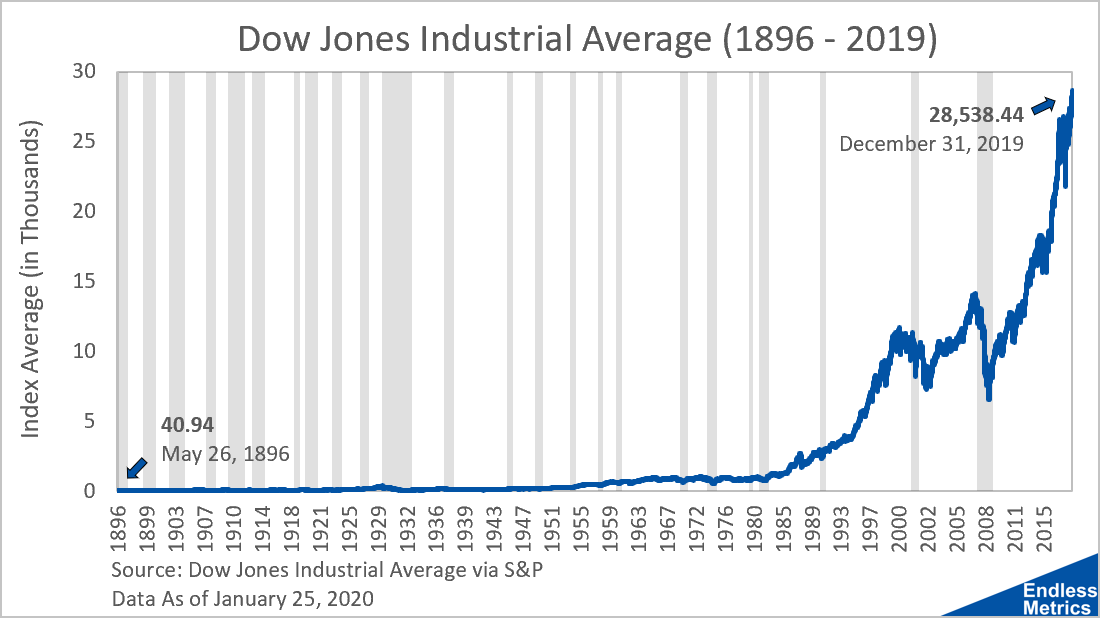

Is the Dow still relevant : Over 120 years later, the Dow, as it is often called, is one of the most-cited indices in the world and is often considered a barometer of the US economy.

Why is S&P better than Dow

Depending on the economy, and the state of the markets, one index may produce higher returns than the others do. For example, in rising markets, the S&P 500 can produce higher gains compared to the Dow due to the presence of more sectors and small-cap stocks in its portfolio.

Should I invest in Dow Nasdaq or S&P 500 : So, if you are looking to own a more diversified basket of stocks, the S&P 500 will be the right fit for you. However, those who are comfortable with the slightly higher risk for the extra returns that investing in Nasdaq 100 based fund might generate will be better off with Nasdaq 100.

Produced by the Bureau of Economic Analysis, GDP data is ranked as one of the three most influential economic measures that affect U.S. financial markets. Gross Domestic Product (GDP), a widely used indicator, refers to the total gross value added by all resident producers in the economy. Growth in the economy is measured by the change in GDP at constant price.

What is the Dow Jones vs S&P

Key Takeaways

The DJIA tracks the stock prices of 30 of the biggest American companies. The S&P 500 tracks 500 large-cap American stocks. Both offer a big-picture view of the state of the stock markets in general.Dow Jones Industrial Average Index is just a number that lets you track performance of the instruments comprising the index, so you can't invest in it directly.The Dow tracks 30 large U.S. companies but has limited representation. The Nasdaq indexes, associated with the Nasdaq exchange, focus more heavily on tech and other stocks. The S&P 500, with 500 large U.S. companies, offers a more comprehensive market view, weighted by market capitalization. They also tend to have similar, though not identical, levels of volatility. But there are important differences in performance that reflect the differences in their composition and style. The Dow contains far fewer stocks than the S&P 500, and as a result, can exhibit higher risk.

Is anything better than the sp500 : The S&P 500's track record is impressive, but the Vanguard Growth ETF has outperformed it. The Vanguard Growth ETF leans heavily toward tech businesses that exhibit faster revenue and earnings gains. No matter what investments you choose, it's always smart to keep a long-term mindset.

Does Nasdaq outperform S&P : Nasdaq 100 has significantly outperformed S&P 500 in terms of performance. Over the past 15 years, Nasdaq 100 has delivered a CAGR of around 16%, while S&P 500 has returned about 8%.

What is the US leading indicator

před 3 dny

The LEI is a predictive variable that anticipates (or “leads”) turning points in the business cycle by around 7 months. Gross Domestic Product (GDP), a widely used indicator, refers to the total gross value added by all resident producers in the economy.GDP Contraction

It's a metric that measures a country's economic output i.e., the market value of all final goods and services produced within the country. A GDP contraction or downturn often signals an economic downturn, and many times turn into a recession.

What is the strongest indicator of economic growth : the gross domestic product (GDP)

Economists and statisticians use several methods to track economic growth. The most well-known and frequently tracked is the gross domestic product (GDP).

Antwort Is The Dow Jones a good indicator? Weitere Antworten – Is the Dow or S&P better

HOW DIFFERENT ARE THE DOW AND THE S&P 500 Their performances have historically tracked relatively closely with each other, but the S&P 500 has been better recently. Its 27.5% rise for the last 12 months easily tops the 19.7% gain for the Dow.There is a reason, though, why the Dow is the financial media's most referenced U.S. market index. Despite all the criticism, it has actually proven to be a fairly reliable indicator of where the stock market and economy are heading.It is a momentum indicator which indicates the current closing price of the stock in relation to its high & low of the past 14 days. Its purpose is to tell whether a stock is trading near the high or the low, or somewhere in between of its recent trading range.

Is the Dow still relevant : Over 120 years later, the Dow, as it is often called, is one of the most-cited indices in the world and is often considered a barometer of the US economy.

Why is S&P better than Dow

Depending on the economy, and the state of the markets, one index may produce higher returns than the others do. For example, in rising markets, the S&P 500 can produce higher gains compared to the Dow due to the presence of more sectors and small-cap stocks in its portfolio.

Should I invest in Dow Nasdaq or S&P 500 : So, if you are looking to own a more diversified basket of stocks, the S&P 500 will be the right fit for you. However, those who are comfortable with the slightly higher risk for the extra returns that investing in Nasdaq 100 based fund might generate will be better off with Nasdaq 100.

Produced by the Bureau of Economic Analysis, GDP data is ranked as one of the three most influential economic measures that affect U.S. financial markets.

Gross Domestic Product (GDP), a widely used indicator, refers to the total gross value added by all resident producers in the economy. Growth in the economy is measured by the change in GDP at constant price.

What is the Dow Jones vs S&P

Key Takeaways

The DJIA tracks the stock prices of 30 of the biggest American companies. The S&P 500 tracks 500 large-cap American stocks. Both offer a big-picture view of the state of the stock markets in general.Dow Jones Industrial Average Index is just a number that lets you track performance of the instruments comprising the index, so you can't invest in it directly.The Dow tracks 30 large U.S. companies but has limited representation. The Nasdaq indexes, associated with the Nasdaq exchange, focus more heavily on tech and other stocks. The S&P 500, with 500 large U.S. companies, offers a more comprehensive market view, weighted by market capitalization.

They also tend to have similar, though not identical, levels of volatility. But there are important differences in performance that reflect the differences in their composition and style. The Dow contains far fewer stocks than the S&P 500, and as a result, can exhibit higher risk.

Is anything better than the sp500 : The S&P 500's track record is impressive, but the Vanguard Growth ETF has outperformed it. The Vanguard Growth ETF leans heavily toward tech businesses that exhibit faster revenue and earnings gains. No matter what investments you choose, it's always smart to keep a long-term mindset.

Does Nasdaq outperform S&P : Nasdaq 100 has significantly outperformed S&P 500 in terms of performance. Over the past 15 years, Nasdaq 100 has delivered a CAGR of around 16%, while S&P 500 has returned about 8%.

What is the US leading indicator

před 3 dny

The LEI is a predictive variable that anticipates (or “leads”) turning points in the business cycle by around 7 months.

Gross Domestic Product (GDP), a widely used indicator, refers to the total gross value added by all resident producers in the economy.GDP Contraction

It's a metric that measures a country's economic output i.e., the market value of all final goods and services produced within the country. A GDP contraction or downturn often signals an economic downturn, and many times turn into a recession.

What is the strongest indicator of economic growth : the gross domestic product (GDP)

Economists and statisticians use several methods to track economic growth. The most well-known and frequently tracked is the gross domestic product (GDP).