Large-cap stocks are represented by the S&P 500; mid-cap stocks by the S&P MidCap 400 Index; and small-cap stocks by the S&P SmallCap 600 Index. These indexes are unmanaged and do not take into account the fees, expenses, and taxes associated with investing.$44.420 trillion dollars

The S&P 500 has a market capitalization of $44.420 trillion dollars. The total market cap is calculated by summing the market capitalization of every company in the index. Each company's calculated market cap is based on the outstanding float share count.

10 Smallest Companies in the S&P500 Index. Business & Books. ·

495. Comerica Inc. ($CMA)

496. Mohawk Industries Inc. ($MHK)

497. Organon & Co ($OGN) Sector: Healthcare.

498. Ralph Lauren Corp ($RL) Sector: Consumer Cyclical.

499. Zions Bancorp ($ZION)

500. Fox Corp Class B ($FOX)

501. Lincoln National Corp ($LNC)

Where can I buy a S&P 500 : Open an investment account: Select a reputable brokerage platform that offers access to the S&P 500. Companies such as Schwab, Fidelity or Vanguard offer their own proprietary S&P 500 index funds, as do many others. Create an account, complete the necessary paperwork and fund your account to begin investing.

Is S&P 500 large-cap or mid-cap

Many indices and benchmarks follow large-cap companies such as the Dow Jones Industrial Average (DJIA) and the Standard and Poor's 500 (S&P 500).

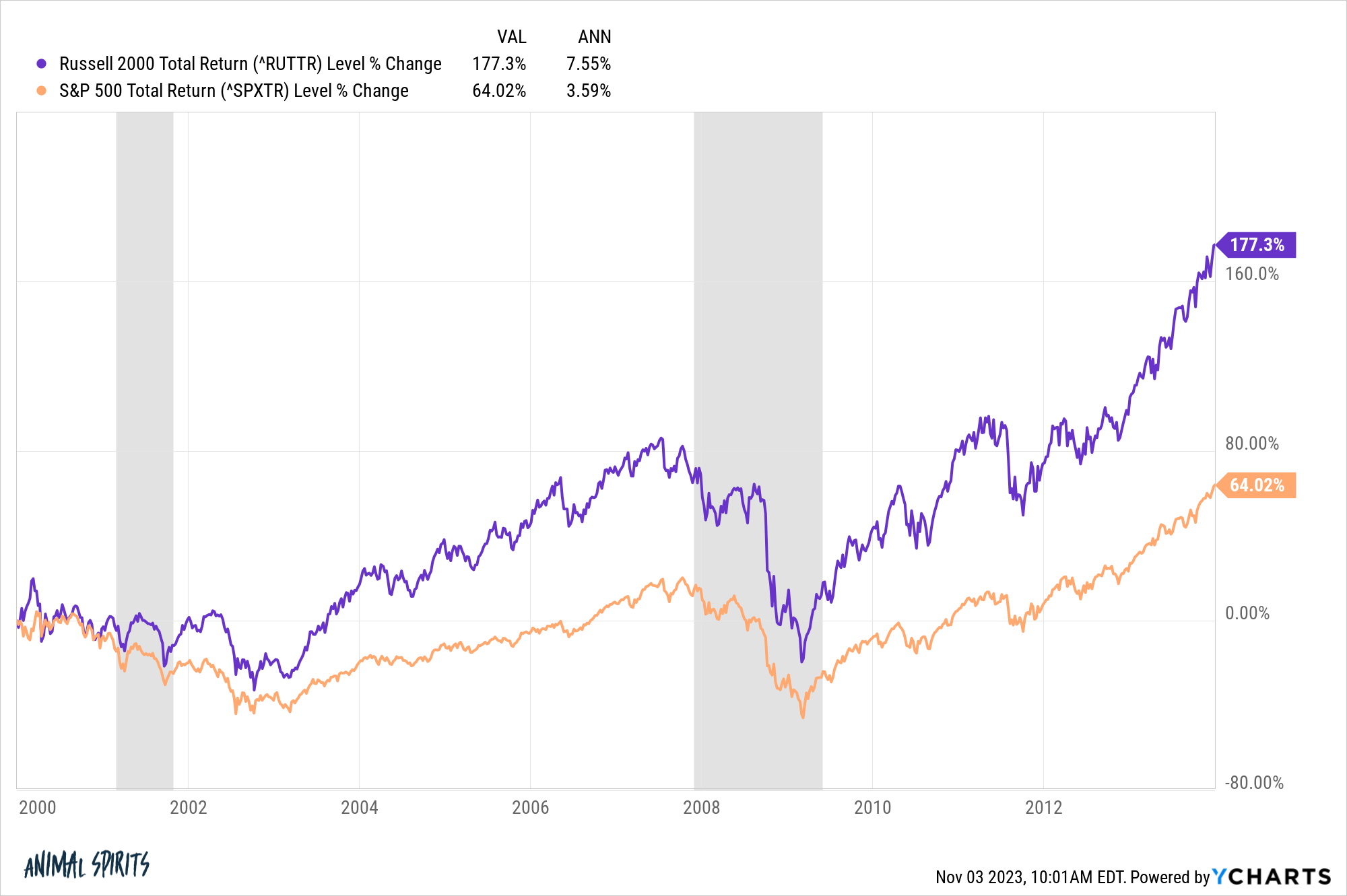

Is S&P small-cap or large-cap : The S&P 500 is used for large cap. Russell MidCap is used for mid cap. Russell 2000 is used for small cap. All data are as of January 19, 2024.

If you are investing in an S&P 500 index fund:

If your index fund has no minimum, you can usually purchase in any dollar amount. If your index fund has a minimum, then you have to purchase at least the minimum amount. If your index fund has an expense ratio, you'll be charged that as a fee. The S&P 500 is a stock market index maintained by S&P Dow Jones Indices. It comprises 503 common stocks which are issued by 500 large-cap companies traded on American stock exchanges (including the 30 companies that compose the Dow Jones Industrial Average).

Can you buy the entire S&P 500

The S&P 500 is a stock market index composed of about 500 publicly traded companies. You cannot directly invest in the index itself. You can buy individual stocks of companies in the S&P 500, or buy an S&P 500 index fund or ETF.You can't directly invest in the S&P 500 because it's an index, but you can invest in one of the many funds that use it as a benchmark and follow its composition and performance.And based on the market cap, the company is either categorized under small cap, mid cap, or large cap respectively. The first 100 companies ranked according to their market capitalization by the stock exchanges are known as large cap companies. These stocks have a market cap of more than Rs. 20,000. The index serves as a gauge for the U.S. mid-cap equities sector and is the most widely followed mid-cap index.

What is the cheapest way to buy the S&P 500 : To invest in S&P 500 ETFs, investors can gain exposure through discount brokers with commission-free trading. S&P 500 index funds trade through brokers and discount brokers and may be accessed directly from the fund companies.

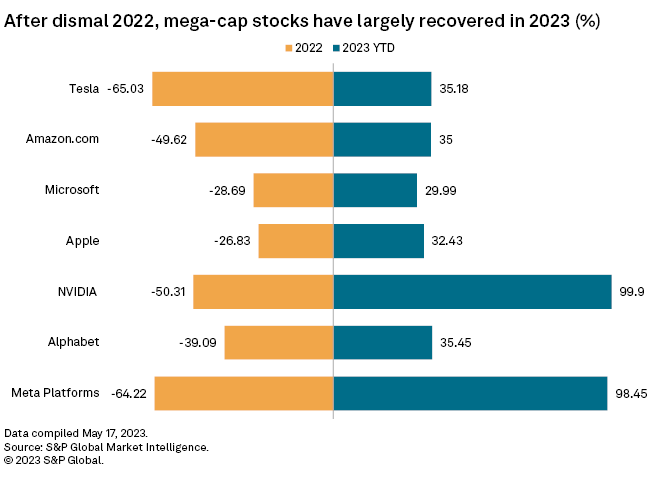

Is S&P overvalued : Bottom Line: The S&P, on a capitalization-weighted perspective, is expensive. However, most of the overvaluation is concentrated in a handful of high-quality, mega-cap technology companies, many of which could benefit from innovations in artificial intelligence.

Is S and P 500 a good investment

Investing in an S&P 500 fund can instantly diversify your portfolio and is generally considered less risky. S&P 500 index funds or ETFs will track the performance of the S&P 500, which means when the S&P 500 does well, your investment will, too. (The opposite is also true, of course.) While most S&P index funds will have similar holdings, they may vary in terms of their fees, such as expense ratios. Expense ratios are annual fees you pay to help cover a fund's expenses.There are never any guarantees when investing, but an S&P 500 index fund is about as close as you can get to guaranteed positive long-term returns. In fact, analysts at Crestmont Research examined the S&P 500's rolling 20-year total returns to find out how many of those periods resulted in positive total gains.

What is Europe’s version of S&P 500 : STOXX Europe 600 index

The equivalent of the S&P 500 in Europe is the STOXX Europe 600 index, as it represents the performance of European companies across various sectors.

Antwort Is S&P 500 only large-cap? Weitere Antworten – Is the S&P 500 all large-cap

Large-cap stocks are represented by the S&P 500; mid-cap stocks by the S&P MidCap 400 Index; and small-cap stocks by the S&P SmallCap 600 Index. These indexes are unmanaged and do not take into account the fees, expenses, and taxes associated with investing.$44.420 trillion dollars

The S&P 500 has a market capitalization of $44.420 trillion dollars. The total market cap is calculated by summing the market capitalization of every company in the index. Each company's calculated market cap is based on the outstanding float share count.

Where can I buy a S&P 500 : Open an investment account: Select a reputable brokerage platform that offers access to the S&P 500. Companies such as Schwab, Fidelity or Vanguard offer their own proprietary S&P 500 index funds, as do many others. Create an account, complete the necessary paperwork and fund your account to begin investing.

Is S&P 500 large-cap or mid-cap

Many indices and benchmarks follow large-cap companies such as the Dow Jones Industrial Average (DJIA) and the Standard and Poor's 500 (S&P 500).

Is S&P small-cap or large-cap : The S&P 500 is used for large cap. Russell MidCap is used for mid cap. Russell 2000 is used for small cap. All data are as of January 19, 2024.

If you are investing in an S&P 500 index fund:

If your index fund has no minimum, you can usually purchase in any dollar amount. If your index fund has a minimum, then you have to purchase at least the minimum amount. If your index fund has an expense ratio, you'll be charged that as a fee.

The S&P 500 is a stock market index maintained by S&P Dow Jones Indices. It comprises 503 common stocks which are issued by 500 large-cap companies traded on American stock exchanges (including the 30 companies that compose the Dow Jones Industrial Average).

Can you buy the entire S&P 500

The S&P 500 is a stock market index composed of about 500 publicly traded companies. You cannot directly invest in the index itself. You can buy individual stocks of companies in the S&P 500, or buy an S&P 500 index fund or ETF.You can't directly invest in the S&P 500 because it's an index, but you can invest in one of the many funds that use it as a benchmark and follow its composition and performance.And based on the market cap, the company is either categorized under small cap, mid cap, or large cap respectively. The first 100 companies ranked according to their market capitalization by the stock exchanges are known as large cap companies. These stocks have a market cap of more than Rs. 20,000.

The index serves as a gauge for the U.S. mid-cap equities sector and is the most widely followed mid-cap index.

What is the cheapest way to buy the S&P 500 : To invest in S&P 500 ETFs, investors can gain exposure through discount brokers with commission-free trading. S&P 500 index funds trade through brokers and discount brokers and may be accessed directly from the fund companies.

Is S&P overvalued : Bottom Line: The S&P, on a capitalization-weighted perspective, is expensive. However, most of the overvaluation is concentrated in a handful of high-quality, mega-cap technology companies, many of which could benefit from innovations in artificial intelligence.

Is S and P 500 a good investment

Investing in an S&P 500 fund can instantly diversify your portfolio and is generally considered less risky. S&P 500 index funds or ETFs will track the performance of the S&P 500, which means when the S&P 500 does well, your investment will, too. (The opposite is also true, of course.)

While most S&P index funds will have similar holdings, they may vary in terms of their fees, such as expense ratios. Expense ratios are annual fees you pay to help cover a fund's expenses.There are never any guarantees when investing, but an S&P 500 index fund is about as close as you can get to guaranteed positive long-term returns. In fact, analysts at Crestmont Research examined the S&P 500's rolling 20-year total returns to find out how many of those periods resulted in positive total gains.

What is Europe’s version of S&P 500 : STOXX Europe 600 index

The equivalent of the S&P 500 in Europe is the STOXX Europe 600 index, as it represents the performance of European companies across various sectors.