Because the S&P 500 contains hundreds of large companies and represents the lion's share of total stock market value, it is considered a much better gauge of how the market is performing, even though it excludes thousands of smaller and midsize companies.The CAGR returns have been in the range of 23-40%. The significantly higher allocation towards FAANG stocks has ensured that Nasdaq 100 has outperformed S&P 500 index by a wide margin.Answer & Explanation

The S&P 500 covers a broader spectrum of industries, offering better diversification compared to the DJIA, which is more concentrated in industrial companies.

What is one advantage the S&P 500 has in comparison to the Dow Jones Industrial Average DJIA ) : The S&P500 is considered less volatile than the DJIA.

Should I buy Dow or S&P

The Bottom Line

While both the DJIA and S&P 500 are used by investors to determine the general trend of the U.S. stock market, the S&P 500 is more encompassing, as it is based on a larger sample of total U.S. stocks.

Is Dow safer than S&P : They also tend to have similar, though not identical, levels of volatility. But there are important differences in performance that reflect the differences in their composition and style. The Dow contains far fewer stocks than the S&P 500, and as a result, can exhibit higher risk.

The S&P 500's track record is impressive, but the Vanguard Growth ETF has outperformed it. The Vanguard Growth ETF leans heavily toward tech businesses that exhibit faster revenue and earnings gains. No matter what investments you choose, it's always smart to keep a long-term mindset. While both the DJIA and S&P 500 are used by investors to determine the general trend of the U.S. stock market, the S&P 500 is more encompassing, as it is based on a larger sample of total U.S. stocks.

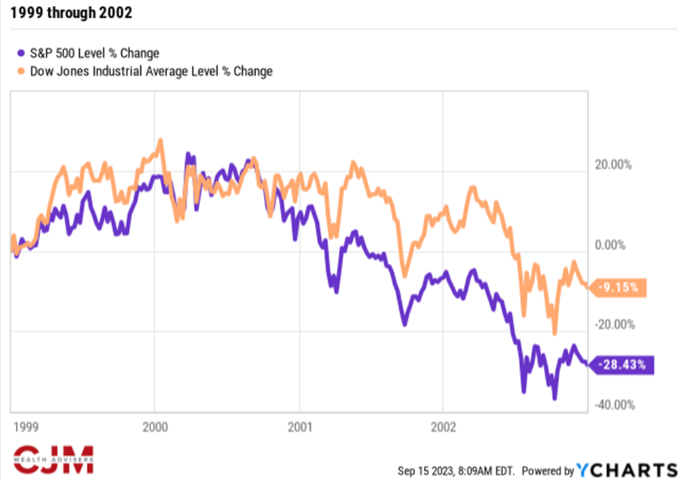

Why does the Dow outperform the S&P

In these circumstances, one contributing factor is that historically The Dow has been somewhat more value-oriented, tracking well-established large-cap companies whose prices can tend to be less volatile. The S&P 500, while more diversified than The Dow, is sometimes more volatile.A better bet would be to buy an ETF that is focused on generating dividend income. A good option is Schwab U.S. Dividend Equity ETF, which offers a yield that's nearly three times the size of what you'd collect from an S&P 500 tracking ETF.In fact, research shows it's actually harder to lose money with the S&P 500 than it is to make money if you keep a long-term outlook. Analysts at Crestmont Research examined the S&P 500's historic performance to determine how often it was able to earn positive returns in a 20-year period. What are the risks associated with investing in the S&P 500 The S&P 500 carries market risk, as its value fluctuates with overall market performance, as well as the performance of heavily weighted stocks and sectors.

Why you shouldn’t just invest in the S&P 500 : The one time it's okay to choose a single investment

That's because your investment gives you access to the broad stock market. Meanwhile, if you only invest in S&P 500 ETFs, you won't beat the broad market. Rather, you can expect your portfolio's performance to be in line with that of the broad market.

Is it possible to beat sp500 : It's not easy to beat the S&P 500. In fact, most hedge funds and mutual funds underperform the S&P 500 over an extended period of time. That's because the S&P 500 selects from a large pool of stocks and continuously refreshes its holdings, dumping underperformers and replacing them with up-and-coming growth stocks.

Should I invest in S&P or Dow Jones

The Bottom Line. While both the DJIA and S&P 500 are used by investors to determine the general trend of the U.S. stock market, the S&P 500 is more encompassing, as it is based on a larger sample of total U.S. stocks. S&P 500 index funds can help you instantly diversify your portfolio by providing exposure to some of the biggest companies in the U.S. Index funds in general are fairly inexpensive compared with other types of mutual funds, making them an attractive option for most investors.The Dow contains far fewer stocks than the S&P 500, and as a result, can exhibit higher risk.

Can anyone beat the S&P 500 : It's not easy to beat the S&P 500. In fact, most hedge funds and mutual funds underperform the S&P 500 over an extended period of time. That's because the S&P 500 selects from a large pool of stocks and continuously refreshes its holdings, dumping underperformers and replacing them with up-and-coming growth stocks.

Antwort Is S&P 500 better than Dow Jones? Weitere Antworten – Is S&P 500 better than Dow Jones

Because the S&P 500 contains hundreds of large companies and represents the lion's share of total stock market value, it is considered a much better gauge of how the market is performing, even though it excludes thousands of smaller and midsize companies.The CAGR returns have been in the range of 23-40%. The significantly higher allocation towards FAANG stocks has ensured that Nasdaq 100 has outperformed S&P 500 index by a wide margin.Answer & Explanation

The S&P 500 covers a broader spectrum of industries, offering better diversification compared to the DJIA, which is more concentrated in industrial companies.

What is one advantage the S&P 500 has in comparison to the Dow Jones Industrial Average DJIA ) : The S&P500 is considered less volatile than the DJIA.

Should I buy Dow or S&P

The Bottom Line

While both the DJIA and S&P 500 are used by investors to determine the general trend of the U.S. stock market, the S&P 500 is more encompassing, as it is based on a larger sample of total U.S. stocks.

Is Dow safer than S&P : They also tend to have similar, though not identical, levels of volatility. But there are important differences in performance that reflect the differences in their composition and style. The Dow contains far fewer stocks than the S&P 500, and as a result, can exhibit higher risk.

The S&P 500's track record is impressive, but the Vanguard Growth ETF has outperformed it. The Vanguard Growth ETF leans heavily toward tech businesses that exhibit faster revenue and earnings gains. No matter what investments you choose, it's always smart to keep a long-term mindset.

While both the DJIA and S&P 500 are used by investors to determine the general trend of the U.S. stock market, the S&P 500 is more encompassing, as it is based on a larger sample of total U.S. stocks.

Why does the Dow outperform the S&P

In these circumstances, one contributing factor is that historically The Dow has been somewhat more value-oriented, tracking well-established large-cap companies whose prices can tend to be less volatile. The S&P 500, while more diversified than The Dow, is sometimes more volatile.A better bet would be to buy an ETF that is focused on generating dividend income. A good option is Schwab U.S. Dividend Equity ETF, which offers a yield that's nearly three times the size of what you'd collect from an S&P 500 tracking ETF.In fact, research shows it's actually harder to lose money with the S&P 500 than it is to make money if you keep a long-term outlook. Analysts at Crestmont Research examined the S&P 500's historic performance to determine how often it was able to earn positive returns in a 20-year period.

What are the risks associated with investing in the S&P 500 The S&P 500 carries market risk, as its value fluctuates with overall market performance, as well as the performance of heavily weighted stocks and sectors.

Why you shouldn’t just invest in the S&P 500 : The one time it's okay to choose a single investment

That's because your investment gives you access to the broad stock market. Meanwhile, if you only invest in S&P 500 ETFs, you won't beat the broad market. Rather, you can expect your portfolio's performance to be in line with that of the broad market.

Is it possible to beat sp500 : It's not easy to beat the S&P 500. In fact, most hedge funds and mutual funds underperform the S&P 500 over an extended period of time. That's because the S&P 500 selects from a large pool of stocks and continuously refreshes its holdings, dumping underperformers and replacing them with up-and-coming growth stocks.

Should I invest in S&P or Dow Jones

The Bottom Line. While both the DJIA and S&P 500 are used by investors to determine the general trend of the U.S. stock market, the S&P 500 is more encompassing, as it is based on a larger sample of total U.S. stocks.

S&P 500 index funds can help you instantly diversify your portfolio by providing exposure to some of the biggest companies in the U.S. Index funds in general are fairly inexpensive compared with other types of mutual funds, making them an attractive option for most investors.The Dow contains far fewer stocks than the S&P 500, and as a result, can exhibit higher risk.

Can anyone beat the S&P 500 : It's not easy to beat the S&P 500. In fact, most hedge funds and mutual funds underperform the S&P 500 over an extended period of time. That's because the S&P 500 selects from a large pool of stocks and continuously refreshes its holdings, dumping underperformers and replacing them with up-and-coming growth stocks.