We operate under the highest ethical standards and work tirelessly to provide long-term value to all stakeholders. Since our public listing in 1994, we have delivered compound average annual total shareholder return of 13.6%, outperforming the US REIT sector and the S&P 500 during that timeframe.Definition of 10 Year Price Total Return

Ten Year Stock Price Total Return for Realty Income is calculated as follows: Last Close Price [ 50.17 ] / Adj Prior Close Price [ 19.15 ] (-) 1 (=) Total Return [ 161.9% ] Prior price dividend adjustment factor is 0.62.O Stock 12 Month Forecast

Based on 8 Wall Street analysts offering 12 month price targets for Realty Income in the last 3 months. The average price target is $58.63 with a high forecast of $65.00 and a low forecast of $56.00. The average price target represents a 6.35% change from the last price of $55.13.

Who owns Realty Income : The ownership structure of Realty Income (O) stock is a mix of institutional, retail and individual investors. Approximately 68.61% of the company's stock is owned by Institutional Investors, 0.24% is owned by Insiders and 31.14% is owned by Public Companies and Individual Investors.

Is Realty Income stable

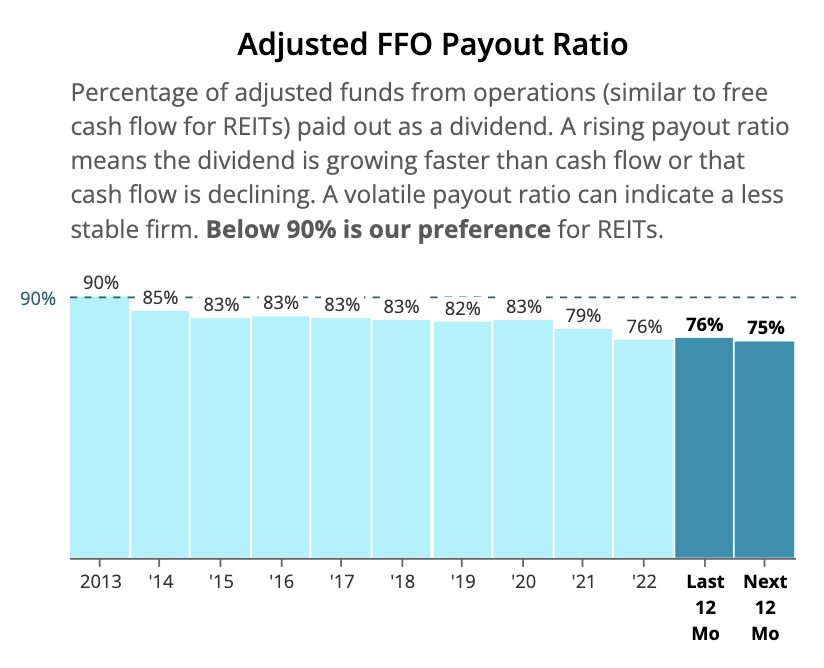

The stock's dividend recently yielded 5.9%, and Realty Income has raised its monthly dividend 124 times since 1994 — with an average annual increase of 4.3%. Realty Income is a low-volatility stock, partly because of the overall stability of its cash flow.

Why is Realty Income dropping : As borrowing costs go up through higher interest rates, it becomes more expensive for the company to finance its expansions. Second, if interest rates go up, or don't fall as quickly as expected, that makes bonds more attractive by comparison, as most investors own Realty Income stock in part for its dividend.

We remain committed to sustainable business practices in our day-to-day activities by encouraging a culture of environmental responsibility at our headquarters and within our communities. We work with our clients to promote environmental responsibility at the properties we own. However, much depends on the kind of investment that generated the return. If a lot of risk was taken on and it only produced a 10% return, it could be somewhat disappointing. If a 10% return was generated out of a low risk savings account, it would be exceptionally good.

Is Realty Income good long term

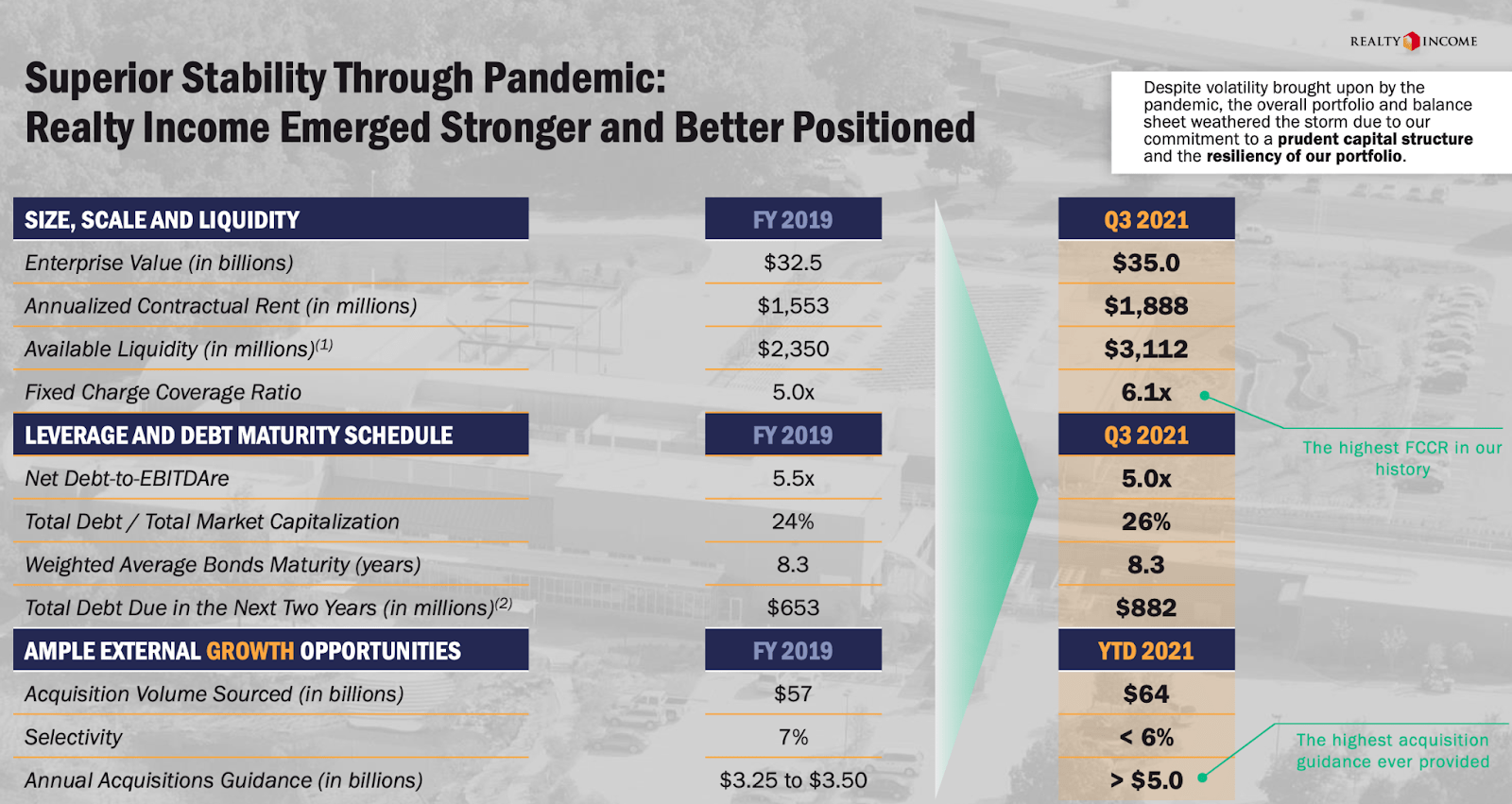

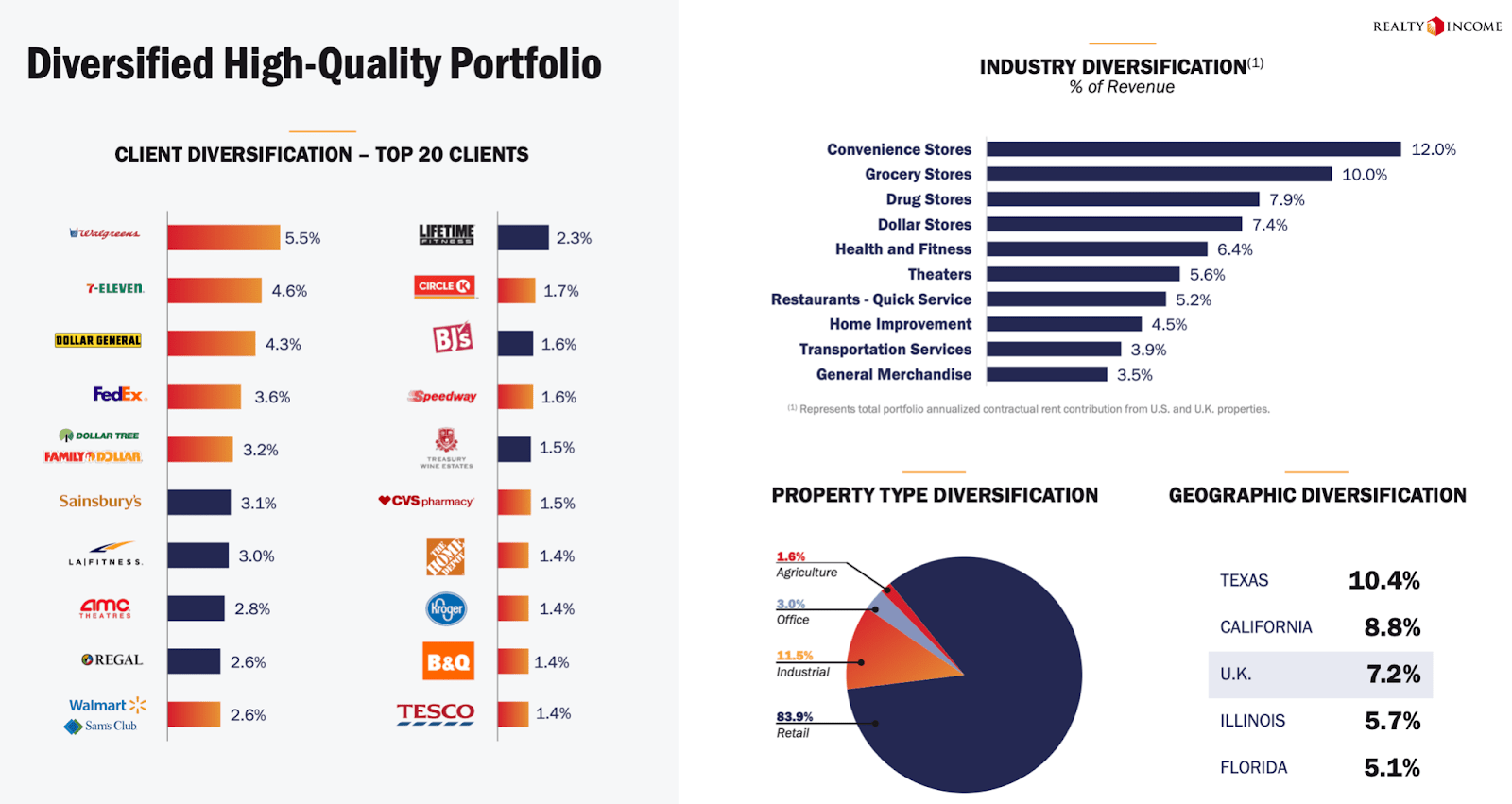

Realty Income (O 0.14%) is often considered a stable long-term investment for conservative income investors. It's one of the world's largest real estate investment trusts (REITs), and its tenants include large retailers like Walgreens, 7-Eleven, Dollar General, Dollar Tree, and Walmart.Realty Income is a net-lease real estate investment trust. It is by far the largest REIT in this property niche. That said, there's still plenty of room for Realty Income to keep growing.Total debt on the balance sheet as of December 2023 : $21.98 B. According to Realty Income's latest financial reports the company's total debt is $21.98 B. A company's total debt is the sum of all current and non-current debts. Realty Income Corporation is a real estate investment trust that invests in free-standing, single-tenant commercial properties in the United States, Spain and the United Kingdom that are subject to NNN Leases. The company is organized in Maryland with its headquarters in San Diego, California.

Is Realty Income good long-term : Realty Income (O 0.14%) is often considered a stable long-term investment for conservative income investors. It's one of the world's largest real estate investment trusts (REITs), and its tenants include large retailers like Walgreens, 7-Eleven, Dollar General, Dollar Tree, and Walmart.

How safe is Realty Income dividend : Dividend income we provide to our shareholders tends to be reliable since it is supported by long-term leases with tenants we have determined can be relied upon to make lease payments.

Is a 7% return realistic

While quite a few personal finance pundits have suggested that a stock investor can expect a 12% annual return, when you incorporate the impact of volatility and inflation, 7% is a more accurate historical estimate for an aggressive investor (someone primarily invested in stocks), and 5% would be more appropriate for … If you invest $10,000 and make an 8% annual return, you'll have $100,627 after 30 years. By also investing $500 per month over that timeframe, your ending balance would be $780,326. Exchange-traded funds (ETFs) and mutual funds are both excellent investment options.Higher interest rates pose a problem for Realty Income

First, like most REITs, Realty Income relies on borrowing money to buy new properties and expand its business. As borrowing costs go up through higher interest rates, it becomes more expensive for the company to finance its expansions.

Is Realty Income safe long term : Dividend income we provide to our shareholders tends to be reliable since it is supported by long-term leases with tenants we have determined can be relied upon to make lease payments. Throughout our operating history, we have never decreased the amount of our regular monthly dividend payment.

Antwort Is Realty Income safe? Weitere Antworten – Is Realty Income a good investment

We operate under the highest ethical standards and work tirelessly to provide long-term value to all stakeholders. Since our public listing in 1994, we have delivered compound average annual total shareholder return of 13.6%, outperforming the US REIT sector and the S&P 500 during that timeframe.Definition of 10 Year Price Total Return

Ten Year Stock Price Total Return for Realty Income is calculated as follows: Last Close Price [ 50.17 ] / Adj Prior Close Price [ 19.15 ] (-) 1 (=) Total Return [ 161.9% ] Prior price dividend adjustment factor is 0.62.O Stock 12 Month Forecast

Based on 8 Wall Street analysts offering 12 month price targets for Realty Income in the last 3 months. The average price target is $58.63 with a high forecast of $65.00 and a low forecast of $56.00. The average price target represents a 6.35% change from the last price of $55.13.

Who owns Realty Income : The ownership structure of Realty Income (O) stock is a mix of institutional, retail and individual investors. Approximately 68.61% of the company's stock is owned by Institutional Investors, 0.24% is owned by Insiders and 31.14% is owned by Public Companies and Individual Investors.

Is Realty Income stable

The stock's dividend recently yielded 5.9%, and Realty Income has raised its monthly dividend 124 times since 1994 — with an average annual increase of 4.3%. Realty Income is a low-volatility stock, partly because of the overall stability of its cash flow.

Why is Realty Income dropping : As borrowing costs go up through higher interest rates, it becomes more expensive for the company to finance its expansions. Second, if interest rates go up, or don't fall as quickly as expected, that makes bonds more attractive by comparison, as most investors own Realty Income stock in part for its dividend.

We remain committed to sustainable business practices in our day-to-day activities by encouraging a culture of environmental responsibility at our headquarters and within our communities. We work with our clients to promote environmental responsibility at the properties we own.

However, much depends on the kind of investment that generated the return. If a lot of risk was taken on and it only produced a 10% return, it could be somewhat disappointing. If a 10% return was generated out of a low risk savings account, it would be exceptionally good.

Is Realty Income good long term

Realty Income (O 0.14%) is often considered a stable long-term investment for conservative income investors. It's one of the world's largest real estate investment trusts (REITs), and its tenants include large retailers like Walgreens, 7-Eleven, Dollar General, Dollar Tree, and Walmart.Realty Income is a net-lease real estate investment trust. It is by far the largest REIT in this property niche. That said, there's still plenty of room for Realty Income to keep growing.Total debt on the balance sheet as of December 2023 : $21.98 B. According to Realty Income's latest financial reports the company's total debt is $21.98 B. A company's total debt is the sum of all current and non-current debts.

Realty Income Corporation is a real estate investment trust that invests in free-standing, single-tenant commercial properties in the United States, Spain and the United Kingdom that are subject to NNN Leases. The company is organized in Maryland with its headquarters in San Diego, California.

Is Realty Income good long-term : Realty Income (O 0.14%) is often considered a stable long-term investment for conservative income investors. It's one of the world's largest real estate investment trusts (REITs), and its tenants include large retailers like Walgreens, 7-Eleven, Dollar General, Dollar Tree, and Walmart.

How safe is Realty Income dividend : Dividend income we provide to our shareholders tends to be reliable since it is supported by long-term leases with tenants we have determined can be relied upon to make lease payments.

Is a 7% return realistic

While quite a few personal finance pundits have suggested that a stock investor can expect a 12% annual return, when you incorporate the impact of volatility and inflation, 7% is a more accurate historical estimate for an aggressive investor (someone primarily invested in stocks), and 5% would be more appropriate for …

If you invest $10,000 and make an 8% annual return, you'll have $100,627 after 30 years. By also investing $500 per month over that timeframe, your ending balance would be $780,326. Exchange-traded funds (ETFs) and mutual funds are both excellent investment options.Higher interest rates pose a problem for Realty Income

First, like most REITs, Realty Income relies on borrowing money to buy new properties and expand its business. As borrowing costs go up through higher interest rates, it becomes more expensive for the company to finance its expansions.

Is Realty Income safe long term : Dividend income we provide to our shareholders tends to be reliable since it is supported by long-term leases with tenants we have determined can be relied upon to make lease payments. Throughout our operating history, we have never decreased the amount of our regular monthly dividend payment.