Realty Income (O 0.14%) is often considered a stable long-term investment for conservative income investors. It's one of the world's largest real estate investment trusts (REITs), and its tenants include large retailers like Walgreens, 7-Eleven, Dollar General, Dollar Tree, and Walmart.Definition of 10 Year Price Total Return

Ten Year Stock Price Total Return for Realty Income is calculated as follows: Last Close Price [ 50.17 ] / Adj Prior Close Price [ 19.15 ] (-) 1 (=) Total Return [ 161.9% ] Prior price dividend adjustment factor is 0.62.O Stock 12 Month Forecast

Based on 8 Wall Street analysts offering 12 month price targets for Realty Income in the last 3 months. The average price target is $58.63 with a high forecast of $65.00 and a low forecast of $56.00. The average price target represents a 6.35% change from the last price of $55.13.

Is Realty Income stock overvalued : Compared to the current market price of 54.95 USD, Realty Income Corp is Undervalued by 6%. What is intrinsic value Realty Income Corp's market capitalization is 47.8B USD. O stock price is 54.95 USD.

Is Realty Income dividend safe

Dividend income we provide to our shareholders tends to be reliable since it is supported by long-term leases with tenants we have determined can be relied upon to make lease payments.

Is Realty Income Sustainable : We remain committed to sustainable business practices in our day-to-day activities by encouraging a culture of environmental responsibility at our headquarters and within our communities. We work with our clients to promote environmental responsibility at the properties we own.

While 10% might be the average, the returns in any given year are far from average. In fact, between 1926 and 2024, returns were in that “average” band of 8% to 12% only eight times. The rest of the time they were much lower or, usually, much higher. Realty Income is a net-lease real estate investment trust. It is by far the largest REIT in this property niche. That said, there's still plenty of room for Realty Income to keep growing.

Is OA buy hold or sell

A “buy” rating means analysts like the stock and think it's worth purchasing because its value is likely to increase. A “hold” rating is neutral. It means analysts are unsure which way share prices will move, so they recommend that you neither buy nor sell. A “sell” rating means analysts expect share prices to fall.A “buy” rating means analysts like the stock and think it's worth purchasing because its value is likely to increase. A “hold” rating is neutral. It means analysts are unsure which way share prices will move, so they recommend that you neither buy nor sell. A “sell” rating means analysts expect share prices to fall.With ample financial flexibility, the company remains well-poised to respond to any challenges and bank on growth opportunities. Moreover, with a healthy financial position and a lower debt-to-equity ratio compared with the industry, we expect the latest dividend rate to be sustainable. Non-traded REITs have little liquidity, meaning it's difficult for investors to sell them. Publicly traded REITs have the risk of losing value as interest rates rise, which typically sends investment capital into bonds.

How safe is Realty Income dividend : Dividend income we provide to our shareholders tends to be reliable since it is supported by long-term leases with tenants we have determined can be relied upon to make lease payments.

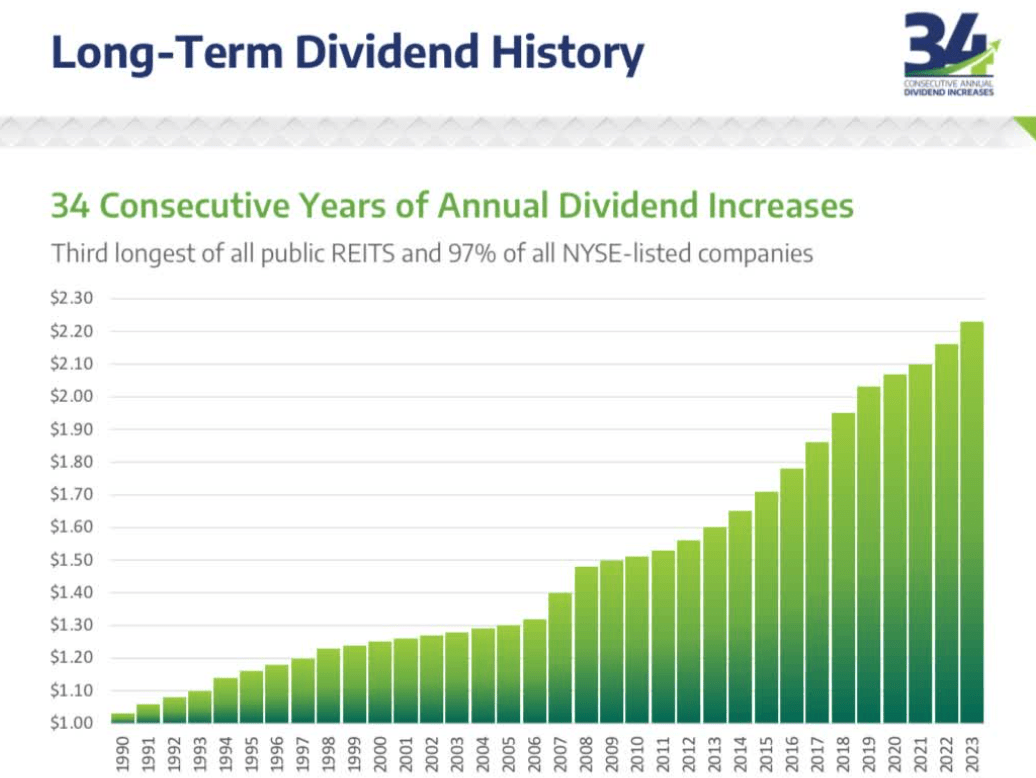

Has Realty Income ever cut its dividend : Realty Income has increased its dividend for 29 consecutive years, demonstrating to investors that it is serious about returning capital to its shareholders. Dividends make a significant difference in shareholder returns.

Is 7% return on investment realistic

General ROI: A positive ROI is generally considered good, with a normal ROI of 5-7% often seen as a reasonable expectation. However, a strong general ROI is something greater than 10%. Return on Stocks: On average, a ROI of 7% after inflation is often considered good, based on the historical returns of the market. 7 stocks that can deliver over 30% returns to make you rich in

Adani Enterprises | CMP: Rs 3,153.

HDFC Bank | CMP: Rs 1,466.

PVR Inox | CMP: Rs 1,434.

SBI Life Insurance | CMP: Rs 1,432.

Cyient | CMP: Rs 1,939.

Asian Paints | CMP: Rs 2,929.

Sunteck Realty | CMP: Rs 470.

What is the Realty ome stock prediction for 2030 According to our Realty ome stock prediction for 2030, O stock will be priced at $ 74.55 in 2030. This forecast is based on the stock's average growth over the past 10 years.

Which stock is a strong buy : Sign up for Kiplinger's Free E-Newsletters

Antwort Is Realty Income a long-term buy? Weitere Antworten – Is Realty Income a good long term stock

Realty Income (O 0.14%) is often considered a stable long-term investment for conservative income investors. It's one of the world's largest real estate investment trusts (REITs), and its tenants include large retailers like Walgreens, 7-Eleven, Dollar General, Dollar Tree, and Walmart.Definition of 10 Year Price Total Return

Ten Year Stock Price Total Return for Realty Income is calculated as follows: Last Close Price [ 50.17 ] / Adj Prior Close Price [ 19.15 ] (-) 1 (=) Total Return [ 161.9% ] Prior price dividend adjustment factor is 0.62.O Stock 12 Month Forecast

Based on 8 Wall Street analysts offering 12 month price targets for Realty Income in the last 3 months. The average price target is $58.63 with a high forecast of $65.00 and a low forecast of $56.00. The average price target represents a 6.35% change from the last price of $55.13.

Is Realty Income stock overvalued : Compared to the current market price of 54.95 USD, Realty Income Corp is Undervalued by 6%. What is intrinsic value Realty Income Corp's market capitalization is 47.8B USD. O stock price is 54.95 USD.

Is Realty Income dividend safe

Dividend income we provide to our shareholders tends to be reliable since it is supported by long-term leases with tenants we have determined can be relied upon to make lease payments.

Is Realty Income Sustainable : We remain committed to sustainable business practices in our day-to-day activities by encouraging a culture of environmental responsibility at our headquarters and within our communities. We work with our clients to promote environmental responsibility at the properties we own.

While 10% might be the average, the returns in any given year are far from average. In fact, between 1926 and 2024, returns were in that “average” band of 8% to 12% only eight times. The rest of the time they were much lower or, usually, much higher.

Realty Income is a net-lease real estate investment trust. It is by far the largest REIT in this property niche. That said, there's still plenty of room for Realty Income to keep growing.

Is OA buy hold or sell

A “buy” rating means analysts like the stock and think it's worth purchasing because its value is likely to increase. A “hold” rating is neutral. It means analysts are unsure which way share prices will move, so they recommend that you neither buy nor sell. A “sell” rating means analysts expect share prices to fall.A “buy” rating means analysts like the stock and think it's worth purchasing because its value is likely to increase. A “hold” rating is neutral. It means analysts are unsure which way share prices will move, so they recommend that you neither buy nor sell. A “sell” rating means analysts expect share prices to fall.With ample financial flexibility, the company remains well-poised to respond to any challenges and bank on growth opportunities. Moreover, with a healthy financial position and a lower debt-to-equity ratio compared with the industry, we expect the latest dividend rate to be sustainable.

Non-traded REITs have little liquidity, meaning it's difficult for investors to sell them. Publicly traded REITs have the risk of losing value as interest rates rise, which typically sends investment capital into bonds.

How safe is Realty Income dividend : Dividend income we provide to our shareholders tends to be reliable since it is supported by long-term leases with tenants we have determined can be relied upon to make lease payments.

Has Realty Income ever cut its dividend : Realty Income has increased its dividend for 29 consecutive years, demonstrating to investors that it is serious about returning capital to its shareholders. Dividends make a significant difference in shareholder returns.

Is 7% return on investment realistic

General ROI: A positive ROI is generally considered good, with a normal ROI of 5-7% often seen as a reasonable expectation. However, a strong general ROI is something greater than 10%. Return on Stocks: On average, a ROI of 7% after inflation is often considered good, based on the historical returns of the market.

7 stocks that can deliver over 30% returns to make you rich in

What is the Realty ome stock prediction for 2030 According to our Realty ome stock prediction for 2030, O stock will be priced at $ 74.55 in 2030. This forecast is based on the stock's average growth over the past 10 years.

Which stock is a strong buy : Sign up for Kiplinger's Free E-Newsletters