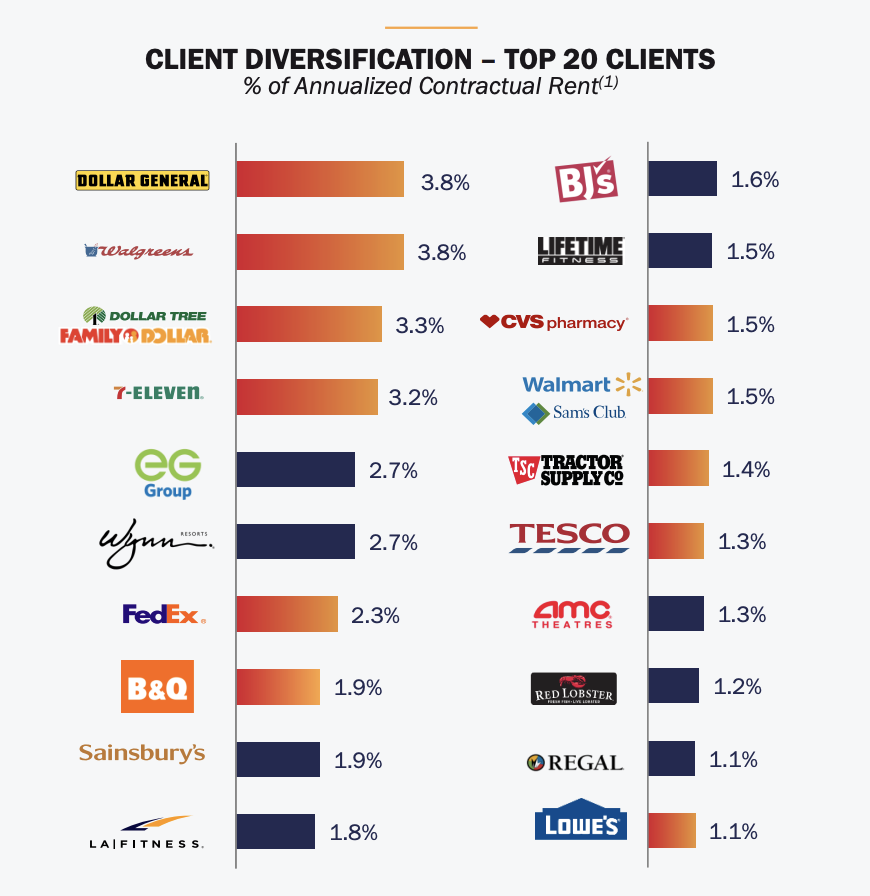

Realty Income (O 0.14%) is often considered a stable long-term investment for conservative income investors. It's one of the world's largest real estate investment trusts (REITs), and its tenants include large retailers like Walgreens, 7-Eleven, Dollar General, Dollar Tree, and Walmart.Definition of 10 Year Price Total Return

Ten Year Stock Price Total Return for Realty Income is calculated as follows: Last Close Price [ 50.17 ] / Adj Prior Close Price [ 19.15 ] (-) 1 (=) Total Return [ 161.9% ] Prior price dividend adjustment factor is 0.62.O Stock 12 Month Forecast

Based on 8 Wall Street analysts offering 12 month price targets for Realty Income in the last 3 months. The average price target is $58.63 with a high forecast of $65.00 and a low forecast of $56.00. The average price target represents a 6.35% change from the last price of $55.13.

Is Realty Income a buy sell or hold : The consensus among 7 Wall Street analysts covering (NYSE: O) stock is to Buy O stock. Out of 7 analysts, 2 (28.57%) are recommending O as a Strong Buy, 3 (42.86%) are recommending O as a Buy, 2 (28.57%) are recommending O as a Hold, 0 (0%) are recommending O as a Sell, and 0 (0%) are recommending O as a Strong Sell.

Is Realty Income a good buy

We operate under the highest ethical standards and work tirelessly to provide long-term value to all stakeholders. Since our public listing in 1994, we have delivered compound average annual total shareholder return of 13.6%, outperforming the US REIT sector and the S&P 500 during that timeframe.

Should I buy Realty Income stock now : But nothing material has changed about the business, or at least not in a permanently negative way. If you are trying to find a reliable dividend stock, there is still time to grab Realty Income and its historically attractive 5.7% yield. Here's why you should do that now and not risk being late to the party.

Are REITs Good Investments Investing in REITs is a great way to diversify your portfolio outside of traditional stocks and bonds and can be attractive for their strong dividends and long-term capital appreciation. The ownership structure of Realty Income (O) stock is a mix of institutional, retail and individual investors. Approximately 68.61% of the company's stock is owned by Institutional Investors, 0.24% is owned by Insiders and 31.14% is owned by Public Companies and Individual Investors.

Can realty income keep growing

Realty Income is a net-lease real estate investment trust. It is by far the largest REIT in this property niche. That said, there's still plenty of room for Realty Income to keep growing.It's "The Monthly Dividend Company"

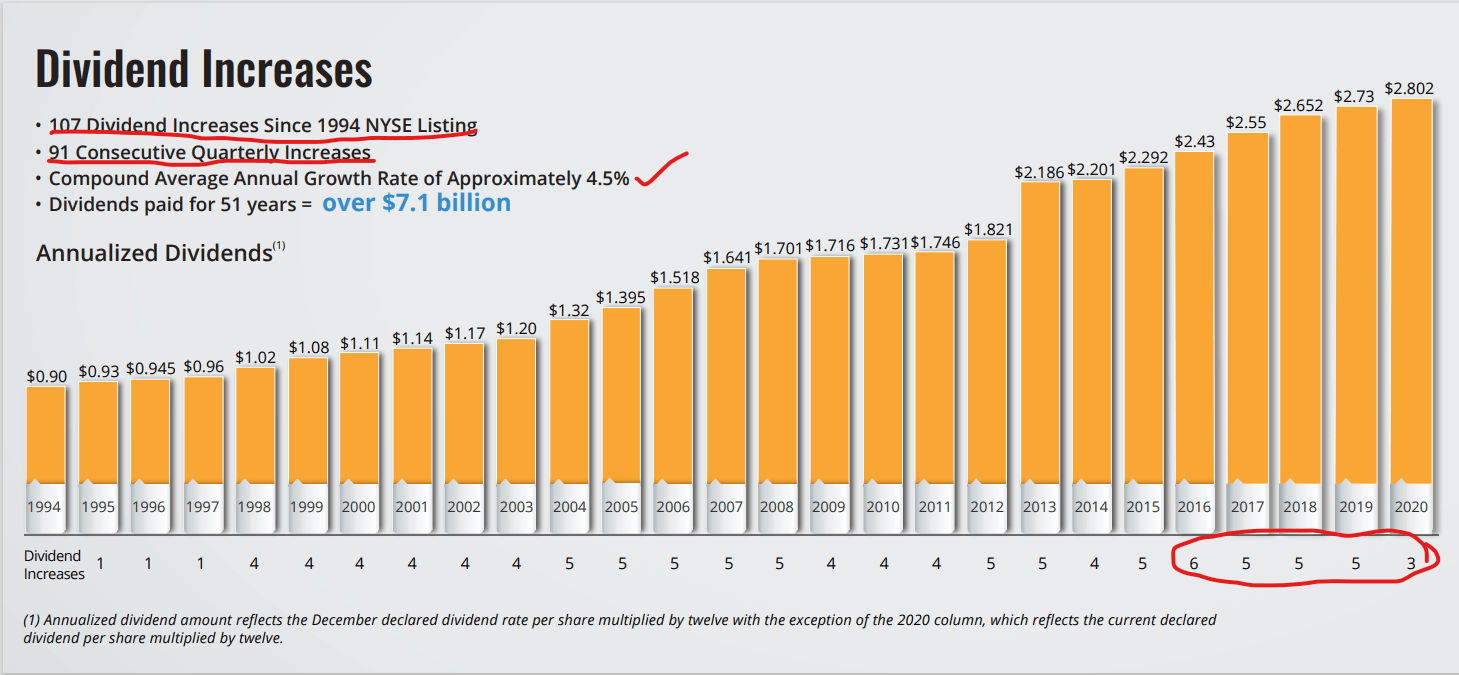

Realty Income has increased its dividend for 29 consecutive years, demonstrating to investors that it is serious about returning capital to its shareholders. Dividends make a significant difference in shareholder returns.Realty Income (NYSE: O) has been a fantastic investment since it came public in 1994. Over those years, the real estate investment trust (REIT) has increased its dividend 123 times, growing its payout at a 4.3% compound annual rate. Having raised its dividend in 107 consecutive quarters — the company's 5.71% yield is based on a forward projection of its new monthly payout — Realty Income is potentially the safest and smartest REIT to buy right now.

Why buy Realty Income stock : Key Points. Realty Income recently declared its 646th consecutive monthly dividend. This REIT offers exposure to some of the strongest retailers in the world. Its diversified property portfolio is a great way to invest in the sector's growth.

Is Realty Income a safe investment : Realty Income (O 0.70%) has been a fantastic investment since it came public in 1994. Over those years, the real estate investment trust (REIT) has increased its dividend 123 times, growing its payout at a 4.3% compound annual rate.

Is Realty Income a safe dividend stock

Dividend income we provide to our shareholders tends to be reliable since it is supported by long-term leases with tenants we have determined can be relied upon to make lease payments. Throughout our operating history, we have never decreased the amount of our regular monthly dividend payment. AEW Capital Management forecasts total REIT returns of approximately 25% over the next two years, which also roughly translates to low double digits in 2024, according to Gina Szymanski, managing director and portfolio manager, real estate securities group for North America, with the firm.Does Warren Buffett invest in REITs The short answer is yes. Berkshire Hathaway does allocate capital real estate ownership throughout REITs. Learn Warren Buffett REIT investments below.

Is Realty Income in debt : Total debt on the balance sheet as of December 2023 : $21.98 B. According to Realty Income's latest financial reports the company's total debt is $21.98 B. A company's total debt is the sum of all current and non-current debts.

Antwort Is Realty Income a good long term stock? Weitere Antworten – Is Realty Income good long term

Realty Income (O 0.14%) is often considered a stable long-term investment for conservative income investors. It's one of the world's largest real estate investment trusts (REITs), and its tenants include large retailers like Walgreens, 7-Eleven, Dollar General, Dollar Tree, and Walmart.Definition of 10 Year Price Total Return

Ten Year Stock Price Total Return for Realty Income is calculated as follows: Last Close Price [ 50.17 ] / Adj Prior Close Price [ 19.15 ] (-) 1 (=) Total Return [ 161.9% ] Prior price dividend adjustment factor is 0.62.O Stock 12 Month Forecast

Based on 8 Wall Street analysts offering 12 month price targets for Realty Income in the last 3 months. The average price target is $58.63 with a high forecast of $65.00 and a low forecast of $56.00. The average price target represents a 6.35% change from the last price of $55.13.

Is Realty Income a buy sell or hold : The consensus among 7 Wall Street analysts covering (NYSE: O) stock is to Buy O stock. Out of 7 analysts, 2 (28.57%) are recommending O as a Strong Buy, 3 (42.86%) are recommending O as a Buy, 2 (28.57%) are recommending O as a Hold, 0 (0%) are recommending O as a Sell, and 0 (0%) are recommending O as a Strong Sell.

Is Realty Income a good buy

We operate under the highest ethical standards and work tirelessly to provide long-term value to all stakeholders. Since our public listing in 1994, we have delivered compound average annual total shareholder return of 13.6%, outperforming the US REIT sector and the S&P 500 during that timeframe.

Should I buy Realty Income stock now : But nothing material has changed about the business, or at least not in a permanently negative way. If you are trying to find a reliable dividend stock, there is still time to grab Realty Income and its historically attractive 5.7% yield. Here's why you should do that now and not risk being late to the party.

Are REITs Good Investments Investing in REITs is a great way to diversify your portfolio outside of traditional stocks and bonds and can be attractive for their strong dividends and long-term capital appreciation.

The ownership structure of Realty Income (O) stock is a mix of institutional, retail and individual investors. Approximately 68.61% of the company's stock is owned by Institutional Investors, 0.24% is owned by Insiders and 31.14% is owned by Public Companies and Individual Investors.

Can realty income keep growing

Realty Income is a net-lease real estate investment trust. It is by far the largest REIT in this property niche. That said, there's still plenty of room for Realty Income to keep growing.It's "The Monthly Dividend Company"

Realty Income has increased its dividend for 29 consecutive years, demonstrating to investors that it is serious about returning capital to its shareholders. Dividends make a significant difference in shareholder returns.Realty Income (NYSE: O) has been a fantastic investment since it came public in 1994. Over those years, the real estate investment trust (REIT) has increased its dividend 123 times, growing its payout at a 4.3% compound annual rate.

Having raised its dividend in 107 consecutive quarters — the company's 5.71% yield is based on a forward projection of its new monthly payout — Realty Income is potentially the safest and smartest REIT to buy right now.

Why buy Realty Income stock : Key Points. Realty Income recently declared its 646th consecutive monthly dividend. This REIT offers exposure to some of the strongest retailers in the world. Its diversified property portfolio is a great way to invest in the sector's growth.

Is Realty Income a safe investment : Realty Income (O 0.70%) has been a fantastic investment since it came public in 1994. Over those years, the real estate investment trust (REIT) has increased its dividend 123 times, growing its payout at a 4.3% compound annual rate.

Is Realty Income a safe dividend stock

Dividend income we provide to our shareholders tends to be reliable since it is supported by long-term leases with tenants we have determined can be relied upon to make lease payments. Throughout our operating history, we have never decreased the amount of our regular monthly dividend payment.

AEW Capital Management forecasts total REIT returns of approximately 25% over the next two years, which also roughly translates to low double digits in 2024, according to Gina Szymanski, managing director and portfolio manager, real estate securities group for North America, with the firm.Does Warren Buffett invest in REITs The short answer is yes. Berkshire Hathaway does allocate capital real estate ownership throughout REITs. Learn Warren Buffett REIT investments below.

Is Realty Income in debt : Total debt on the balance sheet as of December 2023 : $21.98 B. According to Realty Income's latest financial reports the company's total debt is $21.98 B. A company's total debt is the sum of all current and non-current debts.