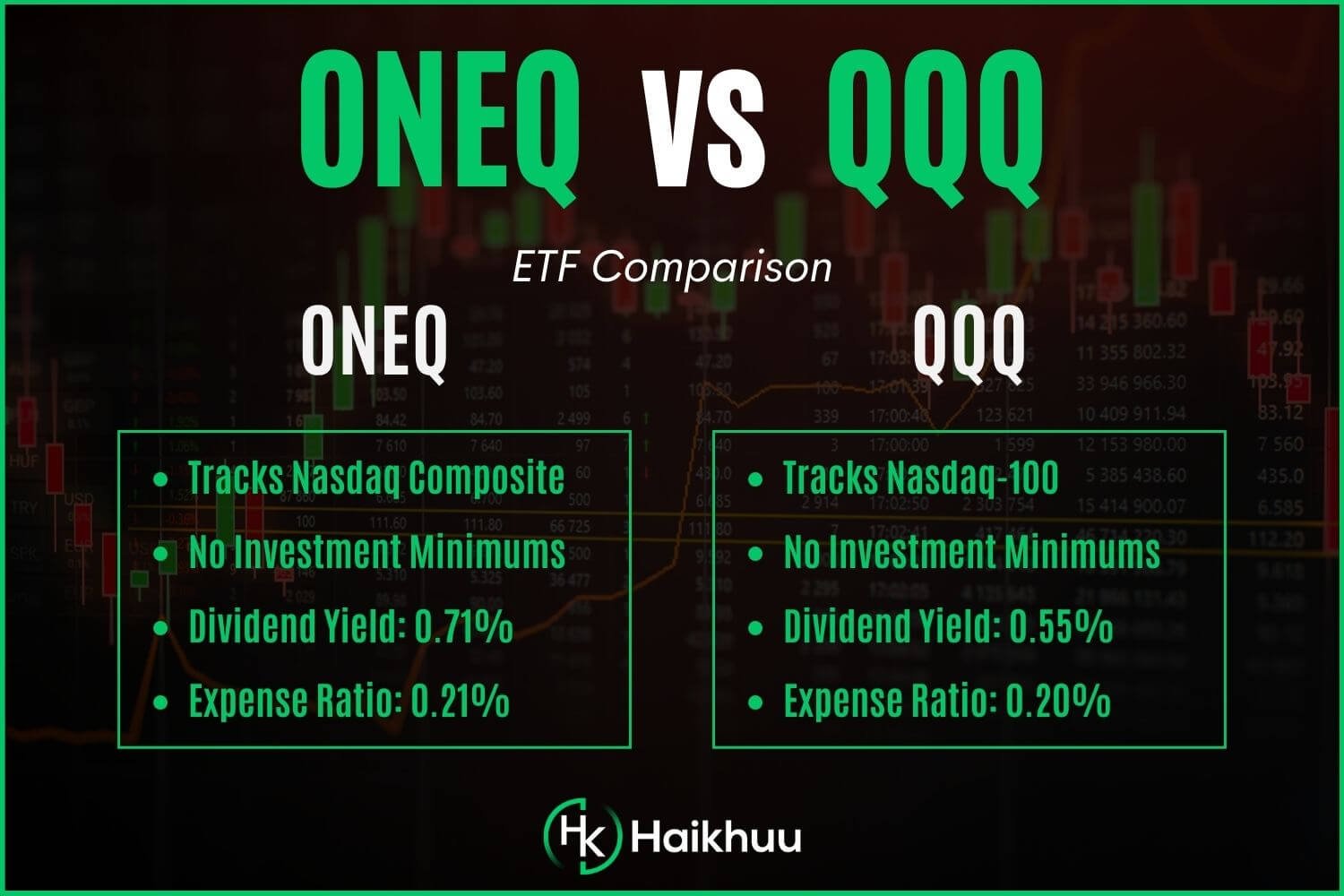

QQQ is an exchange traded fund (ETF) designed to correspond to the price and yield performance of the NASDAQ-100 Index, which consists of NASDAQ's largest 100 non-financial companies. QQQ currently trades at a value set by NASDAQ at approximately 1/40 th of the value of the NASDAQ-100 Index.Fidelity Nasdaq Composite Index ETF

Fidelity Nasdaq Composite Index ETF (ONEQ)NDQ Nasdaq 100 ETF is the ASX-traded equivalent of QQQ in that both ETFs seek to track the Nasdaq 100 Index, so NDQ and QQQ will give you exposure to the same companies. However, QQQ is not traded on the ASX, whereas NDQ is.

What is the difference between the Nasdaq and the Nasdaq-100 : The Nasdaq-100 is frequently confused with the Nasdaq Composite Index. The latter index (often referred to simply as "The Nasdaq") includes the stock of every company that is listed on Nasdaq (more than 3,000 altogether). The Nasdaq-100 is a modified capitalization-weighted index.

Does QQQ mimic Nasdaq

QQQ is the most popular Nasdaq ETF because it uses a full replication strategy, meaning this ETF includes every security in the Nasdaq Index rather than a representative sample. Invesco QQQ offers an annualized return of 9.5% since its inception in 1999.

Is QQQ the only Nasdaq ETF : The Nasdaq-100® is one of the most well-known indexes in the investing world. Representing the largest non-Financial listings on the Nasdaq exchange, the Nasdaq-100® Index (NDX) has futures and exchange-traded funds (ETFs) with significant liquidity and investor interest.

eQQQ

In the USA, the popular QQQ ETF, which tracks the Nasdaq 100, has been available since 1999. It is managed by Invesco. The European counterpart of this ETF uses the ticker symbol eQQQ.

What's the difference between the Nasdaq Composite Index and the Nasdaq-100® Unlike the Nasdaq Composite Index, the Nasdaq-100 does not include the stocks of financial institutions, investment companies or sectors such as oil & gas.

What category is QQQ

Invesco QQQ is an exchange-traded fund (ETF) that features Apple, Google, Microsoft, and more. Invesco QQQ ETF tracks the Nasdaq-100® Index — giving you access to the performance of the 100 largest non-financial companies listed on the Nasdaq. The fund and the index are rebalanced quarterly and reconstituted annually.Around 80% of the Nasdaq Composite's index weightings overlap with the Nasdaq-100, while the remaining 20% gives the Nasdaq Composite a differentiating exposure for investors who seek to track other innovative companies beyond the 100 largest.What's the difference between the Nasdaq Composite Index and the Nasdaq-100® Unlike the Nasdaq Composite Index, the Nasdaq-100 does not include the stocks of financial institutions, investment companies or sectors such as oil & gas.

Invesco QQQ ETF tracks the Nasdaq-100® Index — giving you access to the performance of the 100 largest non-financial companies listed on the Nasdaq.

Which ETF tracks Nasdaq-100 : QQQ ETF

The Nasdaq 100 index

In the USA, the popular QQQ ETF, which tracks the Nasdaq 100, has been available since 1999. It is managed by Invesco. The European counterpart of this ETF uses the ticker symbol eQQQ.

What is the Nasdaq 100 equivalent in Europe : The Nasdaq 100 index

In the USA, the popular QQQ ETF, which tracks the Nasdaq 100, has been available since 1999. It is managed by Invesco. The European counterpart of this ETF uses the ticker symbol eQQQ.

Is QQQ European or American

For traders, two major differences (between QQQ and NDX) that beginners should be aware of are dividends and contract size. ETFs such as QQQ pay dividends and are American-style, which adds additional risk of early exercise on a dividend capture. Indexes do not pay dividends and are European-style, removing this risk.

What's the difference between the Nasdaq Composite Index and the Nasdaq-100® Unlike the Nasdaq Composite Index, the Nasdaq-100 does not include the stocks of financial institutions, investment companies or sectors such as oil & gas.It also operates two benchmark stock indexes based on companies that trade on its exchange: the Nasdaq Composite and the Nasdaq 100. The Nasdaq Composite tracks the performance of more than 2,500 stocks listed on the Nasdaq while the Nasdaq 100 captures the performance of the exchange's largest non-financial companies.

Is QQQ part of Nasdaq : Yes. Invesco QQQ is a passively managed ETF that tracks the Nasdaq-100 index, which contains some of the world's most innovative companies.

Antwort Is QQQ Nasdaq-100 or composite? Weitere Antworten – Is QQQ the same as Nasdaq-100

QQQ is an exchange traded fund (ETF) designed to correspond to the price and yield performance of the NASDAQ-100 Index, which consists of NASDAQ's largest 100 non-financial companies. QQQ currently trades at a value set by NASDAQ at approximately 1/40 th of the value of the NASDAQ-100 Index.Fidelity Nasdaq Composite Index ETF

Fidelity Nasdaq Composite Index ETF (ONEQ)NDQ Nasdaq 100 ETF is the ASX-traded equivalent of QQQ in that both ETFs seek to track the Nasdaq 100 Index, so NDQ and QQQ will give you exposure to the same companies. However, QQQ is not traded on the ASX, whereas NDQ is.

What is the difference between the Nasdaq and the Nasdaq-100 : The Nasdaq-100 is frequently confused with the Nasdaq Composite Index. The latter index (often referred to simply as "The Nasdaq") includes the stock of every company that is listed on Nasdaq (more than 3,000 altogether). The Nasdaq-100 is a modified capitalization-weighted index.

Does QQQ mimic Nasdaq

QQQ is the most popular Nasdaq ETF because it uses a full replication strategy, meaning this ETF includes every security in the Nasdaq Index rather than a representative sample. Invesco QQQ offers an annualized return of 9.5% since its inception in 1999.

Is QQQ the only Nasdaq ETF : The Nasdaq-100® is one of the most well-known indexes in the investing world. Representing the largest non-Financial listings on the Nasdaq exchange, the Nasdaq-100® Index (NDX) has futures and exchange-traded funds (ETFs) with significant liquidity and investor interest.

eQQQ

In the USA, the popular QQQ ETF, which tracks the Nasdaq 100, has been available since 1999. It is managed by Invesco. The European counterpart of this ETF uses the ticker symbol eQQQ.

What's the difference between the Nasdaq Composite Index and the Nasdaq-100® Unlike the Nasdaq Composite Index, the Nasdaq-100 does not include the stocks of financial institutions, investment companies or sectors such as oil & gas.

What category is QQQ

Invesco QQQ is an exchange-traded fund (ETF) that features Apple, Google, Microsoft, and more. Invesco QQQ ETF tracks the Nasdaq-100® Index — giving you access to the performance of the 100 largest non-financial companies listed on the Nasdaq. The fund and the index are rebalanced quarterly and reconstituted annually.Around 80% of the Nasdaq Composite's index weightings overlap with the Nasdaq-100, while the remaining 20% gives the Nasdaq Composite a differentiating exposure for investors who seek to track other innovative companies beyond the 100 largest.What's the difference between the Nasdaq Composite Index and the Nasdaq-100® Unlike the Nasdaq Composite Index, the Nasdaq-100 does not include the stocks of financial institutions, investment companies or sectors such as oil & gas.

Invesco QQQ ETF tracks the Nasdaq-100® Index — giving you access to the performance of the 100 largest non-financial companies listed on the Nasdaq.

Which ETF tracks Nasdaq-100 : QQQ ETF

The Nasdaq 100 index

In the USA, the popular QQQ ETF, which tracks the Nasdaq 100, has been available since 1999. It is managed by Invesco. The European counterpart of this ETF uses the ticker symbol eQQQ.

What is the Nasdaq 100 equivalent in Europe : The Nasdaq 100 index

In the USA, the popular QQQ ETF, which tracks the Nasdaq 100, has been available since 1999. It is managed by Invesco. The European counterpart of this ETF uses the ticker symbol eQQQ.

Is QQQ European or American

For traders, two major differences (between QQQ and NDX) that beginners should be aware of are dividends and contract size. ETFs such as QQQ pay dividends and are American-style, which adds additional risk of early exercise on a dividend capture. Indexes do not pay dividends and are European-style, removing this risk.

What's the difference between the Nasdaq Composite Index and the Nasdaq-100® Unlike the Nasdaq Composite Index, the Nasdaq-100 does not include the stocks of financial institutions, investment companies or sectors such as oil & gas.It also operates two benchmark stock indexes based on companies that trade on its exchange: the Nasdaq Composite and the Nasdaq 100. The Nasdaq Composite tracks the performance of more than 2,500 stocks listed on the Nasdaq while the Nasdaq 100 captures the performance of the exchange's largest non-financial companies.

Is QQQ part of Nasdaq : Yes. Invesco QQQ is a passively managed ETF that tracks the Nasdaq-100 index, which contains some of the world's most innovative companies.