Chief Analyst & CEO, NAND Research. In its fiscal Q4 2024 earnings release, Pure Storage exceeded revenue and operating profit guidance, demonstrating strong financial performance and market demand for its products and services.1Pure Storage Announces Fourth Quarter and Full Year Fiscal 2022 Financial ResultsQ4 revenue grew 41% year-over-yearSubscription Services ARR $849million, up 31% year-over-yearDoubled growth of annual operating cash flow, exceeding $400millionMOUNTAIN VIEW, Calif.US$2.83b

Pure Storage (NYSE:PSTG) Full Year 2024 Results

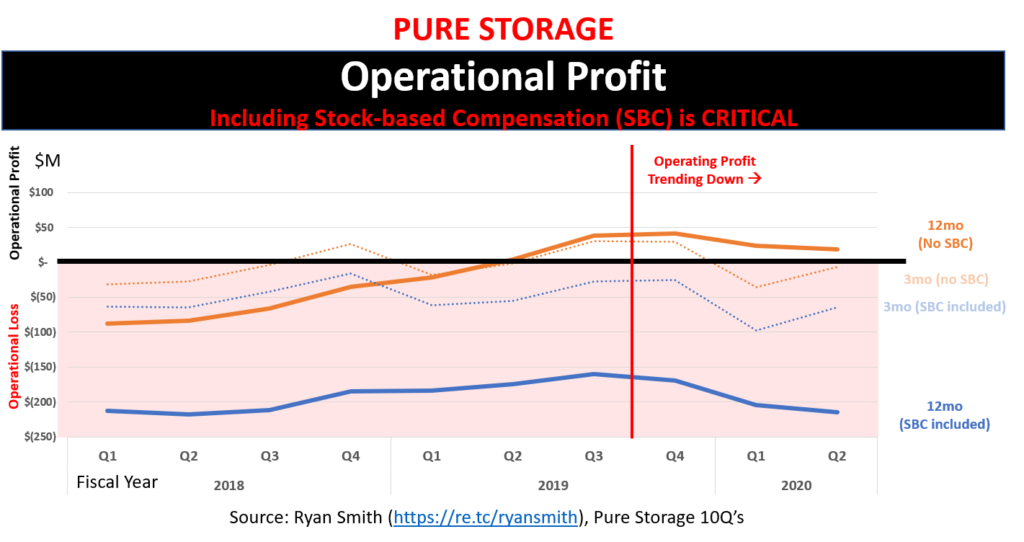

Revenue: US$2.83b (up 2.8% from FY 2023). Net income: US$61.3m (down 16% from FY 2023). Profit margin: 2.2% (down from 2.7% in FY 2023). EPS: US$0.20 (down from US$0.24 in FY 2023).

Who competes with Pure Storage : Competitors and Alternatives to Pure Storage

Hewlett Packard Enterprise (HPE)

NetApp.

Dell Technologies.

IBM.

Hitachi Vantara.

Fujitsu.

Huawei.

Oracle.

Is Pure Storage a good investment

What do analysts say about Pure Storage Pure Storage's analyst rating consensus is a Strong Buy. This is based on the ratings of 19 Wall Streets Analysts.

Why buy Pure Storage : Pure provides built-in data replication and space-efficient, immutable snapshots, providing protection against human error and malicious intent. With Safemode™ enabled, ransomware can't eradicate, modify, or encrypt snapshots, even with admin credentials.

Price to Value Only NetApp FabricPool automatically balances and optimizes your production all-flash capacity with efficient cloud storage. Pure's inefficient approach to data placement requires separate storage arrays and can't leverage cost-effective HDD storage media. Pure Storage has a market cap or net worth of $19.14 billion as of May 17, 2024. Its market cap has increased by 170.92% in one year.

Is Pure Storage overvalued

Compared to the current market price of 54.41 USD, Pure Storage Inc is Overvalued by 25%.Pure provides built-in data replication and space-efficient, immutable snapshots, providing protection against human error and malicious intent. With Safemode™ enabled, ransomware can't eradicate, modify, or encrypt snapshots, even with admin credentials.With Pure Storage, there's no need to separate files on different disks to avoid contention, monitor I/O service times, or periodically reorganize the database storage layout to accommodate changes in the I/O workload profile. Like a number of other unicorns, Pure Storage's later funding rounds have drawn investors who more typically operate in the public equity market.

Should I invest in Pure Storage : The highest analyst price target is $66.00 ,the lowest forecast is $44.00. The average price target represents 12.43% Increase from the current price of $49.46. Pure Storage's analyst rating consensus is a Strong Buy. This is based on the ratings of 18 Wall Streets Analysts.

Should I invest in pure storage : The highest analyst price target is $66.00 ,the lowest forecast is $44.00. The average price target represents 12.43% Increase from the current price of $49.46. Pure Storage's analyst rating consensus is a Strong Buy. This is based on the ratings of 18 Wall Streets Analysts.

Is pure storage better than NetApp

Price to Value Only NetApp FabricPool automatically balances and optimizes your production all-flash capacity with efficient cloud storage. Pure's inefficient approach to data placement requires separate storage arrays and can't leverage cost-effective HDD storage media.

Antwort Is Pure Storage profitable? Weitere Antworten – Does Pure Storage make a profit

Chief Analyst & CEO, NAND Research. In its fiscal Q4 2024 earnings release, Pure Storage exceeded revenue and operating profit guidance, demonstrating strong financial performance and market demand for its products and services.1Pure Storage Announces Fourth Quarter and Full Year Fiscal 2022 Financial ResultsQ4 revenue grew 41% year-over-yearSubscription Services ARR $849million, up 31% year-over-yearDoubled growth of annual operating cash flow, exceeding $400millionMOUNTAIN VIEW, Calif.US$2.83b

Pure Storage (NYSE:PSTG) Full Year 2024 Results

Revenue: US$2.83b (up 2.8% from FY 2023). Net income: US$61.3m (down 16% from FY 2023). Profit margin: 2.2% (down from 2.7% in FY 2023). EPS: US$0.20 (down from US$0.24 in FY 2023).

Who competes with Pure Storage : Competitors and Alternatives to Pure Storage

Is Pure Storage a good investment

What do analysts say about Pure Storage Pure Storage's analyst rating consensus is a Strong Buy. This is based on the ratings of 19 Wall Streets Analysts.

Why buy Pure Storage : Pure provides built-in data replication and space-efficient, immutable snapshots, providing protection against human error and malicious intent. With Safemode™ enabled, ransomware can't eradicate, modify, or encrypt snapshots, even with admin credentials.

Price to Value Only NetApp FabricPool automatically balances and optimizes your production all-flash capacity with efficient cloud storage. Pure's inefficient approach to data placement requires separate storage arrays and can't leverage cost-effective HDD storage media.

Pure Storage has a market cap or net worth of $19.14 billion as of May 17, 2024. Its market cap has increased by 170.92% in one year.

Is Pure Storage overvalued

Compared to the current market price of 54.41 USD, Pure Storage Inc is Overvalued by 25%.Pure provides built-in data replication and space-efficient, immutable snapshots, providing protection against human error and malicious intent. With Safemode™ enabled, ransomware can't eradicate, modify, or encrypt snapshots, even with admin credentials.With Pure Storage, there's no need to separate files on different disks to avoid contention, monitor I/O service times, or periodically reorganize the database storage layout to accommodate changes in the I/O workload profile.

Like a number of other unicorns, Pure Storage's later funding rounds have drawn investors who more typically operate in the public equity market.

Should I invest in Pure Storage : The highest analyst price target is $66.00 ,the lowest forecast is $44.00. The average price target represents 12.43% Increase from the current price of $49.46. Pure Storage's analyst rating consensus is a Strong Buy. This is based on the ratings of 18 Wall Streets Analysts.

Should I invest in pure storage : The highest analyst price target is $66.00 ,the lowest forecast is $44.00. The average price target represents 12.43% Increase from the current price of $49.46. Pure Storage's analyst rating consensus is a Strong Buy. This is based on the ratings of 18 Wall Streets Analysts.

Is pure storage better than NetApp

Price to Value Only NetApp FabricPool automatically balances and optimizes your production all-flash capacity with efficient cloud storage. Pure's inefficient approach to data placement requires separate storage arrays and can't leverage cost-effective HDD storage media.