Panama. Panama became a tax haven for US citizens due to its favorable tax policies and territorial tax system. The country operates on a territorial basis, which means that only income earned within its borders is subject to taxation.What Countries Are Tax Havens

Hong Kong. Strategically located at the heart of Asia, Hong Kong is home to many global trading companies.

Cayman Islands. The Cayman Islands is a British Overseas Territory with more companies than citizens.

The Bahamas.

Malta.

British Virgin Islands.

Singapore.

Luxembourg.

Mauritius.

A tax haven offers businesses and individuals reduced or no tax liabilities. Tax haven states — states without income tax — provide perks like reduced tax burdens and asset protection. However, they can come with higher sales taxes and fees in other areas.

Is Panama good for taxes : key takeaways. Panama's legal and tax structures make it a pure tax haven. Panama imposes no income, corporate, capital gains, or estate taxes on offshore entities that only engage in business outside of the jurisdiction. Offshore companies can engage in business locally—a rare perk—but will pay local taxes as a result …

Is Panama zero tax

Panama is not a zero-tax jurisdiction. There is a tax in Panama, and local companies pay it. However, income sourced abroad is not taxed in Panama due to our territorial taxation system.

What is the best country to save taxes : 55% wealth tax Here are top 8 countries in the world where people pay 'Zero Taxes'

The Bahamas.

Panama.

Cayman Islands.

Dominica.

Dubai.

Qatar.

UAE.

Oman. Currently tax-free, Oman is evaluating a potential Personal Income Tax Regime as part of its fiscal plans.

Among the countries with the lowest tax rates in the world are Malta, Cyprus, Andorra, Montenegro and Singapore. Aside from zero income tax, in Antigua and Barbuda, individuals are also free from paying taxes on wealth, capital gains, and inheritance. If by tax haven you mean a tax-free country, then Costa Rica is far from a tax haven. However, with the right team, moving to Costa Rica can be the best way to lower your taxes legally.

Is Portugal a good tax haven

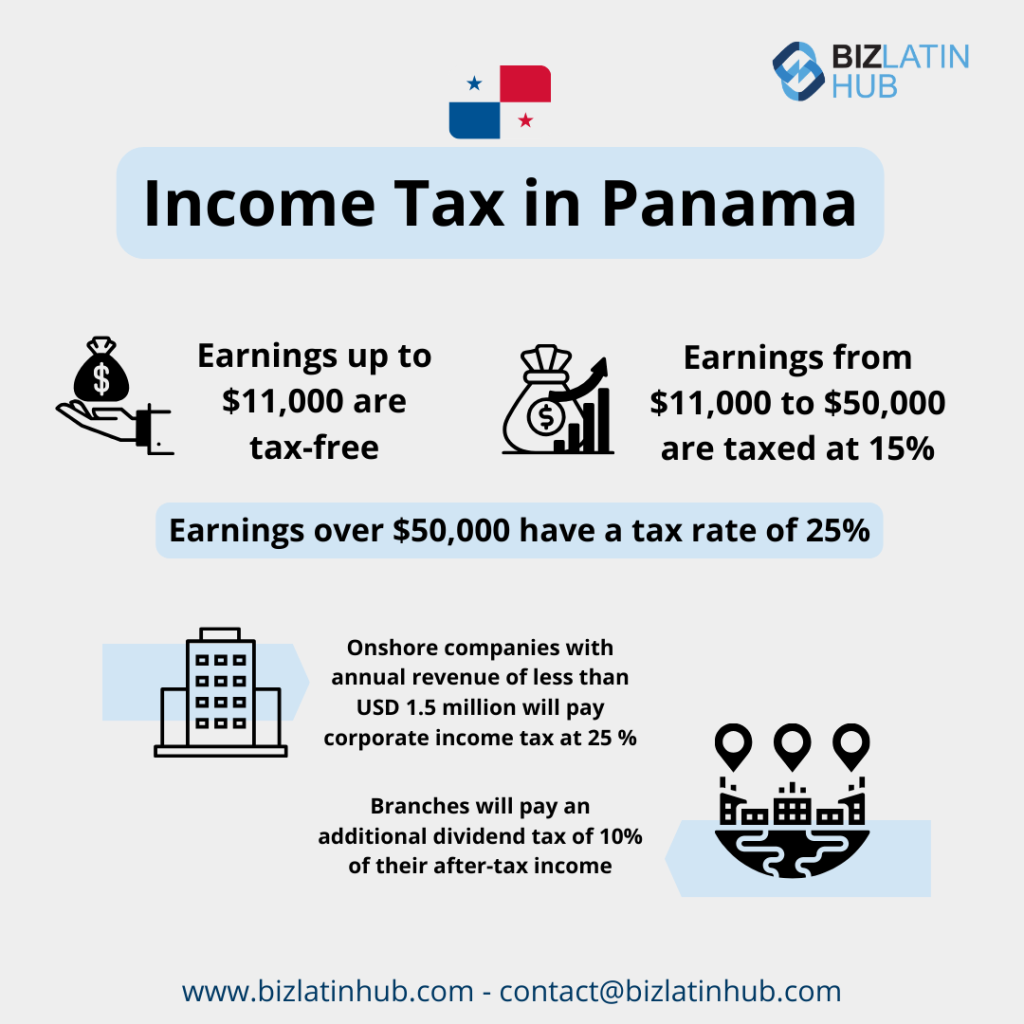

In conclusion, while Portugal offers attractive tax incentives and has gained popularity as a tax haven, it is essential to separate fact from fiction when considering the country as a tax planning destination. Portugal is not a tax haven in the traditional sense.Panama is a high income economy with a history of low inflation.Income Tax in Panama

If you earn between $0 to $11,000 annually, you will not pay income tax. If you earn between $11,001 and $50,000, you're taxed at 15% on all income above $11,000. If you earn over $50,000, you'll pay $5,850 in income tax, plus 25% on all income over $50,000. 20 Countries with the Lowest Income Tax Rates in the World

Bulgaria.

Turkmenistan.

Guatemala. Personal Income Tax Rate: 7%

Brunei. Personal Income Tax Rate: 0%

Saudi Arabia. Personal Income Tax Rate: 0%

Oman. Personal Income Tax Rate: 0%

Kuwait. Personal Income Tax Rate: 0%

Qatar. Personal Income Tax Rate: 0%

Is Portugal tax free : Residents in Portugal for tax purposes are taxed on their worldwide income at progressive rates varying from 13.25% to 48% for 2024.

Is Thailand a tax haven : Territorial Tax Countries in Asia

Countries like Thailand have territorial tax systems that essentially make them countries that don't tax in Asia for the expats who live there and earn money abroad.

How is Belize a tax haven

One of the key attractions of Belize is its favorable tax regime. The country does not impose corporate taxes, capital gains taxes, or property taxes, making it a haven for those looking to minimize their fiscal exposure. Kitts and Nevis is its incredibly lenient tax regime. For individuals, the islands offer a paradise of sorts with no income tax, inheritance tax, gift tax, duty, capital gains tax, or corporate tax. This means that the money you earn, inherit, or invest remains firmly in your pocket.The lowest tax rate on wages in the EU is set in Bulgaria and Romania – 10%. The highest taxes in Europe are paid by residents of Finland – here the collection can reach 56.5 % of profit. As a rule, the payment is imposed on the employer. Property, inheritance, gift.

Is Portugal 0% tax : Residents in Portugal for tax purposes are taxed on their worldwide income at progressive rates varying from 13.25% to 48% for 2024.

Antwort Is Panama a low tax country? Weitere Antworten – Is Panama considered a tax haven

Panama. Panama became a tax haven for US citizens due to its favorable tax policies and territorial tax system. The country operates on a territorial basis, which means that only income earned within its borders is subject to taxation.What Countries Are Tax Havens

A tax haven offers businesses and individuals reduced or no tax liabilities. Tax haven states — states without income tax — provide perks like reduced tax burdens and asset protection. However, they can come with higher sales taxes and fees in other areas.

Is Panama good for taxes : key takeaways. Panama's legal and tax structures make it a pure tax haven. Panama imposes no income, corporate, capital gains, or estate taxes on offshore entities that only engage in business outside of the jurisdiction. Offshore companies can engage in business locally—a rare perk—but will pay local taxes as a result …

Is Panama zero tax

Panama is not a zero-tax jurisdiction. There is a tax in Panama, and local companies pay it. However, income sourced abroad is not taxed in Panama due to our territorial taxation system.

What is the best country to save taxes : 55% wealth tax Here are top 8 countries in the world where people pay 'Zero Taxes'

Among the countries with the lowest tax rates in the world are Malta, Cyprus, Andorra, Montenegro and Singapore. Aside from zero income tax, in Antigua and Barbuda, individuals are also free from paying taxes on wealth, capital gains, and inheritance.

If by tax haven you mean a tax-free country, then Costa Rica is far from a tax haven. However, with the right team, moving to Costa Rica can be the best way to lower your taxes legally.

Is Portugal a good tax haven

In conclusion, while Portugal offers attractive tax incentives and has gained popularity as a tax haven, it is essential to separate fact from fiction when considering the country as a tax planning destination. Portugal is not a tax haven in the traditional sense.Panama is a high income economy with a history of low inflation.Income Tax in Panama

If you earn between $0 to $11,000 annually, you will not pay income tax. If you earn between $11,001 and $50,000, you're taxed at 15% on all income above $11,000. If you earn over $50,000, you'll pay $5,850 in income tax, plus 25% on all income over $50,000.

20 Countries with the Lowest Income Tax Rates in the World

Is Portugal tax free : Residents in Portugal for tax purposes are taxed on their worldwide income at progressive rates varying from 13.25% to 48% for 2024.

Is Thailand a tax haven : Territorial Tax Countries in Asia

Countries like Thailand have territorial tax systems that essentially make them countries that don't tax in Asia for the expats who live there and earn money abroad.

How is Belize a tax haven

One of the key attractions of Belize is its favorable tax regime. The country does not impose corporate taxes, capital gains taxes, or property taxes, making it a haven for those looking to minimize their fiscal exposure.

Kitts and Nevis is its incredibly lenient tax regime. For individuals, the islands offer a paradise of sorts with no income tax, inheritance tax, gift tax, duty, capital gains tax, or corporate tax. This means that the money you earn, inherit, or invest remains firmly in your pocket.The lowest tax rate on wages in the EU is set in Bulgaria and Romania – 10%. The highest taxes in Europe are paid by residents of Finland – here the collection can reach 56.5 % of profit. As a rule, the payment is imposed on the employer. Property, inheritance, gift.

Is Portugal 0% tax : Residents in Portugal for tax purposes are taxed on their worldwide income at progressive rates varying from 13.25% to 48% for 2024.