AMZN joined the S&P 500 in 2005.Jan 24 (Reuters) – The S&P 500 climbed to its fourth straight record high close on Wednesday, as Netflix surged following blowout quarterly results and a strong report from ASML fueled gains in chipmakers.The S&P 500 index can be traded indirectly by using mutual funds or ETFs made up of stocks or futures, or it can be traded via Contracts for Difference (CFDs). Traders could choose to mimic S&P 500 trading by purchasing stocks or futures from each of the 500 companies.

What companies are under S and P 500 : S&P 500 ETF Components

#

Company

Symbol

1

Microsoft Corp

MSFT

2

Apple Inc.

AAPL

3

Nvidia Corp

NVDA

4

Amazon.com Inc

AMZN

What are the 11 sectors of the S&P 500

The eleven sectors of the S&P 500 are information technology, financials, health care, consumer discretionary, communication services, industrials, consumer staples, energy, real estate, materials, and utilities.

Why are Netflix stocks so high : Key Takeaways. Netflix shares were sharply higher in pre-market trading Wednesday after the streaming giant said it added 13.1 million subscribers in the fourth quarter, well ahead of Wall Street's consensus view. The company plans to increase its programming slate and tap into new areas, such as advertising and gaming …

Revenue was primarily driven by an increase in its net subscribers which grew by 13.1 million to 260.3 million, easily cruising past analysts' 8.7 million growth prediction. Operating income spiked 172% YoY to $1.5 billion as the operating margin rose from 7% to 16.9%, exceeding the company's guidance of 13%. Over time, the S&P 500 has delivered strong returns to investors. Those who remained invested enjoyed the benefits of compounding, or the process of earning returns on the returns you've already accumulated. “Since 1970, it has delivered an average 11% return per year, including dividends,” said Reynolds.

Is SPX same as sp500

SPX is a symbol referring to the S&P 500 index, which consists of the largest 500 publicly traded companies, as measured by market capitalization. Investors can't directly invest in SPX, but they can invest in ETFs or index funds that are designed to track the performance of the index.Other companies in the S&P 500's top 10 list include NVIDIA, Alphabet, Berkshire Hathaway, Meta (formerly Facebook), UnitedHealth, and Tesla.

Apple (AAPL) Index Weighting: 7.10% Market Cap: $2.75 trillion.

Microsoft (MSFT) Index Weighting: 6.51%

Amazon (AMZN) Index Weighting: 3.24%

NVIDIA (NVDA)

The eleven sectors of the S&P 500 are information technology, financials, health care, consumer discretionary, communication services, industrials, consumer staples, energy, real estate, materials, and utilities. The order of the 11 sectors based on size is as follows: Information Technology, Health Care, Financials, Consumer Discretionary, Communication Services, Industrials, Consumer Staples, Energy, Utilities, Real Estate, and Materials.

What is the largest sector in the S&P 500 : Information Technology

Top Sectors in the S&P 500

Sector

Weighting in the S&P 500

Information Technology

30.30%

Financials

12.58%

Health Care

12.22%

What will Netflix stock be worth in 2030 : The stock's total value must multiply by nearly 5 before reaching a $1 trillion market cap — an ambitious goal that calls for time and patience. A more reasonable, yet consistently market-beating, estimate suggests Netflix could reach a $564 million market cap by 2030 and $1 trillion in 2035.

Is Netflix stock good to buy

The average price target represents 17.54% Increase from the current price of $559.49. What do analysts say about Netflix Netflix's analyst rating consensus is a Moderate Buy. This is based on the ratings of 36 Wall Streets Analysts. Fair Value Estimate for Netflix

With its 2-star rating, we believe Netflix's stock is overvalued compared with our long-term fair value estimate of $425, which implies a multiple of 25 times our 2024 earnings per share forecast.Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498.

How much money was $1000 invested in the S&P 500 in 1980 : In 1980, had you invested a mere $1,000 in what went on to become the top-performing stock of S&P 500 (^GSPC 0.09%), then you would be sitting on a cool $1.2 million today. That equates to a total return of 120,936%.

Antwort Is Netflix a part of the S&P 500? Weitere Antworten – Is Amazon a part of the S&P 500

AMZN joined the S&P 500 in 2005.Jan 24 (Reuters) – The S&P 500 climbed to its fourth straight record high close on Wednesday, as Netflix surged following blowout quarterly results and a strong report from ASML fueled gains in chipmakers.The S&P 500 index can be traded indirectly by using mutual funds or ETFs made up of stocks or futures, or it can be traded via Contracts for Difference (CFDs). Traders could choose to mimic S&P 500 trading by purchasing stocks or futures from each of the 500 companies.

What companies are under S and P 500 : S&P 500 ETF Components

What are the 11 sectors of the S&P 500

The eleven sectors of the S&P 500 are information technology, financials, health care, consumer discretionary, communication services, industrials, consumer staples, energy, real estate, materials, and utilities.

Why are Netflix stocks so high : Key Takeaways. Netflix shares were sharply higher in pre-market trading Wednesday after the streaming giant said it added 13.1 million subscribers in the fourth quarter, well ahead of Wall Street's consensus view. The company plans to increase its programming slate and tap into new areas, such as advertising and gaming …

Revenue was primarily driven by an increase in its net subscribers which grew by 13.1 million to 260.3 million, easily cruising past analysts' 8.7 million growth prediction. Operating income spiked 172% YoY to $1.5 billion as the operating margin rose from 7% to 16.9%, exceeding the company's guidance of 13%.

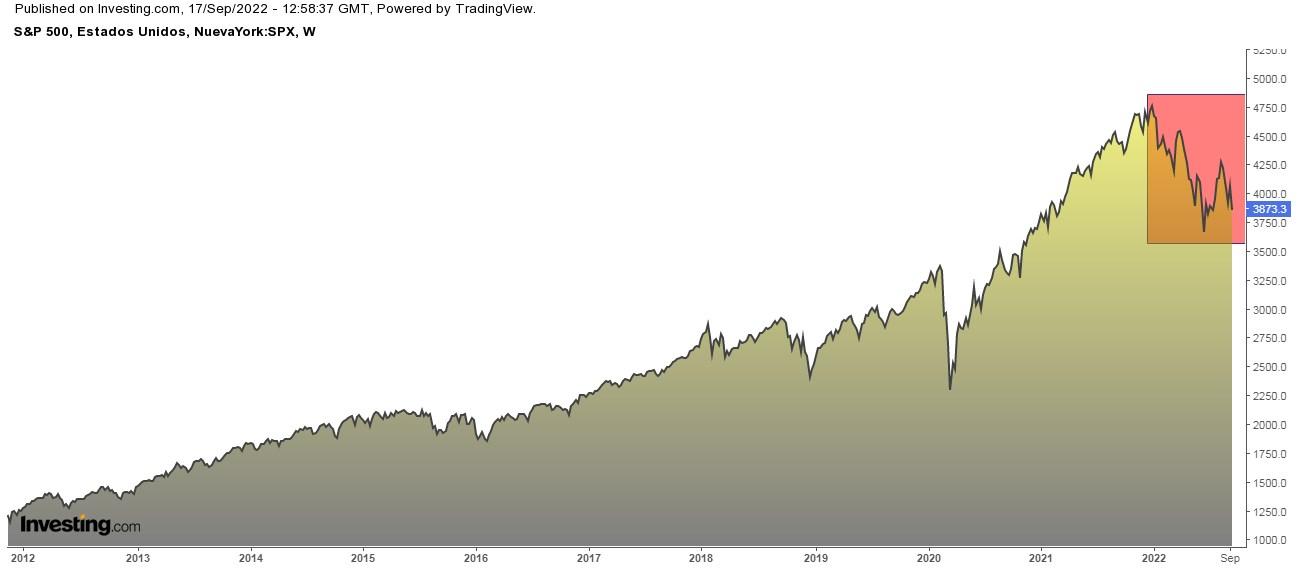

Over time, the S&P 500 has delivered strong returns to investors. Those who remained invested enjoyed the benefits of compounding, or the process of earning returns on the returns you've already accumulated. “Since 1970, it has delivered an average 11% return per year, including dividends,” said Reynolds.

Is SPX same as sp500

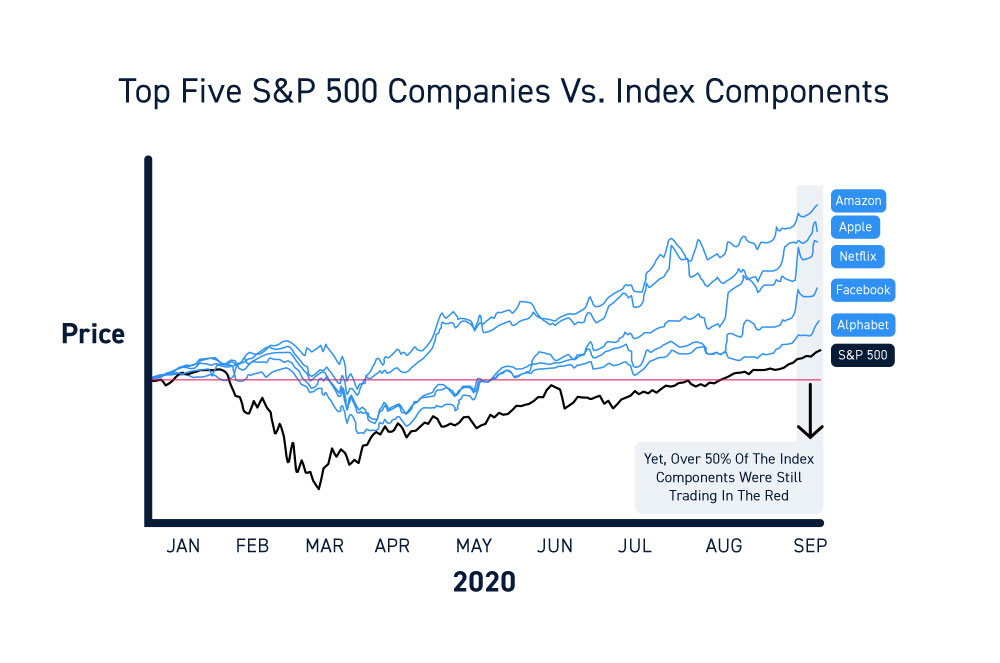

SPX is a symbol referring to the S&P 500 index, which consists of the largest 500 publicly traded companies, as measured by market capitalization. Investors can't directly invest in SPX, but they can invest in ETFs or index funds that are designed to track the performance of the index.Other companies in the S&P 500's top 10 list include NVIDIA, Alphabet, Berkshire Hathaway, Meta (formerly Facebook), UnitedHealth, and Tesla.

The eleven sectors of the S&P 500 are information technology, financials, health care, consumer discretionary, communication services, industrials, consumer staples, energy, real estate, materials, and utilities.

The order of the 11 sectors based on size is as follows: Information Technology, Health Care, Financials, Consumer Discretionary, Communication Services, Industrials, Consumer Staples, Energy, Utilities, Real Estate, and Materials.

What is the largest sector in the S&P 500 : Information Technology

What will Netflix stock be worth in 2030 : The stock's total value must multiply by nearly 5 before reaching a $1 trillion market cap — an ambitious goal that calls for time and patience. A more reasonable, yet consistently market-beating, estimate suggests Netflix could reach a $564 million market cap by 2030 and $1 trillion in 2035.

Is Netflix stock good to buy

The average price target represents 17.54% Increase from the current price of $559.49. What do analysts say about Netflix Netflix's analyst rating consensus is a Moderate Buy. This is based on the ratings of 36 Wall Streets Analysts.

Fair Value Estimate for Netflix

With its 2-star rating, we believe Netflix's stock is overvalued compared with our long-term fair value estimate of $425, which implies a multiple of 25 times our 2024 earnings per share forecast.Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498.

How much money was $1000 invested in the S&P 500 in 1980 : In 1980, had you invested a mere $1,000 in what went on to become the top-performing stock of S&P 500 (^GSPC 0.09%), then you would be sitting on a cool $1.2 million today. That equates to a total return of 120,936%.