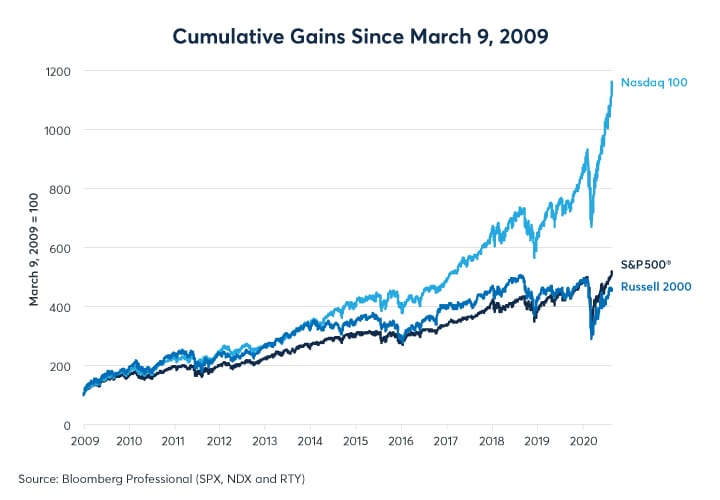

So, if you are looking to own a more diversified basket of stocks, the S&P 500 will be the right fit for you. However, those who are comfortable with the slightly higher risk for the extra returns that investing in Nasdaq 100 based fund might generate will be better off with Nasdaq 100.With a significant focus on innovation across sectors like Technology, Consumer Discretionary, and Health Care, the Nasdaq-100 has managed to outshine the S&P 500 by a considerable margin over the last 16 years (12/31/2007 – 12/31/2023).The Dow tracks 30 large U.S. companies but has limited representation. The Nasdaq indexes, associated with the Nasdaq exchange, focus more heavily on tech and other stocks. The S&P 500, with 500 large U.S. companies, offers a more comprehensive market view, weighted by market capitalization.

Is there an overlap between the S&P 500 and the Nasdaq : The S&P500 and the NASDAQ are both indices of stocks and there's a lot of overlap between the 2. Many of the top 10 stocks are the same, so if you're invested in both, you may not be as diversified as you think.

Is there anything better than the S&P 500

The S&P 500's track record is impressive, but the Vanguard Growth ETF has outperformed it. The Vanguard Growth ETF leans heavily toward tech businesses that exhibit faster revenue and earnings gains. No matter what investments you choose, it's always smart to keep a long-term mindset.

Why is the S&P 500 not a good investment : The S&P 500 weighting system gives a small number of companies major influence, which could have an undue negative effect on the index if one or a few of them run into trouble. The index does not expose investors to small or emerging companies with the potential for market-beating growth.

Berkshire Hathaway

A big cash pile protects the above-average core operations of this stellar company. Warren Buffett has an incredible track record of outperforming the S&P 500. At the start of every Berkshire Hathaway (BRK. A 0.68%) (BRK. A better bet would be to buy an ETF that is focused on generating dividend income. A good option is Schwab U.S. Dividend Equity ETF, which offers a yield that's nearly three times the size of what you'd collect from an S&P 500 tracking ETF.

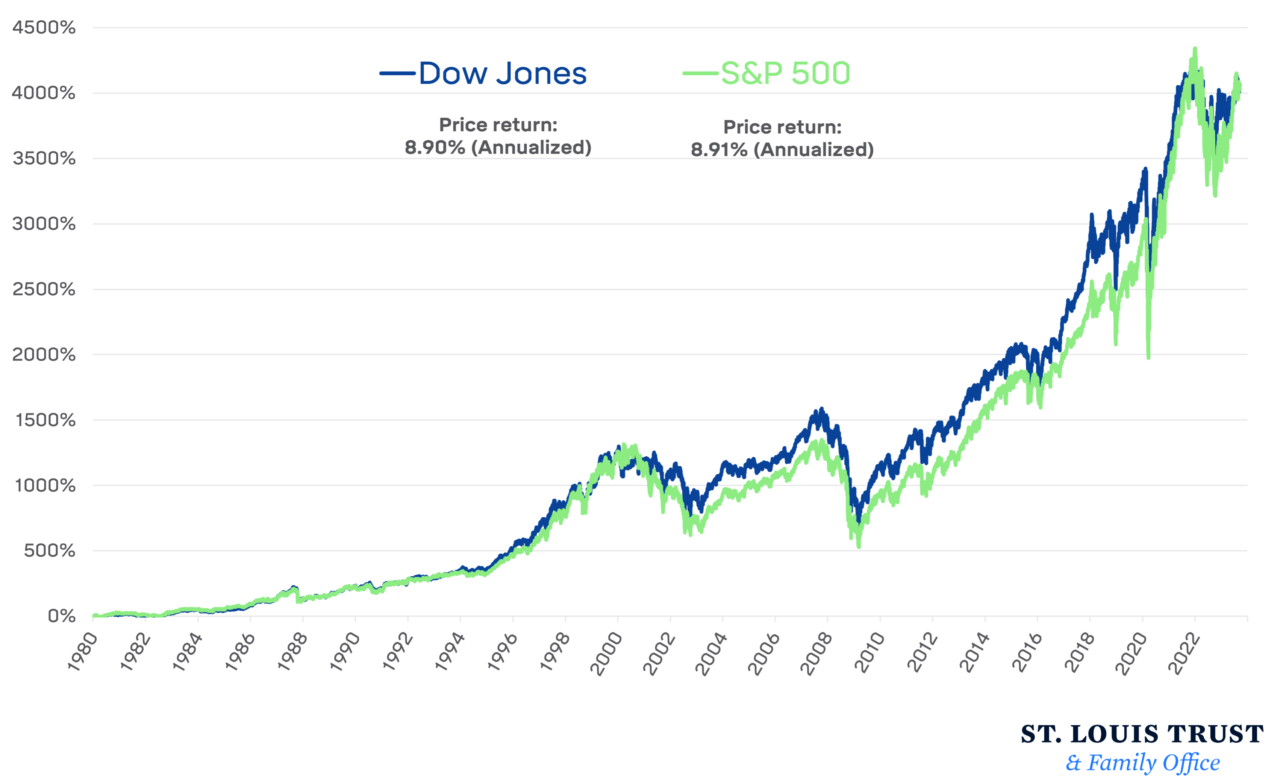

Is it better to invest in Dow Jones or S&P 500

Because the S&P 500 contains hundreds of large companies and represents the lion's share of total stock market value, it is considered a much better gauge of how the market is performing, even though it excludes thousands of smaller and midsize companies.The Nasdaq-100 is quite different than the S&P 500

But all of the largest companies in the Nasdaq-100 are also included in the S&P 500 index, including Apple, Microsoft, Amazon, Alphabet, Facebook, and (now) Tesla.10 funds that beat the S&P 500 by over 20% in 2023

Fund

2023 performance (%)

3yr performance (%)

MS INVF US Insight

52.26

-47.18

Sands Capital US Select Growth Fund

51.3

-20.88

Natixis Loomis Sayles US Growth Equity

49.56

26.07

T. Rowe Price US Blue Chip Equity

49.54

5.81

DexCom, Inc. (NASDAQ:DXCM) and Medpace Holdings, Inc. (NASDAQ:MEDP) are the only two healthcare sector companies that have made it onto our list of 13 stocks that outperform the S&P 500 every year for the last 5 years. The shares of DexCom, Inc.

What if I invested $1000 in S&P 500 10 years ago : Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498.

Is it bad to invest everything in S&P 500 : Investing in an S&P 500 fund can instantly diversify your portfolio and is generally considered less risky. S&P 500 index funds or ETFs will track the performance of the S&P 500, which means when the S&P 500 does well, your investment will, too. (The opposite is also true, of course.)

What is the 10 year return on Berkshire Hathaway

Ten Year Stock Price Total Return for Berkshire Hathaway is calculated as follows: Last Close Price [ 416.94 ] / Adj Prior Close Price [ 127.13 ] (-) 1 (=) Total Return [ 228.0% ] Prior price dividend adjustment factor is 1.00. Over the course of the past few years, Warren Buffett's Berkshire Hathaway (NYSE: BRK. A) (NYSE: BRK.B) has measurably outperformed the S&P 500 (SNPINDEX: ^GSPC).3 Great ETFs to Play a Rebound in Small-Value Stocks

Vanguard S&P Small-Cap 600 Value ETF. (VIOV)

Dimensional US Small Cap Value ETF. (DFSV)

Avantis US Small Cap Value ETF. (AVUV)

What’s better than the S&P 500 : A better bet would be to buy an ETF that is focused on generating dividend income. A good option is Schwab U.S. Dividend Equity ETF, which offers a yield that's nearly three times the size of what you'd collect from an S&P 500 tracking ETF.

Antwort Is Nasdaq Composite better than S&P 500? Weitere Antworten – Which is better to invest, Nasdaq or S&P 500

So, if you are looking to own a more diversified basket of stocks, the S&P 500 will be the right fit for you. However, those who are comfortable with the slightly higher risk for the extra returns that investing in Nasdaq 100 based fund might generate will be better off with Nasdaq 100.With a significant focus on innovation across sectors like Technology, Consumer Discretionary, and Health Care, the Nasdaq-100 has managed to outshine the S&P 500 by a considerable margin over the last 16 years (12/31/2007 – 12/31/2023).The Dow tracks 30 large U.S. companies but has limited representation. The Nasdaq indexes, associated with the Nasdaq exchange, focus more heavily on tech and other stocks. The S&P 500, with 500 large U.S. companies, offers a more comprehensive market view, weighted by market capitalization.

Is there an overlap between the S&P 500 and the Nasdaq : The S&P500 and the NASDAQ are both indices of stocks and there's a lot of overlap between the 2. Many of the top 10 stocks are the same, so if you're invested in both, you may not be as diversified as you think.

Is there anything better than the S&P 500

The S&P 500's track record is impressive, but the Vanguard Growth ETF has outperformed it. The Vanguard Growth ETF leans heavily toward tech businesses that exhibit faster revenue and earnings gains. No matter what investments you choose, it's always smart to keep a long-term mindset.

Why is the S&P 500 not a good investment : The S&P 500 weighting system gives a small number of companies major influence, which could have an undue negative effect on the index if one or a few of them run into trouble. The index does not expose investors to small or emerging companies with the potential for market-beating growth.

Berkshire Hathaway

A big cash pile protects the above-average core operations of this stellar company. Warren Buffett has an incredible track record of outperforming the S&P 500. At the start of every Berkshire Hathaway (BRK. A 0.68%) (BRK.

A better bet would be to buy an ETF that is focused on generating dividend income. A good option is Schwab U.S. Dividend Equity ETF, which offers a yield that's nearly three times the size of what you'd collect from an S&P 500 tracking ETF.

Is it better to invest in Dow Jones or S&P 500

Because the S&P 500 contains hundreds of large companies and represents the lion's share of total stock market value, it is considered a much better gauge of how the market is performing, even though it excludes thousands of smaller and midsize companies.The Nasdaq-100 is quite different than the S&P 500

But all of the largest companies in the Nasdaq-100 are also included in the S&P 500 index, including Apple, Microsoft, Amazon, Alphabet, Facebook, and (now) Tesla.10 funds that beat the S&P 500 by over 20% in 2023

DexCom, Inc. (NASDAQ:DXCM) and Medpace Holdings, Inc. (NASDAQ:MEDP) are the only two healthcare sector companies that have made it onto our list of 13 stocks that outperform the S&P 500 every year for the last 5 years. The shares of DexCom, Inc.

What if I invested $1000 in S&P 500 10 years ago : Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498.

Is it bad to invest everything in S&P 500 : Investing in an S&P 500 fund can instantly diversify your portfolio and is generally considered less risky. S&P 500 index funds or ETFs will track the performance of the S&P 500, which means when the S&P 500 does well, your investment will, too. (The opposite is also true, of course.)

What is the 10 year return on Berkshire Hathaway

Ten Year Stock Price Total Return for Berkshire Hathaway is calculated as follows: Last Close Price [ 416.94 ] / Adj Prior Close Price [ 127.13 ] (-) 1 (=) Total Return [ 228.0% ] Prior price dividend adjustment factor is 1.00.

Over the course of the past few years, Warren Buffett's Berkshire Hathaway (NYSE: BRK. A) (NYSE: BRK.B) has measurably outperformed the S&P 500 (SNPINDEX: ^GSPC).3 Great ETFs to Play a Rebound in Small-Value Stocks

What’s better than the S&P 500 : A better bet would be to buy an ETF that is focused on generating dividend income. A good option is Schwab U.S. Dividend Equity ETF, which offers a yield that's nearly three times the size of what you'd collect from an S&P 500 tracking ETF.