NDQ Nasdaq 100 ETF is the ASX-traded equivalent of QQQ in that both ETFs seek to track the Nasdaq 100 Index, so NDQ and QQQ will give you exposure to the same companies. However, QQQ is not traded on the ASX, whereas NDQ is.Yes. Invesco QQQ is a passively managed ETF that tracks the Nasdaq-100 index, which contains some of the world's most innovative companies.QQQ tracks the NASDAQ-100 market cap weighted index. Moreover, the influence of the 10 largest companies in this index is even more significant than in the S&P 500. The NASDAQ-100 includes 100 non-financial companies from the NASDAQ stock exchange.

What is similar to QQQ : For investors seeking an alternative to QQQ's mega-cap exposure, the Invesco S&P 500 Top 50 ETF (XLG) is an excellent option. XLG tracks the S&P 500 Top 50 Index, which, like QQQ, is heavily weighted towards top-tier tech and consumer stocks.

Why is QQQ different than Nasdaq

QQQ is an ETF that tracks the Nasdaq 100 Index. It has 102 holdings and is the fourth-most popular ETF in the world. 1 The index excludes financial companies and is based on market capitalization. Like the Nasdaq 100, QQQ holdings are heavily weighted toward large-cap technology companies.

Is QQQ the only Nasdaq ETF : The Nasdaq-100® is one of the most well-known indexes in the investing world. Representing the largest non-Financial listings on the Nasdaq exchange, the Nasdaq-100® Index (NDX) has futures and exchange-traded funds (ETFs) with significant liquidity and investor interest.

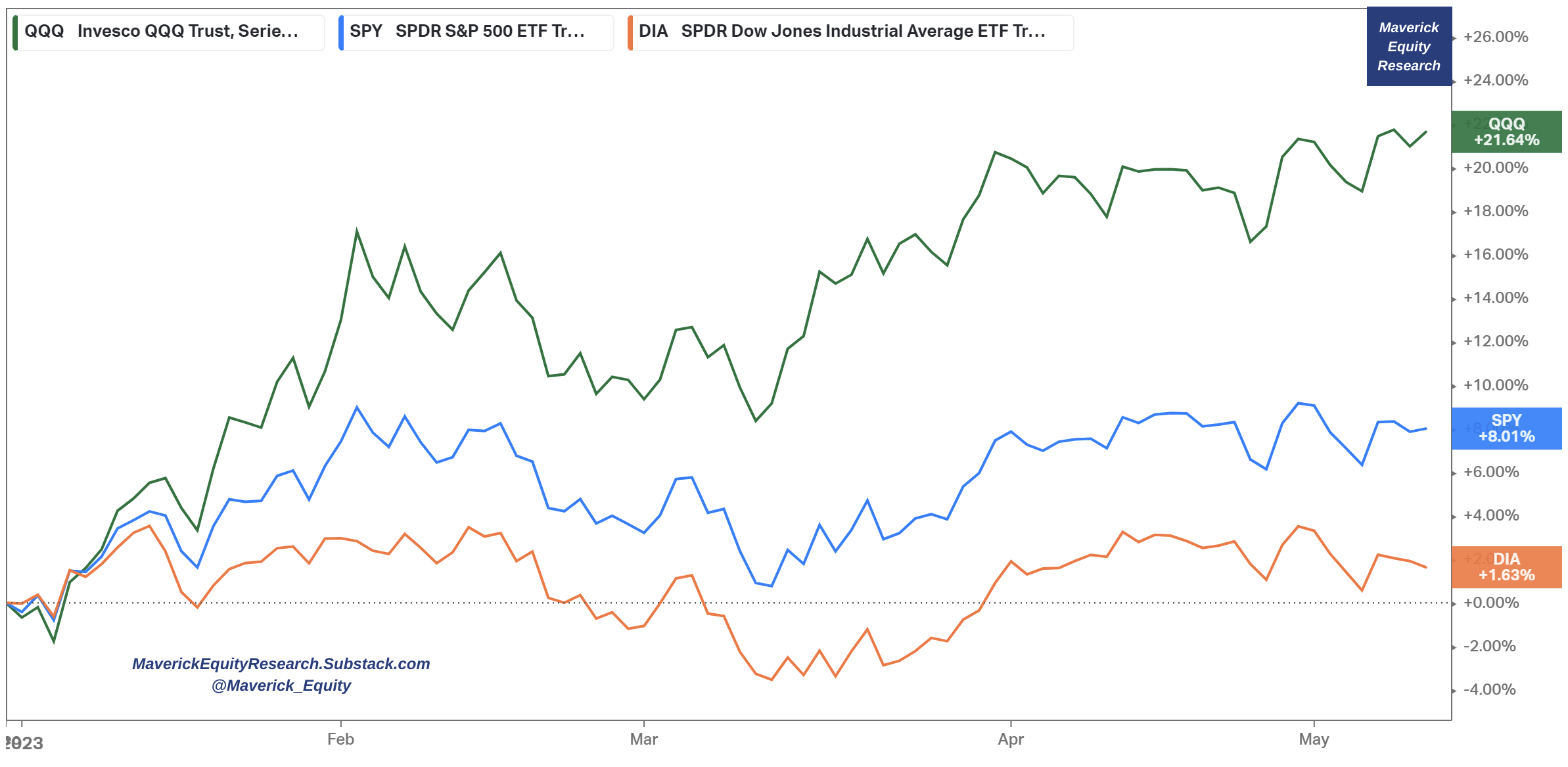

But some investors want a little more, and place a heavier bet on the growth opportunity of the tech sector. In that case, the Invesco QQQ Trust (NASDAQ: QQQ) mirrors the gains or losses of the tech-heavy Nasdaq-100 index. It's a higher-risk, higher-reward idea, tracking a smaller basket of more volatile stocks.

Over the past 10 years, NDAQ has outperformed QQQ with an annualized return of 20.09%, while QQQ has yielded a comparatively lower 18.79% annualized return. The chart below displays the growth of a $10,000 investment in both assets, with all prices adjusted for splits and dividends.

Does QQQ mimic Nasdaq

QQQ is the most popular Nasdaq ETF because it uses a full replication strategy, meaning this ETF includes every security in the Nasdaq Index rather than a representative sample. Invesco QQQ offers an annualized return of 9.5% since its inception in 1999.The Invesco QQQ ETF is an exchange-traded fund (ETF) that tracks the Nasdaq 100 Index. Because it passively follows the index, the QQQ share price goes up and down along with the tech-heavy Nasdaq 100.

Antwort Is Nasdaq 100 same as QQQ? Weitere Antworten – What is the difference between Nasdaq 100 and QQQ

NDQ Nasdaq 100 ETF is the ASX-traded equivalent of QQQ in that both ETFs seek to track the Nasdaq 100 Index, so NDQ and QQQ will give you exposure to the same companies. However, QQQ is not traded on the ASX, whereas NDQ is.Yes. Invesco QQQ is a passively managed ETF that tracks the Nasdaq-100 index, which contains some of the world's most innovative companies.QQQ tracks the NASDAQ-100 market cap weighted index. Moreover, the influence of the 10 largest companies in this index is even more significant than in the S&P 500. The NASDAQ-100 includes 100 non-financial companies from the NASDAQ stock exchange.

What is similar to QQQ : For investors seeking an alternative to QQQ's mega-cap exposure, the Invesco S&P 500 Top 50 ETF (XLG) is an excellent option. XLG tracks the S&P 500 Top 50 Index, which, like QQQ, is heavily weighted towards top-tier tech and consumer stocks.

Why is QQQ different than Nasdaq

QQQ is an ETF that tracks the Nasdaq 100 Index. It has 102 holdings and is the fourth-most popular ETF in the world. 1 The index excludes financial companies and is based on market capitalization. Like the Nasdaq 100, QQQ holdings are heavily weighted toward large-cap technology companies.

Is QQQ the only Nasdaq ETF : The Nasdaq-100® is one of the most well-known indexes in the investing world. Representing the largest non-Financial listings on the Nasdaq exchange, the Nasdaq-100® Index (NDX) has futures and exchange-traded funds (ETFs) with significant liquidity and investor interest.

But some investors want a little more, and place a heavier bet on the growth opportunity of the tech sector. In that case, the Invesco QQQ Trust (NASDAQ: QQQ) mirrors the gains or losses of the tech-heavy Nasdaq-100 index. It's a higher-risk, higher-reward idea, tracking a smaller basket of more volatile stocks.

Over the past 10 years, NDAQ has outperformed QQQ with an annualized return of 20.09%, while QQQ has yielded a comparatively lower 18.79% annualized return. The chart below displays the growth of a $10,000 investment in both assets, with all prices adjusted for splits and dividends.

Does QQQ mimic Nasdaq

QQQ is the most popular Nasdaq ETF because it uses a full replication strategy, meaning this ETF includes every security in the Nasdaq Index rather than a representative sample. Invesco QQQ offers an annualized return of 9.5% since its inception in 1999.The Invesco QQQ ETF is an exchange-traded fund (ETF) that tracks the Nasdaq 100 Index. Because it passively follows the index, the QQQ share price goes up and down along with the tech-heavy Nasdaq 100.